Note: This website was automatically translated, so some terms or nuances may not be completely accurate.

"2024 Internet Advertising Media Costs" Explained. Video Advertising Growth Accelerates Further. Social Advertising Costs Surpass 1 Trillion Yen.

CARTA COMMUNICATIONS (CCI), Dentsu Inc., Dentsu Digital Inc., and SEPTENI CO.,LTD jointly released the " 2024 Detailed Analysis of Japan's Advertising Expenditures: Internet Advertising Media Costs " (hereinafter, this survey). Takahiro Konno of CCI explains the key points of this survey.

*News Release : "2024 Japan Advertising Expenditures: Detailed Analysis of Internet Advertising Media Costs"

<Table of Contents>

▼Internet Advertising Spending Hits New Record High in 2024

▼[Ad Type] Video Ads Surpass Display Ads in Share for the First Time

▼[Transaction Method] Programmatic Advertising Accounts for Nearly 90%. What Happened to Third-Party Cookie Regulations?

▼[Ad Type × Transaction Method] Video ad growth shows no signs of stopping: Breakdown of internet ad spending

▼Topic ① Vertical video adoption significantly contributes to out-stream ad growth

▼Topic ② Social ad spending surpasses ¥1 trillion for the first time

▼Topic 3: The spread and penetration of "Connected TV" supporting the expansion of the TV media digital market

▼ "Product-based e-commerce platform advertising spending" enters a slightly more stable growth trajectory

▼What will internet advertising spending look like in 2025? What impact will "ad-supported plans" on paid subscription video services have?

Related Articles:

"2024 Japan Advertising Expenditures" Analysis──Third Consecutive Year of Record Highs. Mass Media Advertising Spending Sees First Growth in Three Years

What's the True Intent Behind the "Declaration to Quit Mass Media"? The Current State of Regional Media

Internet Advertising Spending Hits New Record High in 2024

Japan's total advertising expenditure in 2024 reached ¥7.673 trillion, a 104.9% increase year-on-year, setting a new record high for the third consecutive year since 2022.

