On February 25, " 2020 Japan Advertising Expenditures " was announced. Toshiyuki Kitahara of Dentsu Inc. Media Innovation Research Department explains the changes in the advertising markets for the four mass media, the internet, and promotional media.

Overview of "2020 Japan Advertising Expenditures"──Internet Advertising Increases Amid Overall Decline

Total advertising expenditure in Japan for 2020 (January to December) was ¥6,159.4 billion.

After growing for eight consecutive years since the 2011 Great East Japan Earthquake, it experienced negative growth for the first time in nine years due to the impact of the COVID-19 pandemic. At 88.8% of the previous year's level, the decline is the second largest since 2009 (88.5% of the previous year), which was affected by the Lehman Shock.

Japan's advertising spending is significantly

- "Mass Media Advertising Expenditures"

- "Internet Advertising Expenditures"

- "Promotional Media Advertising Expenditures"

.

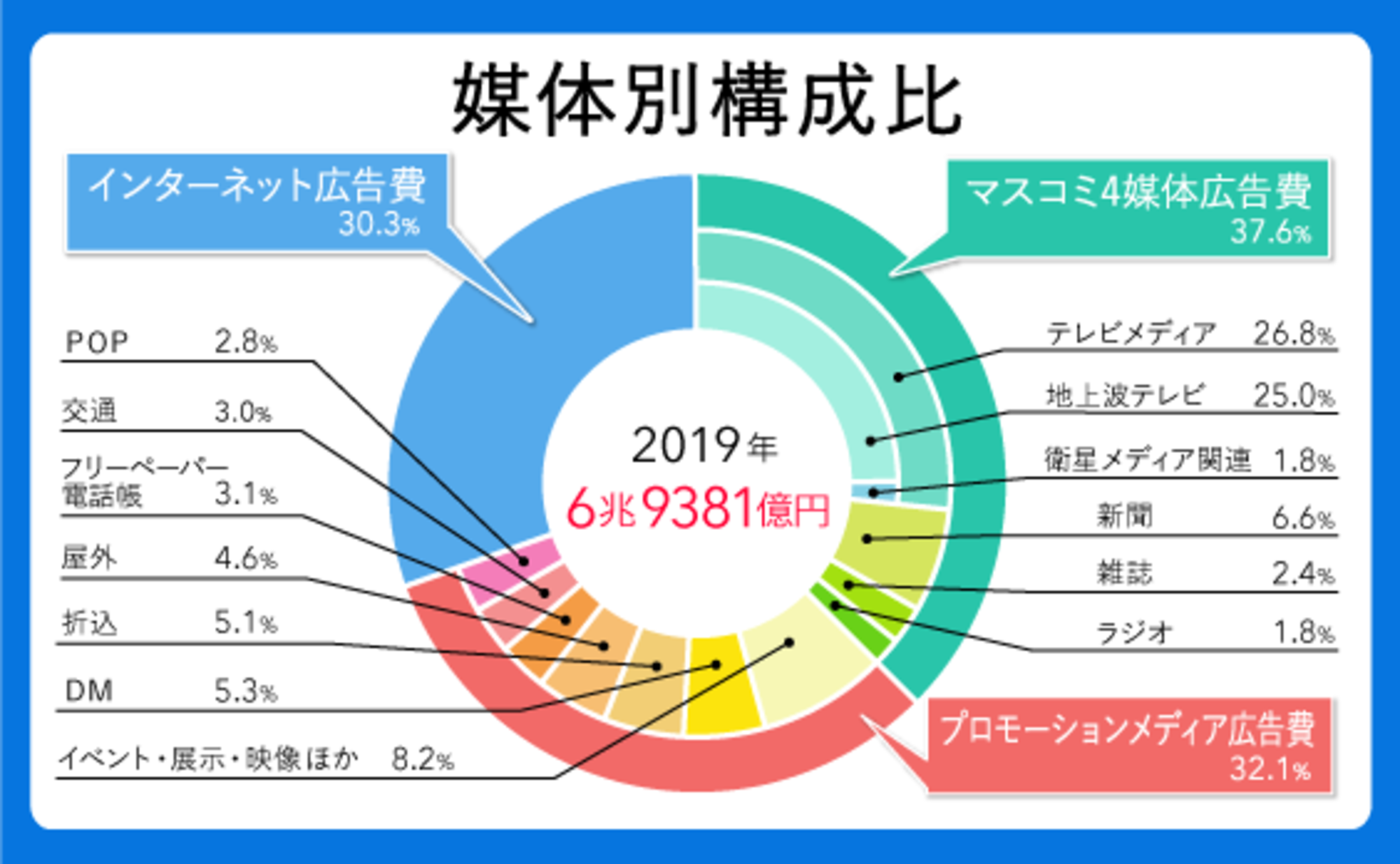

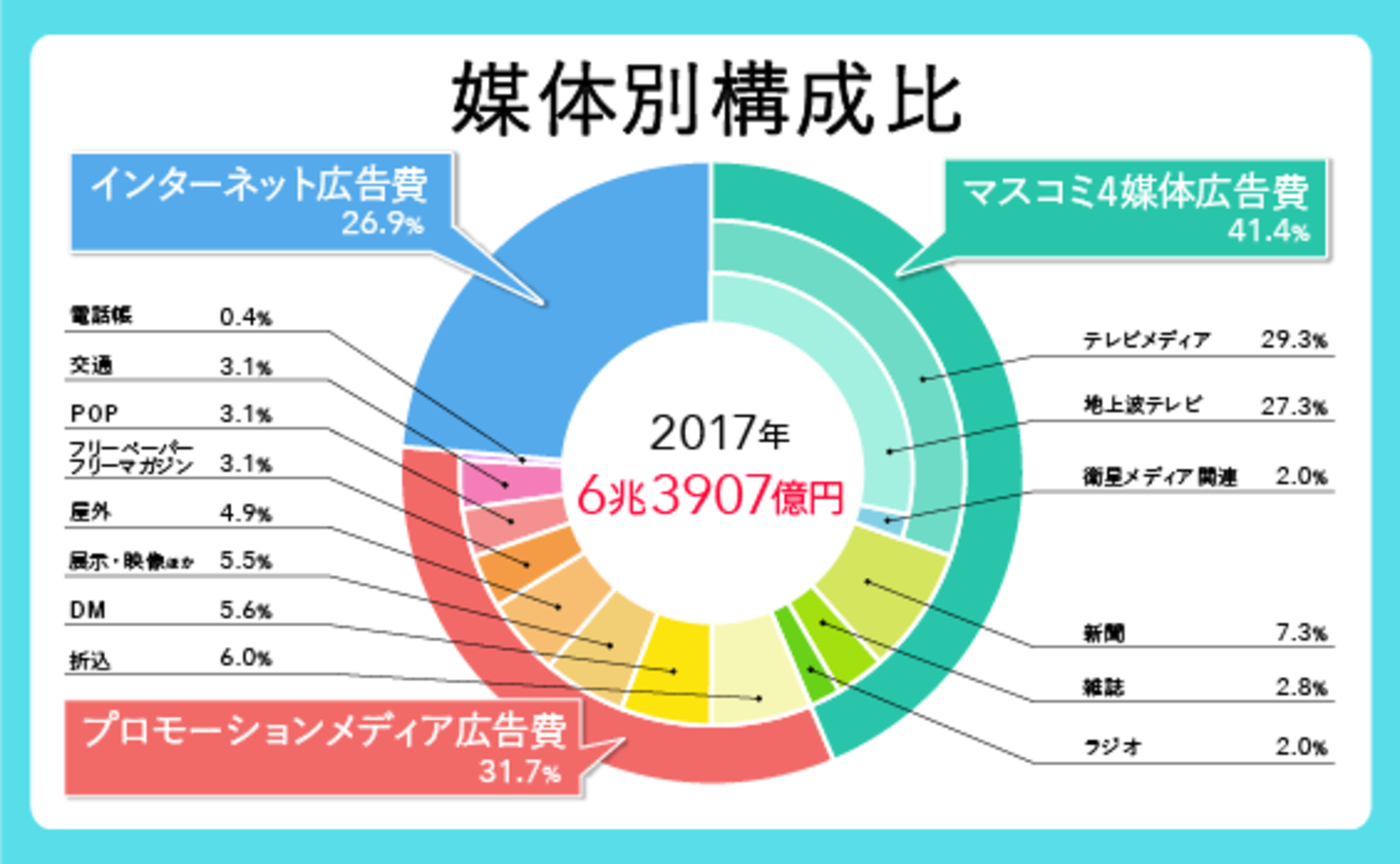

The respective shares of total advertising expenditure are: mass media 4 at 36.6%, internet at 36.2%, and promotional media at 27.2%.

Advertising expenditures decreased year-on-year for mass media (86.4%) and promotional media (75.4%), while Internet advertising expenditures increased year-on-year (105.9%).

