On March 17, four companies—D2C Inc., Cyber Communications Inc. (CCI), Dentsu Inc., and Dentsu Digital Inc.—jointly released the " 2019 Detailed Analysis of Internet Advertising Media Costs in Japan " (hereinafter referred to as this survey).

Toshiyuki Kitahara of Dentsu Inc. Media Innovation Lab explains the findings of this survey, including the "E-commerce Platform Advertising Expenditures" which were not included in the Internet Advertising Media Expenditures.

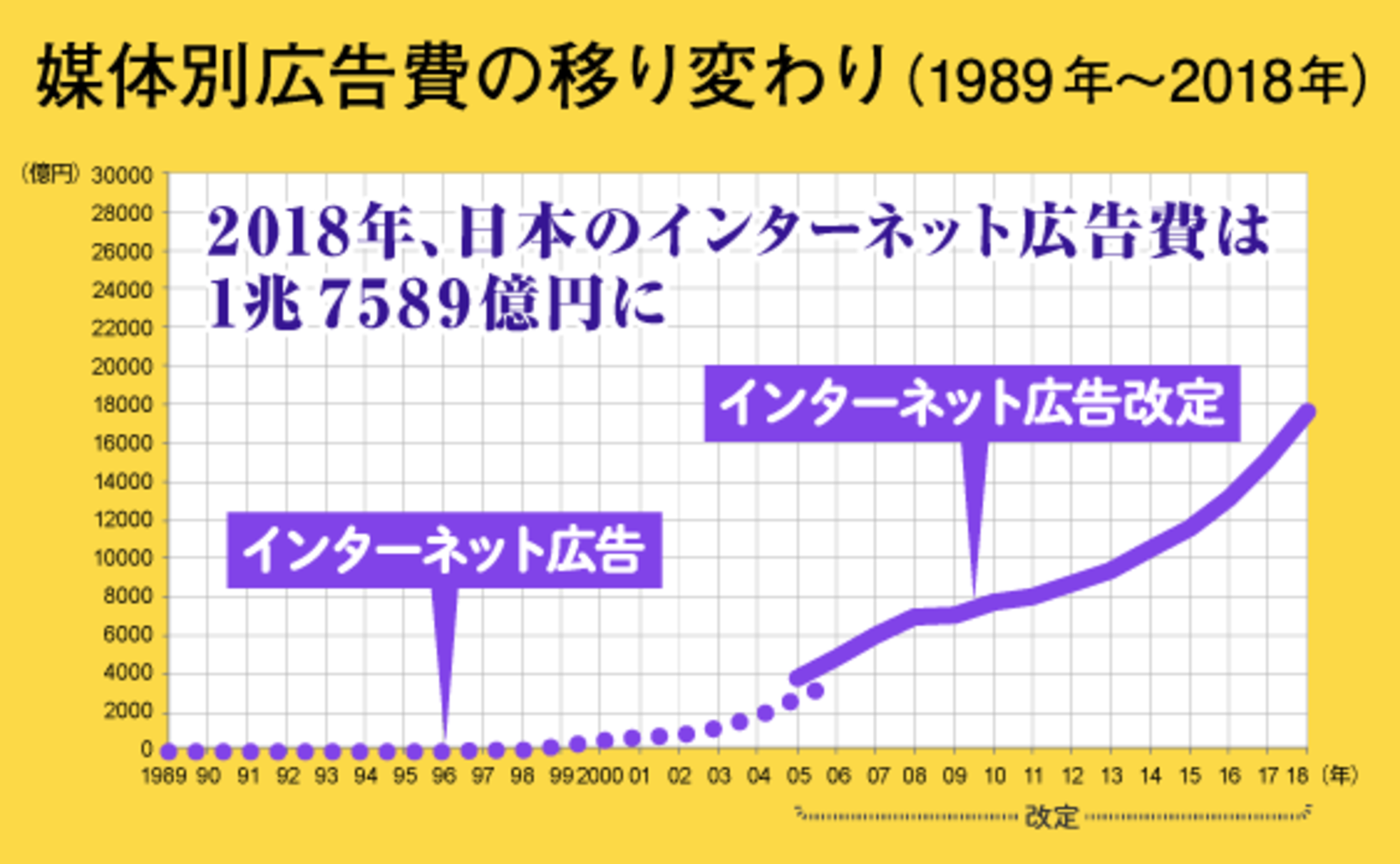

Internet advertising expenditure reaches 30.3% of Japan's total advertising expenditure

Japan's total advertising expenditure in 2019 was ¥6,938.1 billion (※). Within this, internet advertising expenditure grew to ¥2,104.8 billion, a 119.7% increase year-on-year, accounting for 30.3% of Japan's total advertising expenditure.

