Cyber Communications Inc. (CCI), D2C Inc., Dentsu Inc., and Dentsu Digital Inc. jointly released the "2020 Detailed Analysis of Internet Advertising Media Costs in Japan" (hereinafter referred to as this survey). Rika Kaji of CCI provides commentary.

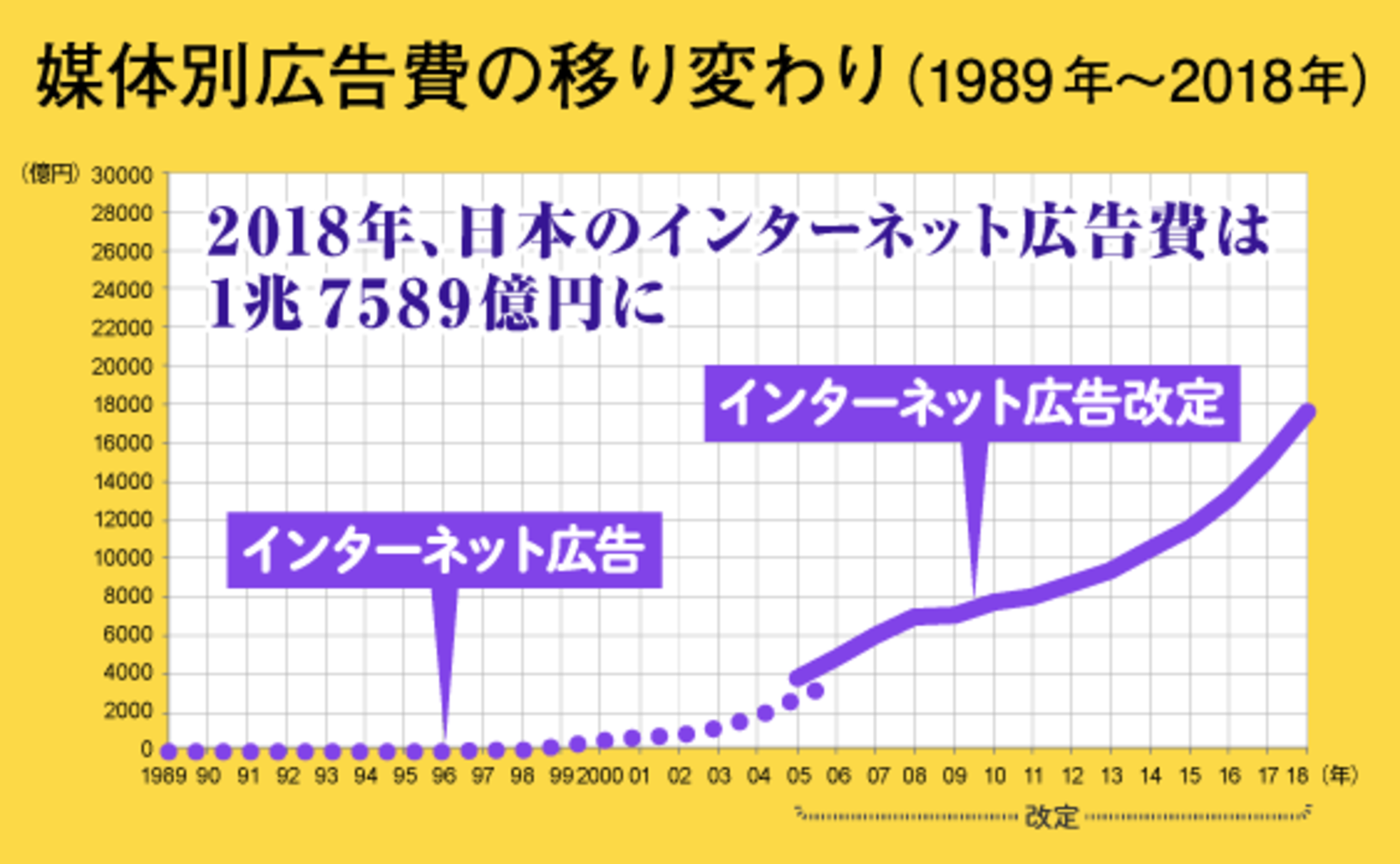

Internet advertising expenditure reaches 36.2% of Japan's total advertising expenditure

As previously reported, Japan's total advertising expenditure in 2020 decreased to ¥6,159.4 billion, 88.8% of the previous year's level, due to the impact of the spread of COVID-19 ( see explanatory article ).

