Note: This website was automatically translated, so some terms or nuances may not be completely accurate.

"2023 Internet Advertising Media Costs" Explained. Signs of Change in the Breakdown of Video Advertising

CARTA COMMUNICATIONS (CCI), Dentsu Inc., Dentsu Digital Inc., and SEPTENI CO.,LTD jointly released the "2023 Detailed Analysis of Japan's Advertising Expenditures: Internet Advertising Media Costs" (hereinafter referred to as this survey). Takahiro Konno of CCI explains the key points of this survey.

*News Release : "Detailed Analysis of Internet Advertising Media Costs in Japan's Advertising Expenditures for 2023"

<Table of Contents>

▼Internet Advertising Expenditures, Driving Japan's Advertising Market, Expand Further!

▼By "Advertising Type": Search-Triggered Advertising Finally Exceeds ¥1 Trillion!

▼By "Transaction Method": Share of Programmatic Advertising Increases Further, Approaching 90% of Total

▼Breakdown of Internet Advertising Expenditures by "Ad Type × Transaction Method"

▼Topic ①: What drove the growth of out-stream video ads?

▼Topic ②: Social advertising continues its significant expansion!

▼Expanding e-commerce platforms. Keep an eye on the "Retail Media" advertising market!

▼What will happen to internet advertising expenditures in 2024?

Related Articles:

"2023 Japan Advertising Expenditure" Analysis──COVID-19 downgraded to Category 5, driving record-high spending. How did advertising budgets change during the pandemic?

Interview with Nobuyuki Sakuma: The "Atmosphere" of Each Media. Special Discussion on "2023 Japan Advertising Expenditure"

Internet Advertising Spending, Driving Japan's Advertising Market, Expands Further!

