This series fully utilizes data to deepen insights and uncover the true nature of Chinese tourists visiting Japan. Last time, we clarified key business-applicable points—such as travel purposes, purchasing tendencies, and consumption patterns—based on findings from an online survey of Chinese tourists visiting Japan, conducted independently by Dentsu Inc. with the cooperation of Ctrip, China's largest online travel agency.

This time, we delve deeper into their characteristics through a preliminary analysis based on information about the daily digital behaviors of Chinese tourists visiting Japan, using Dentsu Inc. China's digital audience data platform, "Merkury." We analyzed frequently asked topics such as "traveler profiles," "travel periods," "popular destinations and search keywords of high interest," and "trends in apps used daily."

◼️About Merkury

A digital audience data platform operated by Dentsu China, holding over 1.2 billion device IDs. Utilizing this data, it analyzes insights and behaviors of Chinese travelers before, during, and after their trips, supporting the formulation of effective customer journeys, marketing strategy development, and communication execution.

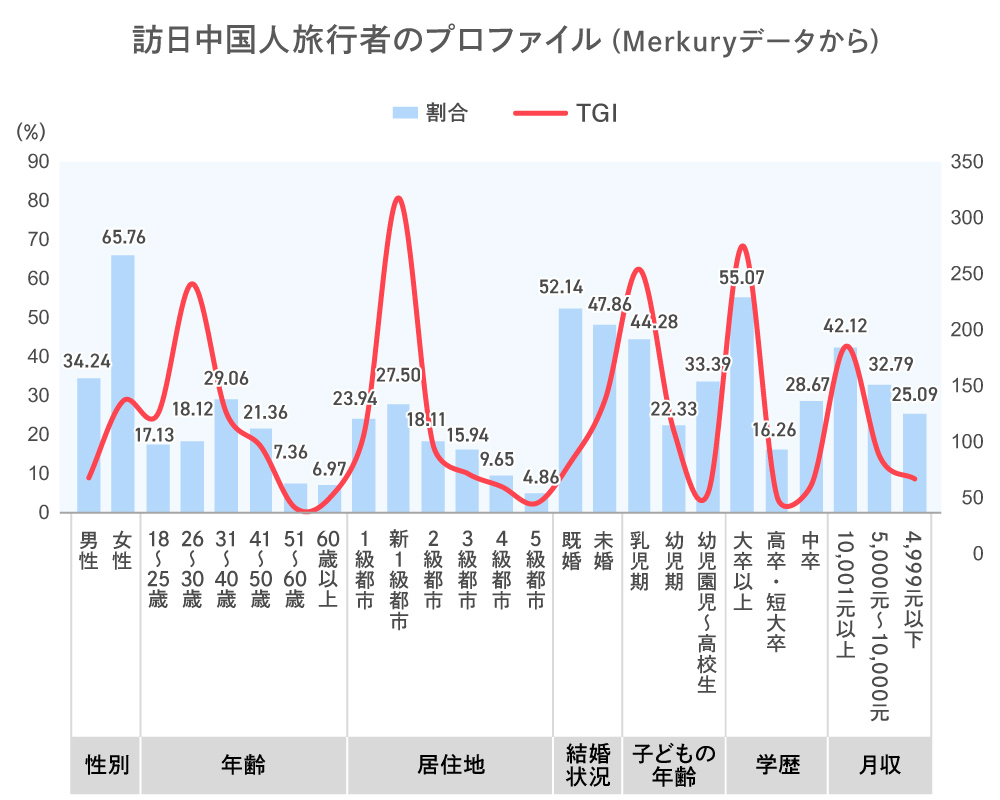

Key Profile Points of Chinese Visitors to Japan

・ Women constitute a high proportion of the Chinese visitor segment

・The core age group is 31-50 years old, concentrated in major cities ( Class 1, New Class 1, and Class 2 cities according to China's urban classification system), with high income and high education levels

・ Within this group, the proportion of residents from new Tier 1 cities and their TGI (Target Group Index)※ significantly exceed those of Tier 1 cities, making new Tier 1 city residents a key potential target for Japan travel

※TGI (Target Group Index):

An indicator that shows how much the target group's share exceeds or falls short of the average, with the average of all Merkury device IDs set to 100. A value greater than 100 indicates a higher target group share.

※China's city classification:

In China, cities are categorized into six tiers—Tier 1 (Beijing, Shanghai, etc.), New Tier 1 (Qingdao, Chengdu, etc.), down to Tier 5—based on various factors like population and economic level. While this is a customary classification rather than a formal administrative division defined by law, it is generally based on the "City Attractiveness Ranking" published by China's major economic magazine "First Financial Daily" and its affiliated think tank. The specific cities included in each tier change slightly each year.