●Mass Media Advertising Expenditures - Sixth Consecutive Year of Decline

Advertising expenditure for the four mass media outlets—newspapers, magazines, television, and radio—totaled ¥2.2536 trillion, representing 86.4% of the previous year's level.

The breakdown shows all categories below the previous year's levels: newspapers at 81.1%, magazines at 73.0%, radio at 84.6%, and television media (combining terrestrial and satellite) at 89.0%. This marks the sixth consecutive year of decline.

●Internet Advertising Expenditures──Nearly on Par with Total Mass Media Advertising

Internet advertising expenditure (media fees + "e-commerce platform advertising fees" + advertising production fees) reached ¥2.229 trillion, a 105.9% increase year-on-year. It has continued consistent growth since estimates began in 1996. In 2020, it finally became a ¥2.2 trillion market, nearly matching the ¥2.2536 trillion spent on the four mass media platforms.

●Promotional Media Advertising Expenditures──Significantly impacted by reduced outings and travel

This reached ¥1.6768 trillion, a 75.4% year-on-year decrease. This decline was driven by the postponement or cancellation of various events and traditional advertising/promotional campaigns, as well as reduced outings and travel. Particularly significant declines were seen in "Events, Exhibitions, Video, etc." and "Insert Ads."

Which sectors saw growth despite the first negative growth in nine years?

In 2020, advertising placements declined significantly throughout the year due to the cancellation or postponement of various events and advertising/promotional campaigns, as well as reduced leisure activities.

However, looking at the quarterly growth rates for the four major media advertising expenditures, while a sharp decline was seen in the April-June period when the first state of emergency was declared, a recovery trend has been observed overall since then.

Furthermore, some industries saw growth due to changes in lifestyle resulting from reduced outings.

●Advertising Expenditures Across Four Major Media Outlets <Newspaper Advertising Expenditures>

By industry, "Transportation/Leisure" advertising fell sharply to 51.1% of the previous year. Event announcements by travel agencies, entertainment/arts/cultural facilities, and newspapers saw particularly large declines.

Conversely, the "Information & Communications" sector grew to 107.9% of the previous year's level, driven by increased advertising for webinars, remote work-related services, and online shops (e-commerce).

●Advertising Expenditures Across Four Media Channels <Magazine Advertising Expenditures>

The situation remained challenging due to declining advertising spending and the accelerated shift to digital. By industry, the large-share sectors "Fashion & Accessories" and "Cosmetics & Toiletries" saw significant declines. Conversely, "Home Appliances & AV Equipment" increased due to stay-at-home demand.

●Advertising Expenditures Across Four Mass Media <Radio Advertising Expenditures>

Radio also saw a significant year-on-year decrease, with reduced placements for event announcements and categories like "Transportation/Leisure" and "Distribution/Retail." However, similar to magazine advertising, placements for "Home Appliances/AV Equipment" increased due to stay-at-home demand.

●Advertising Expenditures Across Four Media Channels<TV Media Advertising Expenditures (Terrestrial TV + Satellite Media Related)>

Advertising spending decreased due to the postponement or cancellation of various major sporting events and reductions in promotional budgets. However, the October-December period showed signs of economic activity resuming, with advertising spending recovering particularly in the "Information & Communications" and "Automobiles & Related Products" sectors.

●Promotional Media Advertising Expenditures <Outdoor Advertising, Transportation Advertising, Insert Advertising>

Following the state of emergency declaration, overall advertising revenue declined significantly due to shortened store hours, canceled events, and reduced usage of various transportation services.

However, a trend toward accelerated optimization for the digital age emerged in response to the new lifestyle. In outdoor advertising, a dedicated vision screen for a beverage manufacturer was newly installed in Shibuya. Additionally, media companies utilizing location data to sell based on impressions began full-scale operations, contributing to the support of outdoor vision advertising. Sales for taxi vision advertising, highlighted as a key point last year, temporarily declined but contributed to support through the introduction of impression-based billing, leading to reduced placements rather than cancellations.

●Promotional Media Advertising Expenditures<DM (Direct Mail)>

The April state of emergency declaration led to a series of postponements and cancellations of planned DM campaigns, creating a very challenging situation. However, the increased use of digital initiatives alongside DM saw a recovery trend from July onwards.

●Promotional Media Advertising Expenses<Free Papers (Collective term for free papers, free magazines, and phone books)>

While showing a year-round downward trend with some publications ceasing or suspending, door-to-door posting types maintained relatively stable distribution volumes. Their enduring strength as "community-focused media" was evident during the emergency.