※Starting this year, "Advertising Expenditures for Product-Based E-Commerce Platforms" ( ※1 ) and "Events" ( ※2 ) were newly added as estimation targets within "Japan's Advertising Expenditures." Using the same estimation method as the previous year, the figure was ¥6,651.4 billion, a 101.9% increase year-on-year.

Internet advertising expenditure can be broadly divided into two categories. One is "Internet Advertising Media Costs," which amounted to ¥1.663 trillion in 2019. The other is "Internet Advertising Production Costs," which amounted to ¥335.4 billion in 2019. In addition to these, the newly estimated "Product-Selling E-Commerce Platform Advertising Costs" for 2019 were ¥106.4 billion.

This time, we conducted a detailed analysis of "Internet Advertising Media Fees," which constitute the largest portion of the above.

Internet Advertising Media Costs by "Advertising Type" and "Transaction Method"

This detailed analysis breaks down the ¥1.663 trillion in Internet Advertising Media Costs by "Advertising Type" and "Transaction Method."

● By Ad Type: Video Ads Expanded to Nearly 20% of the Total

By advertising type, "search-linked advertising" accounted for the largest share of the total ¥1.663 trillion in internet advertising media costs, representing 40.2% or ¥668.3 billion. This refers to advertising linked to search engines.

Next, "display ads"—banner-type ads displayed on various websites—accounted for 33.3% of the total, or ¥554.4 billion.

The category showing particularly strong growth this time was "video advertising," which categorizes ads in video file format (moving images and sound). Video advertising accounted for only 9.5% (¥115.5 billion) of total internet advertising media spending in 2017. However, it reached 14.0% (¥202.7 billion) of the total in 2018 and then 19.1% (¥318.4 billion) in 2019.

This represents a year-on-year increase of 157.1%, significantly outpacing the 119.7% growth of total internet advertising spending.

As mobile device communication speeds continue to improve year after year, the trend of video advertising—which enables richer expression—growing steadily is likely to continue for some time.

● Video advertising also shows growth in share by transaction method and ad type

By transaction method, "performance-based advertising" accounted for 79.8% or ¥1.3267 trillion, representing approximately 80% of the total. As in previous years, it remains the mainstream method for internet advertising transactions.

Breaking down this advertising expenditure by transaction method into ad types (see chart above), "programmatic search-linked ads" represent the largest share at 40.2% of the total.

"Programmatic display advertising" accounted for 24.2%, and "reserved display advertising" accounted for 9.1%, representing significant shares. However, compared to 2018, where programmatic display advertising was 28.0% and reserved display advertising was 11.0% of the total, both saw slight decreases.

Conversely, "programmatic video advertising" grew significantly to 15.2% (up from 12.0% in 2018), and "reserved video advertising" also saw substantial growth to 4.0% (up from 2.0% in 2018).

●Estimation of Advertising Expenditures by Device (Reference Values)

Until 2018, we also published survey results broken down by device (mobile ads and desktop ads). However, starting in 2019, we decided to treat these as reference values.

The reason is that "device-agnostic ad delivery" has become the mainstream. Considering the current reality where ads are delivered regardless of device, based on individual interests, preferences, location, and time—a shift from the traditional "ad slot-based" sales approach—the significance of publishing data separated by device has diminished.

Therefore, while these figures should be viewed strictly as "reference values," they do provide insight into the current reality: mobile devices dominate actual ad delivery numbers, even if advertising budgets aren't explicitly split.

Approximately 30% of total internet advertising media spending is allocated to "social advertising."

We estimate that advertising deployed on social media platforms, which use user-generated content as its foundation, constitutes "social advertising."

Furthermore, "social advertising" is categorized into "SNS-type," "video sharing-type," and "other" (including blog services, social bookmarking services, and electronic bulletin board services).

When broken down by social media type into "SNS-based," "video sharing-based," and "other," "SNS-based" accounted for the largest share at ¥228 billion.

Social advertising expenditure grew at a high rate of 126% year-on-year, reaching ¥489.9 billion, accounting for 29.5% of total internet advertising media expenditure. Whether this high growth will continue remains noteworthy.

What is the rapidly growing "merchandise-based e-commerce platform advertising expenditure"?

In July 2019, three domestic Dentsu Group companies (D2C Inc., CCI, Dentsu Inc.) focused on the rapidly expanding advertising market for product-selling e-commerce platforms. As a first-time initiative, they estimated and announced the 2018 domestic advertising expenditure for these platforms.

