※Glossary

【Social Sourcing】

A mechanism for co-creation with society by obtaining necessary resources—such as ideas, funding, and skills—from the community.

【Crowdfunding】

A mechanism for broadly raising money from individuals via the internet. Includes various methods like "donation-based," "reward-based," "lending-based," and "investment-based."

【Fundraising】

The act of raising money for a specific purpose.

Note 1: Unless otherwise specified in this document, "crowdfunding" refers to the "reward-based" model.

Note 2: Crowdfunding platform operators must conduct business in compliance with relevant laws: "reward-based" under the Specified Commercial Transactions Act (and depending on the mechanism, the Payment Services Act or Banking Act), "investment-based" under the Financial Instruments and Exchange Act, and "lending-based" under the Money Lending Business Act.

◆J-WAVE's Crowdfunding Project Launches Its First Sequel!

The funding campaign for the J-WAVE LISTENERS' POWER PROGRAM " We want to create a radio program to promote Kawasaki-grown vegetables! " introduced in Part 3 of this series successfully reached its target amount and aired on October 29. Now, funding is underway for the program's first-ever sequel broadcast.

The program funded through crowdfunding sparked a strong response from listeners and viewers, increasing support for producing and broadcasting a sequel, which in turn expands the circle of crowdfunding supporters... If we can achieve this cycle of broadcasting and funding, I believe it represents a new possibility for mass media. This is the first attempt at that.

◆Which Came First, the Chicken or the Egg? The Crowdfunding Dilemma

"Produce and broadcast a program through crowdfunding, then leverage its mass media influence to secure funding for the next project." Even if this cycle becomes reality, the "startup funding" for the initial broadcast requires promotion and PR without relying on the program's broadcast power. Obviously, the beginning is the hardest part.

This reveals a fundamental nature of crowdfunding. It faces a chicken-or-egg causality dilemma.

Due to its nature of soliciting funds from an unspecified number of consumers via the internet, funding for popular content, already recognized brands, or projects backed by celebrities tends to succeed relatively easily. Conversely, unknown projects often struggle to succeed unless the promoter driving the funding campaign is passionate and puts in significant effort (though exceptions exist, which is part of the appeal of this system).

Currently, most domestic crowdfunding projects are still in the startup phase, striving to gain popularity and trust.

Lack of trust in the rewards means funds don't come in. Lack of funds means they can't develop compelling content or do effective promotion/PR, so expectations for the rewards don't grow. It's a chicken-and-egg situation.

However, the real significance of this debate lies in the question of who should take the necessary risks to break this dilemma. And that, I believe, is the very essence of crowdfunding.

◆The Essence of "Receiving Support"

In traditional business logic, the entrepreneur took the risk and invested in initial costs like development, promotion, and PR.

If we liken funds to the chicken and the product/content/service to the egg, the traditional approach involved the entrepreneur taking the risk to provide the chicken and then presenting an appealing egg to consumers to resolve the dilemma.

Crowdfunding can be seen as a mechanism where consumers share some of the risk traditionally borne by the entrepreneur.

By having consumers trust and purchase unseen eggs, the entrepreneur can secure the chickens. While limited, this allows consumers to take on a certain degree of risk. This, I believe, is the true meaning of "receiving support."

Purchase-based crowdfunding is a system where consumers buy unfinished products, content, or services at the planning stage. The proceeds from these sales are then used to fund development or production, with the finished product delivered to the purchasers (supporters) afterward. As a mechanism that hedges business risks like development, inventory, and performance risks, it's highly attractive to business owners. However, these risks haven't vanished from this world; they've simply been shifted onto someone else. Specifically, they've been shifted onto the supporting consumers.

Business risks, such as development risks (delays, specification changes), inventory risks (finished products lacking appeal), and performance risks (finished content being uninteresting), are unavoidable as long as the future remains uncertain, no matter how meticulously plans are made. The core function of crowdfunding lies in this mechanism: having consumers purchase these uncertain yet planned future products, content, or services during the planning stage, thereby shifting part of the risk onto them. Understanding this essence is crucial for effectively leveraging crowdfunding.

