Note: This website was automatically translated, so some terms or nuances may not be completely accurate.

"2021 Internet Advertising Media Costs" Explained: Video Ads, Social Ads, and Current Trends

CARTA COMMUNICATIONS (CCI), D2C Inc., Dentsu Inc., and Dentsu Digital Inc. jointly released the "2021 Detailed Analysis of Japan's Advertising Expenditures: Internet Advertising Media Costs" (hereinafter referred to as this survey). Rika Kajiwara of CARTA HOLDINGS, INC provides commentary.

*News Release : "2021 Japan Advertising Expenditure: Detailed Analysis of Internet Advertising Media Costs"

<Table of Contents>

▼Internet Advertising Expenditures Exceed Total Mass Media Advertising Expenditures for the First Time

▼Internet Advertising Media Expenditures by "Advertising Type" and "Transaction Method"

▼Topic ① Video Advertising Spending: In-Stream Ads Surpass Out-Stream Ads

▼Topic 2: Social advertising accounts for 35.4% of total internet advertising media spending

▼What will happen to internet advertising spending in 2022?

Internet advertising spending surpasses total advertising spending across the four major media outlets for the first time

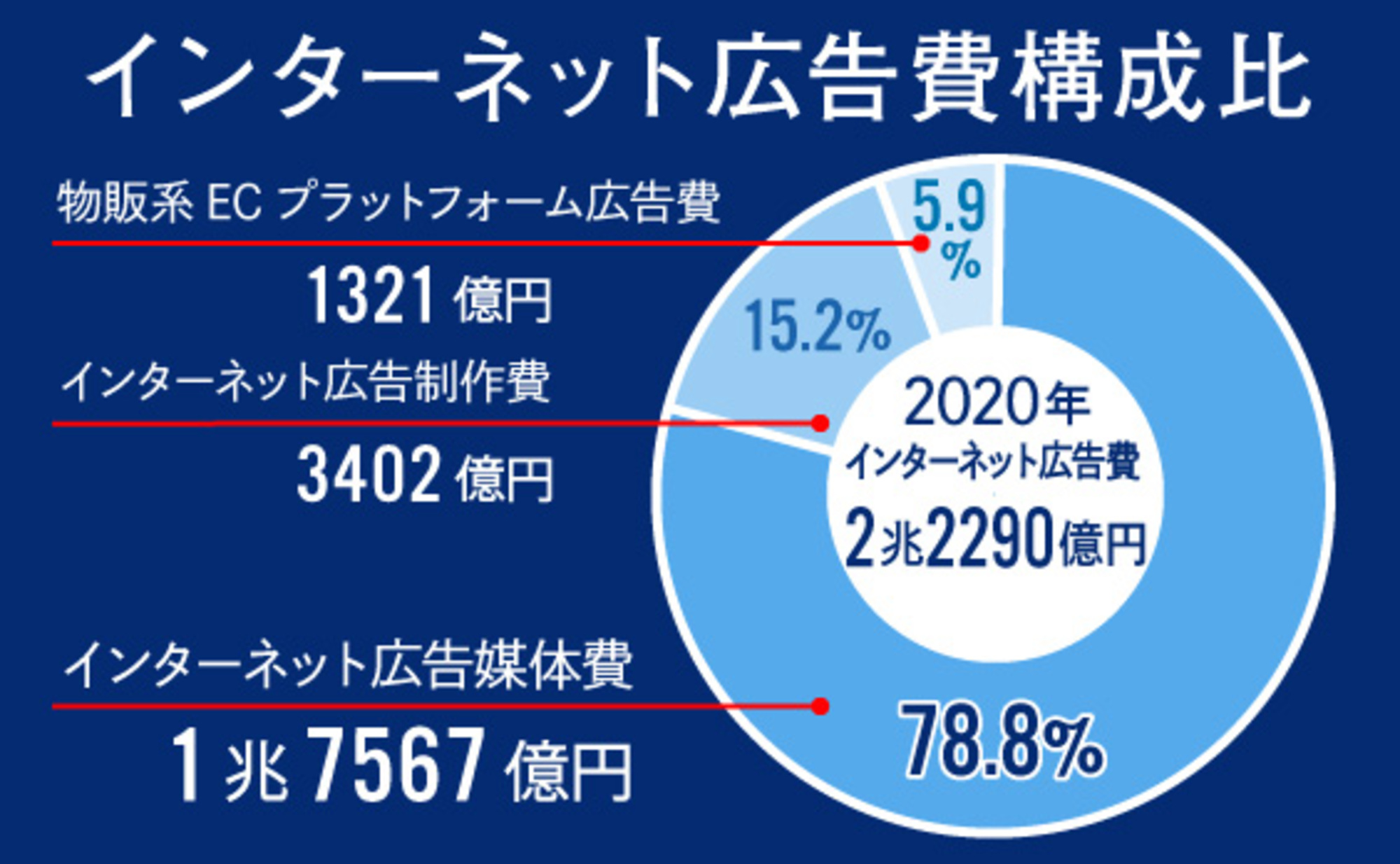

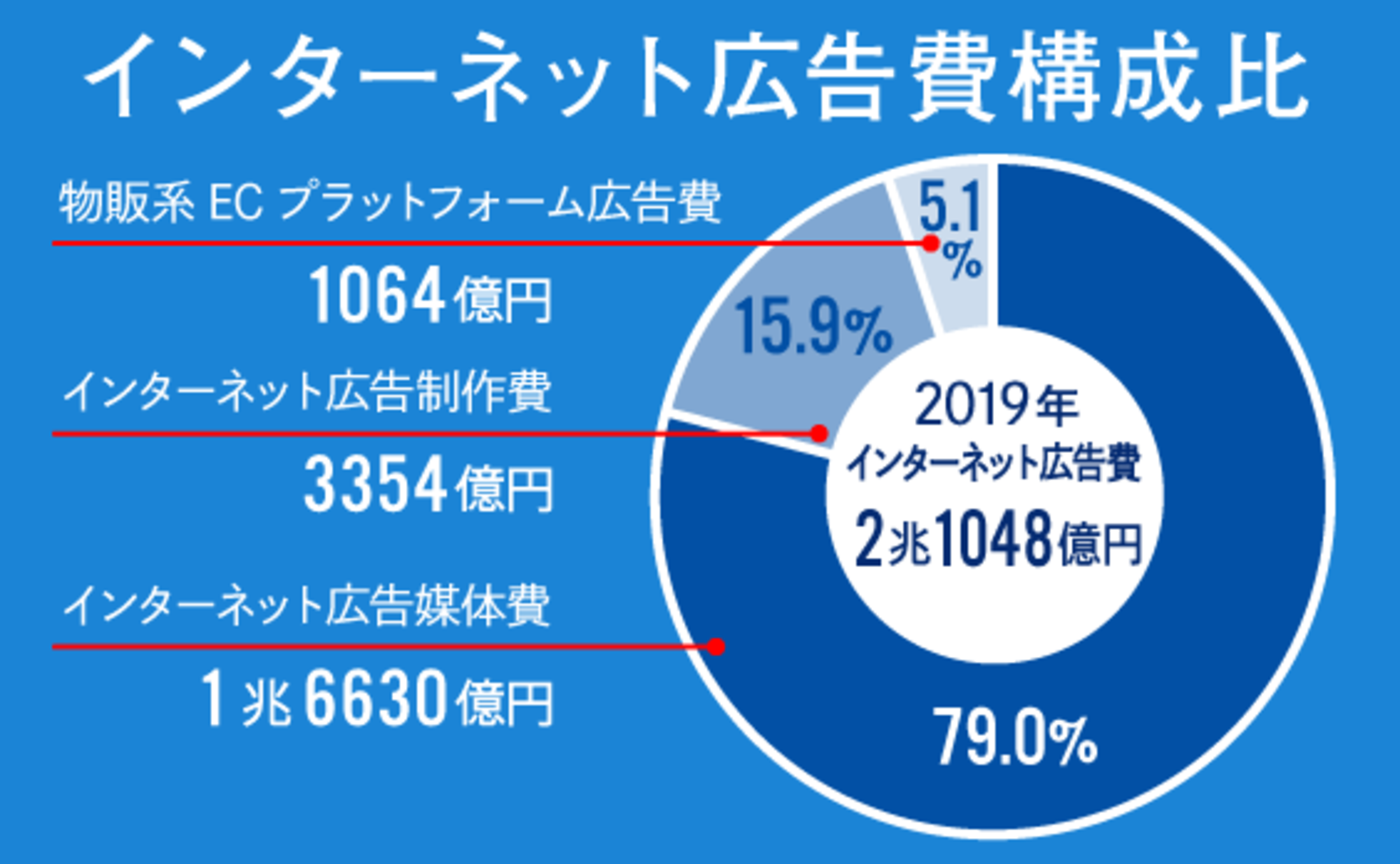

Japan's total advertising expenditure in 2021 was ¥6.7998 trillion. Within this, total internet advertising expenditure reached ¥2.7052 trillion, a 121.4% increase year-on-year. This surpassed the total advertising expenditure for the four major media outlets (※) of ¥2.4538 trillion for the first time. Its share of total advertising expenditure grew to 39.8%.