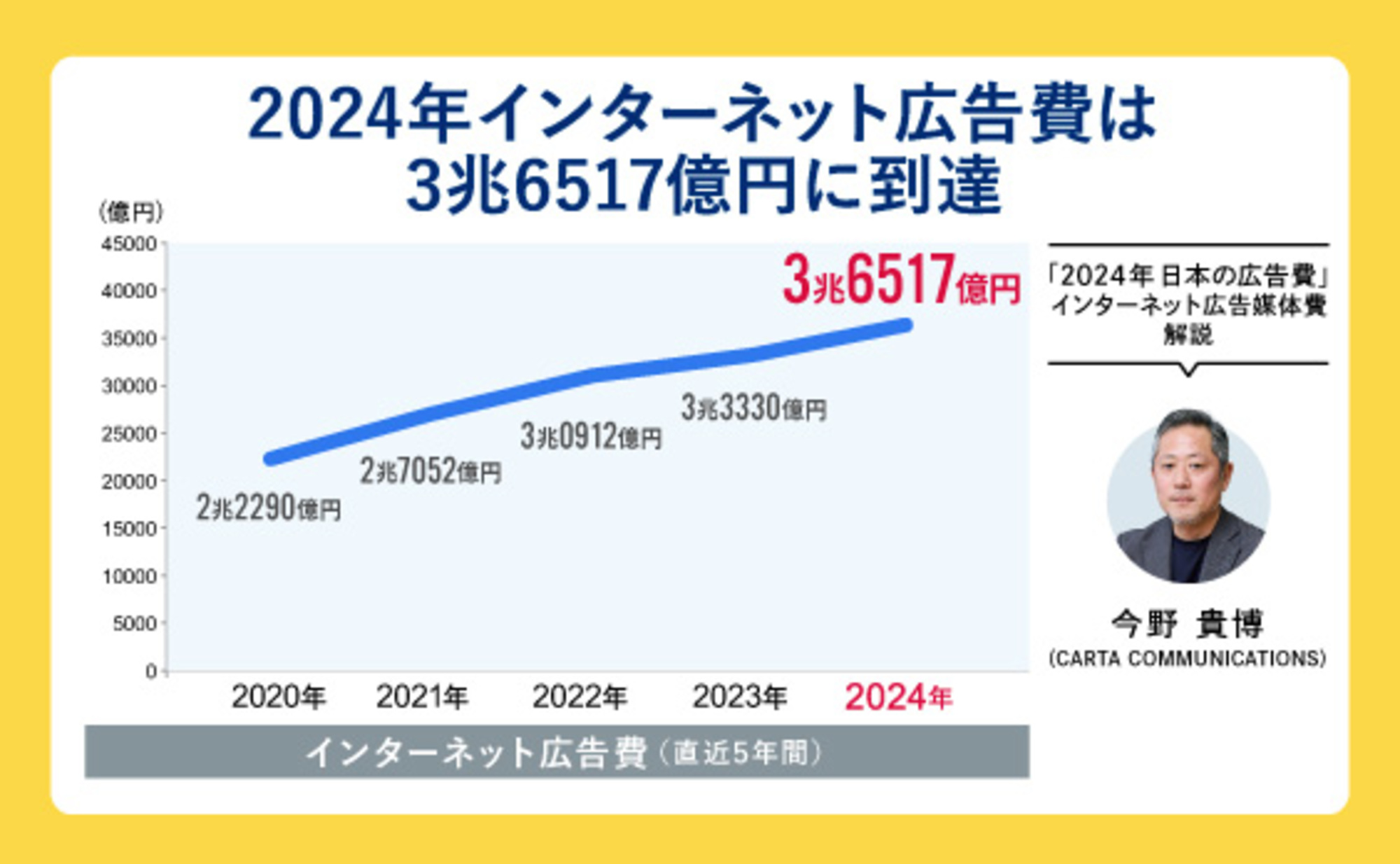

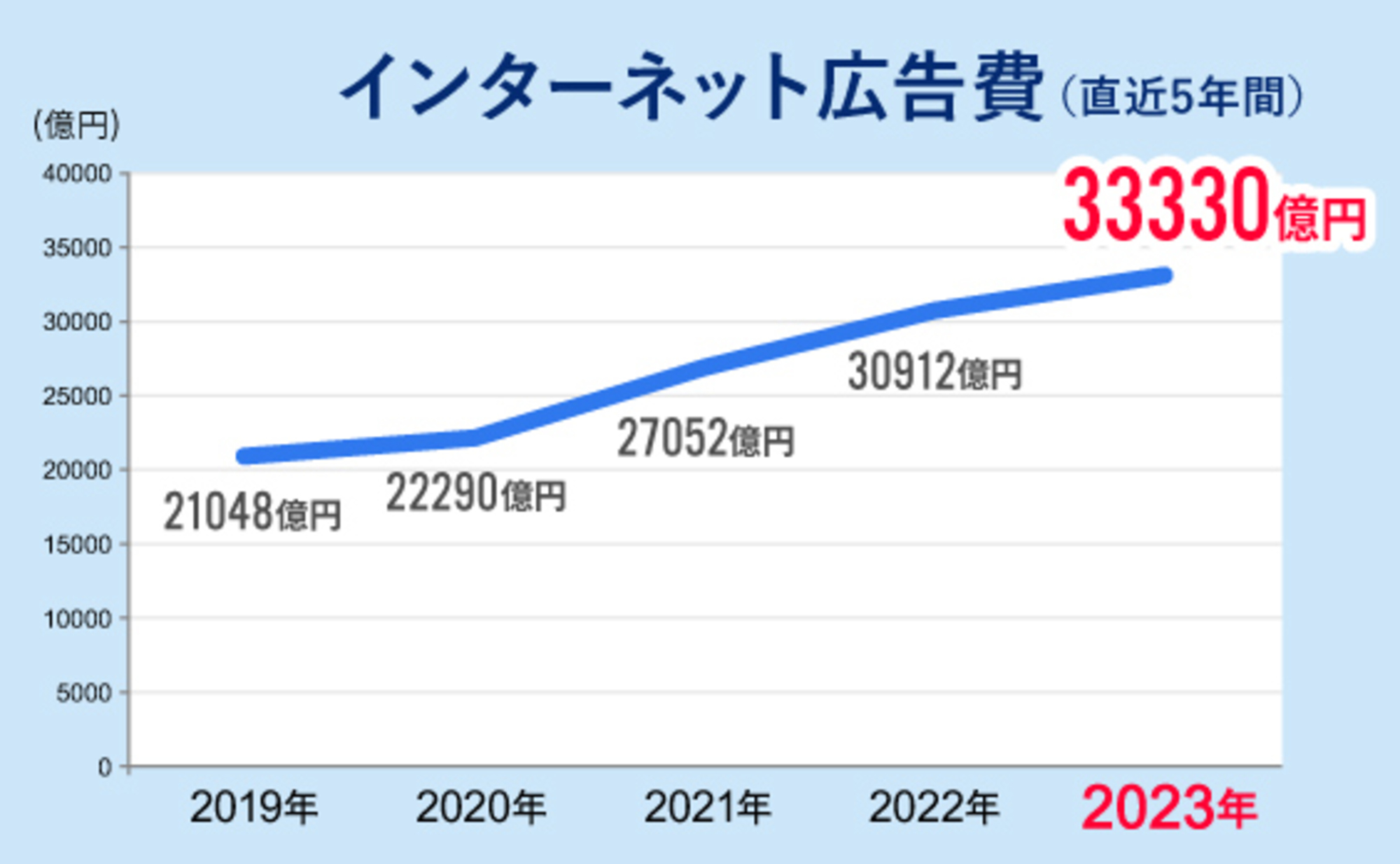

Japan's total advertising expenditure in 2023 reached ¥7.3167 trillion, a 3.0% increase year-on-year, setting a new record high for the second consecutive year.

Internet advertising expenditure is a major driver of this market growth. Riding the wave of accelerated digitalization during the COVID-19 pandemic, it reached a record high of ¥3.33 trillion (107.8% year-on-year), an increase of ¥241.8 billion over the previous year. It now accounts for 45.5% of Japan's total advertising expenditure. Areas such as video advertising and digital sales promotions are experiencing particularly strong growth.

