Note: This website was automatically translated, so some terms or nuances may not be completely accurate.

Analysis of "2021 Japan Advertising Expenditures" - Advertising Market Shows Significant Recovery. Internet Advertising Expenditures Surpass Total of Four Mass Media for the First Time

On February 24, " 2021 Japan Advertising Expenditures " was announced. Toshiyuki Kitahara of Dentsu Inc. Media Innovation Lab explains the changes in the advertising markets for the four major media outlets, the internet, and promotional media.

Overview of "2021 Japan Advertising Expenditures"──Bright Signs for the Overall Advertising Market Alongside Recovery in Human Flow and the Economy

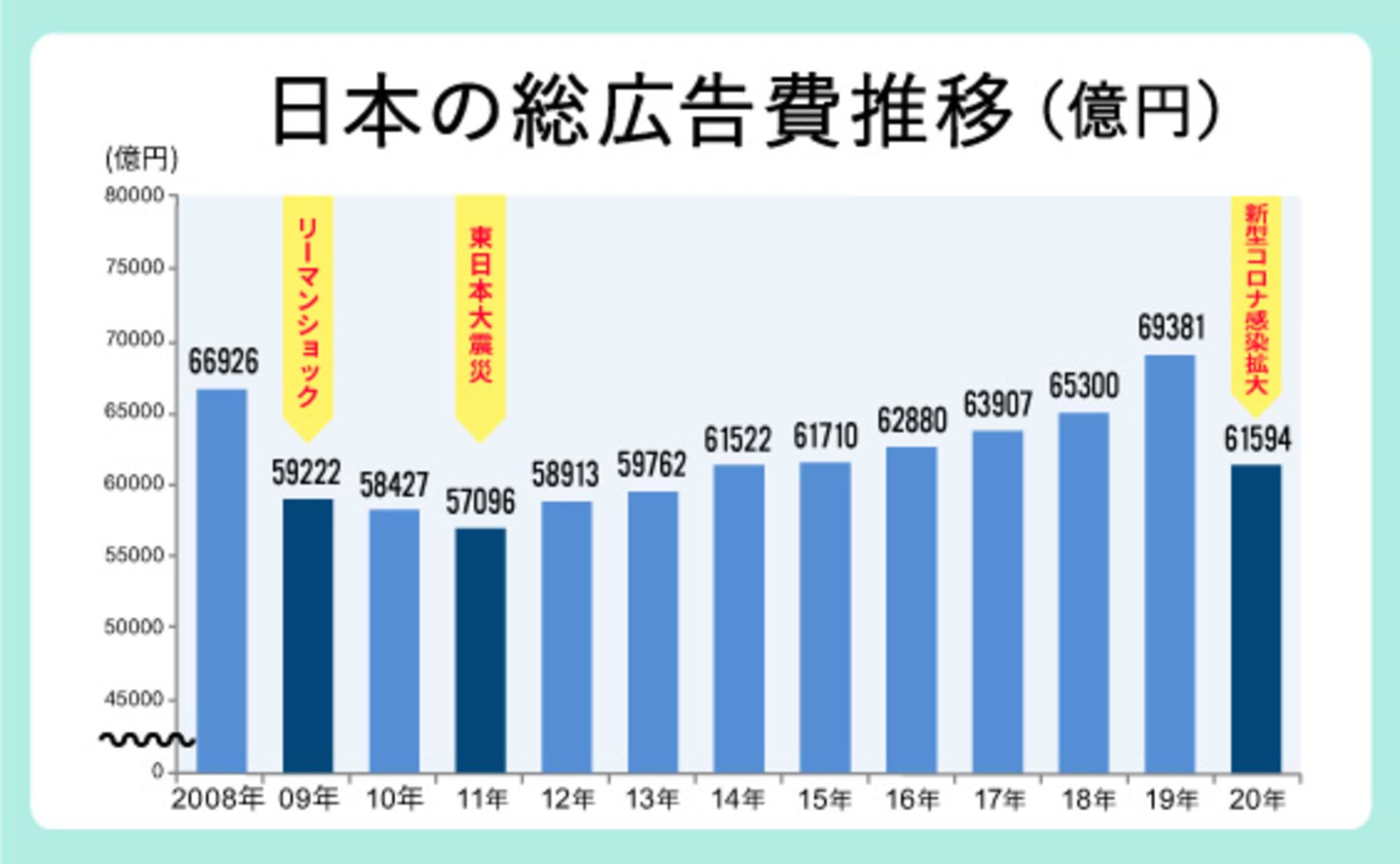

Japan's total advertising expenditure for 2021 (January to December) was ¥6.7998 trillion. Compared to 2020, which saw a significant decline due to the impact of the novel coronavirus disease (COVID-19), this represents 110.4%. The overall advertising market has recovered substantially.