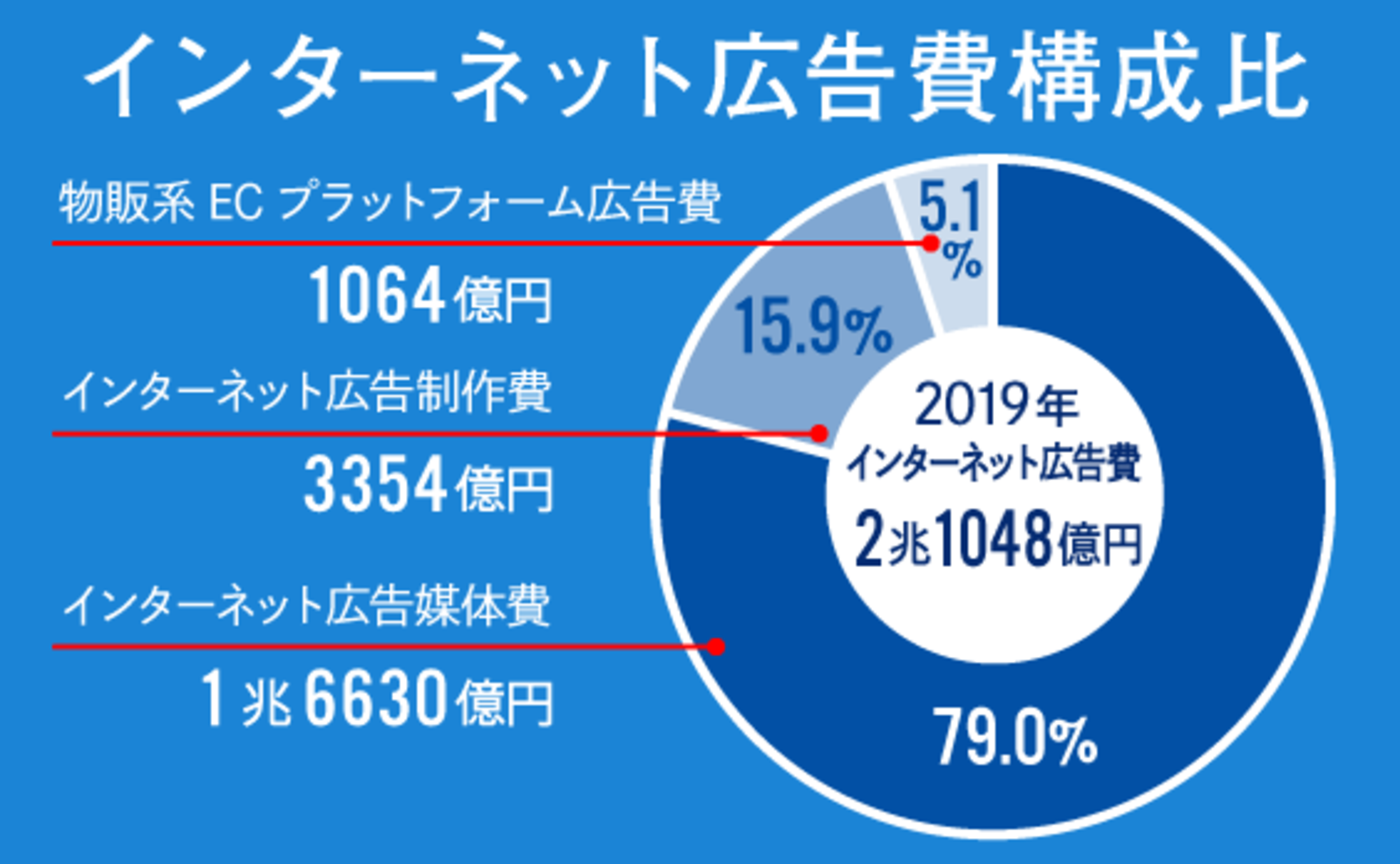

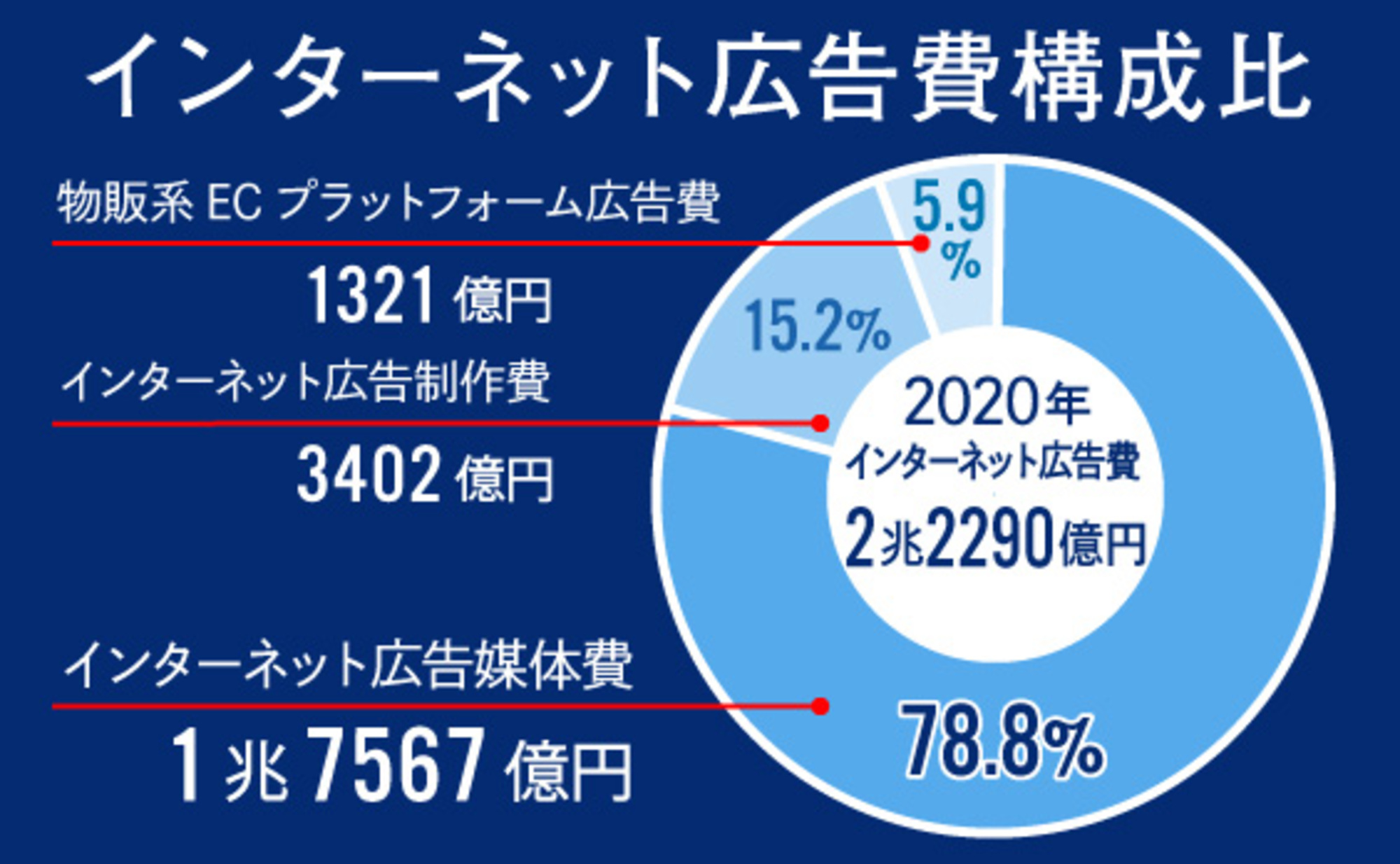

However, even under these circumstances, "Internet Advertising Expenditures" continued consistent growth, reaching ¥2.229 trillion – comparable to the ¥2.2536 trillion spent on "Mass Media Advertising" – and growing into a market accounting for 36.2% of total advertising expenditures.