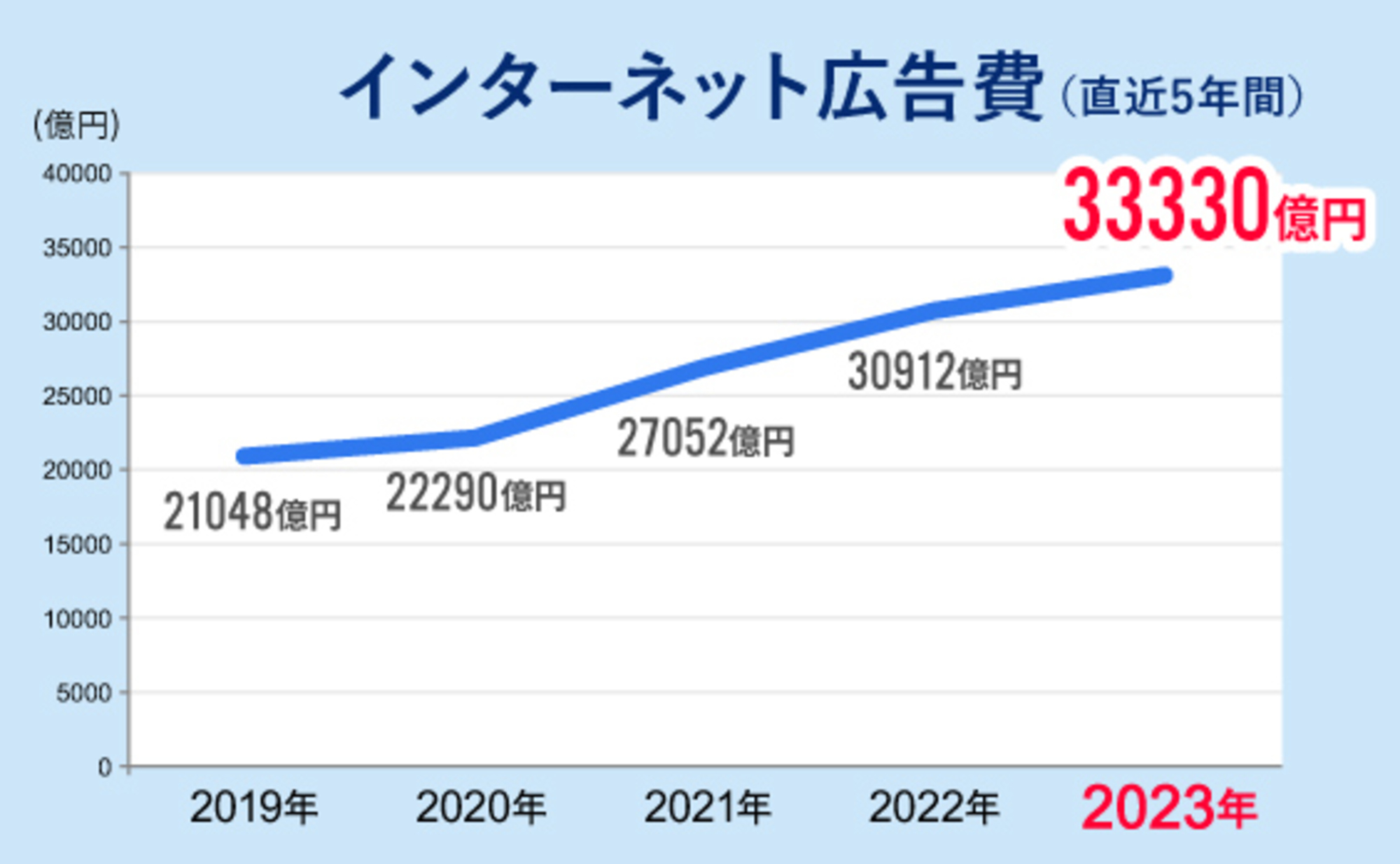

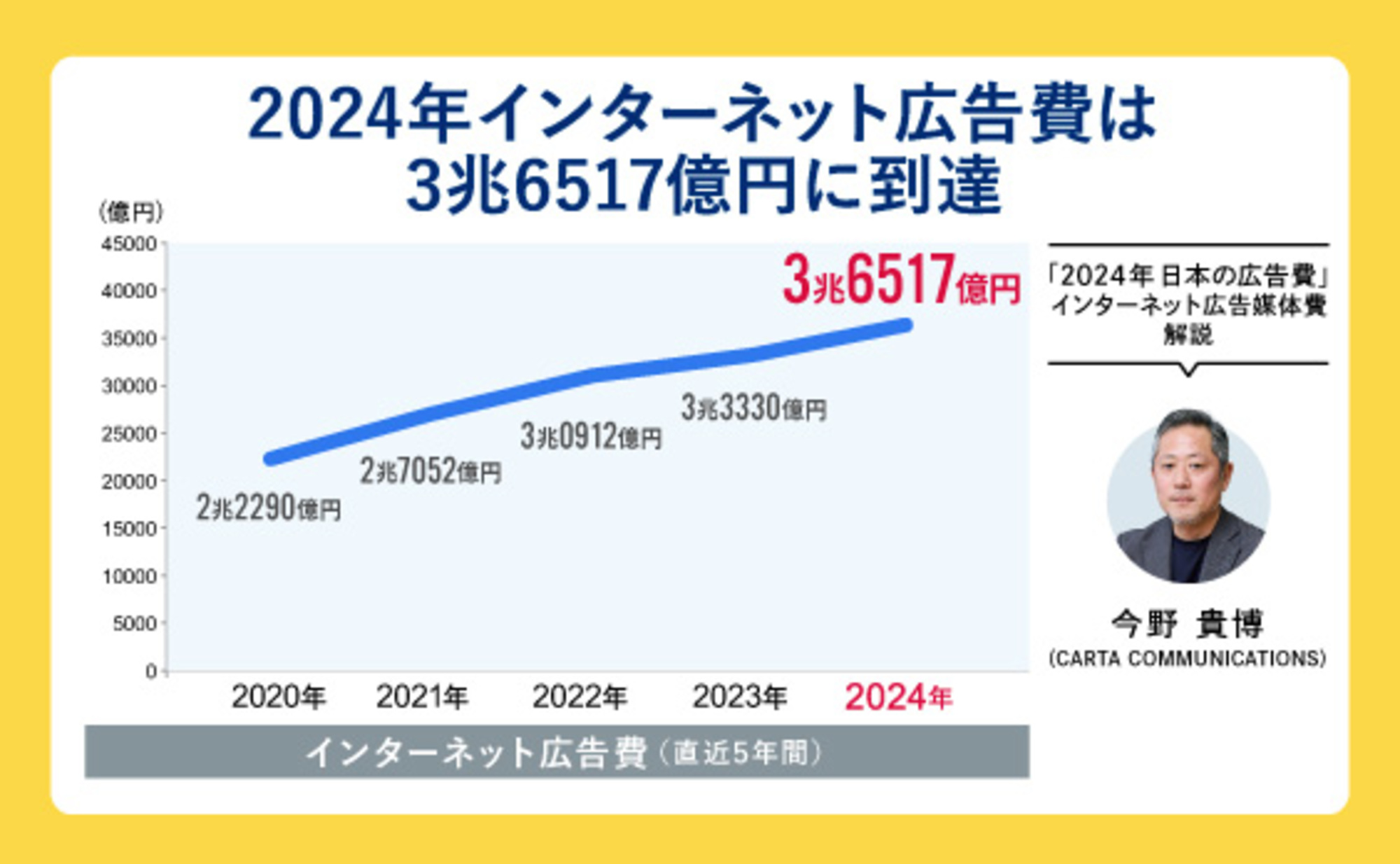

Internet advertising spending continued its steady growth from the previous year, reaching 3.6517 trillion yen (109.6% year-on-year), also setting a new record high. It accounted for 47.6% of Japan's total advertising spending, approaching nearly half of the total, and continues to drive market growth.