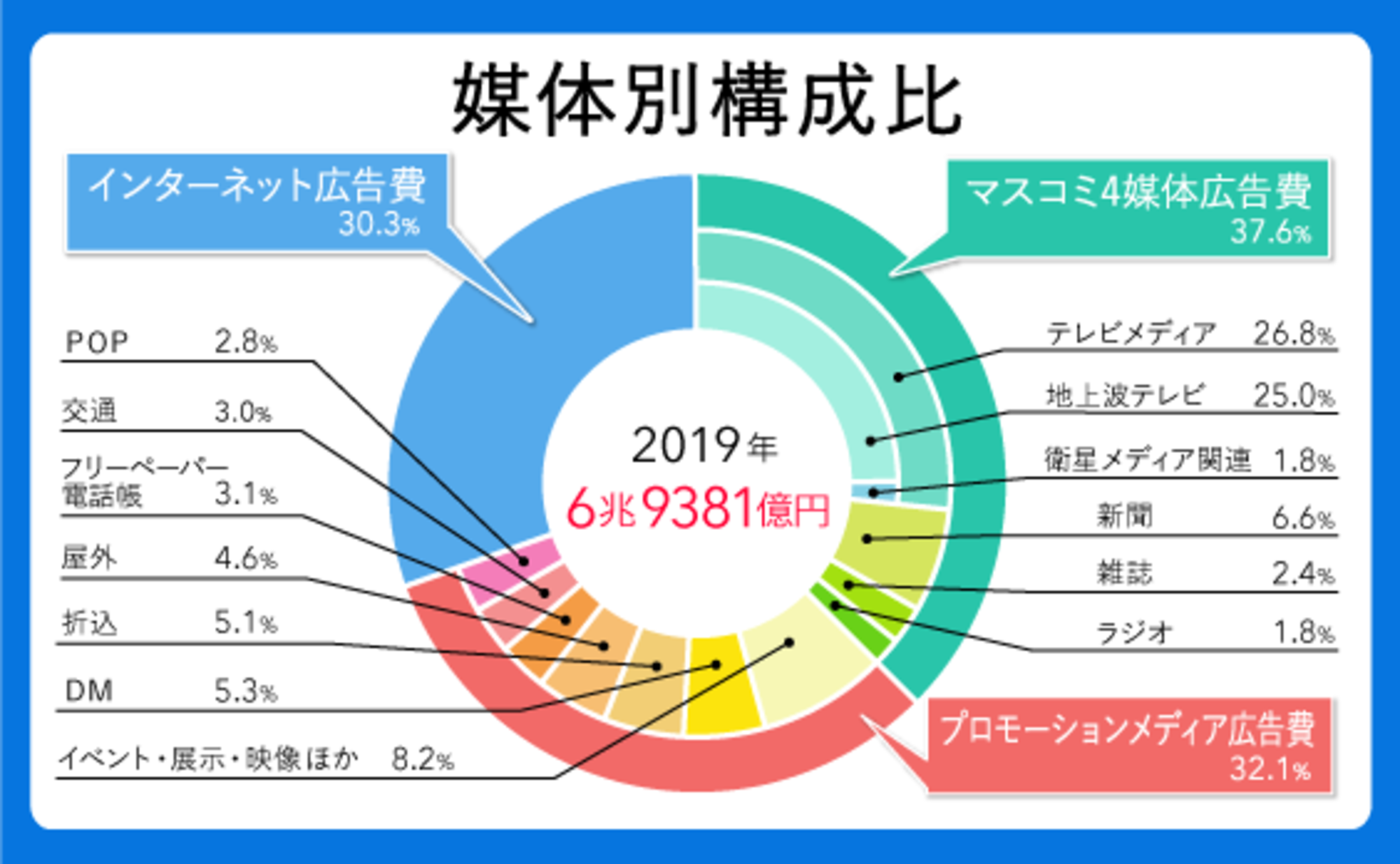

Among these, total internet advertising expenditure, which performs strongly every year, reached ¥2.7052 trillion, a 121.4% increase year-on-year. This exceeded the total advertising expenditure for the four mass media platforms, which was ¥2.4538 trillion.

This marks the first time internet advertising expenditure has surpassed mass media advertising expenditure since estimates began in 1997 for the 1996 performance.

Note: Mass media advertising expenditure refers to the combined media and production costs for "newspapers," "magazines," "radio," and "television media (terrestrial TV + satellite media-related)." Internet advertising expenditure includes media costs, e-commerce platform advertising costs (for goods sales) as defined in "Japan's Advertising Expenditure," and production costs.

Japan's advertising expenditures are broadly categorized as follows:

- "Mass Media Advertising Expenditures"

- "Internet Advertising Expenditures"

- "Promotional Media Advertising Expenditures"

The respective shares of each category within total advertising expenditure are as follows:

The respective shares of total advertising expenditure are: mass media at 36.1%, internet at 39.8%, and promotional media at 24.1%.

Mass Media Advertising, which had been declining until the previous year, recovered to 108.9% compared to the previous year. Internet Advertising increased significantly to 121.4% compared to the previous year.

●Mass Media Advertising Expenditures Recover from Previous Year's Decline

Advertising expenditure for the four major media outlets—newspapers, magazines, television, and radio—totaled ¥2.4538 trillion, a 108.9% increase year-on-year. This figure includes production costs.

Newspapers increased to 103.4% year-on-year, magazines to 100.1%, and radio to 103.8%. Television media, combining terrestrial and satellite, saw double-digit growth at 111.1%, partly due to increased demand from home-based activities.

●Internet Advertising Expenditures──Rapid Digitalization of Society Provides Further Tailwind