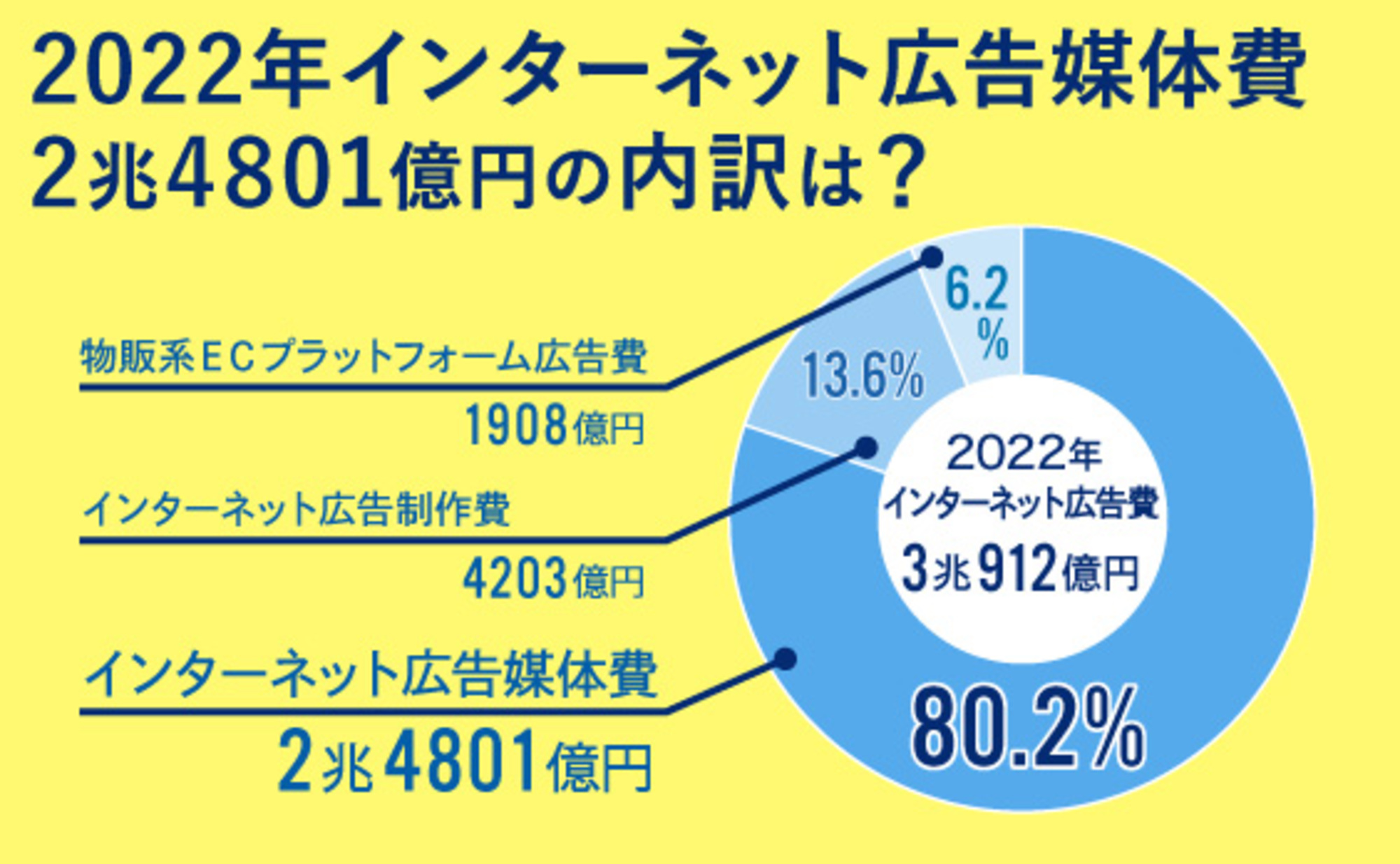

This article explains the breakdown of the ¥2.687 trillion in "Internet Advertising Media Costs" – derived from total Internet advertising expenditure after excluding "Internet Advertising Production Costs" and "Product-Selling E-Commerce Platform Advertising Costs."

By "advertising type," search-linked advertising finally surpassed ¥1 trillion!

First, let's examine the breakdown of internet advertising media costs by "advertising type." Advertising types are classified into the following five categories.

The three most mainstream types are "Search-Triggered Ads," "Display Ads," and "Video Ads."

"Search-linked advertising" refers to ads displayed on search results pages based on specific keywords entered into search engines, primarily search sites. This includes what are commonly known as listing ads.

"Display ads" refer to banner-type advertisements shown on various websites, while "video ads" are advertisements in video file format (visuals and audio).

The key point to note in this breakdown of "advertising types" is search-linked advertising. It reached ¥1.0729 trillion, marking the first time it has exceeded ¥1 trillion since the detailed analysis of internet advertising media costs began.

Looking at growth rates, search-linked ads increased by 109.9% year-on-year, display ads by 104.5%, and video ads by 115.9%.

Video advertising showed the highest growth rate. Its share of the total expanded to 25.5%, approaching the 28.7% share held by display advertising. The sustained growth of video advertising over recent years shows no signs of slowing down.

A key factor is the rapid growth of "TV media-related video ads" driven by the expanding use of internet-connected TVs, or connected TVs. Video streaming services provided by TV media, such as catch-up streaming for terrestrial TV, are gradually taking root.

※Video advertising related to TV media = Video ads primarily on TV program video platforms operated by TV media companies, such as TVer and ABEMA.

Another factor is the shift from display ads to video ads. While growth in "in-stream ads" placed before or after video content has drawn attention in recent years, this year saw a noticeable shift toward "out-stream ads," particularly the video format in social advertising. This will be discussed in more detail later.

The momentum of video advertising is being driven by two key factors: video advertising on TV media platforms and the increase in banner ads using video file formats.

The share of programmatic advertising within "by transaction method" has increased further, approaching 90% of the total.

Next, let's examine the breakdown of internet advertising media spending by "transaction method."

"Performance-based advertising" refers to ads traded via "auction-based methods" through platforms such as search-linked ads, video-sharing sites, SNS, and ad networks.

On the other hand, ads traded at a "fixed price" as specific non-bid ads or tie-up ads are called "reservation-based advertising."

Performance-based advertising refers to ads where compensation is paid to the media outlet or the viewing user based on the action taken by the user who viewed the ad (such as a click-through or purchase).

When categorizing internet advertising media costs by transaction method, performance-based advertising constitutes the majority. Since its estimated inception, it surpassed ¥2 trillion for the first time in 2022. This trend continued in 2023, reaching ¥2.349 trillion—a 110.9% year-on-year increase—setting a new record high. Furthermore, its share reached 87.4%, approaching 90% of the total.

