To commemorate the publication of the 2018 Information Media White Paper, this fourth installment of our serialized feature continues from last time with "How Long Will the Smartphone Monopoly Last?" Part 2.

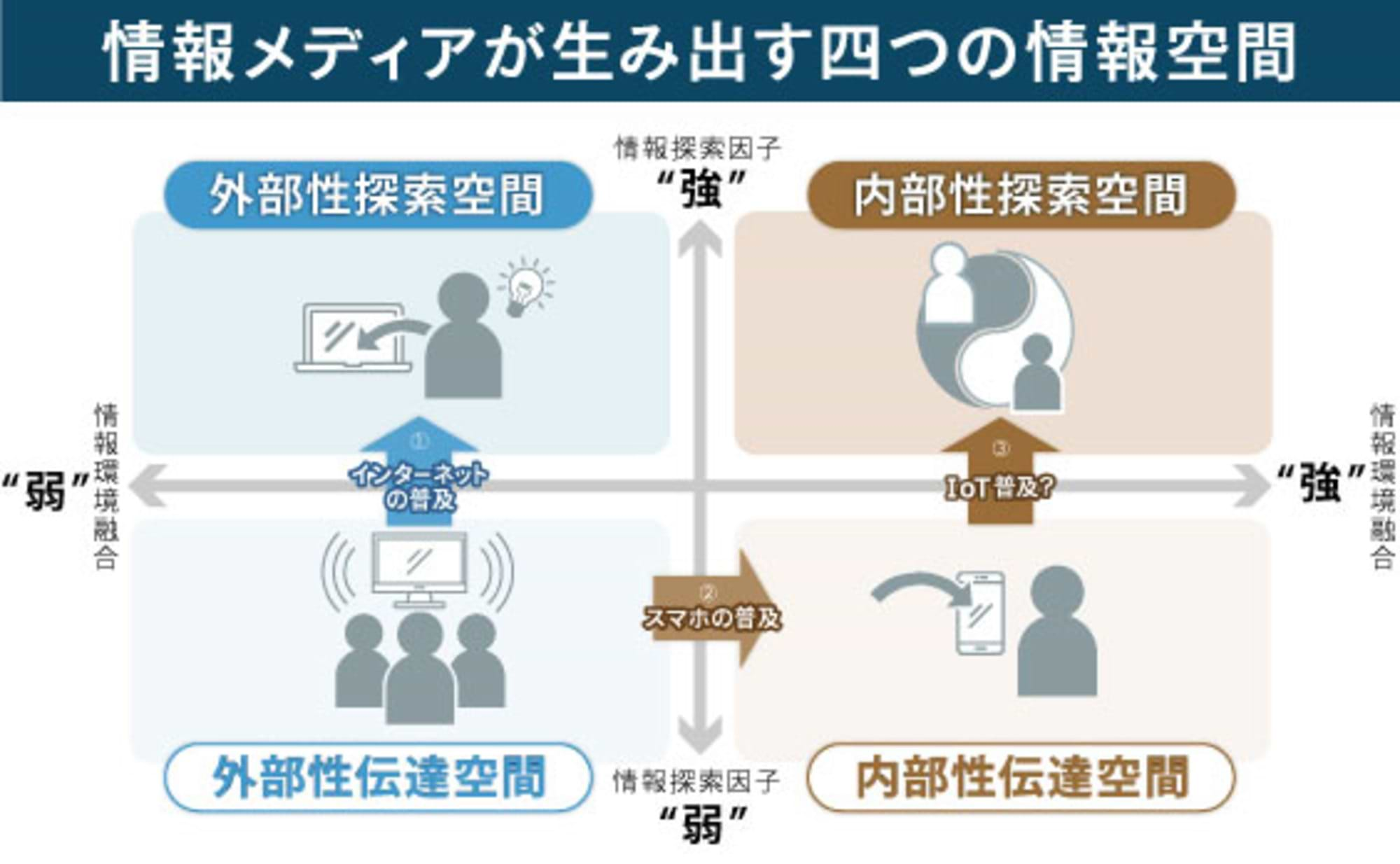

Figure 1: Four Information Spaces and Information Behaviors

In Part 1, under the subtitle "The New Information Space Pioneered by IoT," we discussed how the modern information media environment can be explained through a framework of four information spaces and information behaviors. We also explored how communication methods with customers differ based on this framework. Furthermore, we argued that the Internal Exploration Space—one of these information spaces—is a new information space created by IoT and holds the key to post-smartphone marketing. In this second part, building on that, we will examine what kind of targets exist within each information space based on the results of cluster analysis by information behavior, aiming to reveal the reality of the diversification of modern information behavior beyond just smartphones.

Diversifying Information Behavior Preferences: 7 Types of Information Behavior Clusters

Figure 2: Seven Information Behavior Clusters

First, we attempted to group people based on their information behaviors. This clustering combines the four information behavior types explained in Part 1 with three "device factors" extracted based on preferences for information acquisition methods. The result yielded the seven cluster types shown in Figure 2. We refer to these as "information behavior clusters" because they represent groupings based on preferences for information behaviors. Let's examine the characteristics of each.