Reference site: China Media Group "First Financial Releases '2025 New First-Tier Cities Attractiveness Ranking', Refreshing the Past and Rediscovering"

https://www.smg.cn/review/202505/0166469.html

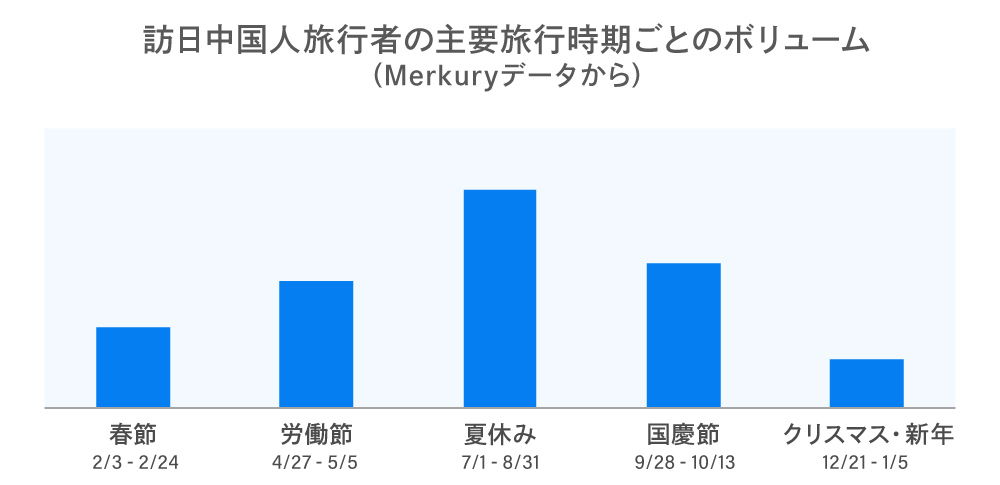

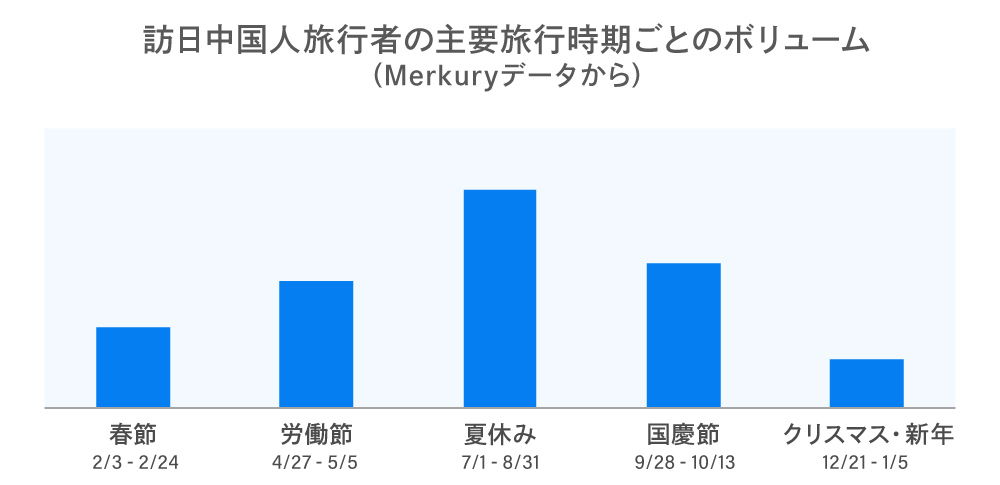

Travel Seasons: Summer vacation (July-August), National Day (November), and Labor Day (May) are peak travel periods.

Analysis of overseas travel timing trends during major holidays in 2024 shows "Summer Vacation" is the most popular, followed by "National Day in November," "May Day holidays," "Chinese New Year," and "Christmas/New Year."