●Promotional Media Advertising Expenditures<POP>

Spending decreased significantly as aggressive in-store customer attraction campaigns became difficult. However, small monitor POP displays were increasingly used to replace live demonstrations and customer interactions, and remote customer service via digital signage at store locations became more common.

●Promotional Media Advertising Expenditures<Events, Exhibitions, Video, etc.>

Events like the Tokyo 2020 Olympics and Paralympics, private shows, and marathons saw changes in format, cancellations, or postponements. However, online events gradually gained traction, showing an upward trend in the October-December period.

Video-related sectors saw new demand emerge, such as video streaming, remote production, and the use of the latest technology. Online events rapidly increased as substitutes for physical events, improving accessibility for those previously hindered by distance or time constraints. On the other hand, events valued for the shared experience of gathering and excitement may return to their pre-pandemic form as vaccine rollouts progress.

While cinema advertising saw a significant decline, a Japanese animated film broke box office records in Japan, attracting numerous advertisers.

Internet advertising showed an early recovery trend, achieving positive growth even during the pandemic

Internet advertising also suffered from sluggish consumption and reduced ad spending due to COVID-19. However, it showed an earlier recovery trend than other media, achieving the only positive growth for the full year at 105.9% year-on-year.

Of the total internet advertising media spending of ¥1.7567 trillion (105.6% YoY), programmatic advertising accounted for ¥1.4558 trillion (109.7% YoY).

Digital advertising originating from the four major media outlets, highlighted as a key point last year, also advanced further, primarily through the use of programmatic advertising. Digital advertising spending originating from these four media outlets reached ¥80.3 billion (112.3% year-on-year), continuing double-digit growth from the previous year.

● Newspaper Digital──Amid Uncertainty, Trust in Digital Editions is Reassessed

Digital newspapers continue their steady growth trend. Although reserved advertising placements decreased in the April-June quarter, site page views increased, leading to higher sales from programmatic advertising. This is likely due to the trust in the content (articles) rooted in the print newspaper.

●Magazine Digital──Stay-at-home demand drives significant growth in digital magazines

From Q2, page views on major web media of publishing companies increased significantly. Digital magazines, particularly comic magazines, showed substantial growth. Advertising models such as webinar planning, online events, content creation for advertiser sites, social media utilization, video production, and distribution planning continue to grow.

●Radio Digital──Focus on Radio Performance-Based Advertising

With the rise in "radiko" listening rates due to stay-at-home requests and the spread of remote work, attention has focused on programmatic advertising for radio digital. Furthermore, while traditional events decreased, initiatives combining radio with online events and radio with SNS increased, resulting in a corresponding rise in ad placements.

●TV Media Digital──Significant Increase in "TVer" Users

Within TV Media Digital, "TV Media-Related Video Advertising" grew to ¥17 billion (113.3% YoY), continuing its expansion from the previous year. Notably, "TVer" significantly increased its user base, leveraging its content strength derived from terrestrial TV broadcasts. Its growing usage on TV sets also contributed to TV Media-Related Video Advertising.

In 2020, amid a crisis, DX (Digital Transformation) dramatically accelerated, rapidly realizing a worldview that was previously thought to take the next decade to materialize.

Amidst this, the reconstruction and redefinition of media value became apparent. For example, while direct mail (DM) saw a decline, its rate of decrease was relatively slow. It continues to play a role in delivering information that cannot be fully conveyed through digital alone.

Fundamentally, traditional mass media advertising like TV commercials differs in nature from internet advertising. For instance, advertising aimed at long-term brand building, relying on lasting memory, still finds strength in TV and newspapers due to their reach and media credibility.

Furthermore, internet advertising is also used by many individuals and small businesses, and its usage often resembles promotional media tactics. Therefore, rather than comparing them equally, we need to consider how to combine and leverage their respective strengths.

For insights on this topic, last year's special discussion on "Japan's Advertising Expenditures" may be helpful.

DX does not necessarily mean "everything becomes digital." Rather, it can be understood as using digital power to restructure the entire media landscape, including print media, and synergistically leverage the strengths of each medium.

The growth in "digital advertising spending originating from the four mass media" during the COVID-19 pandemic emergency likely reflects the "trustworthiness" of media like newspapers and television. It was a year that saw the various values and roles of media reaffirmed.

Details on "2020 Japan Advertising Expenditures" can be found here (Dentsu Inc. News Release).