"Internet advertising media costs," which exclude "internet advertising production costs" and "product-selling e-commerce platform advertising costs" from "internet advertising costs," reached ¥1.7567 trillion (105.6% year-on-year).

This article focuses on explaining these "Internet Advertising Media Costs."

Internet Advertising Media Costs by "Advertising Type" and "Transaction Method"

We analyzed the breakdown of the ¥1.7567 trillion in Internet advertising media costs by "advertising type" and "transaction method."

● By Ad Type: Video Ads Surpassed 20% of Online Advertising, Growing 121.3% YoY

By advertising type, "search-linked advertising" accounted for the largest share of the total ¥1.7567 trillion in internet advertising media costs, representing 38.6% or ¥678.7 billion. This refers to advertising linked to search engines.

Next, banner-type "display ads" appearing on various websites accounted for 32.6% of the total, or ¥573.3 billion. Together, these two types represent 70% of the total.

Video advertising, which uses video file formats (moving images and sound), continued its significant growth from the previous year.

Video advertising accounted for less than 10% of internet advertising media spending in 2017 (9.5%, or ¥115.5 billion) (※1), but reached 14.0% (¥202.7 billion) in 2018, 19.1% (¥318.4 billion) in 2019, and finally exceeded 20% for the first time in 2020, reaching 22.0% or ¥386.2 billion.

This represents a 121.3% year-on-year increase, significantly outpacing the overall internet advertising expenditure growth rate of 105.6%.

While video advertising applications were once limited, infrastructure improvements have advanced year by year, making it the advertising category driving the growth of internet advertising spending. Further utilization is expected with the spread of 5G networks and other developments.

*1: In 2018, "digital advertising spending originating from the four mass media" was added to the estimation scope for internet advertising media spending. Therefore, the scope for 2017 differs and is provided as a reference value.

●Video advertising also grows in share by transaction method and ad type

By transaction method, "performance-based advertising" accounted for 82.9% (¥1.4558 trillion), exceeding approximately 80% of the total. It continues to be the mainstay of internet advertising transactions, attracting significant demand.

Conversely, due to the impact of the COVID-19 pandemic, both pre-booked advertising (87.5% of the previous year) and performance-based advertising (93.9% of the previous year) decreased.

When cross-referencing this breakdown of advertising expenditure by transaction method with ad type (see figure above), "search-linked performance-based advertising" leads with 678.7 billion yen, accounting for 38.6% of the total.

Next were "programmatic display advertising" at 25.7% (¥452 billion) and "reservation-based display advertising" at 6.9% (¥121.3 billion), both representing significant shares. However, while programmatic display advertising grew by 112.1% year-on-year, reservation-based display advertising grew by only 80.1% year-on-year, a rate even lower than the overall decline.

Here too, "programmatic video advertising" showed strong growth, reaching 320.6 billion yen (18.3% share; 15.2% in 2019). "Reserved video advertising" saw a slight decrease to 65.6 billion yen (3.7% share; 4.0% in 2019), but remained close to the previous year's level.