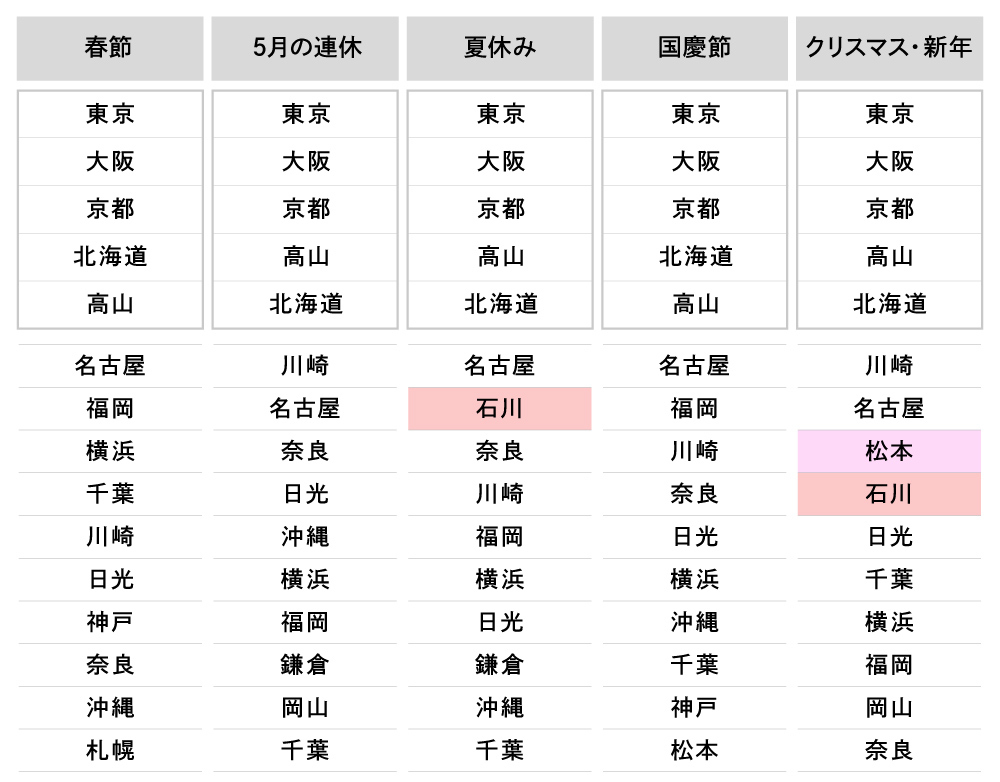

Popular Destinations

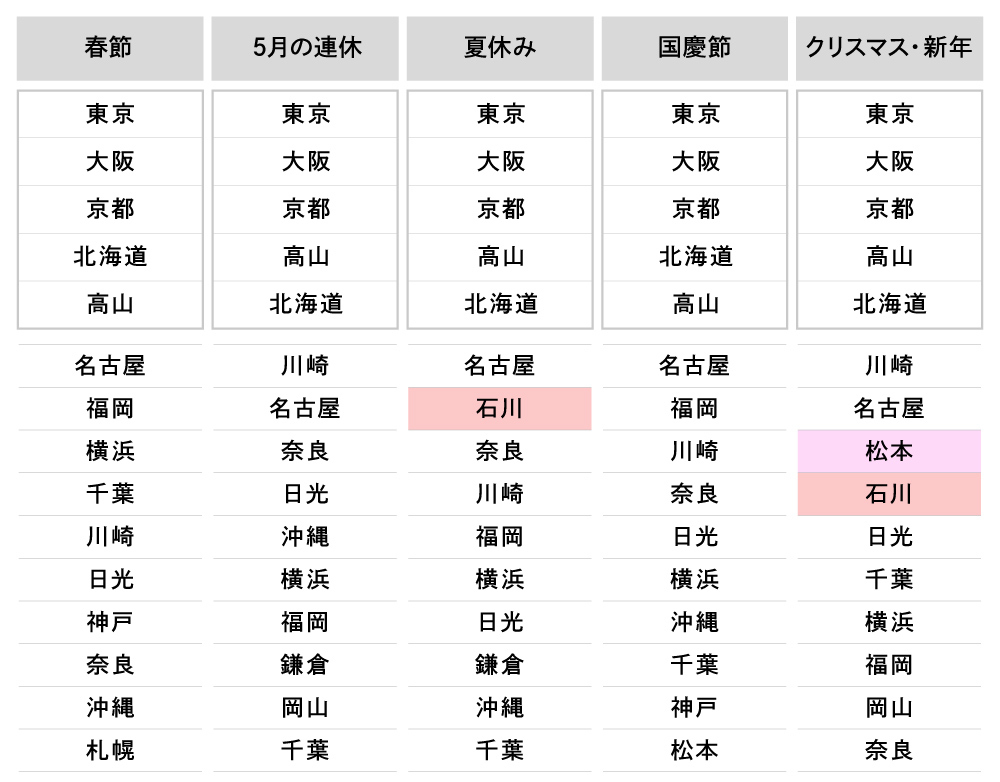

Looking at search keyword trends related to Japan travel, the major popular destinations are the Kanto region centered on Tokyo (Yokohama, Kawasaki, Kamakura, Chiba, Nikko), the Kansai region represented byOsaka, Kyoto, and Nara, Nagoya, and Hokkaido.

Looking at trends by major travel season, interest is high for regions such as "Tokyo, Osaka, Kyoto, Hokkaido, and Takayama" as top travel search destinations.

