To achieve success in inbound marketing targeting Chinese visitors to Japan, it is essential to deeply understand and effectively utilize the media and platforms they engage with daily.

This series will feature data from major Chinese travel platforms used by Chinese travelers, such as Ctrip (China's largest online travel agency, with which Dentsu Inc. has a partnership), the major SNS platform Xiaohongshu (Xiaohongshu, English name "rednote"), as well as data from online surveys conducted by Dentsu Inc. and proprietary data held by Dentsu China.

Part 1 reviews trends in Chinese outbound travel for 2024 using publicly available data from the Chinese government and other sources. Focusing on the scale of Chinese outbound travelers, their primary destinations, and demographic characteristics, we organize foundational information relevant to Japan's selection as a travel destination. This includes understanding what Chinese travelers seek and when they typically travel abroad.

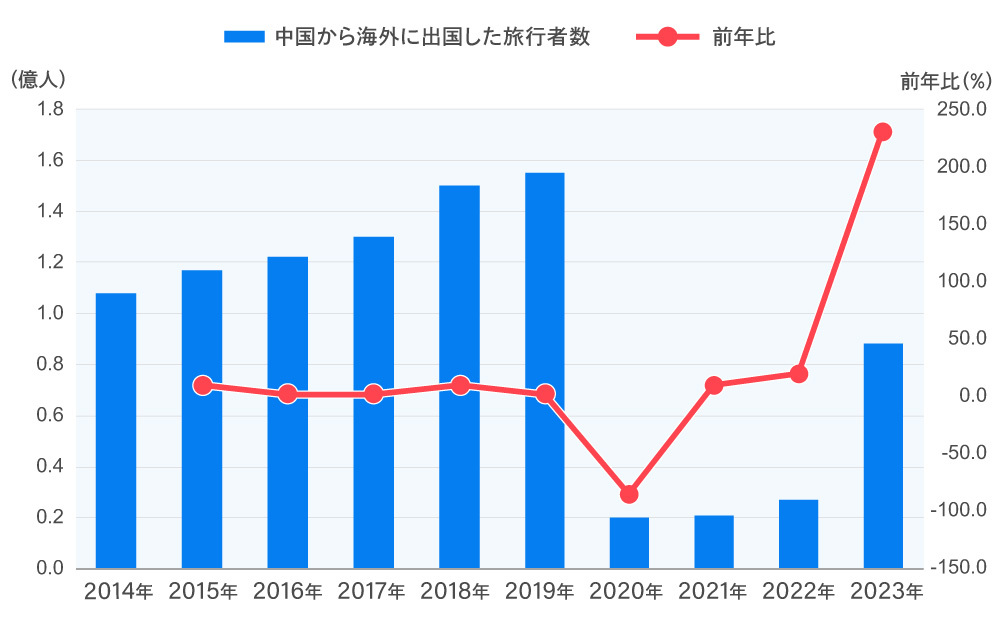

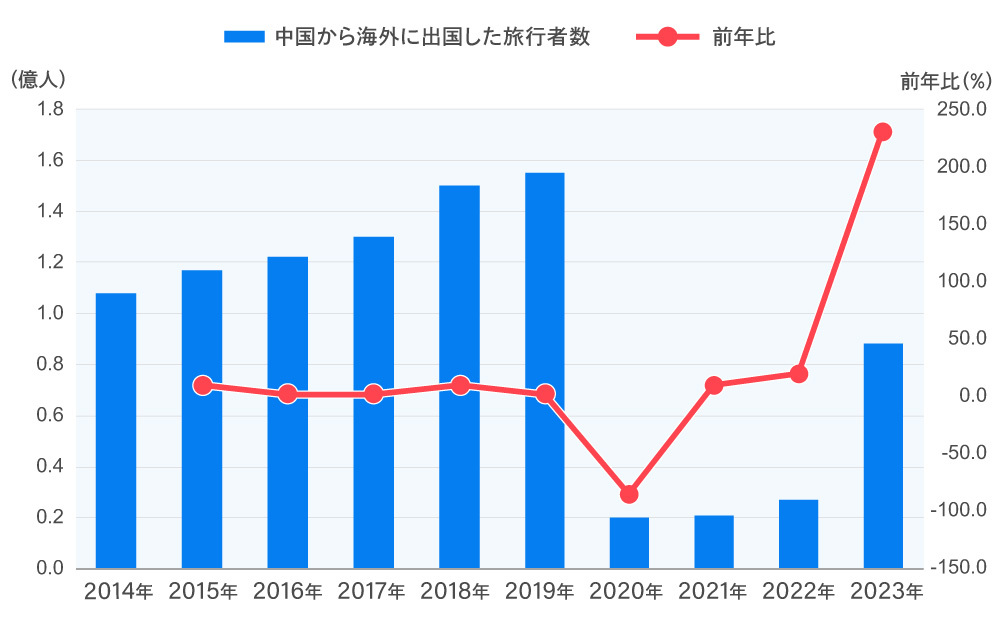

Post-Pandemic Chinese Outbound Travel Market Recovers Rapidly

In 2023, the number of Chinese outbound travelers exceeded 87 million, recovering to 60% of pre-pandemic 2019 levels.

China Tourism Academy "China Outbound Tourism Development Report (2023-2024)"