Internet advertising expenditure (media fees + "product-selling e-commerce platform advertising fees" + production costs) is growing significantly, driven by the rapid digitalization of society as a whole.

For the first time since estimates began in 1997, it surpassed advertising spending across the four major media outlets. Furthermore, within internet advertising spending, "digital advertising spending originating from the four major media outlets" (detailed later) achieved double-digit growth, exceeding ¥100 billion for the first time.

●Promotional Media Advertising Expenditures──Impact of COVID-19 Persists

Spending continues to decline, at 97.9% of the previous year's level. While various real-world events involving human contact and advertising/promotional campaigns primarily focused on traditional customer attraction are gradually being implemented, the situation remains challenging from the perspective of preventing the spread of COVID-19.

On the other hand, large-scale, high-impact OOH (e.g., large-scale signage in downtown areas or at single stations, large boards) and "insert ads" and "DM (direct mail)" targeting stay-at-home and home-based demand increased.

Detailed Analysis by Medium: Accelerating DX. Trends Revealed Amid the Pandemic

2021 can be described as a year showing bright signs, with the gradual recovery of foot traffic and the economy accompanying the establishment of new lifestyles, leading to a recovery trend for many advertising media.

The digital transformation (DX) of society, which had begun even before the pandemic, accelerated significantly. A digital-first structure began permeating all advertising, from outdoor ads and in-store POP displays to direct mail.

With the normalization of staying home and remote work, advertising spending on television media and internet advertising increased. Demand for video advertising, in particular, grew, expanding the video-based market.

Furthermore, various large-scale events, including the Tokyo 2020 Olympic and Paralympic Games, were held in formats different from previous years.