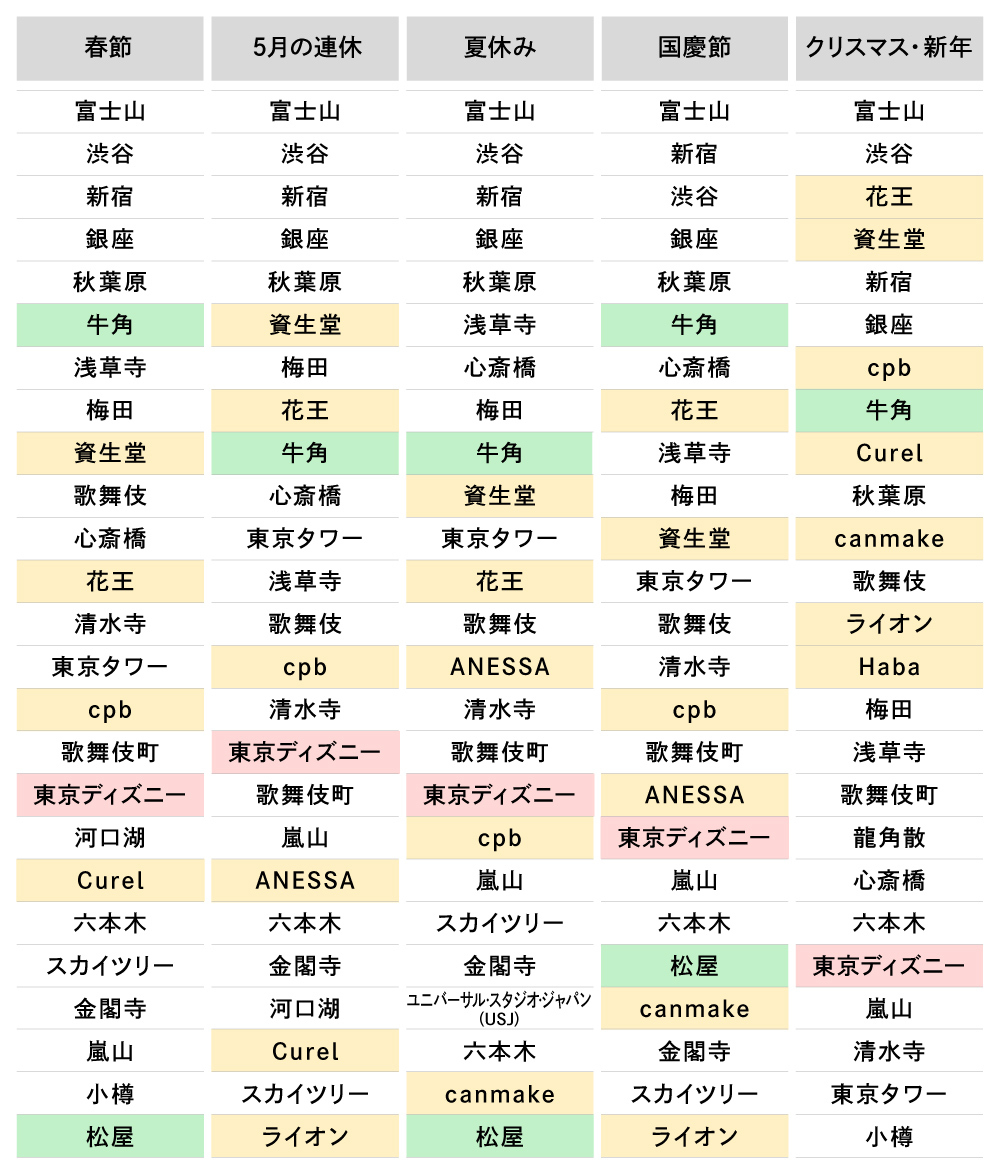

Popular Destination Search Keywords (Region Names) by Major Travel Season

Destinations gaining attention also vary by season and time period (e.g., increased interest in Matsumoto and Ishikawa during the Christmas and New Year period). Even when visiting the same place, travelers have different preferences and travel needs depending on the season, making it crucial to implement strategies and measures based on this understanding.

Popular Search Keywords

Compared to destination searches, search keywords for inbound travelers showed little variation by season. The top 25 search keywords primarily focused on: ① Commercial districts in Tokyo and Osaka ② Japanese local brands ③ Classic and popular tourist spots

Food and Beverage Keywords:

The Japanese restaurant chain "Gyukaku" was the most searched food-related keyword. The next most searched food-related keyword was "Matsuya".

Brand-Related Keywords:

"Shiseido," "Kao," and "CPB ( )" ranked highly among brand-related keywords, indicating strong popularity. These were followed by "Curel," "Lion," and "canmake."

Differences During Travel Periods:

Search volume for brand-related keywords increases during the Christmas and New Year period. It is assumed that travel to Japan around Christmas and the New Year is a time when interest in shopping (for gifts) rises.

