The Eye Required for Risk Management to Grasp the "External Environment"

The current standard for risk management, JIS Q 31000 (Risk Management—Principles and Guidelines), defines risk as "the effect of uncertainty on objectives." While we won't delve into the definition's details here, a key characteristic is that this "effect" encompasses both favorable and unfavorable outcomes. Essentially, the current trend in risk management is to recognize both upward and downward deviations from intended objectives as "risks" and to manage them thoroughly.

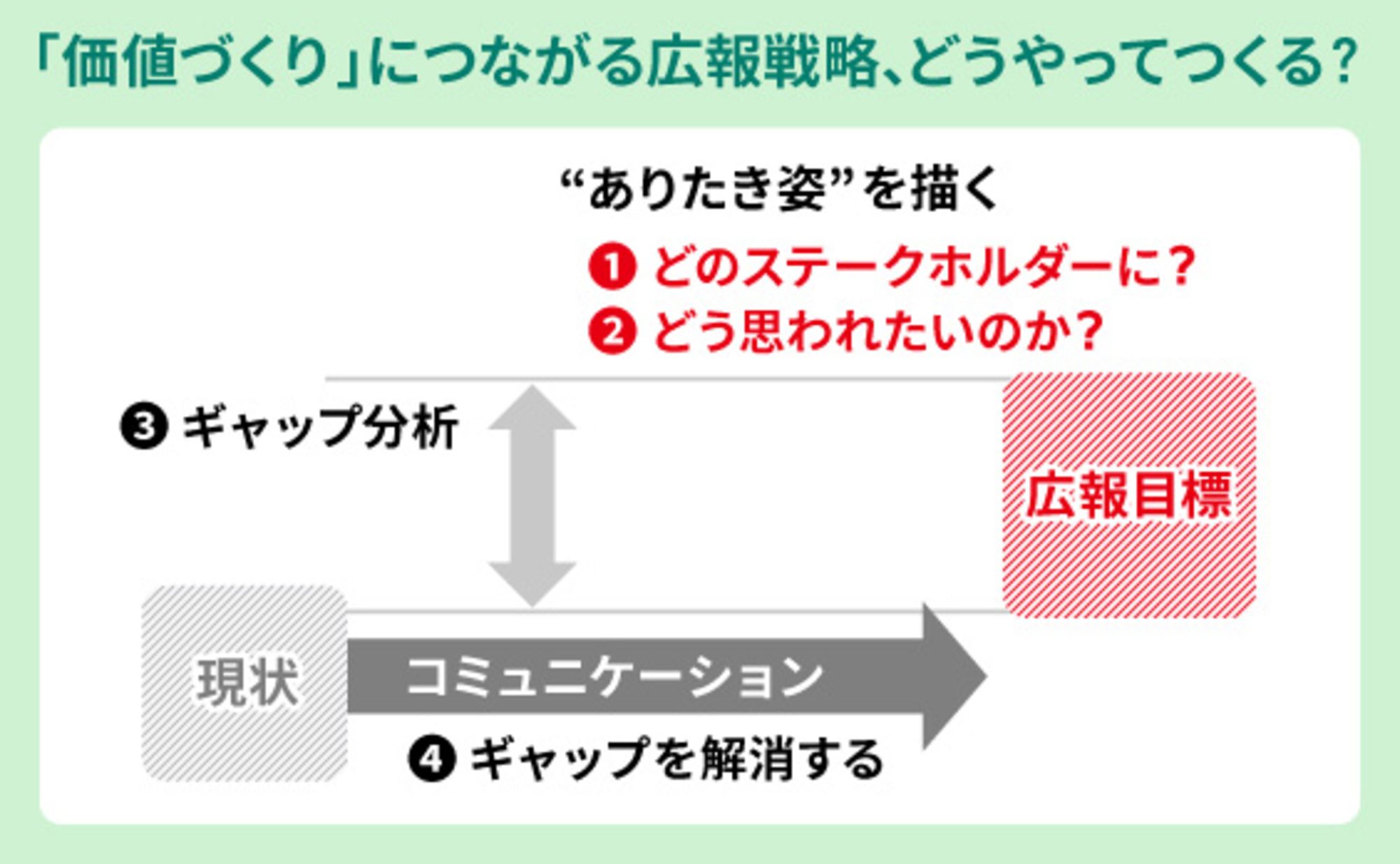

So why do these upward and downward impacts occur? Generally speaking, one contributing factor is often an incomplete grasp of the external environment. It can be said we have entered an era where, not only in business planning but also in risk assessment, identifying the "gap" with the external environment and more reliably determining future impacts is essential.

Verifying Gaps with "Mass Media" and "Other Companies"

However, collecting and analyzing such external information solely through the efforts of internal risk management or crisis management departments is extremely challenging. Therefore, this article introduces the "3D Risk Map," developed by our institute based on the "Corporate Crisis Management Survey" jointly conducted by Dentsu Inc. Public Relations' Corporate Communications Strategy Institute and the University of Tokyo Graduate School of Information Science and Technology's Comprehensive Disaster Prevention Information Research Center. We will explore what kinds of "gaps" can arise between companies and the external environment.

