※Glossary

【Social Sourcing】

A mechanism for co-creation with society by obtaining necessary resources—such as ideas, funds, and skills—from the community.

【Crowdfunding】

A mechanism for broadly collecting money from individuals via the internet. Various methods exist, including "donation-based," "reward-based," "lending-based," and "investment-based."

【Fundraising】

The act of collecting money for a specific purpose

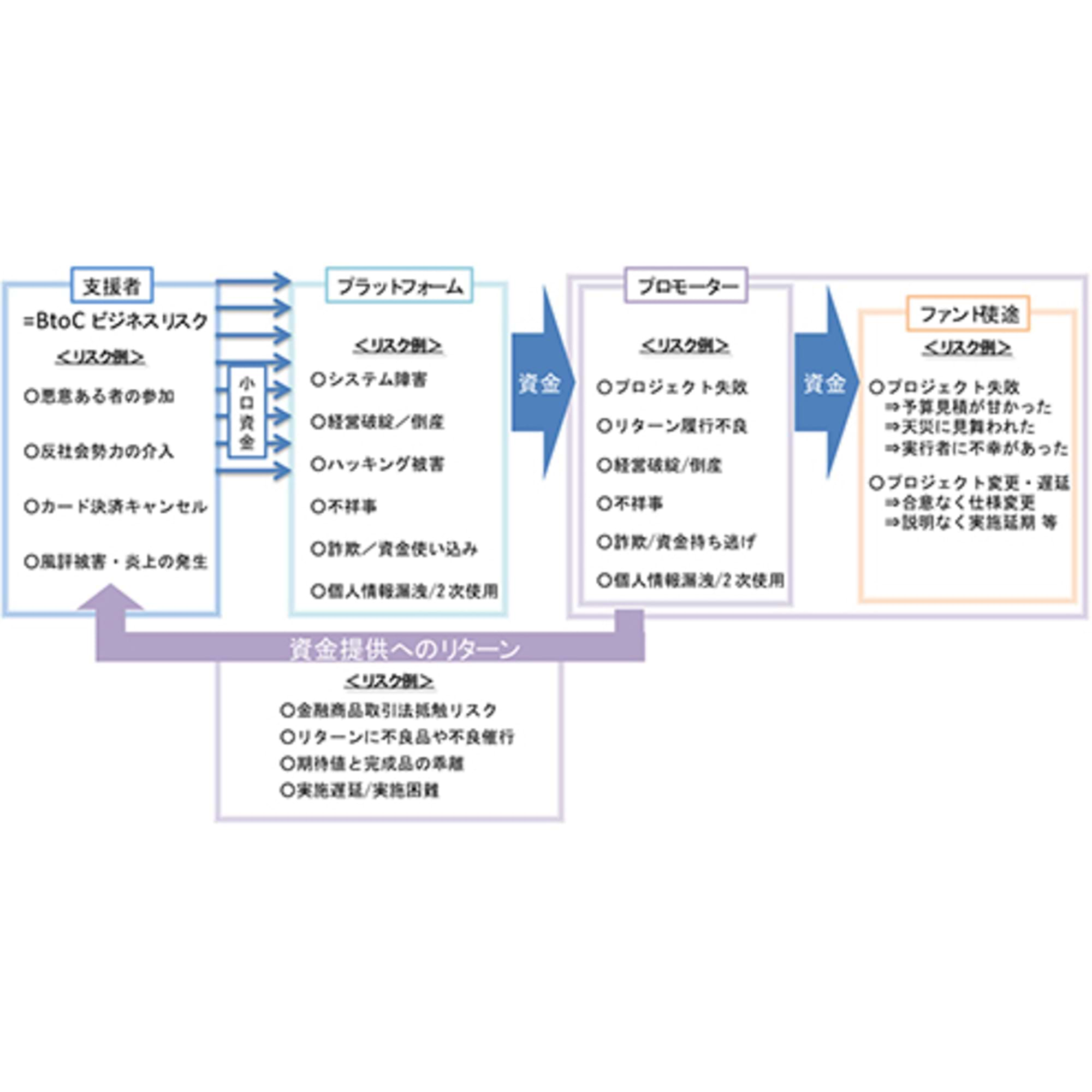

In Part 5 of this series, we explained that community power is essential for fundraising. We categorized the players in a fund into initiators, evangelists, supporters, cheerleaders, the indifferent, and the unaware, illustrating this as the "Fundraising Community Analysis Framework" (Figure 1 below).

This time, based on this diagram, I would like to categorize the groups from a financial perspective and provide an explanation.

◆Classifying Players by Financial Role

The pyramid below, with the promoter (fund initiator) at the apex, illustrates the players comprising the community and its periphery.

| Figure 1: Fundraising Community Analysis Framework |

|

|

Based on this diagram, classifying the market and funding characteristics each player belongs to yields the following:

| Figure 2: Player Classification by Funding Perspective |

|

◆What is Sweet Money?

The funding provided by the "Promoters" and "Evangelists" in this framework is what is commonly referred to as "sweet money." This is a term frequently used in the venture capital industry. It refers to funds provided by the fundraisers themselves or by their very close associates.

Even if a fund lacks the content power or context power (fund power) discussed in Part 2 of this series, Sweet Money can be secured to a certain extent solely through the promoter's family, friends, and acquaintances.

Some crowdfunding campaigns succeed solely on this "sweet money," but due to its limited scale, most set their target amounts low from the start. It's not uncommon to see funds that fail to reach their target amount.

◆What is a Warm Market?

Warm Market is a term frequently used in the context of direct sales or network marketing. It's a concept considered when devising sales strategies targeting broadly defined stakeholders or past purchasers. It is distinguished as a Warm Market because the difficulty and approach differ compared to selling to an unspecified large number of new customers.

"Supporters," who are acquaintances or individuals with existing personal relationships, are particularly considered part of the warm market.

Regarding the "fan" segment, they often exhibit high affinity with the funding purpose (content strength) and context (alignment with personal interests), making them relatively receptive to calls for support. Enthusiastic fans, fan club members, and doujin creators can sometimes be expected to show loyalty comparable to those with prior purchase experience. Therefore, funding targeting fans can also be partially considered part of the warm market.

◆What is a Cold Market (COLD MARKET)?

This is the opposite of the warm market described above. It refers to the concept of targeting completely unfamiliar individuals as new prospects. In the pyramid diagram, it includes the lightly engaged fan base, the uninterested segment, and the unaware segment.

This is the segment least likely to provide support, yet it also represents the largest volume segment.

◆Who Drives Rapid Fund Growth?

So, which segment holds the potential to significantly grow the fund?

In fact, it is precisely the largest majority segment of the Cold Market—the one where support is hardest to obtain—that can cause a fund to expand explosively.

To achieve a fund exceeding hundreds of millions, as seen in overseas cases, I feel it hinges on how effectively this cold market is developed. Relying solely on sweet money and funds from the warm market will rarely allow a fund to scale.

To succeed in fundraising, it is essential to develop a strategy for cultivating the cold market.