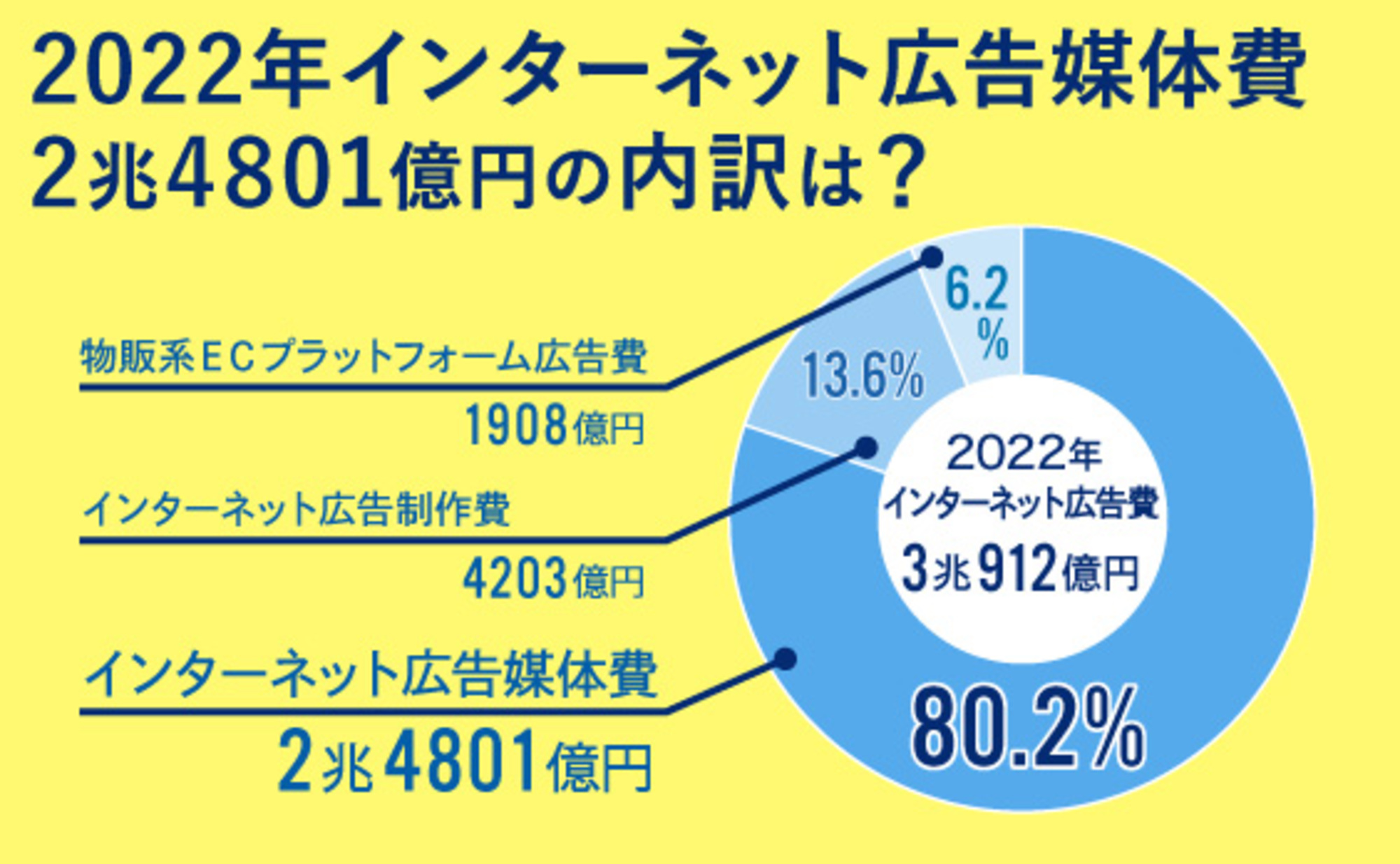

This article explains the breakdown of "Internet Advertising Media Costs" (¥2.9611 trillion, 110.2% year-on-year), which excludes "Internet Advertising Production Costs" and "Product-Selling E-Commerce Platform Advertising Costs" from total Internet advertising expenditure.

[Ad Type] Video ad share surpasses display ads for the first time

First, we examine the breakdown of Internet advertising media costs by "advertising type." Advertising types are classified into the following five categories.

Of particular note here is "Video (Motion Picture) Advertising." This refers to advertisements in video file format (moving images and sound).

Video advertising recorded the highest growth rate among ad types, reaching ¥843.9 billion, a 123.0% increase year-on-year. While last year's forecast projected growth to ¥769.7 billion, the actual growth far exceeded this, showing a sharp increase. Its share within ad types reached 28.5%, surpassing display advertising (25.8% share) for the first time since estimates began.

As we will discuss in detail later, "out-stream ads"—video ads displayed "outside of video content," such as in display ad slots or in-feed ad slots—have grown significantly. While "in-stream ads" placed before, after, or within video content also grew, out-stream ads showed even stronger growth, nearly reaching the same level of share. This is considered one of the factors driving the growth of video advertising.

Categories other than video advertising also grew. Continuing from the previous year, search-linked advertising held the highest share among ad types (40.3%).

Search-linked advertising refers to ads displayed on search engine results pages based on specific keywords entered into search engines, primarily search sites. This includes what are commonly known as listing ads. It recorded double-digit growth, reaching ¥1,193.1 billion, a 111.2% increase year-on-year. This represents a further increase from last year, when it exceeded ¥1 trillion for the first time since estimates began.

On the other hand, "display advertising" saw a decrease in both advertising expenditure and share. This is likely due to traditional static image and text-based ads being replaced by the aforementioned out-stream ads. The growth of out-stream ads is also related to the rise of vertical videos, particularly on social media platforms. This will be explained in detail later.