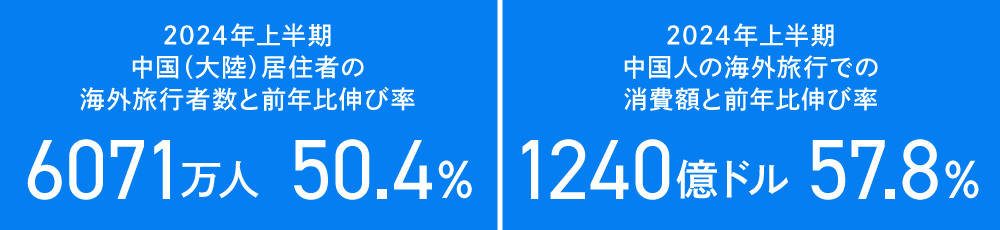

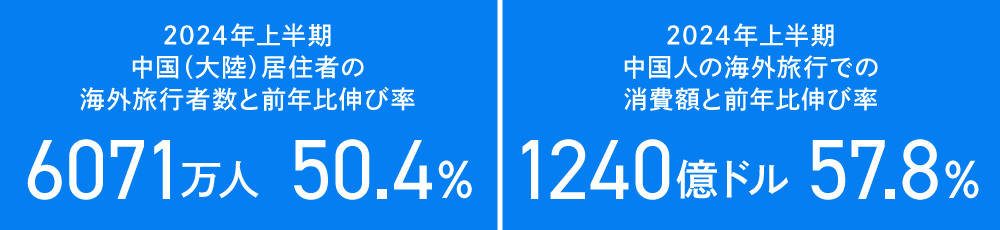

Furthermore, in the first half of 2024, the number reached 60.71 million, a 50.4% increase year-on-year, recovering to 74.7% of 2019 levels. Travel expenditure also reached $124 billion (approximately ¥19 trillion). While there are reports of concerns about the Chinese economy, the enthusiasm for overseas travel among Chinese citizens shows renewed strong momentum.

Fastdata "2024 China Outbound Tourism Industry Development Trends Report"

Fastdata "2024 China Outbound Tourism Industry Development Trends Report" According to the Japan National Tourism Organization (JNTO), approximately 3.072 million Chinese tourists visited Japan in the first half of 2024. This suggests that about 5% of Chinese outbound travelers visited Japan. Furthermore, while total spending by visitors to Japan in 2024 was approximately 8 trillion yen, Chinese outbound travelers alone spent 19 trillion yen in the first half of the year. This highlights their significant potential spending power.

Changes in Chinese Outbound Travel Demand Post-Pandemic: Greater Emphasis on Travel Quality

Since 2023, demand for overseas travel has continued to expand. The recovery pace has accelerated due to the resumption of international scheduled flights, Chinese government policies, and improved convenience.