※Mass media advertising expenditure = The combined media fees and production costs for "newspapers," "magazines," "radio," and "television media (terrestrial TV + satellite media-related)."

"Internet advertising media costs" (excluding "internet advertising production costs" and "advertising costs on e-commerce platforms selling physical goods") reached ¥2.1571 trillion, a 122.8% increase year-on-year.

This article focuses on explaining "Internet Advertising Media Costs."

Internet Advertising Media Costs by "Advertising Type" and "Transaction Method"

We will analyze the breakdown of the ¥2.1571 trillion in Internet advertising media costs by "advertising type" and "transaction method."

● Advertising Expenses by "Advertising Type"

By advertising type, out of the total 2.1571 trillion yen in internet advertising media costs, "search-linked advertising" (linked to search engines like Google) accounted for 799.1 billion yen. This represented 37.0% of the total, the largest share.

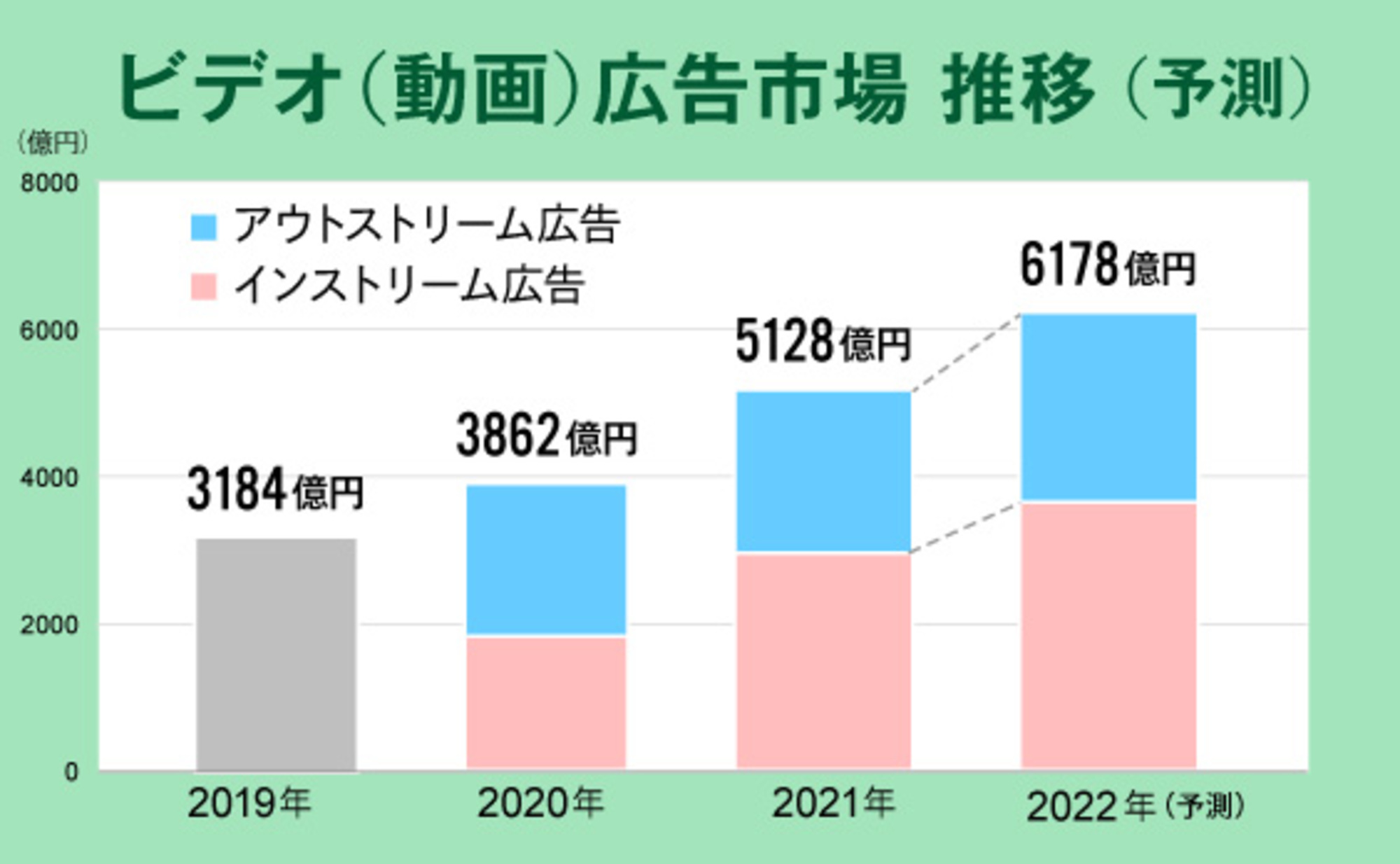

Next, "display advertising" (banner-type ads displayed on various websites) accounted for ¥685.6 billion, or 31.8% of the total. "Video advertising," which is growing significantly every year, accounted for ¥512.8 billion, or 23.8% of the total. Video advertising is projected to exceed ¥600 billion in 2022.

● Advertising Expenditures by Transaction Method

Next, we examine advertising expenditures by transaction method.

Next, we examine advertising expenditures by transaction method.

Once again, "Performance-Based Advertising" was the largest category at ¥1.8382 trillion, accounting for a substantial 85.2% of total advertising expenditure. This ratio continues to increase year on year. As the mainstay of internet advertising transactions, performance-based advertising has grown annually, expanding significantly in 2021 with a 126.3% year-on-year increase. The continued strong momentum of overseas platforms, led by Google, is a major reason for this.

"Reservation-based advertising" also grew, reaching 111.1% of the previous year's level, but its share slightly decreased due to the expansion of performance-based advertising. "Performance-based advertising" decreased to 95.4% of the previous year's level, continuing the decline seen in 2020.

● Advertising Expenditures by Trading Method × Ad Type

Breaking down advertising expenditure by transaction method and cross-referencing with ad type (see chart above), "Programmatic × Search-linked Advertising" reached ¥799.1 billion (117.7% YoY). This accounted for 37.0% of total internet advertising media expenditure, representing the largest share.