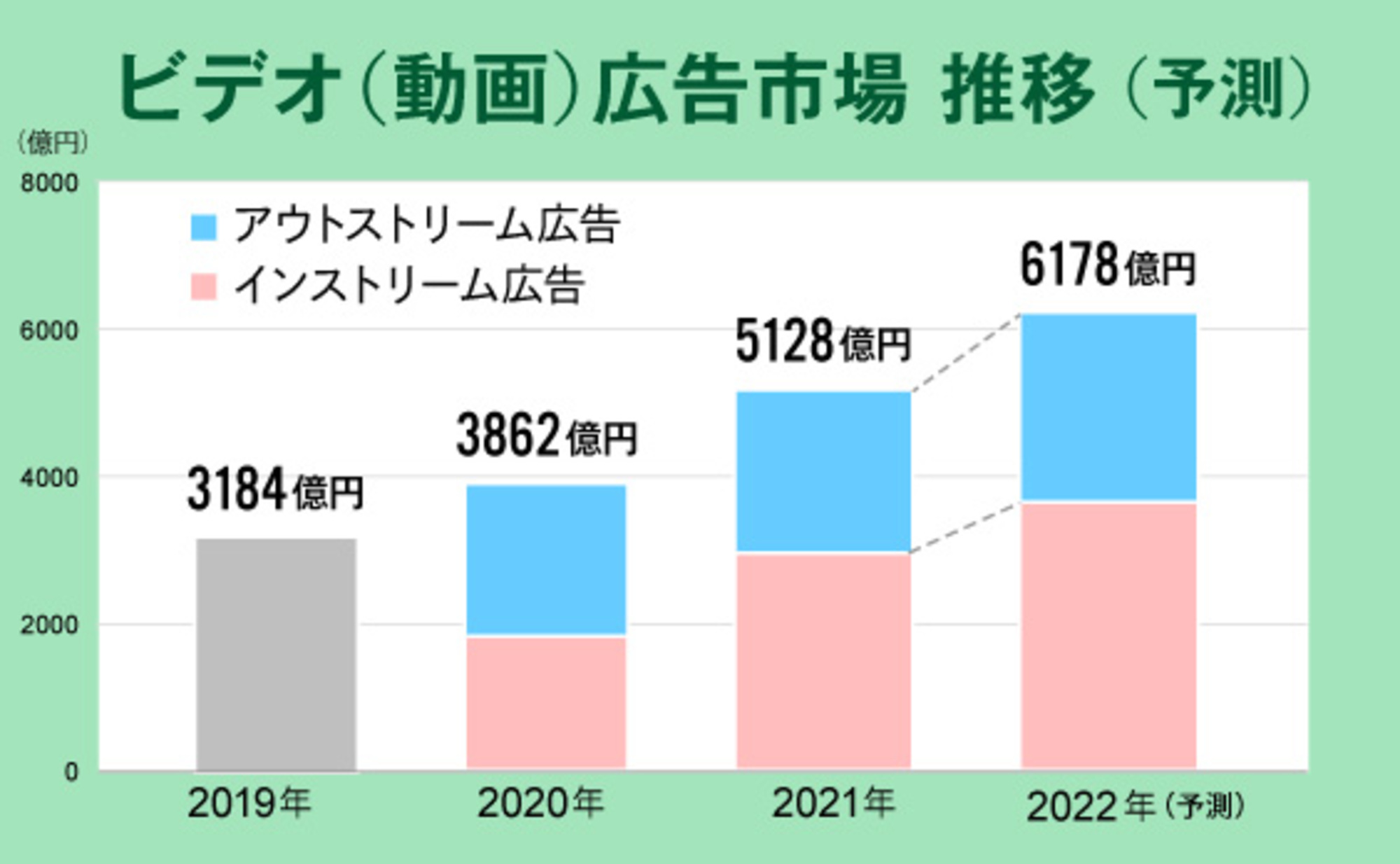

Topic ① Video Advertising Spend Split Even Between In-Stream and Out-Stream

Here, we analyze the breakdown of video advertising spending, which has shown particularly strong growth in recent years within internet advertising.

Of the ¥386.2 billion spent on video advertising, "in-stream ads"—played before, during, or after video content—accounted for 46.6% of the total, or ¥180.0 billion. "Out-stream ads"—displayed in ad slots outside video content on the web or within article content—accounted for 53.4% of the total, or ¥206.3 billion.

While nearly evenly matched, out-stream content holds a slightly higher proportion.