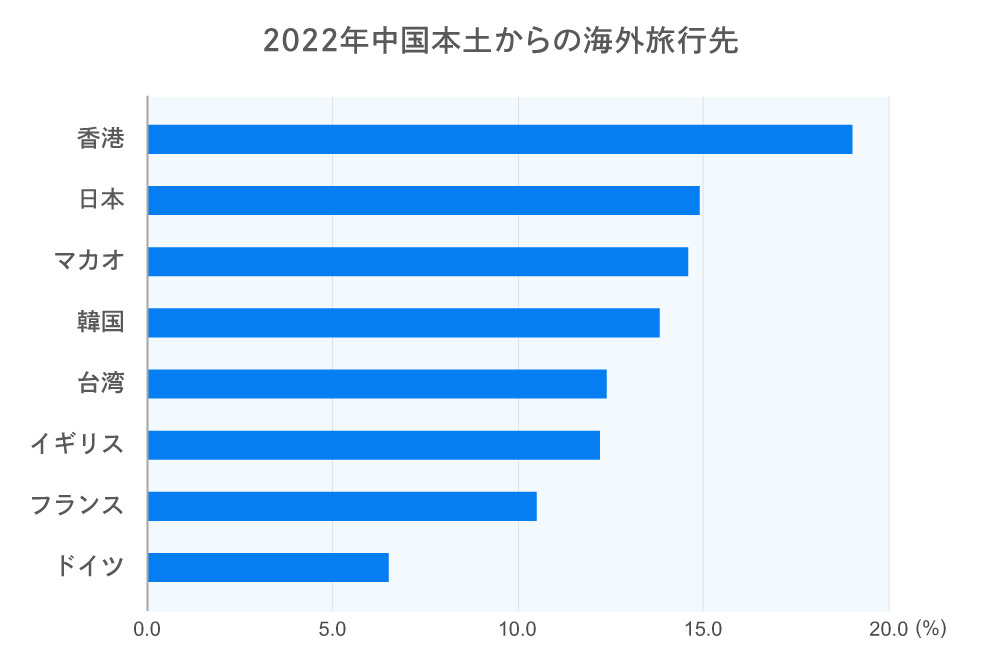

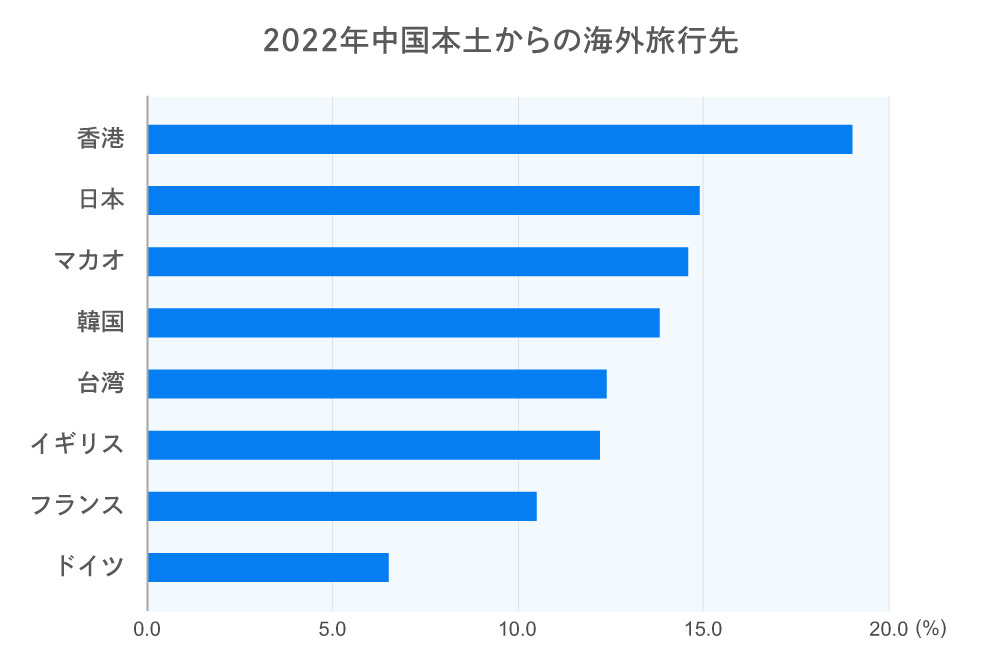

The top 10 destinations are Hong Kong, Japan, Macau, South Korea, Taiwan, the UK, France, and Germany. As before the pandemic, travel to nearby East Asian regions remains highly popular.