Breaking down advertising expenditure by transaction method and cross-referencing with ad type (see chart above), "Programmatic × Search-linked Advertising" reached ¥799.1 billion (117.7% YoY). This accounted for 37.0% of total internet advertising media expenditure, representing the largest share.

Next was " ×Display Advertising" at ¥605.9 billion (134.1% YoY), accounting for 28.1% of the total. Furthermore, " ×Video Advertising" grew significantly at 133.8% YoY, slightly increasing its share of total to 19.9%.

Topic ① Video Advertising Spending: In-Stream Ads Surpassed Out-Stream Ads

We analyzed the breakdown of video advertising expenditure, which showed particularly strong growth within internet advertising expenditure.

In video advertising spending, "in-stream ads"—which play before, during, or after video content—accounted for ¥292.1 billion, representing 57.0% of the total and thus a majority share.

Meanwhile, "out-stream ads," which appear in ad slots outside video content or within article content, totaled ¥220.7 billion, accounting for 43.0% of the total.

In 2020, in-stream ads accounted for 46.6% and out-stream ads for 53.4%, meaning in-stream ads reversed this trend in 2021. Driven by YouTube's surging popularity, demand for in-stream ads from advertisers is clearly increasing year by year.

Regarding video ad spending by transaction method, "programmatic" dominated at 83.7%, a composition ratio virtually unchanged from 2020.

Topic ② Social advertising accounts for 35.4% of total internet advertising media spending

"Social media (SNS-type, video-sharing-type, other)" utilizes user-generated content. This survey estimates advertising deployed on social media platforms as "social advertising."

Social advertising showed high growth rates in 2020, but growth accelerated significantly in 2021. Total social advertising reached ¥764 billion (134.3% year-on-year), now accounting for 35.4% of total internet advertising media spending.

Similar to 2020, we analyzed the composition ratio by classifying it into three categories: "SNS-based," "video sharing-based," and "other" (including blog services, social bookmarking services, and electronic bulletin board services).

Within social advertising, "SNS-based" platforms were the largest segment at ¥316.8 billion, accounting for 41.5% of the total.

"Video sharing" platforms reached ¥261 billion, representing 34.2% of the total. This is a significant increase from 2020, when they accounted for 27.9% (¥158.5 billion).

What will happen to internet advertising spending in 2022?

In 2021, total internet advertising expenditure reached ¥2.7052 trillion, a 121.4% increase from the previous year. This represents 39.8% of Japan's total advertising expenditure.

This represents a significant increase from 30.3% in 2019 and 36.2% in 2020, indicating a steady annual rise in the proportion of internet advertising within Japan's total advertising expenditure.

