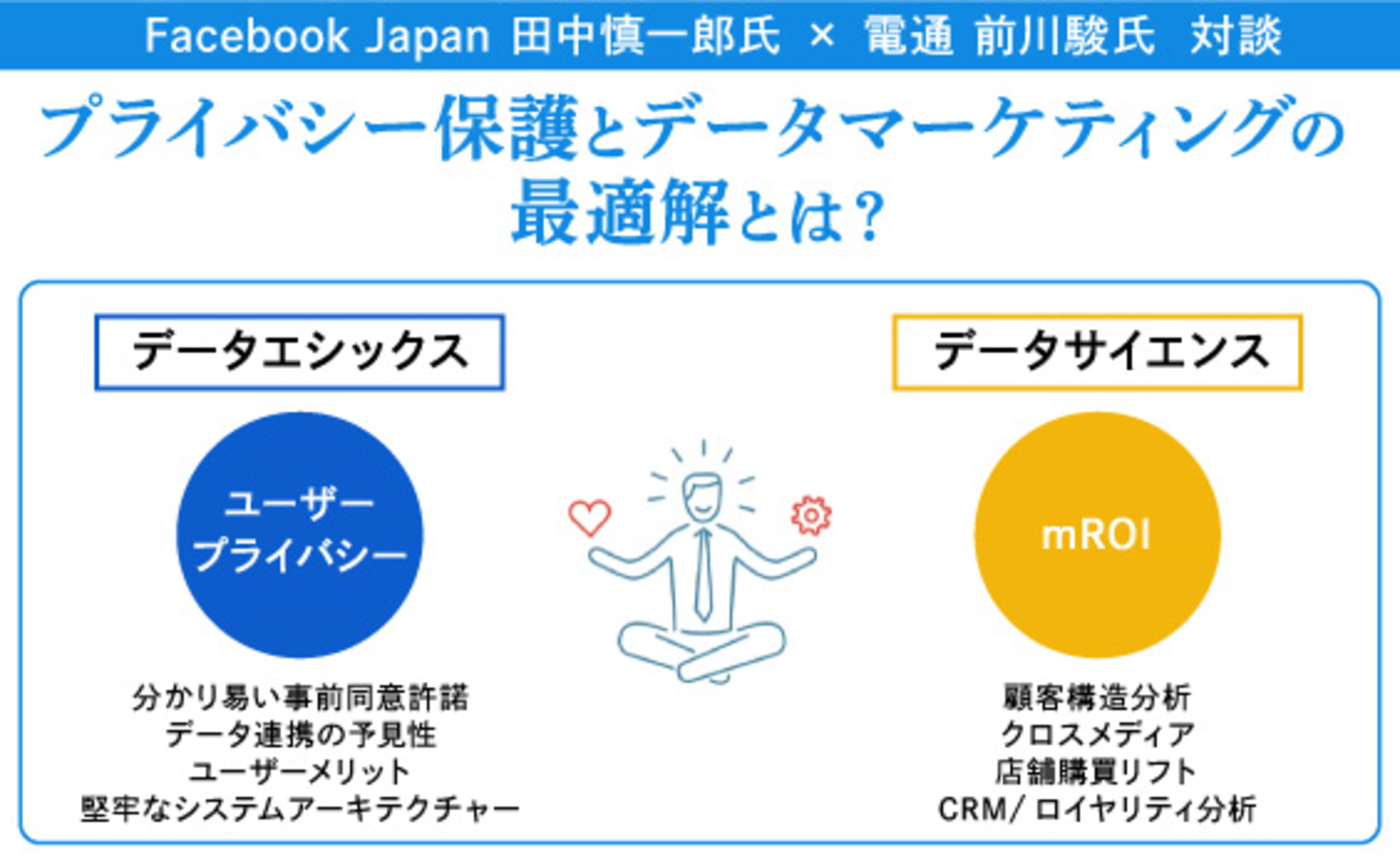

How will companies confront the "cookie-free era"? How will marketing and digital advertising change?

This series, produced by Treasure Data—which provides CDPs (Customer Data Platforms) to businesses— and the D ents u Group, shares insights on corporate DX.

This installment explores "data clean rooms"—a solution born to balance privacy protection with solving marketing challenges.

We invited Wataru Tokushige from LINE's Data Solutions Department as a guest. Together with Kohei Yamamori, Executive Officer at Treasure Data, and Shun Maekawa from Dentsu Inc.'s Data & Technology Center, they delve deep into the current state of Data Clean Rooms.

The "Data Clean Room" Evolving the "Per-Person" Approach

──Last time, Mr. Maekawa explained the arrival of the "cookie-free era" and the benefits and applications of data clean rooms in response. This time, using LINE's data clean room as an example, we hear from all three about practical applications of data clean rooms.

Now, last time Mr. Maekawa mentioned analyzing and verifying the "effectiveness" of digital promotions using data clean rooms. What are your thoughts on that, Mr. Yamamori and Mr. Tokushige?

Yamamori: Analyzing with data clean rooms allows us to "check the answers" for our initiatives. Hearing about Mr. Maekawa's approach, I recognize this is clearly a solution with benefits for clients.

However, I also get the impression that unless you fully utilize the data clean room from the initial design phase of marketing initiatives, it might be difficult to master. For example, when analyzing to improve results, if you don't prepare the necessary data in advance with a hypothesis, you won't get good results. In other words, I think it's hard to achieve results with partial analysis or verification using "whatever data happens to be on hand." Tokushige, as someone who actually provides data clean rooms, what are your thoughts?