A new trend is the increasing travel to countries like Turkey, the United Arab Emirates (UAE), and Egypt, driven by international exchanges and cooperation under the Chinese government's "Belt and Road" initiative. This diversification of destinations is broadening the travel options for Chinese tourists.

Source: China Tourism Academy "China Outbound Tourism Development Report (2023-2024)"

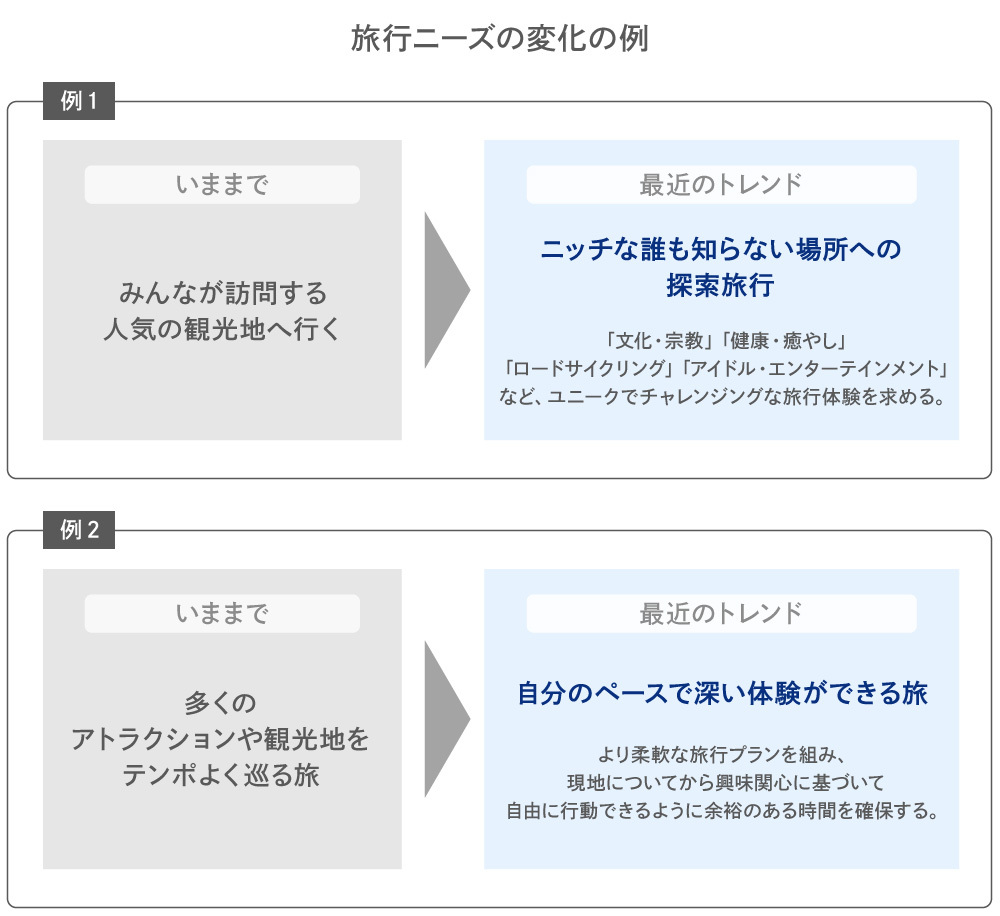

Moreover, the travel needs of Chinese outbound tourists are constantly evolving, and their consumption habits are changing. Chinese travelers now "place greater emphasis on travel quality," desire "experience-focused, original, and customized trips," and are increasingly willing to spend on "unique, high-quality, and experience-oriented services."

