From left: Asahi Group Foods' Meiko Kobayashi, Dentsu Digital Inc.'s Taishō Tomoi, Dentsu Inc.'s Shun Maekawa

The essential analytical environment for the era of data marketing is the "Data Clean Room" (DCR) provided by major platform operators.

This time, we introduce a digital marketing case study utilizing DCR for MINTIA, the refreshing confectionery brand from Asahi Group Foods.

Traditionally, analyzing the advertising ROI for consumer goods meant relying solely on intermediate metrics like impressions or clicks to gauge contribution to sales. This global initiative represents an ambitious effort: by leveraging DCR across platforms, it enabled detailed analysis based on actual purchase counts.

We spoke with Meiko Kobayashi, who handles marketing for products like MINTIA at Asahi Group Foods; Taishō Tomoi of Dentsu Digital Inc., primarily responsible for analysis in this project; and Shun Maekawa of Dentsu Inc., involved in developing and operating solutions utilizing DCR.

Now possible: platform-specific effectiveness verification starting from "purchase data"—previously difficult!

──Please tell us why Asahi Group Foods adopted DCR.

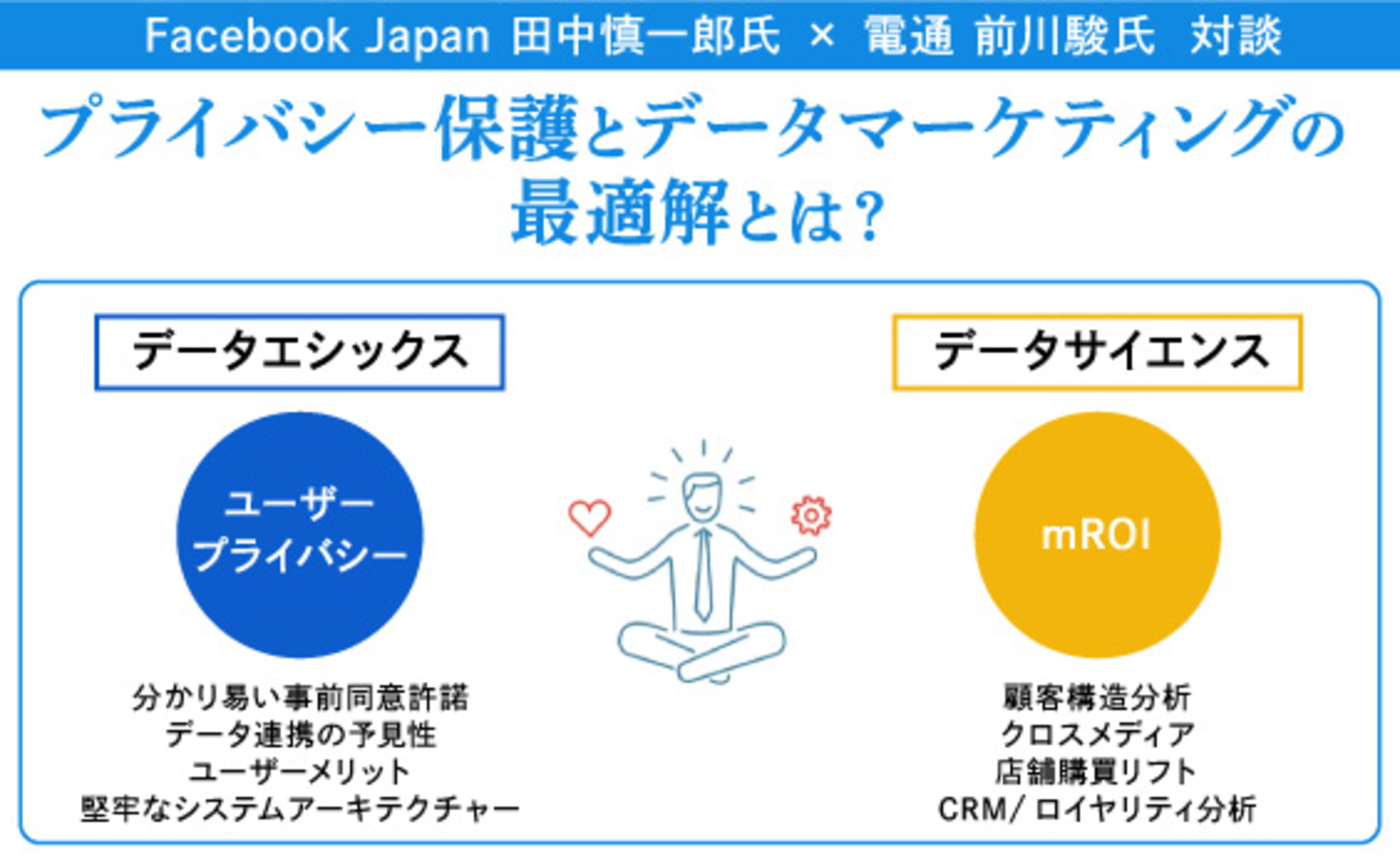

Kobayashi: As advertising media diversified, selecting placement media and evaluating cross-media effectiveness became challenging. We also needed to balance user privacy protection with marketing analytics ahead of the so-called "cookie-free era."