Reservation-based advertising remained nearly flat at ¥264.8 billion, a 100.0% year-on-year rate. Performance-based advertising saw a significant decrease to ¥73.2 billion, a 75.8% year-on-year rate. This further indicates that programmatic advertising is driving much of the growth in internet advertising spending.

On the other hand, programmatic advertising also faces concerns. Among these, the looming impact of third-party cookie regulations is particularly significant.

Much of programmatic advertising has relied on third-party cookies to track user actions like searches and browsing, enabling targeting and retargeting.

However, in recent years, the trend toward phasing out third-party cookies has accelerated due to privacy and security concerns. Starting in 2024, Google will also begin phasing out the use of third-party cookies in its own browser, Chrome.

Given this situation, concerns have been raised that the inability to use third-party cookies may reduce the targeting accuracy of programmatic advertising. However, alternative methods and services addressing these regulations are also emerging.

For instance, Google, which provides many search-linked ads, has proposed the concept of the "Privacy Sandbox," aiming to deliver ads while respecting user privacy.

Additionally, numerous initiatives are emerging to deliver better advertising and user experiences without relying on cookies. These include content matching, which analyzes the context of content, and persona targeting utilizing survey data.

The 2023 estimates did not yet show a major impact from third-party cookie restrictions. However, 2024 is expected to mark the full onset of the "cookie-free" era. Advertisers and platforms will need to closely monitor market trends while utilizing alternative methods.

Breakdown of Internet Advertising Expenditures by Ad Type and Transaction Method

Next, we delve deeper into the actual state of internet advertising media spending by cross-referencing advertising types and transaction methods.

"Search-linked advertising" accounted for 39.9% of the total, maintaining its position as the largest share, consistent with previous years.

Next were "managed display ads" at 25.8% and "managed video ads" at 21.5%, showing a slight decrease in the share of display ads. As mentioned earlier, this trend is also related to the shift from static banner ads to video ads ( ).

Topic ①: What drove the growth of out-stream video ads?

Video advertising saw growth in both programmatic (117.2% year-on-year) and reserved formats (109.1%). Overall, programmatic advertising accounted for 84.4% of the total.

Video ads can be broadly categorized into two main types.

Video ads can be broadly categorized into two main types.

Ads inserted before, after, or within video content on platforms like YouTube are called "in-stream ads." On the other hand, video ads displayed in ad slots, within article content areas, or on social media timelines are called "out-stream ads."