Shift in the Volume Zone of the Generation Traveling Overseas: Younger Generations Now Make Up Over Half of Chinese Outbound Travelers

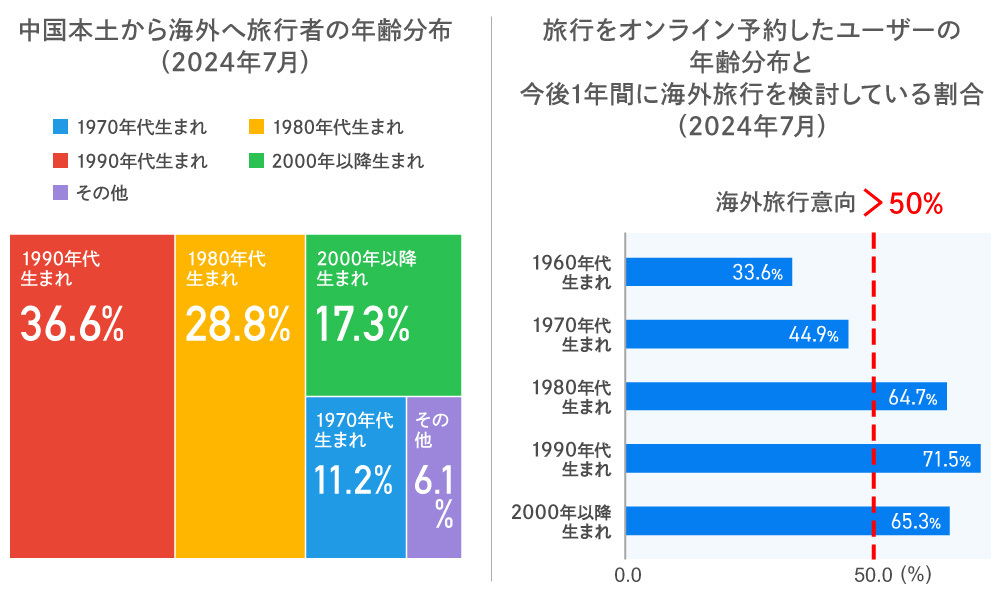

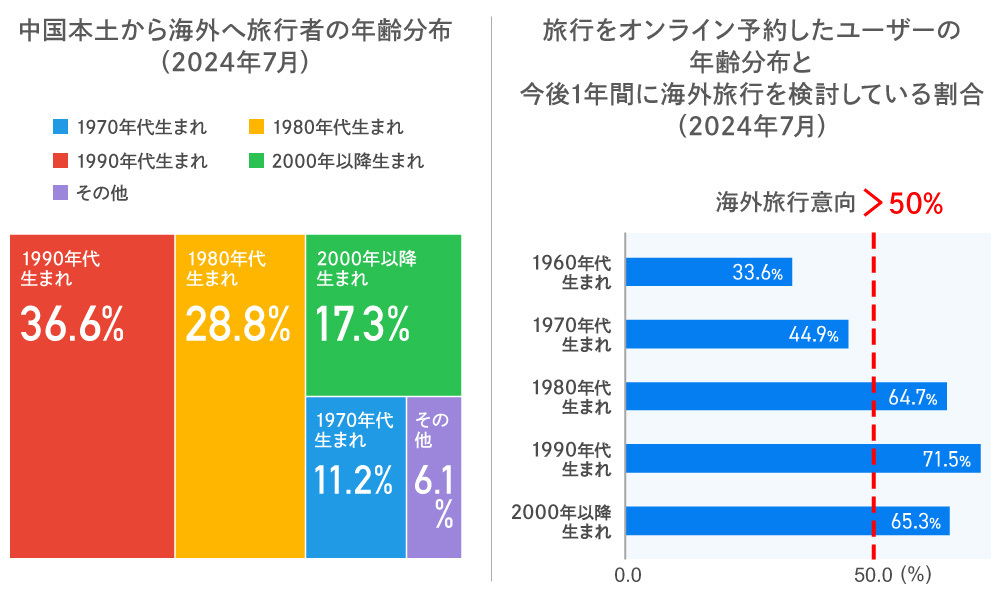

Younger generations are becoming the core demographic of Chinese outbound travelers. Those born in the 1990s and 2000s (ages 20s to 30s) now account for over half of all Chinese outbound travelers, with young people showing significantly higher enthusiasm for overseas travel than other age groups.