Meiko Kobayashi, Asahi Group Foods

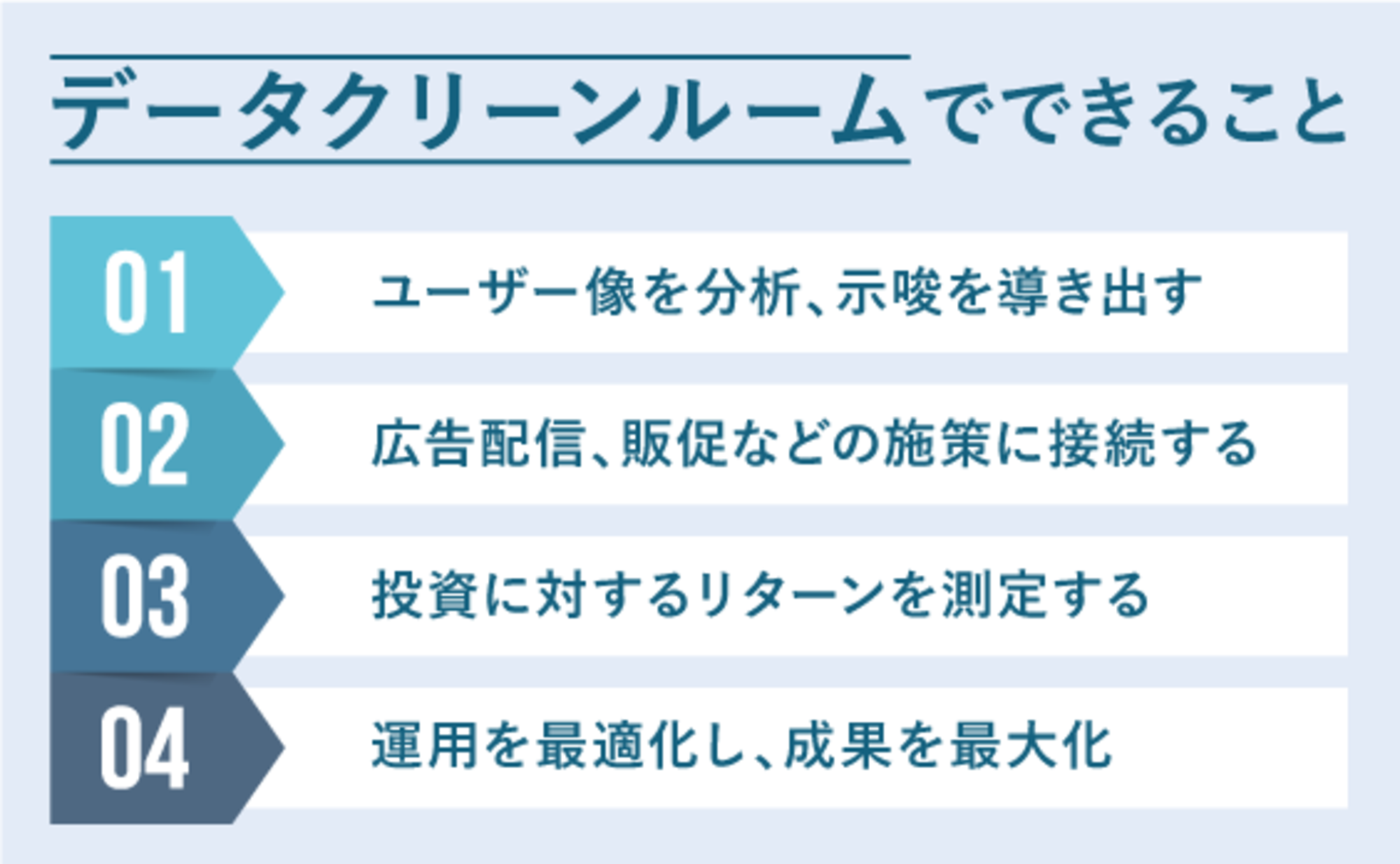

Maekawa: Typically, the DCRs provided by each platform operator operate in a privacy-protected environment where the platform has obtained user consent for matching with external data. By matching various data within this DCR, we can perform analysis that directly contributes to business results more effectively than ever before, while safeguarding user personal information.

――Were there any unique challenges specific to the MINTIA product?

Kobayashi: Mintia is primarily an offline retail product. Therefore, even when running digital ads or implementing social media campaigns, the challenge was the lack of established metrics to measure their offline impact, such as contribution to actual sales. As the proportion of digital advertising increases year by year, we needed to establish an environment where we could verify the effectiveness of campaigns through "on-off integration."

――This time, you're utilizing a significant number of DCRs across the board. What is the overall design like?

Tomoi: Without knowing how much Mintia is actually purchased in stores, we couldn't verify campaign effectiveness. So we centered our approach around "offline purchase panel data." Specifically, we linked the purchaser panel—based on the loyalty marketing common point service "Ponta"—to DCRs for each media channel. We then segmented users into types based on their purchase behavior and grouped them accordingly.

We then use this to visualize purchasing tendencies by group and verify which media influence what kind of purchasing behavior. So far, we've analyzed multiple major domestic media platforms, including Google, LINE, X (formerly Twitter), and Facebook.

――So you're conducting analysis across numerous media and numerous DCRs. Why did you choose the Ponta panel for offline purchase data?

Tomoi: The key point for this project was "how many media platforms can we analyze across?" Ponta's appeal lies in its extensive data integration across various platforms. Furthermore, Ponta has a very large membership base and is strong in data from convenience stores and other outlets, making it highly compatible with "purchasing behavior at convenience stores," one of MINTIA's most significant purchase points.

──Could you share specifically what aspects of Mintia you've been able to analyze over these past two years?