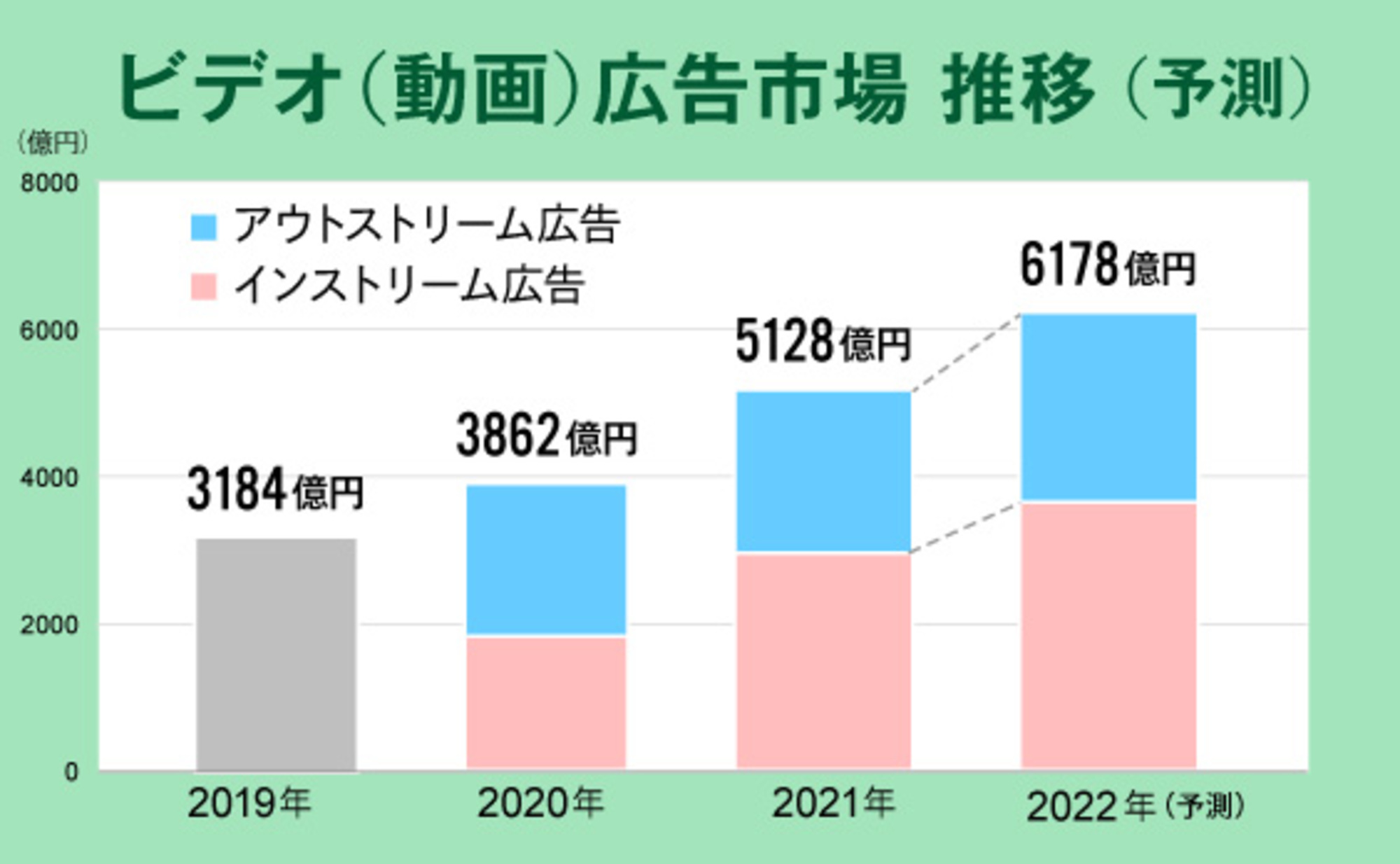

In 2023, in-stream ads accounted for ¥383.7 billion (55.9% of the total), while out-stream ads accounted for ¥302.2 billion (44.1% of the total). As in the previous year, in-stream ads held a larger share.

However, compared to the previous year, out-stream ads showed a higher growth rate, while in-stream ads saw their share decline from 58.4% to 55.9%.

The primary factor behind the increased share of out-stream advertising is the aforementioned "shift from display ads to video ads." The growth of social advertising, coupled with the transition within display ads from traditional static images to video, has inevitably led to an increase in out-stream advertising.

This transformation in display advertising can also be considered a defining trend of 2023. Beyond advertising alone, the broader internet trend of "shifting towards video" ( ) is expected to continue into 2024.

Topic ② Social advertising continues to grow significantly!

Social advertising, deployed on social media services, reached ¥973.5 billion, a 113.3% increase year-on-year, approaching the ¥1 trillion mark. Its share of total internet advertising media spending also grew to 36.2%. While it showed a 112.5% growth rate the previous year, 2023 surpassed that by 1.5%.

Our detailed analysis categorizes social media into three segments—"video sharing," "SNS," and "other"—to estimate advertising expenditures.

"Video-sharing platforms" refer to user-generated video sharing platforms, including short-form video platforms like TikTok.

"SNS-type" refers to platforms other than video sharing, such as Facebook, Instagram, and X. "Other" includes advertising slots on blogs and electronic bulletin boards.

In this classification, SNS platforms accounted for the largest share at ¥407.0 billion (41.8% of the total), followed by video sharing platforms at ¥337.2 billion (34.6%), and other platforms at ¥229.4 billion (23.6%). The overall composition ratio remained nearly identical to the previous year, showing no significant changes.

Expanding product-based e-commerce platforms. Keep an eye on the "retail media" advertising market too!