Particularly noteworthy are the "video ads" and "social ads" we analyzed in detail this time.

One major factor driving the growth of "Video Advertising" is the expansion of "video-sharing platforms" represented by YouTube and TikTok. While this trend accelerated in 2020 due to the COVID-19 pandemic, it continued into 2021.

Furthermore, while video ads on social media were primarily targeted at Generation Z, platforms like TikTok are now seeing a broadening of user age demographics. This expansion of the user base opens up new marketing opportunities, and "video ads on social media" are expected to grow further.

Given the current momentum, the growth of "product-based e-commerce platform advertising" is also noteworthy. Driven by increased consumer e-commerce use during the pandemic, this segment reached ¥163.1 billion, a 123.5% year-on-year increase. This follows the 124.2% growth (¥132.1 billion) in 2020, indicating substantial continued expansion.

Advertising expenditure on e-commerce platforms refers to ads used by companies operating online stores within e-commerce malls to drive traffic to their product pages. Furthermore, within the broader e-commerce landscape, "social commerce" is also growing. This involves brands using services like Shopify to establish online shops, communicating with consumers on social media, and seamlessly connecting product awareness to purchase. Social media advertising expenditure aimed at driving traffic to proprietary e-commerce sites is also expected to increase going forward.

Digital advertising expenditure originating from the four major media outlets (included in media costs) reached ¥106.1 billion, a 132.1% increase year-on-year, surpassing the ¥100 billion mark. Among these, television media digital showed particularly strong growth at 146.8% year-on-year, contributing significantly to the expansion of in-stream advertising expenditure.

TVer, a key driver of this TV media digital growth, has seen steady increases in both playback counts and user numbers. This growth stems from increased service awareness, an expanded library of available programs, and viewership during the Tokyo 2020 Olympic and Paralympic Games. Furthermore, starting in October 2021, Nippon TV began live streaming its broadcasts. By April 2022, all major commercial broadcasters had launched real-time streaming. As content offerings expand and viewership grows, further growth is anticipated.

While internet advertising media spending continues to grow steadily, let's conclude by considering future projections and challenges. First, the 2022 forecast: internet advertising media spending is expected to expand further, reaching ¥2.4811 trillion (115% year-on-year).

Driven by the trend toward personal data protection, major platforms are discontinuing the marketing use of third-party cookies, heralding the arrival of the so-called "cookie-free era." The impact of "cookie-free" on 2021 internet advertising spending was not particularly significant. However, challenges are beginning to emerge, such as the inability to perform various types of targeting and the difficulty in capturing conversions.

Social media performance advertising, which currently accounts for a large portion of internet advertising spending, has also fundamentally relied on third-party cookies. In 2022, new approaches will likely be needed to deliver personalized ads to each individual while protecting personal information.

*Related articles on cookie-free advertising can be found here

Beyond personal information protection, "trustworthiness" is a constant issue in internet advertising. Challenges include the Consumer Affairs Agency issuing warnings regarding the Act Against Unjustifiable Premiums and Misleading Representations and the Pharmaceutical Affairs Law, copyright issues arising, and malicious ads being delivered.

To address these problems, the advertising industry is advancing regulations for affiliate advertising. Furthermore, three advertising-related organizations—the Japan Advertisers Association, the Japan Advertising Agencies Association, and the Japan Interactive Advertising Association—established JICDAQ (General Incorporated Association Digital Advertising Quality Certification Organization). JICDAQ is working on quality certification focused on "excluding invalid impressions, including ad fraud" and "ensuring brand safety through ad placement quality."

JICDAQ (Japan Interactive Advertising Quality Assurance Association)

https://www.jicdaq.or.jp/about.html

Moving forward, addressing issues of trust is essential for the healthy growth of internet advertising. We believe this is an area where the entire advertising industry must intensify its efforts.

Was this article helpful?

Newsletter registration is here

We select and publish important news every day

For inquiries about this article

Back Numbers

2021/03/22

Explaining "2020 Internet Advertising Media Costs": What's the Breakdown of Over 2.2 Trillion Yen, Nearly on Par with the Four Mass Media?

2020/04/03

Total internet advertising expenditure exceeded ¥2 trillion in 2019. Detailed analysis of media costs and explanation of new categories.

Author

Rika Kajiwara

CARTA HOLDINGS, INC

Management Office

Group Communication Office Director

Responsible for public relations and market research. Primary research includes: "Japan's Advertising Expenditures" detailed analysis of internet advertising media costs, digital signage advertising market research, and video streaming service usage surveys.