[By Transaction Method] Programmatic Advertising Accounts for Nearly 90%. What Happened to Third-Party Cookie Regulations?

Next, let's examine the breakdown of internet advertising media costs by "transaction method."

"Programmatic advertising" refers to ads traded via "auction-based systems" through platforms like search-linked ads, video-sharing sites, and social media, as well as DSPs (Demand-Side Platforms) and ad networks.

On the other hand, ads traded at a "non-bid (fixed price)" rate as specific non-bid ads or tie-up ads are called "reservation-based ads."

Performance-based advertising refers to ads where compensation is paid to the media outlet or the viewing user based on the actions taken by the user who viewed the ad (such as clicks or purchases).

By transaction method composition, performance-based advertising dominates. Continuing its steady growth, performance-based advertising reached ¥2.6095 trillion, a 111.1% year-on-year increase, setting a new record high in 2024. Its composition share also surpassed the previous year, reaching 88.1%, approaching nearly 90%.

Reservation-based advertising increased to ¥278.9 billion, a 105.4% year-on-year increase. This figure is likely driven by the significant growth of video advertising.

Performance-based advertising saw a slight decrease, reaching ¥72.7 billion, a 99.3% year-on-year figure.

Now, programmatic advertising continues to drive the growth of internet advertising spending, and the technology underpinning it is third-party cookies. Last year, concerns were raised about the impact of third-party cookie regulations. However, in July 2024, Google announced a de facto shift in its plans. To date, the programmatic advertising market continues to grow steadily, unchanged from previous trends.

Nevertheless, the trend toward privacy protection will continue unabated. Various alternatives (cookie-less solutions) are being explored for different purposes, including by Google itself. We must continue to monitor developments closely.

[Ad Type × Transaction Method] Video Advertising Growth Shows No Signs of Slowing: Breakdown of Internet Advertising Expenditures

Next, we examine figures combining ad type and transaction method.

In terms of composition by advertising type × transaction method, "search-linked advertising" holds the highest share of total internet advertising media spending at 40.3%.

Next, "managed video advertising" holds a 24.0% share, surpassing "managed display advertising" for the first time since estimates began.

Regarding video advertising, both programmatic (711.9 billion yen, up 123.0% year-on-year) and reserved (132.0 billion yen, up 123.2% year-on-year) formats showed significant growth. The increase in reserved video advertising is thought to be related to the growth of free on-demand video services and internet TV services offered by entities such as television broadcasters.

Topic ①: The proliferation of vertical videos significantly contributed to the growth of out-stream advertising

As mentioned earlier, video advertising expenditure reached ¥843.9 billion, a 123.0% increase year-on-year, recording the highest growth rate among all advertising categories.

Breaking this down, in-stream advertising accounted for ¥426.0 billion (50.5% share), while out-stream advertising accounted for ¥417.8 billion (49.5% share), remaining nearly equal.

To clarify, in-stream ads are video advertisements that play before, during, or after video content. They are commonly seen on video-sharing sites, free on-demand streaming services, and internet TV services.

Outstream ads, on the other hand, refer to video ads displayed in video file format within display ad slots or social media feed ad slots. These are video ads separate from the "video content" itself. Some video-sharing sites and social media platforms allow both in-stream and out-stream ads to be placed.

The situation where in-stream and out-stream ads hold roughly equal market share symbolizes the recent changes in the video advertising market.

While out-stream ad growth drew attention last year, the trend of ads traditionally classified as display ads being "replaced" by video formats is accelerating. Furthermore, the rapid rise of vertical video formats on social media and user-generated video sharing sites is also driving the growth of out-stream advertising.

In-stream advertising also maintained a growth rate largely unchanged from last year, partly due to the rapid rise of "TV media digital" mentioned earlier.

Given the enormous scale of the SNS market, there is considerable potential for out-stream advertising to grow further alongside the adoption of vertical video. However, in-stream advertising also holds growth potential. By 2025, paid subscription-based video streaming services are expected to accelerate the introduction of advertising models to fund further content investment, which will impact in-stream advertising spending.