Theme park trends:

"Disney Resort" and "USJ" are searched, with "Disney Resort" consistently ranking high regardless of the season.

Search Keywords During Major Travel Seasons

Interests, Preferences, and Media Contact Points

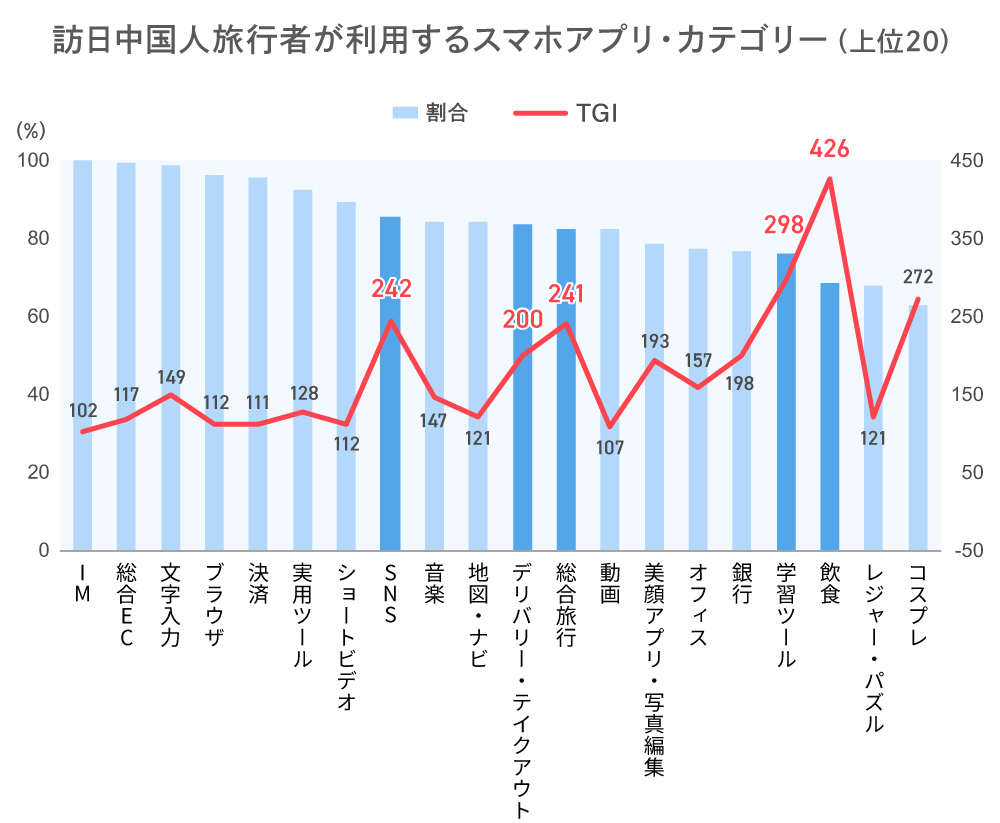

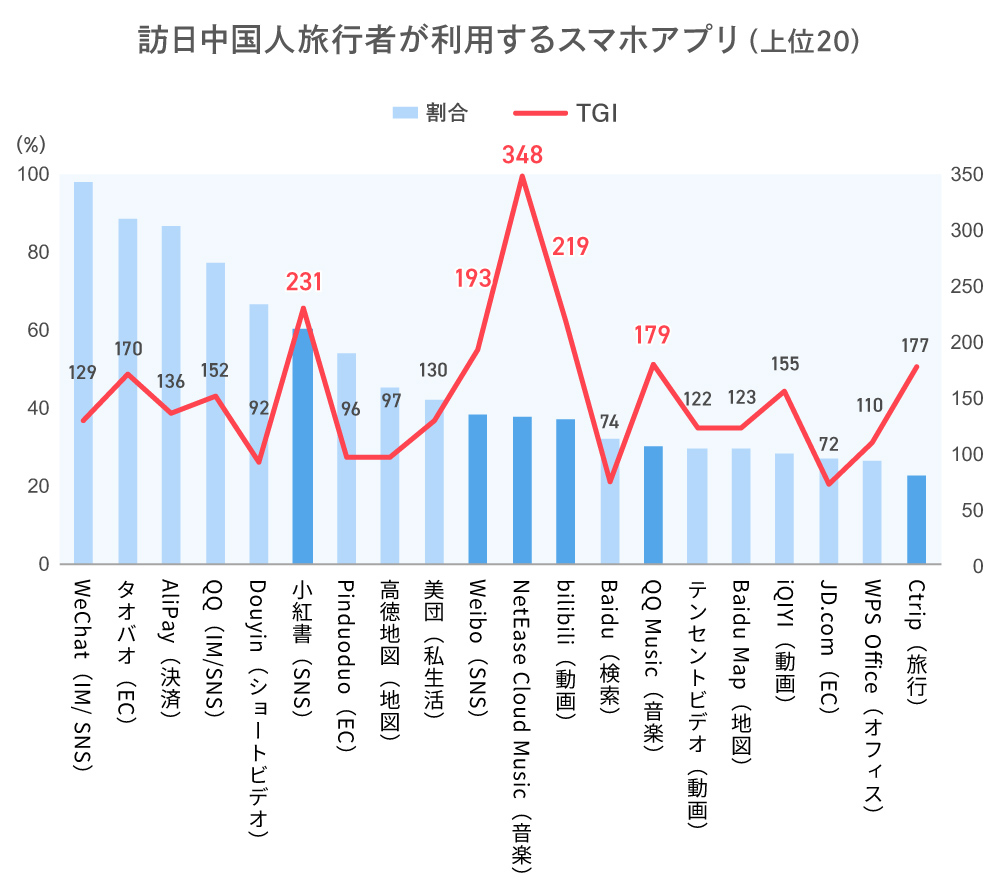

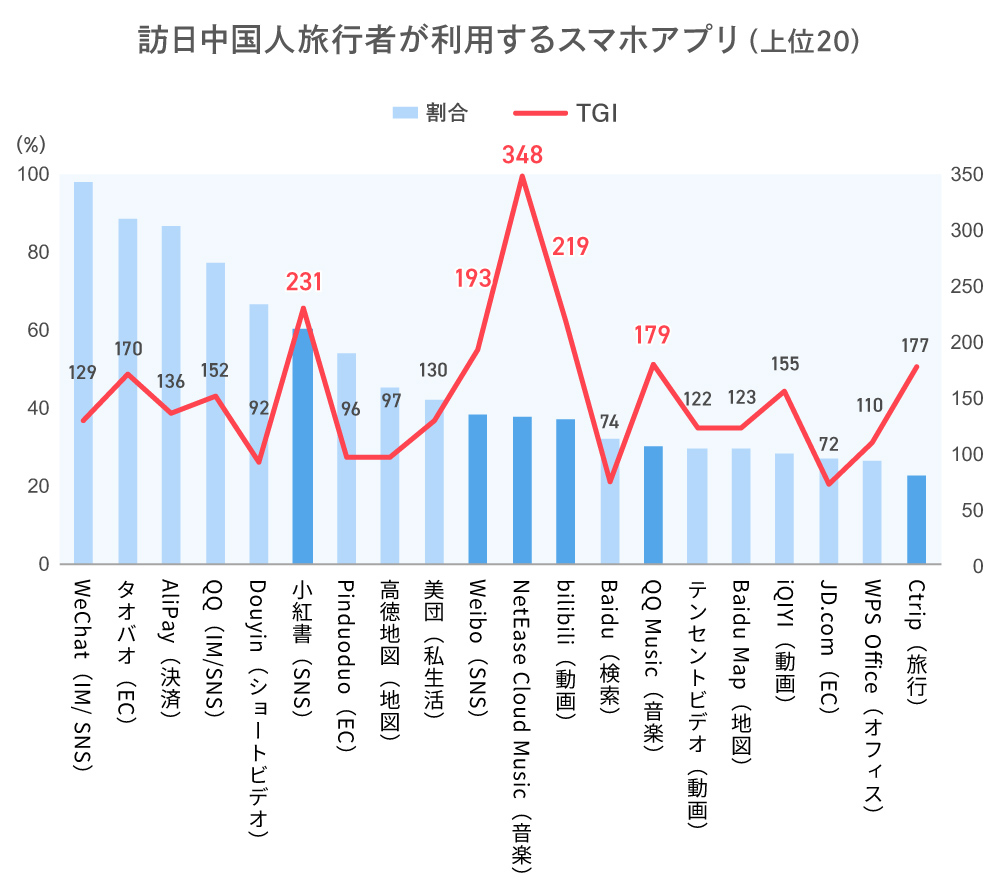

The following chart analyzes which smartphone apps Chinese tourists in Japan use, based on Merkury data.

The usage rates for apps in the categories "SNS," "Delivery/Takeout," "Travel," and "Learning Tools" are high, indicating that tools for gathering information during travel and making travel more convenient are being used more actively than usual.

Specifically, SNS apps like Xiaohongshu (Rednote), Weibo, and Bilibili; the music app NetEase Cloud Music; and online travel platforms such as Ctrip are highly preferred by Chinese visitors to Japan.