Tokushige: At this point, it's not necessarily true that many companies are fully utilizing data clean rooms from the initial design phase or are capable of doing so. However, I believe results can still be achieved even with "partial utilization."

For example, LINE utilizes its data clean room to verify the effectiveness of "Talk Head View," the banner displayed at the top of the Talk list. Talk Head View is a media platform reaching millions of users daily. When analyzing how much Talk Head View ads contributed to purchases after running campaigns combined with TV commercials, agencies utilize LINE's data clean room. The findings are then used to inform future campaign planning and support proposal content.

Yamamori: Thank you. Next, I'd like to ask Maekawa-san: What are the current challenges with data clean rooms? For instance, if third-party cookies disappear, I'm concerned it will become quite cumbersome to develop separate data linkage mechanisms for each platform, including LINE.

Maekawa: It's certainly challenging to address everything. My current understanding of the issues is this: "The ID ecosystems centered around points and other assets held by each platform are fundamentally fragmented by platform. Data between these ecosystems cannot be connected without explicit permission." "Mutual access is not possible."

In this environment, client companies must determine which ecosystem to focus on and optimize their approach for each ecosystem. While users may act across ecosystems, I recognize that how to optimize this approach still requires verification and research.

However, it's becoming clear that focusing on a single major ecosystem for a specific product or product category can reach 80-90% of customers. Furthermore, users actually don't cross ecosystems as much as previously thought. For example, many have fixed locations or channels for purchasing specific items, like "I buy beer at this supermarket" or "I buy electronics at this e-commerce site." Indeed, research on a certain beverage shows that "when viewed per person, about 70% have the habit of buying the product at the same single store."

Of course, focusing solely on a single economic zone won't capture the entire customer base. Therefore, for "understanding the market structure to capture all customers," we believe utilizing panel data from research firms, as has been done traditionally, remains effective. When cross-zone movement isn't possible, data is needed to gain an overview of the entire market or to adjust results by economic zone. Panel data is useful for filling this gap.

A certain food manufacturer used panel data quarterly to visualize users who stopped shopping due to reduced outings during the pandemic and users who continued purchasing despite the pandemic, first analyzing the characteristics of these user groups. Subsequent verification revealed that advertising investment would be more efficient focused on the continuing segment rather than the churned segment. Consequently, by recreating the same cluster within "Ponta member" IDs on LINE's data clean room, segmenting the "continuing purchasing segment," and delivering ads on LINE (including extensions), a third-party survey showed the inclusion rate of the "continuing purchasing segment" increased by approximately 1.7 times relative to the number of ads delivered.

Figure: Example of linking panel data and actual purchase data

──As data utilization evolves in this way, the level of support clients demand increases both strategically and technically.

Yamamori: As a solution provider, Treasure Data should focus on delivering technical support. I believe there's a need for services that "reduce client burden" on the technical side—such as connecting first-party data with various platform data. What are your thoughts, Mr. Maekawa?

Maekawa: As you pointed out, data integration between client companies and platforms looks simple on paper, but execution is extremely labor-intensive.

Numerous considerations arise: ensuring proper data privacy protection, safely transferring proprietary data to data clean rooms, and automating post-transfer analytical queries.

Taking LINE as an example, while clients possess "information obtained from their own LINE Official Accounts," data such as gender, age, and purchasing habits resides with LINE. The path to connecting these starts with coordination across data policy, system, and business aspects.

This is precisely where Dentsu Inc. aims to collaborate with tech partners like Treasure Data—to make this "data integration" simple and secure.

──Finally, let me ask about "social login," which becomes crucial in platform-centric economic sphere marketing. This allows users to access various corporate services by logging in with their platform account, correct?

Yamamori: We also consider social login extremely important. It relates to the recently highlighted "consent management" as well. Social login could enable simpler implementation of consent management tied to cookies, email delivery, LINE messages, and other forms of consent.

LINE Login seems fundamentally very similar to what are called consent management tools. Its widespread adoption could potentially increase marketing flexibility in the future.

Tokushige: I agree. However, one challenge is that social login itself hasn't really taken root among Japanese users yet. Some surveys indicate a low adoption rate for social login. Reasons seem to include a lack of awareness about the benefits of using it, and concerns like "I don't know what personal information is contained in my ID, or how that personal information will be used by companies."

On the other hand, how to provide "benefits to users" becomes a major key. To get users to use their platform accounts for social login, profile input is necessary, but the question is how to provide the incentive for that.

Personally, I believe Amazon account-based social logins are currently favored by companies. This is because Amazon is an e-commerce site, meaning account information is accurately linked to real addresses.

Looking ahead, I want to build a world where, after users understand the benefits of social login and give their consent, we can use the data obtained—that is, "properly acquired data"—to optimize ad delivery.

Furthermore, LINE has approximately 90 million users in Japan (as of December 2021). This large user base also makes LINE accounts highly advantageous for companies to adopt as a social login option.

Maekawa: I believe social login offers relatively clear "user benefit returns," such as personalizing content and services provided by the platform or rewarding points. For example, participating in a brand's promotional campaign through a LINE Official Account and receiving LINE Points creates a chain of user benefits that justifies entrusting their data.

In this discussion, we explored the present and future of data utilization in the new era often called the post-cookie era. Moving forward, various companies will likely pursue people-centric marketing that enhances customer experience by leveraging both data environments like data clean rooms and CDPs. As partners capable of providing the necessary information, insights, and technical support for this, LINE, Treasure Data, and Dentsu Inc. aspire to be the chosen entities by client companies.

If you are interested in the solutions provided through the collaboration between Treasure Data and Dentsu Inc./Dentsu Digital Inc., please feel free to contact us.