The following is a breakdown by category.

Mass Media Advertising Spending: Significant Recovery from the Previous Year

●Advertising Expenditures in the Four Major Media <Newspaper Advertising Expenditures>

Newspaper advertising spending increased throughout the year, influenced by the Tokyo 2020 Olympic and Paralympic Games and the 49th House of Representatives election.

Driven by stay-at-home and home-based demand, "Cosmetics & Toiletries" grew to 112.0% year-on-year. "Information & Communications" saw a decline to 96.3% due to a rebound effect from the previous year's substantial increase in advertising spending, but demand related to webinars, remote work, and e-commerce sites continues to expand.

●Mass Media Advertising Expenditures <Magazine Advertising Expenditures>

Looking at magazine advertising spending by industry, "Home Appliances/AV" and "Information/Other (including corporate group ads)" increased compared to the previous year. This is likely influenced by the Tokyo 2020 Olympics and Paralympics.

Meanwhile, the estimated sales value of printed publications in 2021 was 98.7% of the previous year, marking the 17th consecutive year of decline. Conversely, the electronic publishing market grew significantly to 118.6% of the previous year. The penetration of vertical scroll comics(※) is seen as a major contributing factor. (Source: Publishing Monthly Report, January 2022 issue)

※Vertical-scroll comics = Web comics optimized for smartphone viewing, featuring "vertical scrolling" and "full color".

●Mass Media Advertising Expenditures <Radio Advertising Expenditures>

Radio advertising spending also increased, rising 3.2% year-on-year to 103.8%, partly due to increased placements in programs related to the Tokyo 2020 Olympic and Paralympic Games.

By industry, "Beverages & Luxury Goods" saw a 126.9% increase due to stay-at-home demand, while "Information & Communications" (which includes SNS and video subscription services) rose 112.9%.

●Advertising Expenditures Across Four Major Media Channels<TV Media Advertising Expenditures>

Television media advertising expenditure (terrestrial TV + satellite media-related) saw double-digit growth. The resumption of various large-scale sporting events, which had been postponed, led to a significant increase in time-slot advertising spending.

Spot advertising also performed well, driven by strong spending from mobile carriers in the "Information & Communications" sector since spring, alongside increased spending from startups and the human resources sector. Furthermore, spending from the "Beverages & Confectionery" sector, benefiting from stay-at-home demand, was also robust. The "Transportation/Leisure" category, which includes movie advertising, is also gradually recovering. Furthermore, advertising spending in the "Food Service/Various Services" sector increased significantly toward the end of the year. For the full year, all eight core regions significantly exceeded the previous year's figures.

Promotional Media Advertising Expenditures: Increased New Initiatives

●Promotional Media Advertising Spending <Outdoor Advertising, Transportation Advertising>

Advertising demand recovered, particularly in sectors like "Fashion," "Medical," and "Entertainment," as foot traffic returned following the lifting of the state of emergency.

Regarding outdoor advertising, while there was some demand for long-term billboards in certain areas like downtown districts, overall recovery has been sluggish, and the market continues to struggle. Short-term billboards, short-term network billboards, outdoor vision displays, and digital out-of-home ( DOOH ) advertising performed well, particularly large, high-impact OOH in downtown areas. The screening of massive 3D content in downtown areas generated significant buzz.

Transportation advertising, viewed overall, showed a declining trend due to the impact of COVID-19. Within railways, demand tended to concentrate on large, high-impact OOH formats rather than network-based media like hanging advertisements, station signage, and station posters. Airports continued to face entry restrictions due to COVID-19, with international flights decreasing compared to the previous year. Among public transportation options, taxi advertising, which allows for easier targeting, saw growth with an increase in in-cab digital signage advertising.

By industry in transportation advertising, gaming, beauty, SNS video streaming, cloud services, and delivery services were prominent, while beverage advertising continued its decline from the previous year.

●Promotional Media Advertising Expenditures<Insert Ads, DM (Direct Mail)>

Insert ads and DM (direct mail) increased, particularly in major metropolitan areas, as media supporting stay-at-home and home-based demand. A major factor was the recovery in promotional use by distribution and retail, including supermarkets, home centers, and electronics retailers.