※1 The "Information Environment Integration Type," who perceives a blending of information sources and personal space; the "Interactive Type," who perceives information as emerging in the space between themselves and others; the "Information Receptive Type," who perceives information and authority as external entities from which they receive; and the "Information Exploration Type," who perceives themselves as actively exploring external information spaces based on their own judgment. For details, refer to the first part.

※2 "Existing Device Type" seeks information from external, independent sources like PCs or SNS; "IoT Device Type" wants to delegate information selection to functions like AI; "Smart Device Type" prefers obtaining information from nearby devices.

■CL1 "Immersive Information Seekers"

"Immersive" means "to be fully absorbed," making this the type most compatible with IoT environments. They strongly perceive information ≈ results, embodying an environment-integrated mindset, while also exhibiting a slight exploratory tendency to seek information externally. Their IoT Device Factor is also very high, showing interest in immersive UIs like VR and AR. These individuals embrace information encountered without distinction between private (internal)/public (external) or intentional/accidental. CL1 is the only cluster exhibiting high scores on both the "Information Environment Integration Factor" and "IoT Device Factor," indicating strong IoT affinity. They represent the "IoT Adoption Potential Segment" poised to drive future IoT adoption and warrant close attention.

CL2 "Smart Device Lovers"

True to its name, this group relies heavily on smartphones for information acquisition and frequently uses SNS. They place the basis for their information decisions outside themselves, such as in others' evaluations or rankings within social spaces. They also exhibit selective information behavior, limiting information to areas of personal interest.

■CL3 "Information Acquisition Efficiency Seekers"

They are passive about all information activities and show interest only in results that require minimal effort or can be obtained easily. These are people who want to minimize the effort of information activities and get results quickly.

■CL4 "Dialogue Process-Oriented"

They have a strong smart device factor but average scores for information exploration. These individuals prioritize obtaining information through interaction and dialogue with others, rather than relying on others' evaluations or one-way information delivery. They could be described as mature smartphone users less swayed by others' opinions.

■CL5 "Steady Online Information Seekers"

These are people who use the internet freely with a firm sense of purpose. They value the internet as a place where they can freely access information from around the world. They possess high literacy and are highly adapted to the modern information media environment, regardless of whether it involves existing media, PCs, or smartphones.

■CL6 "Mass Audience 2.0"

This cluster exhibits strong information environment integration while also showing some information exploration tendencies. In seeking information both internally and externally, it resembles CL1. However, unlike CL1, it maintains affinity for existing devices. While grounded in mass-transmitted information spaces, it struggles with smartphones and seeks new information behaviors. Could this be the next generation of "audience"?

■CL7 "Discerning Audience"

Similar to CL5 in factor score trends, but with a slightly lower information exploration factor. It shows low affinity for smart devices and very high affinity for existing devices. It can be described as a balanced "audience" that values internet-based information behavior—selecting and discarding information based on personal values and judgment—while also being familiar with traditional media like television.

Information behaviors of people who have "evolved" along two distinct paths

Figure 3: "Which Information Space Each Cluster Belongs To" and "Marketing Space"

Having examined the characteristics of the seven information behavior clusters, we now turn to the main topic. What kind of targets lie within each information space? Figure 3 plots each information behavior cluster onto the four information spaces explained in the previous section.

Figure 3 immediately reveals the existence of two major "evolutionary" streams in information behavior. The first is the flow from the externalities transmission space (listening) of mass media to the externalities exploration space (finding) opened up by the internet (see the blue arrows in Figure 3). These are people who adapted to finding information through their own free will as the internet expanded. This is the "rational" route. Plotted in the external exploration space are CL5 "Steady Online Information Seekers" and CL7 "Discerning Audience," while CL4 "Dialogue Process Prioritizers" are positioned near the border between the external exploration and external transmission spaces. Overall, these groups show affinity for existing devices like TVs and PCs, while exhibiting a tendency of non-affinity towards IoT devices. These are the people targeted by existing marketing that communicates through mass media and the internet.

Another flow is from the external communication space of mass media (listening) through the smartphone-based internal communication space (receiving) to the post-smartphone internal exploration space (encountering) (see red arrows in Figure 3). These are consumers whose information behaviors shifted toward context-driven actions triggered by smartphones and SNS—essentially the "sensibility" route. The internal transmission space includes CL2 "Smart Device Lovers" and CL3 "Information Acquisition Efficiency Seekers," while the internal exploration space includes CL1 "Immersive Information Explorers" and CL6 "Mass Audience 2.0." CL2 naturally shows affinity for smart devices and is the target of the increasingly prominent SNS/smartphone marketing. Conversely, CL1 and CL6, residing in the Internality Exploration Space linked to IoT, are not necessarily smart device-affinity groups. This suggests the IoT era will begin with people who are not dependent on smartphones. This point is worth remembering.