◆ What is the Risk of "Purchase-Based" Crowdfunding?

In the latter half of Part 3 of this series, I discussed how crowdfunding is more appropriately viewed as gathering allies mediated by fundraising. In this context, I believe these allies are "partners who not only share dreams and goals but also share risks." I believe sharing risks creates an unprecedented, strong bond between both parties.

READYFOR, our partner in the J-WAVE LISTENERS' POWER PROGRAM, operates a "reward-based" crowdfunding model. This type follows the framework of "online retail sales." For any reward-based platform, the platform operator—acting as the online retailer—must clearly display the legally required disclosures under the Specified Commercial Transactions Act (*).

(*)Note: Depending on the structure, "purchase-type" crowdfunding may be subject to regulations under the Payment Services Act (or the Banking Act).

While the mechanism of "purchase-type" crowdfunding is mail-order sales, using the revenue from these sales for fundraising, it is not simply about pre-selling goods or experiences. It must be approached with the mindset of "seeking partners who share and support the dream or goal, and are willing to share the risk." Promoters must interact with supporters with deep gratitude and trust for becoming partners.

Of course, the supporter's risk is highly limited. Since purchase-type crowdfunding is often structured as a "sales contract," the risk borne by the supporter is solely whether the goods, services, or content they anticipated and purchased meet their initial expectations. Since they are "purchasing" in advance, even if the final product doesn't meet expectations, the value of the payment amount itself won't become completely worthless, except in exceptional cases like the product not being delivered. (However, naturally, if the actual finished product lacks the qualities it should normally possess, the business operator may bear liability for defects.)

◆High-Risk, High-Return "Investment-Type"

In the case of "investment-type" crowdfunding, similar to stock investments, if the funded business fails, the invested capital could become completely worthless. There is no principal guarantee. Compared to "reward-based" crowdfunding, it is considered high-risk. However, commensurate with this risk, if the invested business generates profits, there is the potential return of receiving dividends. Individuals investing in "investment-based" crowdfunding are called "investors," not "supporters" as in "reward-based" crowdfunding.

"Equity-based" crowdfunding qualifies as a "financial product," so funding can only be conducted on platforms registered as financial instruments business operators. Conversely, offering monetary returns to backers in "reward-based" crowdfunding, which operates under the Specified Commercial Transactions Act, violates the Financial Instruments and Exchange Act and is therefore prohibited. The returns must strictly be products, services, or experiences. Funds from backers are considered "consumed" rather than "invested."