Tomoi: We grouped IDs on DCR into "easier-to-purchase segments" and "harder-to-purchase segments," including other tablet candies that could be Mintia's competitors. Then, we verified "which segment was exposed to which ad and how they purchased" for each media channel. This allowed us to select the optimal media not just based on simple purchase rates, but also by understanding "how to get our target audience to take action."

K obayashi: It's significant that we can now take a bird's-eye view of which media reached which target groups with what approach and how that contributed to sales. Based on these results, we can select media and scale both products and advertising. Furthermore, the results of our collaborations with idols and comics revealed details like which demographic came from which media and in what quantities—aspects that were invisible in traditional digital marketing.

Gaining a new metric beyond cookies. The benefits of DCR's "cross-media" and "continuity"

──Please share the outcomes and insights gained specifically from working continuously on this project for about two years.

Tomoi: We've accumulated two years of purchase analysis data broken down by "media × target group," enabling quantitative comparisons. Qualitatively, we group users by purchase behavior. For example, for a campaign featuring a male idol, we can analyze that "even among the same female demographic, targeting via this specific media channel led to higher sales." This leverages DCR's strength: translating analytical insights directly into ad delivery decisions across media.

Dentsu Digital Inc., Taishō Tomoi

Kobayashi: We've been able to uncover the reality that "customers who actually purchase are exposed to this media," based on sales data. It's a major achievement that we can now effectively approach the "volume zone of exposure" backed by data, not just experience or intuition.

We started this project in 2021. Due to MINTIA's product characteristics, a certain number of users stopped purchasing it when more people stayed home during the COVID-19 pandemic. As the pandemic gradually subsided, some users started buying again. We could then examine questions like: "Which user segments are dropping off?" and "Which media channels lead to higher repurchase rates?" The accumulation of data has made it possible to visualize this user churn and flow.