By transaction method, programmatic advertising dominated with ¥320.6 billion, accounting for over 80% of video advertising.

Topic 2: Over 30% of Total Internet Advertising Spending Goes to "Social Advertising"

This survey estimates "social advertising" as ads displayed on "social media" services (*2) that use user-generated content.

In 2020, social advertising grew significantly, reaching ¥568.7 billion (116.1% year-on-year), accounting for over 30% of total internet advertising media spending.

Similar to last year, we analyzed the composition ratio by categorizing them into three groups: "SNS-type," "video-sharing type," and "other" (including blog services, social bookmarking services, and electronic bulletin board services).

※2 Social Media

This survey defines "social media" as platforms that provide services where users share and interact with content posted by other users.

Continuing from the previous year, "SNS-type" remained the largest segment, accounting for 43.7% with 248.8 billion yen. "Video sharing-type" grew to 158.5 billion yen (113.9 billion in 2019), representing 27.9% (23.2% in 2019), closing in on the "Other" category's 28.4%.

What will happen to internet advertising spending in 2021?

In "2020 Japan Advertising Expenditures," while the impact of the COVID-19 pandemic led to the first negative growth in nine years, internet advertising expenditure was the only category to show positive growth.

Particularly noteworthy is the continued growth from the previous year in "Video Advertising," "Social Advertising," and "E-commerce Platform Advertising. "

Regarding video advertising, as communication environments become smoother with the spread of 5G and other factors, viewership is expected to increase further. Particularly during the pandemic-induced "stay-at-home" period, free video streaming services have also increased their viewership, and further growth and expansion of the in-stream advertising supporting them is anticipated.

Video advertising on TV-related media, such as TVer, still has significant room for growth. For instance, if the trend toward simultaneous streaming accelerates, demand could potentially explode.

Within social advertising, "video-sharing platforms" have seen particularly strong growth, with the pre-existing trend accelerating due to the pandemic. Changes in consumer lifestyles driven by the pandemic will likely make "video ads on social media" increasingly mainstream going forward.

Furthermore, "e-commerce platform advertising spend" (estimated since 2019) is now in its second year. Alongside changes in consumer purchasing behavior during the pandemic, e-commerce usage has increased, driving advertising spend to ¥132.1 billion (124.2% year-on-year growth) (※3).

Advertising expenditure on product-selling e-commerce platforms refers to ads placed by companies operating online stores within e-commerce malls to drive traffic to their product pages. Furthermore, the number of DtoC (Direct to Consumer) businesses without physical stores is increasing, making it crucial to effectively direct users to their own pages online. Against this backdrop, advertising expenditure on product-selling e-commerce platforms is expected to continue expanding.

※3 Regarding "Product-Based E-Commerce Platform Advertising Expenditures" in "Japan's Advertising Expenditures"

Starting in 2019, "E-commerce Platform Advertising Expenditures" were newly estimated and added within "Internet Advertising Expenditures" in "Japan's Advertising Expenditures." This is not included in "Internet Advertising Media Fees."

Finally, let's consider future challenges for internet advertising based on findings from CCI's "Internet Advertising Market Trends in the Second Half of 2020 During the COVID-19 Pandemic," a survey conducted among advertisers, media platform operators, advertising agencies, media reps, consulting firms, and ad tech vendors.

While programmatic advertising showed steady growth in the 2020 internet advertising market, challenges remain. The issue that garnered the most responses in the survey was "content quality."

On social media, where user-generated content is central, controlling content quality is difficult, and many respondents cited brand risk as a challenge.

Furthermore, for targeting ads—the core of performance-based advertising—consideration for user privacy is becoming increasingly important, as seen in Google's full-scale move away from cookies. Technical responses are also urgently needed, such as addressing cookie regulations and IDFA policy changes.

While this has been a key focus area for the advertising industry, including the Dentsu Group, in recent years, the central questions for internet advertising going forward will be: "How can we improve content quality and reduce brand risk for advertisers while ensuring sufficient reach and effectiveness?" and "How can we prioritize user privacy protection in marketing?"