Topic 2: Social Advertising Spending Exceeds ¥1 Trillion for the First Time

In 2024 internet advertising media spending, "social advertising" deployed on SNS platforms exceeded ¥1 trillion for the first time since estimates began, reaching ¥1,100.8 billion. It showed a high growth rate of 113.1% year-on-year, and its share of total internet advertising media spending expanded to 37.2%.

A closer look at the growth of the overall social advertising market reveals that video formats are becoming increasingly prominent within this space.

First, "SNS-based" advertising deployed on SNS platforms accounted for 455 billion yen, representing 41.3% of the total. However, this ratio has changed slightly from last year, decreasing by 0.5 percentage points.

On the other hand, advertising spending on "video sharing" platforms, which operate on user-generated video sharing sites, reached ¥405.4 billion, accounting for 36.8% of the total. This represents a notable growth of 2.2 percentage points compared to the previous year.

The "Other" category includes advertising on blogs and electronic bulletin boards. This segment decreased by 1.7 percentage points from the previous year, totaling ¥240.4 billion (21.8% share).

While the social advertising market is growing, the growth rates differ. Going forward, it will be important to watch how the balance between SNS-based advertising and video-sharing advertising evolves.

Topic 3: The Spread and Penetration of "Connected TV" Supporting the Expansion of the TV Media Digital Market

"2024 Japan Advertising Expenditures" highlighted the remarkable growth of "TV Media Digital" – including free catch-up streaming services and internet TV services provided by TV broadcasters – which surged 146.3% year-on-year to ¥65.4 billion.

This growth has been remarkable over the past five years. Riding the wave of the overall video shift on the internet, this category is expected to continue growing.

The background to the growth in TV Media Digital advertising spending lies in the penetration and establishment of "Connected TV (internet-connected TV devices)."

Households increasingly use TV devices to watch internet videos, driving corresponding growth in advertising placements on internet video sharing sites. Demand for connected TVs—which offer larger displays than smartphones and are well-suited for shared viewing of movies, dramas, sports, etc.—is expected to continue rising.

According to certain published data, when comparing average daily viewing time on TV devices, commercial broadcasters rank first, but video sharing services follow closely in second place. Data also indicates that subscription video-on-demand services and internet TV services are closing in on commercial broadcasters in the subsequent rankings.

"Advertising spending on product-based e-commerce platforms" is on a slightly more stable growth trajectory

While this analysis primarily covers internet advertising media costs, we will also touch on "product-based e-commerce platform advertising."

This refers to advertising used by retailers operating online stores on "mall-type" product-based e-commerce platforms to direct users to their product sales pages. Examples include ads that display their products as "PR items" at the top of keyword search results or feature their products on the top page during specific campaigns.

While product-based e-commerce platform advertising costs showed steady growth in 2024 at 103.4% year-on-year, the pace of growth appears to be slowing somewhat as the market size expands. This may also reflect the e-commerce market itself stabilizing as the COVID-19 pandemic subsided.

Nevertheless, there remains room for expansion, and stable growth is expected going forward.

It should be noted that "advertising expenditure on product-based e-commerce platforms" can also be considered a type of media provided by distribution and retail businesses, commonly known as "retail media." While there is no universally agreed-upon definition for this term globally, the use of proprietary media—such as retail companies' apps and in-store digital signage—as advertising space is increasing, making it a currently prominent keyword.

What will happen to internet advertising spending in 2025? What impact will "ad-supported plans" for paid subscription video services have?

Internet advertising media spending in 2025 is projected to reach ¥3.2472 trillion, a 109.7% increase year-on-year. This will mark the first time internet advertising media spending exceeds ¥3 trillion.

Furthermore, when considering "internet advertising expenditure"—which includes internet advertising production costs and advertising fees on e-commerce platforms selling physical goods—it could potentially reach 50% of Japan's total advertising expenditure.