While dining and travel-related spending continued to decline due to stay-at-home requests and travel restrictions, delivery services, grocery delivery, and buyback businesses performed well.

Furthermore, the market for "unaddressed DM" expanded to reach targets difficult to reach via digital advertising. Its use grew, primarily in insurance sales, amid the COVID-19 impact making face-to-face sales difficult.

●Promotional Media Advertising Expenditures <Free Papers>

Free papers encompass tabloid-sized papers, magazine-style publications (free magazines), and telephone directories. Following the previous year's trend, spending decreased due to the COVID-19-related stay-at-home requests. Contributing factors include the suspension of some publications, consolidation of distribution areas, and reductions in the number of issues published.

The flow of people, disrupted by factors like increased remote work, has not fully returned, leading to a decrease in free papers placed at train stations.

Conversely, local newspapers and magazines show steady performance. This is underpinned by active sales efforts—leveraging regional reporting capabilities and editorial strength—combined with digital promotion and meticulous distribution.

●Promotional Media Advertising Expenditures

To prevent the spread of COVID-19, in-store customer attraction events and sales promotions continued to be curtailed and showed a decreasing trend.

Conversely, previously unseen initiatives emerged, such as in-store DX initiatives (※), the introduction of digital signage, and the use of new methods like AR and VR, expanding new possibilities for POP advertising.

※In-store DX initiatives = Attempts to collect and analyze data, such as touch-and-try data, purchase path data, and audience size/attribute surveys using AI cameras.

●Promotional Media Advertising Expenditures <Events, Exhibitions, Video, etc.>

Driven by the Tokyo 2020 Olympic and Paralympic Games, the event sector saw an increase to ¥137.2 billion (126.0% year-on-year).

In the exhibition sector, demand for renovations at cultural facilities, department stores, and offices increased. Conversely, at "people-gathering places" like mixed-use commercial facilities and theme parks, spending decreased significantly due to reduced capital investment related to the economic slowdown caused by COVID-19.

Additionally, demand surged for video production for online exhibitions, web conferences, seminars, accompanying streaming videos, and product introductions.

Internet Advertising Expenditures: Demand for Rich Video Ads Rises

In the previous year, when overall advertising spending declined significantly due to the COVID-19 impact, internet advertising expenditure was the only sector to achieve growth. This momentum continued, with a substantial year-on-year increase of 121.4% in 2021, growing to a market size exceeding that of the four major media outlets.

Internet Advertising Media Spending: Digital Advertising Originating from the Four Major Media Exceeds ¥100 Billion for the First Time

Internet advertising media spending grew substantially to ¥2.1571 trillion (122.8% year-on-year). Video streaming service users, widely adopted due to stay-at-home demand, continue to increase. The Tokyo 2020 Olympic and Paralympic Games being held without spectators also contributed to a significant rise in video advertising.

Digital advertising originating from the four major media outlets (included in media spending), which has been attracting attention in recent years, exceeded ¥100 billion for the first time, achieving double-digit growth for the second consecutive year.

● Newspaper Digital──Leveraging newspaper credibility, reserved advertising also increased

During the first half of the year, reservation-based advertising, such as tie-up articles leveraging the strength of "newspaper credibility," increased. Furthermore, page views rose due to news related to the Tokyo 2020 Olympic and Paralympic Games and COVID-19, leading to an increase in programmatic advertising during that period. Throughout the year, online events hosted by newspaper companies were also active.

●Magazine Digital──Advertising initiatives leveraging publishing editorial content creation and audience-gathering capabilities

Magazine content digitization continued its strong growth from the previous year. A key factor was the establishment of advertising initiatives leveraging the unique strengths of publishing and editing, such as content production capabilities (webinar planning, online events, advertiser content creation, video production/distribution) and community-based audience attraction.

Furthermore, synergies between magazines and e-commerce/social media are being effectively leveraged. Various R&D initiatives utilizing "publishing IP (intellectual property)" are advancing, including monetizing fan communities, expanding comic businesses, XR(※), the metaverse domain, and high-value content transactions using NFTs (non-fungible tokens).