■Explanation of the "2018 Estimated Survey of Advertising Expenditures on Product-Selling E-Commerce Platforms"―The rapidly expanding advertising market size for product-selling e-commerce platforms reached ¥112.3 billion

https://dentsu-ho.com/articles/6754

The above survey estimated 2018 advertising expenditure on merchandise-based e-commerce platforms at ¥112.3 billion. However, it was discovered that this figure partially included advertising expenditure already estimated in previous "Japan Advertising Expenditure" reports.

In this "2019 Japan Internet Advertising Media Expenditure" survey, we attempted a new estimation using definitions and questions designed to isolate the portion not overlapping with "Japan's Advertising Expenditure". As a result, we estimated the non-overlapping portion (the portion not previously estimated) to be ¥106.4 billion (red boxed area in the figure above).

As a reference value, using the same estimation method as before, the 2019 "Product-Selling E-Commerce Platform Advertising Expenditure" is estimated at ¥137.6 billion, a 128.5% increase from the previous year. This further suggests the blue shaded area in the figure above is growing.

We plan to continue monitoring this area as one expected to see significant growth and will conduct further research at .

What will happen to internet advertising spending in 2020?

The "2019 Japan Advertising Expenditures" report estimated impactful figures such as "Internet advertising expenditure surpassing 2 trillion yen for the first time" and "growing to account for 30% of Japan's total advertising expenditure." The internet advertising media expenditure analyzed here is also expected to maintain its growth trajectory.

However, we cannot simply conclude from these figures that "traditional mass media advertising will be replaced by internet advertising." As mentioned in the section on advertising expenditure by device, advertising is increasingly being conceived and delivered not in terms of "slots" but fundamentally in terms of "people."

Recently, we published a "Special Discussion on Japan's Advertising Expenditures " in Web Dentsu News, featuring Makoto Koide, Managing Director of the Japan Advertisers Association, and Ritsuya Oku from Dentsu Inc. Media Innovation Lab. As Koide-san states in this article, today's era demands advertising planning from a "media-neutral" perspective, regardless of whether it's online or offline.

In this context, the old dichotomy between mass media and the internet no longer holds meaning. Instead, we need to consider new forms of advertising communication that combine the strengths of each medium.

Regarding challenges in internet advertising, issues like ad fraud and brand risk, mentioned by Mr. Koide in the above discussion, exist. These challenges are certainly not being ignored; the entire advertising industry, including the Japan Advertisers Association and Dentsu Group companies, is working to resolve them.

Our role is to realize advertising communication that benefits both advertisers and consumers. We hope this survey, by providing an overview of trends from the perspective of "advertising expenditure," will contribute to the strategies of advertisers and media, and help build a better future.

※1 "Advertising Expenditures in Japan" - "Advertising Expenditures on Product-Selling E-Commerce Platforms"

This refers to advertising expenditures invested within an e-commerce (EC) platform that sells goods such as home appliances, miscellaneous goods, books, clothing, and office supplies (referred to as a "retail EC platform" in this advertising expenditure report) by businesses that have "opened a storefront" on that platform (referred to as "businesses with storefronts" in this advertising expenditure report). This does not refer to the broader category of "Internet advertising expenditure aimed at promoting sales within the e-commerce domain" as a whole. Furthermore, while D2C Inc., CCI, and Dentsu Inc. jointly announced "Advertising Expenditure on Product-Selling E-Commerce Platforms" on July 29, 2019, this figure has been newly estimated for the "2019 Advertising Expenditure in Japan" survey by eliminating overlaps with "Advertising Expenditure in Japan," redefining the scope, and making additional projections. 2018: ¥82.2 billion (reference value, not included in "2018 Japan Advertising Expenditure") / 2019: ¥106.4 billion (reference year-on-year change: 129.4%)

Reference) July 29, 2019 Joint Release by D2C Inc., CCI, and Dentsu Inc.

https://www.dentsu.co.jp/news/release/2019/0729-009857.html

2018 Actual: ¥112.3 billion (120.6% YoY)

2019 Forecast: ¥144.1 billion (128.3% year-on-year)

↑Back to main text

※2 "Events, Exhibitions, Video, etc."

This includes production costs for various events, exhibitions, expositions, PR pavilions, etc., handled by the advertising industry (including sales promotion campaigns), as well as production and screening costs for cinema ads, videos, etc. The event portion, defined below, has been added to the previously estimated "Exhibitions, Video, etc." category.

Definition of "Event" advertising expenditure in "Japanese Advertising Expenditure" (¥180.3 billion in 2019; not disclosed for 2018 as estimation was not possible): Production costs for promotional campaigns, pop-up stores, sports events, PR events, etc., within the event domain handled by the advertising industry, excluding display advertising, exhibitions, expos, and promotional video production.

↑Back to main text