It was fascinating to observe how users changed alongside societal shifts over two years of continuous tracking. Mintia tends to run major campaigns in "spring" and "fall" each year, focusing on measuring post-campaign changes rather than meticulously tracking monthly figures. In that sense, DCR's ability to capture significant shifts at key points feels well-suited to the product.

Maekawa: Regarding continuity, I believe measuring ad effectiveness and optimizing ad delivery using third-party cookies—a standard practice in digital marketing for the past decade or so—will become increasingly difficult going forward. However, at the same time, the contact points between brands and users are increasing.

We're moving beyond an era where messages were unilaterally delivered through a single medium or channel. Building long-term relationships through dialogue between brands and users is now crucial, shifting the focus toward broad marketing investments aimed at increasing brand advocates.

In this era, I believe it's crucial to systematize and continuously accumulate a "yardstick" that evaluates various initiatives—leveraging platforms and proprietary assets—multidimensionally using the same criteria and definitions. Being able to instantly revisit past insights anytime should allow marketers to spend their time devising "initiatives that move people's hearts," even in rapidly changing market environments.

──Beyond "continuity," I believe "cross-media" is another key feature of this project.

Tomoi: The ability to measure across numerous media channels using offline purchase data as an indicator is indeed a major feature of this project. External data, like the Ponta panel, can be integrated into each DCR for analysis within a secure environment.

However, each DCR is not identical. For instance, even something like an online ad click-through rate (CTR) varies in value depending on the media. Since how ads are displayed differs across platforms, some media might see clicks from casual browsing, while others involve clicks after thorough engagement.

Therefore, this time, we created a "common metric" that allows for judgment and analysis based on the same standard by standardizing the definition of "how much contribution to sales was made relative to the advertising cost."

Maekawa: Furthermore, the purchase data from the Ponta panel alone does not represent Mintia's total sales. This means we need to "extrapolate" the overall picture based on Ponta's data.

Furthermore, if the analysis results—the "advertising effectiveness of each media channel relative to sales"—become disconnected from reality, they lose meaning. We worked with the client to build the logic for how to create metrics that could be used across all media channels while still reflecting actual conditions.

Kobayashi: In terms of cross-media analysis, we could have done simple comparisons ourselves, like "How much budget was allocated to Media A and Media B, and what were their respective impression counts?" But it's obvious that a media outlet costing ¥3 million will have different impression numbers than one costing ¥5 million. Plus, impression numbers and click-through rates are influenced by market conditions and the number of companies bidding. Just looking at those numbers alone doesn't really give you actionable insights for the next steps.

In contrast, the approach of "using purchase data as a benchmark to cross-reference all media" was something we couldn't achieve on our own. This common metric is constantly being refined and becoming more precise, and it's reassuring that the number of media we can verify is gradually increasing.

Moreover, it's challenging for a single person to handle all the updates for numerous media platforms while still executing optimal planning. The fact that TOBIRAS enables us to achieve this very quickly is truly invaluable.

Maekawa: Allow me to briefly explain TOBIRAS here. The DCRs of each media platform differ in system specifications and technical expertise. Comparing them side-by-side using the same standard is inherently difficult. Furthermore, as Mr. Kobayashi mentioned, while "defining the measurement of digital advertising effectiveness" is important for digital marketing managers, it's only a small part of their job. Amidst their many other responsibilities, "providing data quickly in a format that's easy to use for immediate marketing operations" is crucial.

Therefore, the Dentsu Group has developed and utilizes a system platform called TOBIRAS to centrally manage multiple DCRs. While DCRs offer flexible analysis across various perspectives, this very flexibility can make them challenging to utilize effectively. We identified the issue as having many "rooms" (DCRs) but lacking a "door" accessible to everyone, hence naming it TOBIRAS. It standardizes DCRs with differing mechanisms, enabling swift cross-analysis.

We aim to build a resilient framework that enables broad, continuous data marketing utilization even in the cookie-free era. In this project, we are also leveraging TOBIRAS to establish a system that delivers purchase data analysis more rapidly.

DCR contributes not only to sales but also to building a fanbase and enhancing customer experience!