Xiaohongshu, in particular, is used by over 50% of the segment, making it a critically important platform for Chinese tourists visiting Japan. It is vital to actively leverage these highly-used apps and platforms as touchpoints during their trip to influence the awareness and behavioral decisions of Chinese tourists visiting Japan.

Key Profiles of Chinese Tourists Visiting Japan

Leveraging Merkury's data, we categorized the primary groups of Chinese visitors to Japan into distinctive groups and personas. By delving into the characteristics of each group, the following five groups emerged as the primary profiles of Chinese visitors to Japan:

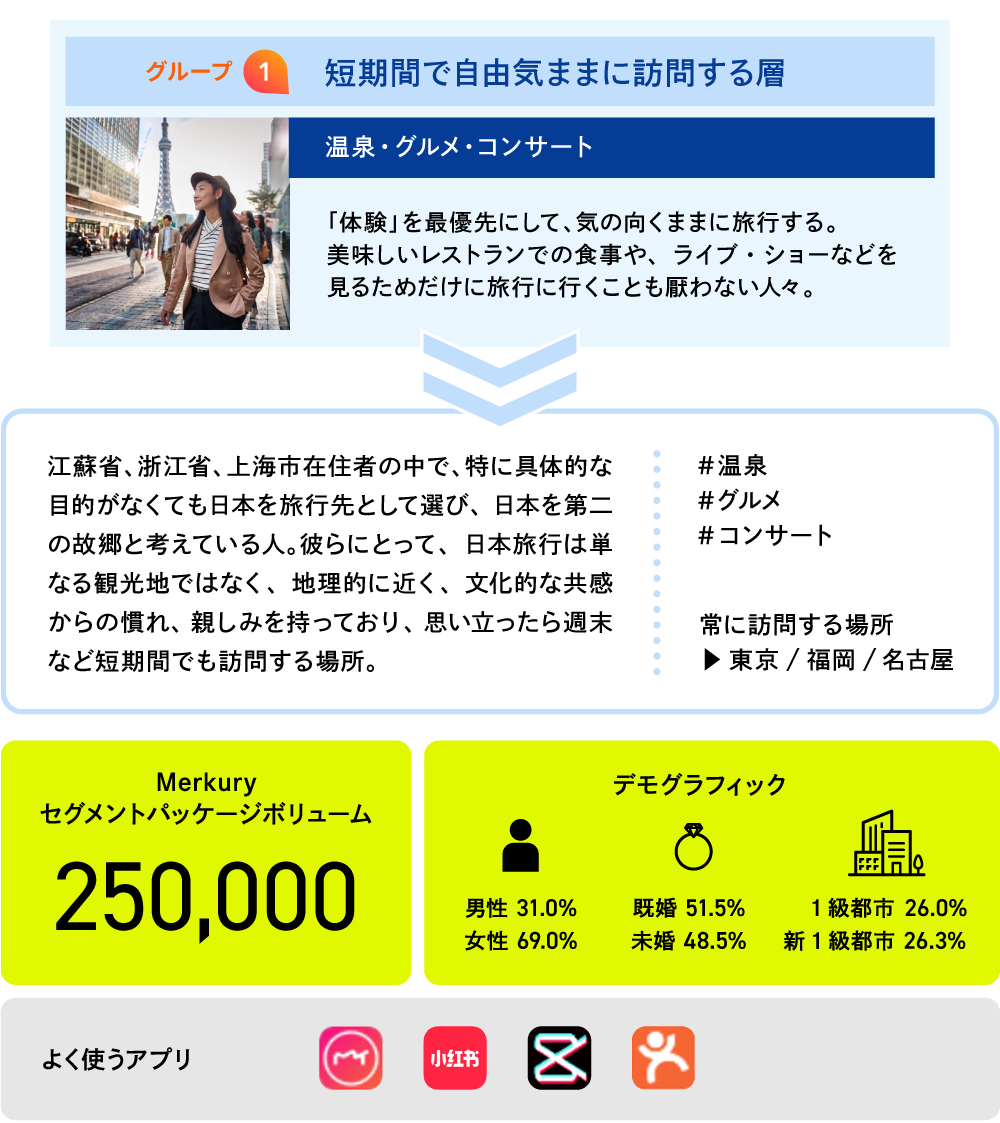

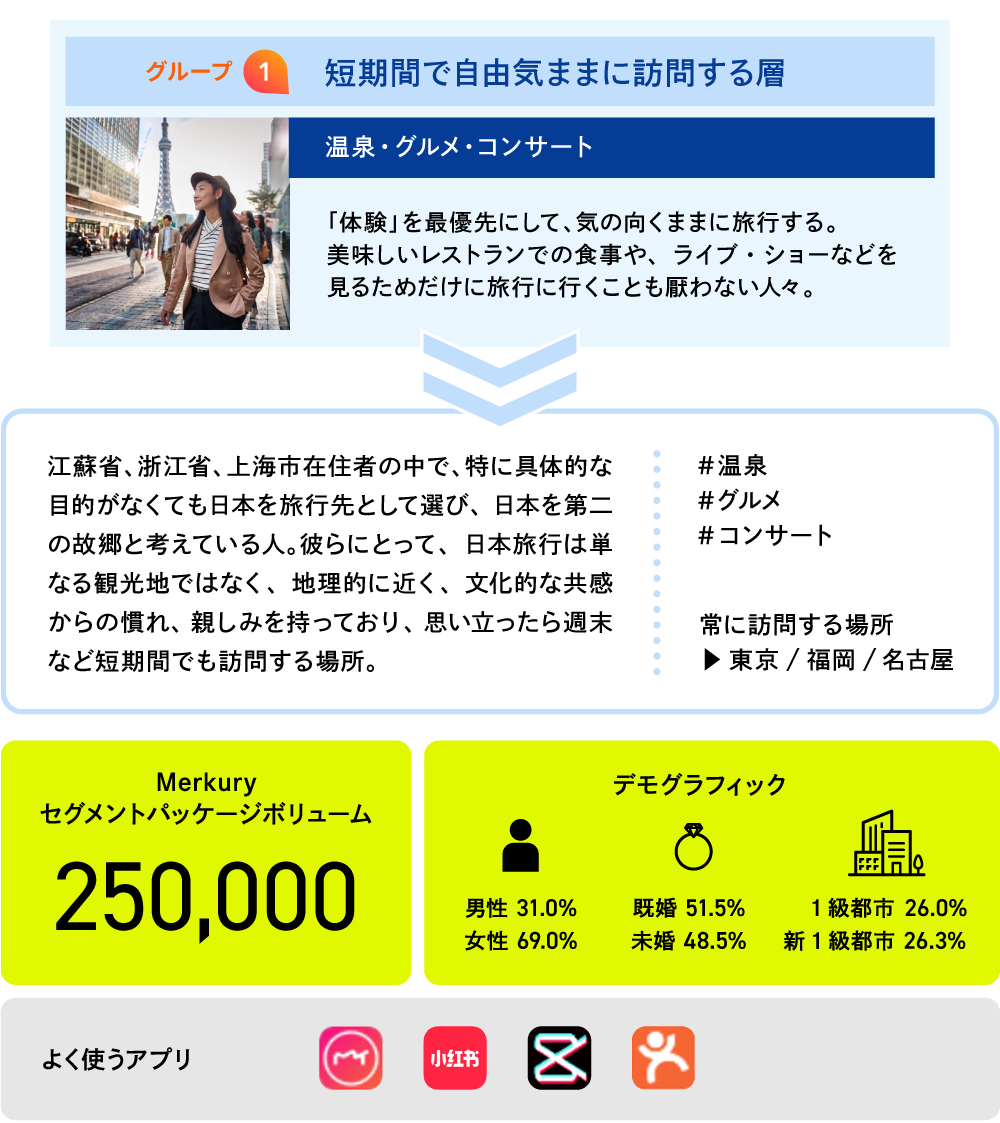

Group 1: Short-term, Free-spirited Travelers

Group 2: Those who primarily enjoy shopping in Japan

Group 3: Those seeking cultural and elegant travel experiences

Group 4: Those who prioritize fulfilling hobbies and interests

Group 5: Affluent and leisurely senior generation

For example, analyzing the attributes and mindset of Group 1 ("Short-term, free-spirited visitors") from the data suggests the following:

・Residents of cities relatively close to Japan, such as Shanghai, Jiangsu Province, and Zhejiang Province

・ View Japan not merely as a tourist destination, but as a geographically close place with a sense of familiarity and closeness stemming from cultural affinity

・ Japan has become a place they visit even for short periods like weekends, even without a specific purpose

Furthermore, based on content such as social media posts, this group shows interest in topics related to the following keywords:

#Gardens #WeekendTrips #BlastTrips #MultipleEntryVisas #CheapFlights #NightFlights

#BudgetHotels #FishMarkets #Omakase #FortuneSlips #Amulets

As each profile possesses distinctive characteristics, communication design, media selection, and campaign execution must adapt to the diversifying purposes and demographics of visitors to Japan.

Dentsu Inc. leverages this data to define target segments of Chinese visitors to Japan for your company's products and services. We provide proposals for effective communication, addressing both messaging and channel selection. Please feel free to contact us.

Contact: dentsu-gbc@dentsu.co.jp

Next time, we'll delve deeper into the interests and concerns of inbound travelers using data provided to Dentsu Inc. from Xiaohongshu, a widely used SNS platform among Chinese users.