We believe continued growth in video advertising and social advertising will continue to drive the market. Video advertising, in particular, is projected to maintain double-digit growth, reaching ¥967.7 billion, a 114.7% increase year-on-year. Depending on the scenario, video advertising alone could potentially exceed ¥1 trillion.

Regarding video advertising, the growth of in-stream and out-stream ads is predicted to be nearly equal. In-stream ads, in particular, are expected to see a significant increase in "ad-supported plans" offered by paid subscription-based video streaming services, which is anticipated to have a major impact on the industry.

Furthermore, the entry of these paid subscription-based video streaming services into the advertising market is expected to further expand advertising delivery on Connected TV, particularly programmatic advertising. Growth potential in this area remains substantial, drawing attention to future market trends.

By ad type, the trend of video ads increasing while display ads decrease is expected to continue in 2025. Furthermore, search-linked ads may see their growth rate impacted by the utilization of generative AI tools and the diversification of search behavior within the e-commerce domain.

While the internet advertising market continues to grow substantially each year, challenges such as ad fraud and ad placements on inappropriate media persist. Against this backdrop, the importance of ensuring ads do not damage brands—so-called "brand safety"—is increasingly paramount. Relevant organizations, including the Ministry of Internal Affairs and Communications, are strengthening efforts to improve advertising standards through expert meetings and other initiatives.

As part of these efforts, ad verification tools (which monitor and evaluate ad placements and content quality to prevent inappropriate ad delivery) are gaining attention. While primarily used for brand safety until now, these tools are beginning to offer services that help advertisers improve ad effectiveness while ensuring ad quality.

Discussions are also progressing regarding ad viewability (a metric indicating how much an ad is actually seen by users). Beyond traditional metrics like impressions, CTR (click-through rate), reach, and frequency, an environment enabling deeper analysis is being introduced. This includes "attention metrics" that measure detailed user engagement using technologies like eye-tracking.

It is said that over 90% of advertisers overseas already utilize attention metrics in some form, and the adoption of these new evaluation standards is also anticipated in Japan.

From a brand safety perspective, the continued adoption of PMPs (Private Marketplaces—closed advertising marketplaces where specific advertisers and publishers transact exclusively) remains necessary, as highlighted as a challenge last year.

PMP is a form of programmatic advertising deployed within more trusted media, characterized by its lower risk of damaging brand value. Overseas, there are cases where more advertising spend is allocated to PMP than to open ad networks.

However, in Japan, there remains a strong tendency to prioritize advertising effectiveness and cost efficiency. Consequently, advertising methods promising broader reach are often preferred over frameworks like PMP. Continued efforts to further develop the ecosystem involving sellers, buyers, intermediaries, as well as government and industry associations, remain crucial.

Finally, let's briefly touch on the current state of generative AI utilization, primarily in programmatic advertising. Major platforms are beginning to standardize AI-powered ad optimization tools within their advertising management dashboards.

These AI-powered tools are expected to reduce operational burdens and enhance advertising effectiveness when used for creative generation and ad delivery optimization. However, we also recognize that aspects surrounding AI adoption, such as transparency and control issues in AI-driven ad delivery, require careful handling.

While the internet advertising market is expected to continue growing, appropriately resolving these various challenges and building a trustworthy environment is crucial—not only for users, but also for us in the advertising industry and for advertising clients. We must continue monitoring market changes and exploring ways to achieve sound, sustainable advertising operations.

Was this article helpful?

Newsletter registration is here

We select and publish important news every day

For inquiries about this article

Back Numbers

Author

Takahiro Konno

CARTA COMMUNICATIONS, Inc.

Corporate Strategy Office

Joined Cyber Communications (now CARTA COMMUNICATIONS). After handling Dentsu Inc. and the Dentsu Group, worked as an Internet advertising media specialist, engaging with numerous media companies and platforms. Subsequently handled general agencies and specialized agencies, served on secondment to LIVE BOARD, and has been engaged in overall corporate planning since 2022.