Shun Maekawa, Dentsu Inc.

――What was the biggest takeaway from this initiative?

Kobayashi: Above all, it's the connection between offline purchase data and digital marketing. We can now see which digital ads users who ultimately purchased MINTIA were exposed to. Moreover, the biggest difference from before is that we can identify the media channels with the highest contribution.

Previously, we could only speculate, "This ad got so many clicks, so it must be contributing to sales." Now, since we can see it from the purchase starting point, impressions and click-through rates have become "intermediate metrics." In a way, I believe this represents a disruptive innovation in digital marketing.

Internally, we used to explain ad ROI based on impressions or click-through rates. Now that we can present purchase-based figures, we can confidently propose plans stating, "We'll allocate this budget for this plan."

Tomoi: When you visualize using offline purchase data, it's quite common to find that "Media B with lower video view rates" actually contributes more to purchases than "Media A with high click-through rates."

Maekawa: Evaluating cost-effectiveness based on "quantity" metrics like impressions or reach is certainly necessary for accountability. Beyond that, assessing the "quality" of user behavior after exposure allows us to provide multifaceted insights, like "A and B have overwhelmingly more impressions, but considering quality, C and D actually performed surprisingly better."

Kobayashi: I had assumed that kind of thinking was specific to e-commerce practitioners. In e-commerce, digital ads directly connect to purchases, and measuring conversion rates allows for evaluating ad quality. It was surprising to learn that approach works even for products like Mintia, where convenience stores are the main sales channel.

――Beyond measuring effectiveness from a purchase perspective, what other discoveries did you make?

Kobayashi: Through this initiative, I feel we've gained a much clearer understanding of our customers. Previously, we relied on personas provided by ad platforms, targeting people based on interests like travel or music. But with DCR, we can now target with much finer granularity: "People around this age, with this lifestyle, specifically interested in this..." While this can improve advertising ROI, it also means focusing on each individual user, which feels like the polar opposite of traditional advertising.

It's already prompting more granular marketing considerations, like what will delight users who initially came through collaborations with idols or comics, and how long they'll stay. We believe this can scale us to reach new customer segments that previously had no interest in MINTIA.

Maekawa: Earlier, we discussed how "building relationships between companies and users is crucial." I believe DCR can also be utilized for cases involving "long-term fan cultivation" in the digital space. With traditional cookie-based user analysis, user IDs would change every few months. However, DCR allows each platform to analyze longer-term relationships through user-approved IDs. I expect initiatives leveraging these unique features of DCR to increase going forward.

――Could you share your outlook for future projects?

Tomoi: Currently, Mintia analyzes data based on extrapolated figures from convenience store purchase data. However, many users also purchase Mintia at supermarkets and drugstores. Dentsu Digital Inc. is exploring methods to integrate these multiple commercial areas and directly utilize the attributes of actual purchasing users for targeting.

Maekawa: With advancing digitalization, product sales channels have diversified. The Dentsu Group is developing alliances and solutions to enable planning, execution, and verification of campaigns by capturing user characteristics and behaviors across multiple channels—including "corporate-owned e-commerce channels," "major online retailers," "supermarkets," "convenience stores," and "drugstores."

Kobayashi: Regarding the cookie-free era, it's not that data utilization will decrease at all. We feel confident that using high-precision data will enable us to deliver better customer experiences. In the future, I believe the days of "running uniform mass advertising and everyone buying one product" will disappear. We want to leverage DCR for initiatives that test various promotional activities targeting more finely segmented needs. I look forward to continuing to work together with Mr. Maekawa and Mr. Tomoi on this.

Maekawa: Thank you! To wrap up with a bit of promotion, the Dentsu Group has been focusing on alliances and solution development in the data clean room space since before the 2015 tag measurement restrictions. We believe we possess practical expertise in its implementation, even on a global scale.

Using DCR requires a legal understanding of handling user data. Additionally, platform operators have different terms of service, and the permissions obtained from users vary. At Dentsu Group, we have certified over 800 employees as "Certified Analysts." These individuals possess expertise in data ethics, combining statistical and machine learning data science knowledge and practical experience with perspectives on legal compliance and customer experience. If you're interested, please feel free to consult with us.

――Thank you for your time today!