Source: Fastdata "2024 China Outbound Tourism Industry Development Trends Report"

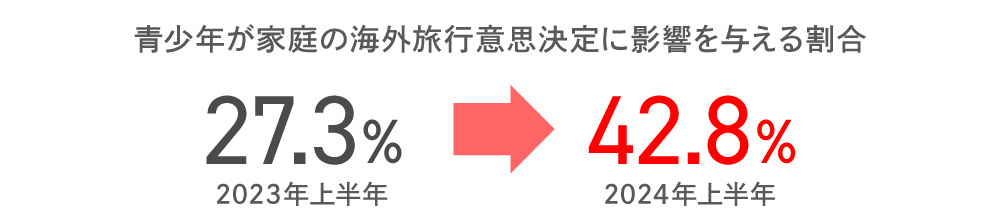

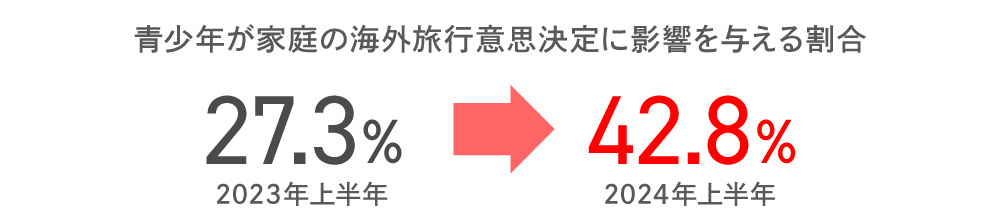

Middle-aged and older parents are increasingly entrusting their children with planning overseas trips. A survey in the first half of 2024 showed this proportion reached 42.8%, a sharp increase from 27.3% a year earlier. This indicates the younger generation's influence on decisions regarding overseas destinations and activities during visits is growing substantially.

Source: Fastdata "2024 China Outbound Tourism Industry Development Trends Report"

Key Digital Channels for Decision-Making: "SNS," "Online Travel Sites," "Search Engines"