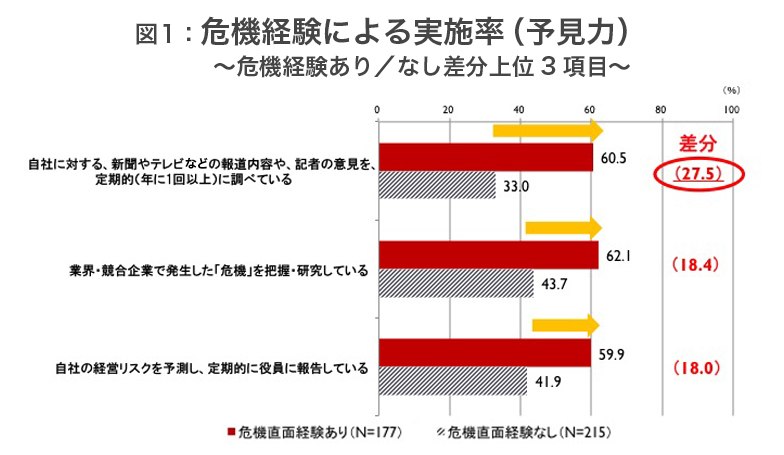

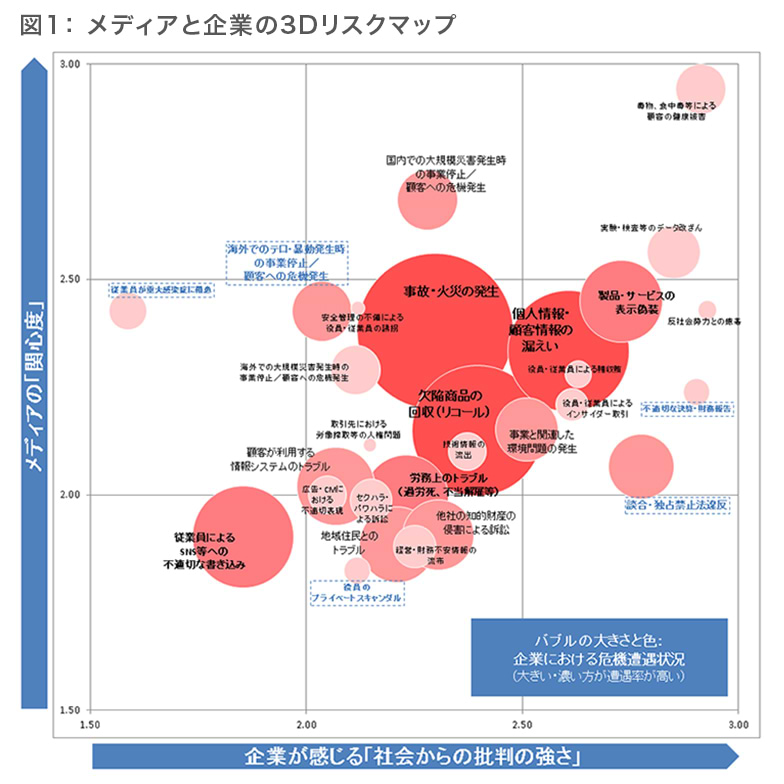

The graph below (Figure 1) depicts the distribution of 28 crisis items considered to occur with some frequency in companies, based on past media coverage. It uses three axes: mass media professionals' "items of high interest" (vertical axis), items perceived by companies as "subject to strong societal criticism" (horizontal axis), and items with "high encounter frequency" within companies (size of circles).

While this "3D Risk Map" can be used in several ways, I will explain how it can be utilized for a more in-depth "risk identification" process.

Generally, crises frequently reported in the media or those commonly occurring within companies tend to receive adequate attention for countermeasures. Conversely, crises that are less prominent are more likely to be overlooked. This "3D Risk Map" allows companies to focus on crisis items with low encounter frequency (smaller circles), providing material for examining risks that may be invisible within their own organization.

Mass media focuses on "current trends and social impact"

In Figure 1, items located in the upper-left area (i.e., items of greater interest to the media than to companies) include "Employees contracting serious infectious diseases" and "Business suspension/customer crises during overseas terrorist attacks or riots." This survey was conducted in February-March 2015, coinciding precisely with the period when "Ebola hemorrhagic fever" and "Islamic State" dominated the news. This reflects how crisis items with significant social impact, aligned with current trends, emerged as high-interest topics.

Many companies prioritize "Occurrence of Organized Fraud"

In Figure 1, items positioned in the lower-right area (i.e., items of greater concern to companies than to the media) include "bid-rigging/antitrust law violations" and "inappropriate financial reporting." A key characteristic is that these items carry a stronger connotation of legal violations compared to other crisis items (e.g., "private scandals involving executives"). It is anticipated that this type of crisis will continue to draw significant corporate attention beyond 2015, often referred to as the "first year of corporate governance."

Conduct risk assessments to identify the "gap" with "external" perspectives!

This survey compiled insights on the "gaps" revealed through the perspectives of 177 mass media professionals and 392 companies, analyzed separately. While many companies typically conduct risk assessments based solely on internal survey data, incorporating external data for deeper analysis is highly effective for anticipating future "impacts" in risk and crisis management.

This "Corporate Crisis Management Survey" also includes industry-specific analyses. Interested companies are encouraged to contact us.