※XR = Cross Reality. A general term for technologies that fuse the real and virtual worlds, enabling the perception of things not present in reality. Includes AR and VR.

●Radio Digital──Growing Demand for Audio Media

New and ongoing advertising placements on radiko are on an upward trend, reaching 127.3% year-on-year. The increased demand for audio media, including podcasts, stems from factors like reduced outings and the spread of remote work. Premium audio ads on radiko, which reach Spotify users, are also performing well.

● TV Media Digital──Viewing on Connected TVs Also Expanding

Video advertising related to TV media continues its rapid growth, reaching 146.5% of the previous year. Among these, "TVer" is showing steady growth in both playback numbers and user numbers.

A recent trend is the widespread adoption of connected TVs. Digital content optimized for viewing on large TV screens is becoming the norm.

E-commerce Platforms for Physical Goods──Everyone is Using Them While Staying Home

With the shift of purchasing to the internet, advertising spending on product-selling e-commerce platforms continued its high growth rate from the previous year. Due to COVID-19 restrictions on going out, distribution has increased not only for daily necessities and home appliances but also for non-essential items like clothing, books, and toys.

Internet Advertising Production Costs - Content is Becoming Increasingly Rich

Changing consumption patterns and corporate digital transformation (DX) are driving increased demand for ad production. Video advertising, in particular, is growing significantly. As a wide range of video ads proliferate—from brand films to viral videos on social media—production costs for rich content have risen notably.

The widespread adoption of infrastructure improvements, including 5G, demanding higher quality is also a contributing factor.

How to leverage the increasingly converged internet and other media?

In 2021, economic activity gradually recovered, and most media saw positive growth. However, with stay-at-home and remote work becoming established, foot traffic has not fully returned, leading to sluggish growth in real-world promotions, outdoor advertising, and travel-related ads.

While internet advertising growth remained strong, the advancement of DX across multiple sectors led to increased use of other media like print to reach audiences beyond what online alone could capture. For example, even in print direct mail, many new initiatives emerged in seemingly non-digital areas, such as optimizing and tailoring messages to individuals based on user data.

Furthermore, more hybrid events combining physical and online elements were held than the previous year, particularly in established fields like sports and music. Initiatives incorporating AR and VR are also gradually increasing.

Compared to the previous year, 2021 saw further expansion of DX. Collaboration with existing media, such as the four major mass media outlets and promotional media advertising, which offer broad reach and high synchronized messaging, deepened significantly. This suggests the relationship between the internet and other media has entered a new phase.

For details on "2021 Japan Advertising Expenditure," see here (Dentsu Inc. News Release).

Was this article helpful?

Newsletter registration is here

We select and publish important news every day

For inquiries about this article

Back Numbers

2021/02/25

Analysis of "2020 Japan Advertising Expenditures"──First Decline in Nine Years Amid Pandemic. Second Half Shows Resilient Recovery Trend

2020/03/11

"2019 Japan Advertising Expenditures" Analysis—Internet Advertising Expenditures Grow at Double-Digit Rate for Sixth Consecutive Year, Surpassing Television Media

Author

Toshiyuki Kitahara

Dentsu Inc.

Dentsu Inc. Media Innovation Lab

Principal Researcher

After working in the Information Systems Department and the Management Planning Department, he joined the Research and Development Department. He has held his current position since 2011. Engaged in research on mass media and communication, consulting for media companies, organizational and personnel system consulting, and advertising and related market/industry trend research. Responsible for "Japan's Advertising Expenditures" in the 'Information Media White Paper'. Author of numerous books and papers, including 'Information Innovators: Leaders of the Co-Creation Society' (co-authored, 1999, Kodansha). Also engaged in various surveys and projects related to newspaper companies, primarily regional papers.

Articles by this person

What's the true intent behind the "Declaration to Quit Mass Media"? The current state of local media. Special Discussion: "Japan's Advertising Expenditures in 2024"