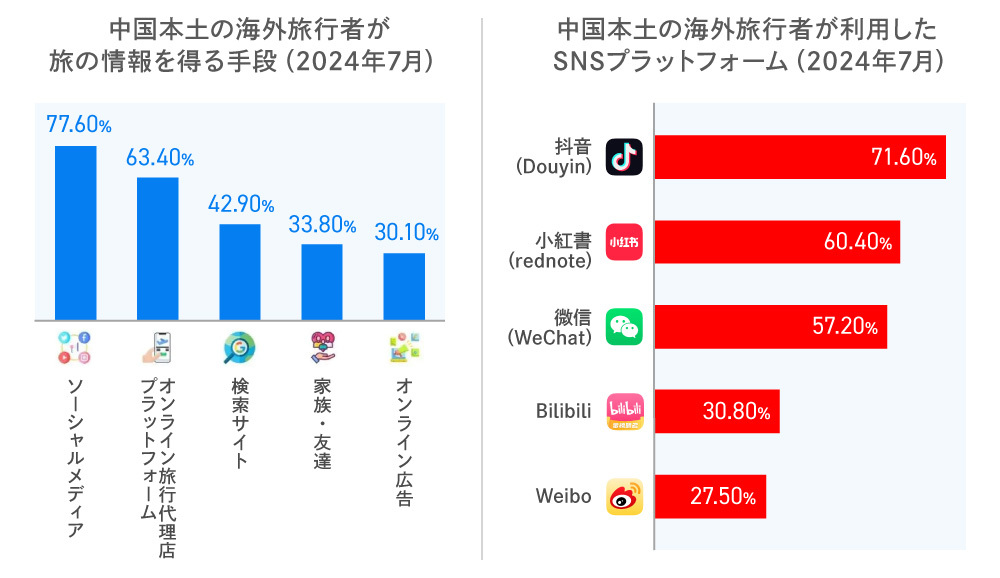

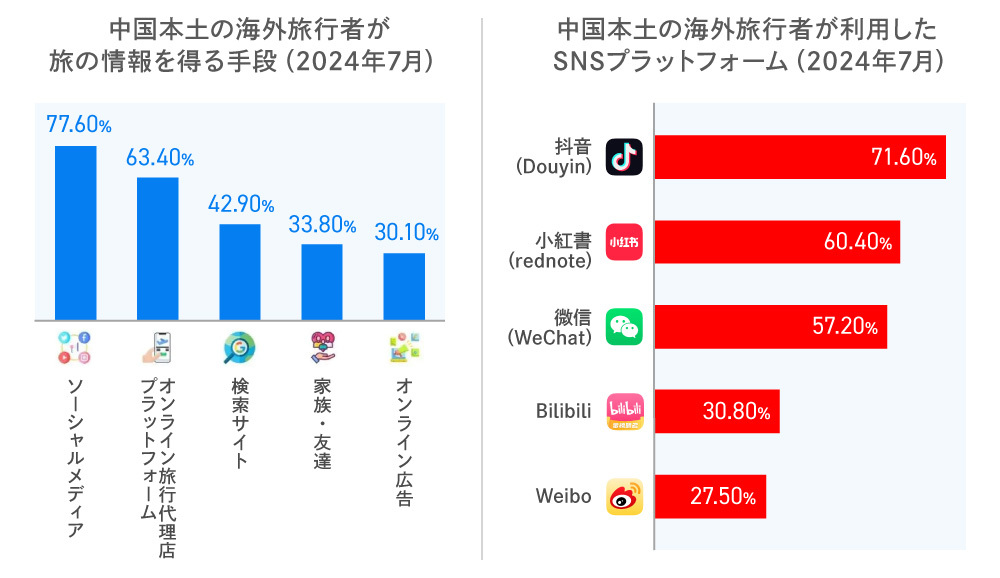

The most influential digital channel for gaining overseas travel inspiration is "SNS." This is followed by "Online Travel Agency Platforms (OTA)" like Ctrip and "Search Engines."

The primary platforms used for "SNS" are "Douyin (Chinese version of TikTok)," "Rednote," and "WeChat," with usage rates for these three platforms exceeding 50%.

Coordination between information dissemination and advertising promotions through official accounts and KOLs (Key Opinion Leaders, or influencers) on these SNS channels is a crucial strategy.

Source: Fastdata "2024 China Outbound Tourism Industry Development Trends Report"