Although not included in this year's "Internet Advertising Media Expenditures" estimate, the growth of "e-commerce platform advertising" remains noteworthy, similar to last year.

In "Japan's Advertising Expenditures," e-commerce platforms selling goods such as home appliances, miscellaneous goods, books, clothing, and office supplies are referred to as "retail e-commerce platforms."

Advertising expenses invested within these platforms by businesses "operating stores" on them are defined as "merchandise-based e-commerce platform advertising expenses."

A keyword gaining attention in recent years is "retail media." While not a term with a strict definition, it generally refers to media owned by retailers, such as in-store signage and apps. E-commerce platforms are sometimes also considered a type of retail media.

CARTA HOLDINGS, INC, a domestic Dentsu Group company, defines retail media as the collective term for various online media advertising provided by brick-and-mortar retailers and pure-play e-commerce businesses. It surveys and estimates the total annual expenditure by advertisers on retail media advertising. According to their findings, the estimated retail media advertising market reached ¥362.5 billion in 2023 (a 121.5% increase year-on-year) and continues to rise steadily.

Retail media, which enables highly targeted ad delivery using first-party data (customer data obtained by the company itself), is a highly sought-after medium by advertisers, including manufacturers. With the trend toward third-party cookie regulations, further growth is anticipated.

What will happen to internet advertising spending in 2024?

Internet advertising media spending in 2024 is projected to remain robust, reaching ¥2,912.4 billion, a 108.4% increase year-on-year.

With companies showing a tendency to raise wages, coupled with the impact of the flat-rate tax reduction to be implemented in 2024, consumption is expected to pick up. This should also boost advertisers' willingness to place ads.

Video advertising, which shows high growth rates within internet advertising media spending, is projected to expand to ¥769.7 billion, a 112.2% increase year-on-year. This growth is driven by the increasing adoption of connected TV and the anticipated rise in social advertising. Both in-stream and out-stream video advertising are expected to grow at similar rates.

Furthermore, while advertising spending across the four major media outlets is declining within Japan's total advertising expenditure, the trend of "digital advertising spending originating from the four major media outlets" – which showed growth in 2023 – is also worth watching.

This represents estimated advertising spending on digital media by mass media companies, including program streaming services by TV and radio stations, digital newspapers provided by newspaper publishers, and magazine websites operated by publishers.

Among these, "TV media-related video advertising," such as free on-demand streaming services for TV programs, continues to experience rapid growth and is expected to maintain an upward trajectory in 2024.

While digital media within the four major mass media channels still has limited scale, it tends to be perceived as having high credibility and safety as a medium for placing brand advertising. This brings attention to the "Private Marketplace (PMP)" advertising exchange, a form of programmatic advertising.

PMPs are closed advertising marketplaces limited to specific publishers and advertisers. They offer advantages over open auctions, such as the ability to purchase higher-quality ad slots, which often face issues with quality and transparency. Another characteristic is the tendency for content media to be selected as the delivery target.

This mechanism is already widespread in Europe and the US. In the US, it's said that around 2020, PMP's share surpassed that of open auctions. While open auctions remain the mainstream in Japan today, it will be very interesting to see if this mechanism becomes established here in the future.

As internet advertising spending grows significantly, recent years have also seen increasing scrutiny of internet advertising's reliability, including issues like ad fraud and ads appearing on inappropriate media. Mechanisms like PMPs are likely to become increasingly important from the perspective of so-called "brand safety."

Furthermore, as mentioned earlier, programmatic advertising, which accounts for a large portion of internet advertising spending, will significantly shift away from targeting reliant on third-party cookies and evolve towards greater protection of user privacy. We will continue to closely monitor how these market changes impact programmatic advertising transactions and content media.

Was this article helpful?

Newsletter registration is here

We select and publish important news every day

For inquiries about this article

Back Numbers

Author

Takahiro Konno

CARTA COMMUNICATIONS, Inc.

Corporate Strategy Office

Joined Cyber Communications (now CARTA COMMUNICATIONS). After handling Dentsu Inc. and the Dentsu Group, worked as an Internet advertising media specialist, engaging with numerous media companies and platforms. Subsequently handled general agencies and specialized agencies, served on secondment to LIVE BOARD, and has been engaged in overall corporate planning since 2022.