Where did the "audience" go?

Clusters plotted in the external transmission space—the information space of mass media—did not appear this time. It is thought that the "audience" that resided in the external transmission space during television's heyday has differentiated into other information spaces with the advent of the internet and smartphones. I believe clusters highly compatible with existing devices, such as CL7 "Discerning Audience" or CL6 "Mass Audience 2.0," represent the "evolved" form of the former audience. CL6, in particular, resides in a post-smartphone information space compatible with IoT. I want to focus on its potential as a new "audience" driving consumption in the IoT era.

New Information Space Leaders: CL1 "Immersive Information Seekers"

Figure 4: "Characteristics of CL1's Information Behavior/Device Factors"

CL1 "Immersive Information Seekers" occupy the deepest part of the "encounter" information space (internal exploration space), representing the current endpoint of the "sensibility" route. They are pioneers of new information behaviors in the IoT era. They exhibit passive attitudes toward existing devices and smartphones, and possess distinct characteristics from other clusters across various metrics—including "consumption awareness," "preferences for corporate promotional methods," and "values"—making them difficult to capture using conventional marketing approaches (Figure 4).

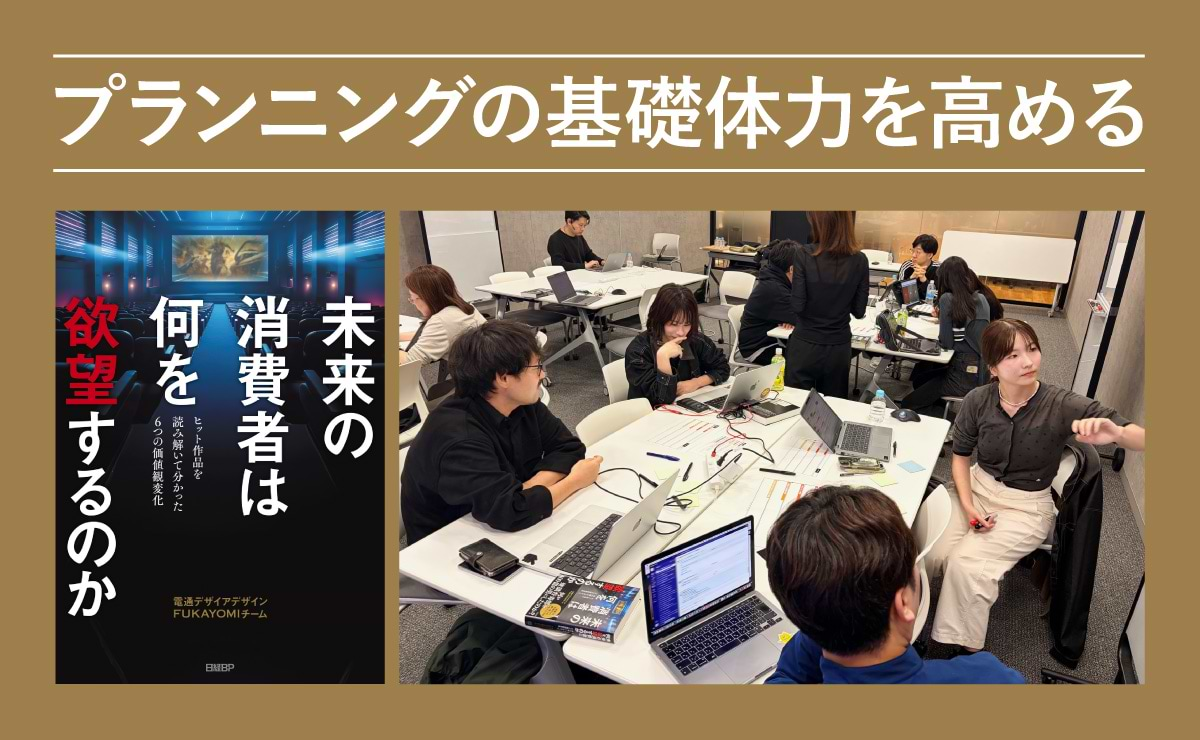

Particularly regarding "preferred advertising methods," they show suggestive scores, such as valuing information originating from "individuals" over companies or media and preferring advertising as content. Moving forward, a "new marketing" approach for the IoT era will likely be required to communicate with people like CL1 "Immersive Information Seekers." For details, please refer to the Information Media White Paper 2018 or contact Dentsu Inc. Media Innovation Lab.

Survey Overview

Survey Name: Survey on Consumers' Information Behavior and IoT Environment Acceptance

Survey Purpose: To understand the actual information behaviors of consumers amid changes in the media information environment. To analyze IoT acceptability and its impact on advertising marketing based on these information behaviors.

Survey Period: October 2017

Survey Method: Web-based survey

Survey Participants: 2,780 samples of men and women aged 18 to 49 nationwide

Cooperating Institution: Video Research Ltd.

Inquiries about this survey: infomedia@dentsu.co.jp