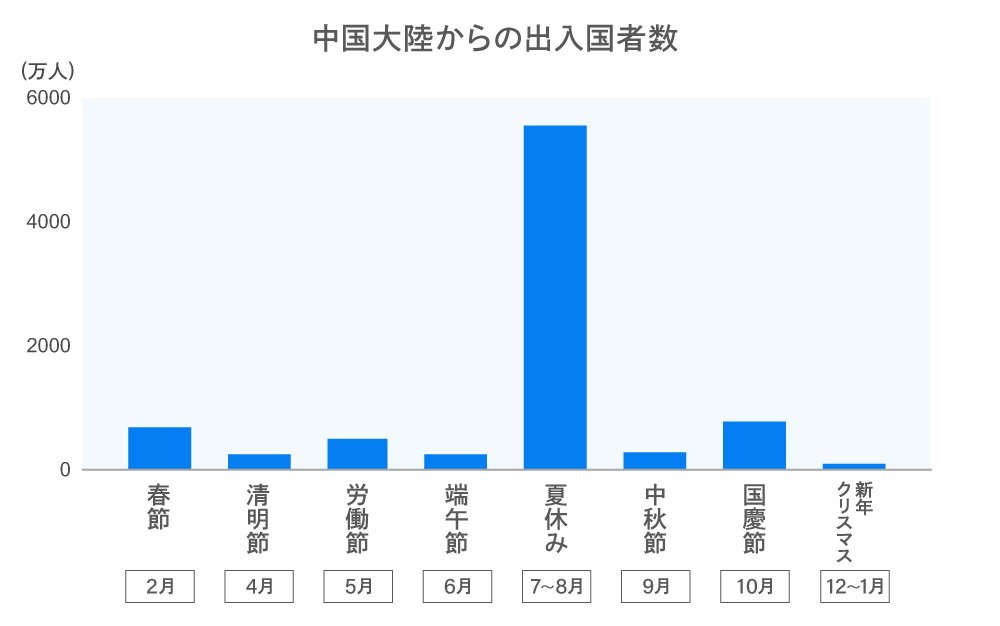

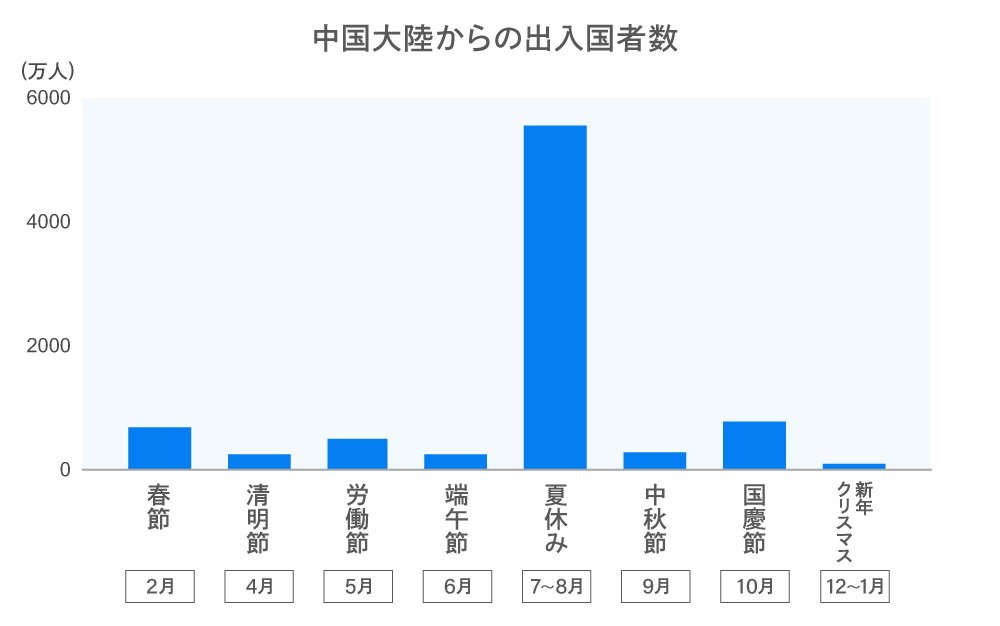

Timing of Chinese Overseas Travel: "Summer Vacation" is the Peak Period

According to statistics from the National Immigration Administration of China, the "summer vacation period (July to August)" represents the largest peak season for inbound and outbound travel. This is followed by the National Day holiday (October), Spring Festival (January to February), and Labor Day holiday (May). While major holidays like Spring Festival and National Day often attract attention as promotional timing for Chinese visitors to Japan, summer vacation is the most suitable time for family overseas travel. Consequently, promotional activities before and during this summer vacation period cannot be ignored. In this sense, it is crucial to design promotions that incorporate not only short-term measures targeting holidays but also medium-to-long-term strategies.

Source: China National Immigration Administration "Statistical Data"

Next time, we will reveal key business insights based on data provided by Ctrip and Dentsu Inc.'s proprietary online survey of Chinese visitors to Japan, including their travel purposes, purchasing tendencies, and consumption patterns.