◆ Supporters are risk-takers positioned between customers and investors

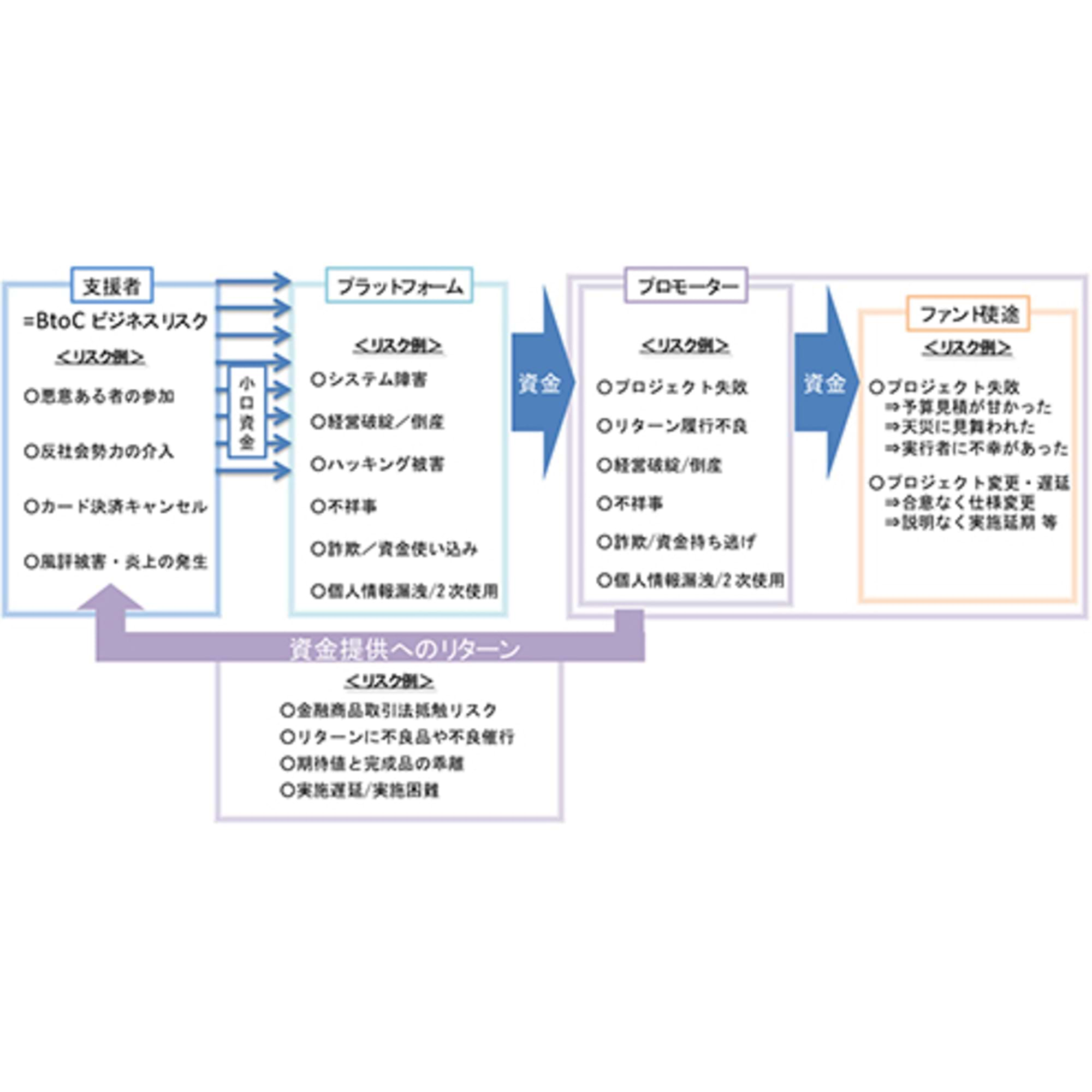

The risk distribution among customers, supporters, investors, and businesses can be illustrated as follows.

|

※This is a simplified diagram and may not apply to every individual case.

|

As shown in this diagram, supporters are risk-takers positioned between customers and investors. If supporters strongly hold the mindset of being "customers" with essentially no risk—meaning they lack awareness that they are "shouldering part of the promoter's risk"—the likelihood of major issues arising when risks materialize increases significantly.

The most obvious example of risk materialization is when "the final product differs from what was expected when support was provided (money was paid) (This wasn't supposed to happen!)". This can involve differences in quality, taste, or personal preferences.

When expectations and outcomes diverge too greatly, complaints and disputes naturally follow. Conversely, if backers only see themselves as customers, this too becomes a factor that triggers complaints and problems.

◆Creating Partnerships and Bonds That Share Not Only Dreams and Goals, But Also Risks

Rather than stringing together pleasant-sounding words to raise money, a consensus is needed between the promoter and backers: "We share dreams and goals, and we also share the risks." Above all, trust between both parties—that is, partnership—is paramount. Building on that, the ideal scenario is for both sides to collaborate further to avoid the shared risks and drive the realization of the goal.

While crowdfunding is a one-time fundraising effort, the bonds formed endure beyond the funding campaign. These bonds accumulate and become an asset. Creating this partnership is arguably the most important use of crowdfunding.