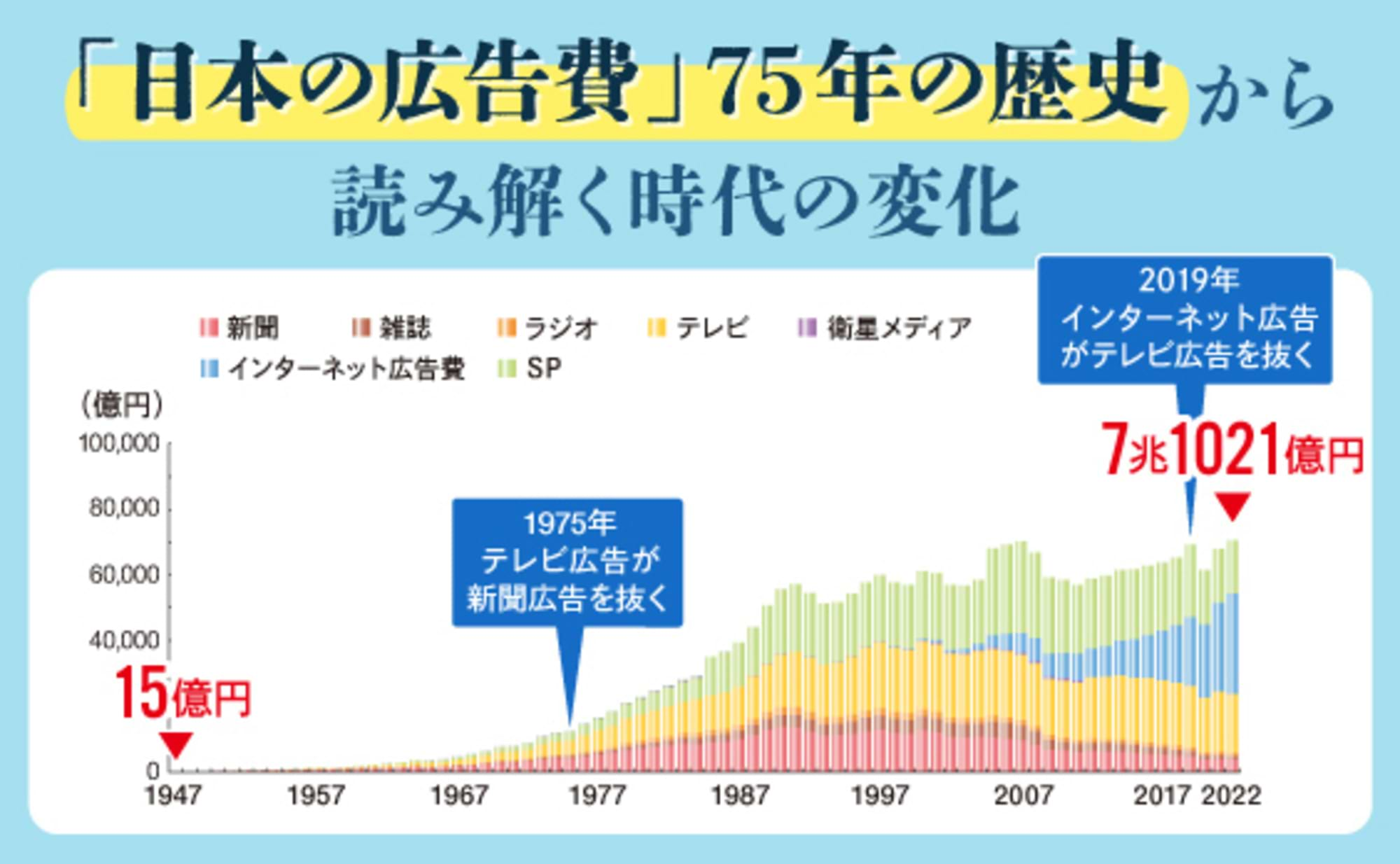

This series introduces portions of the opening feature from Dentsu Inc. Media Innovation Lab's "Information Media White Paper 2023." The previous installment, based on the feature "Japan's Advertising Expenditures: A 75-Year Retrospective," examined how postwar Japanese advertising spending has been influenced by economic and social conditions.

This article primarily focuses on internet advertising expenditure, which has achieved growth and transformation in a short period, examining trends in its advertising expenditure, shifts in its position relative to the four major media outlets, and the short-term future outlook for advertising.

In 2022, Japan's advertising expenditure reached ¥7.1021 trillion, marking the highest level since 2007 when it first surpassed ¥7 trillion. However, the breakdown by medium has changed significantly over these 15 years. In 2007, internet advertising expenditure accounted for only 8.6% of total advertising spending, but by 2022, it had grown to 43.5% ( details here ).

Internet advertising expenditure, for which estimates began in 1996, has continued to grow without ever declining. Furthermore, the estimation methodology has been revised repeatedly to align with changes in consumers' media environments and advertising market trends. While several media types have undergone revisions to their advertising expenditure estimation methods, the majority of these revisions have pertained to internet advertising. We will now detail this evolution.

Continuing Expansion of Internet Advertising Expenditures

Dentsu Inc. began publishing estimates for internet advertising spending in 1996, the year after Windows 95 debuted. The first year saw 1.6 billion yen, followed by 6 billion yen the next year (a 375% increase year-on-year), and then 11.4 billion yen the year after that (a 190% increase year-on-year), demonstrating significant growth.

In 1999, NTT DoCoMo launched i-mode, which became a major catalyst for expanding internet access from indoors to outdoor locations. Furthermore, according to the Ministry of Internal Affairs and Communications' "Information and Communications White Paper 2001," 2001 was dubbed the "Year One of Broadband." High-speed, flat-rate internet connections, primarily ADSL, began to proliferate. Internet advertising spending continued its steady growth during this period, surpassing ¥100 billion in 2003 at ¥118.3 billion, and reaching ¥181.4 billion the following year, exceeding radio advertising (¥179.5 billion).

The 2000s saw the emergence of numerous services in Japan that would later be termed social media. In blogging, "Cocolog" launched in 2003 and "Ameba Blog" in 2004. In SNS, "mixi" and "GREE" successively began service in 2004, each rapidly expanding their user base within a short period.

The concept of "Web 2.0," proposed by Tim O'Reilly in the US in 2005, made it easier for individuals to disseminate information via the internet. These developments encouraged consumers to use the internet more frequently. Simultaneously, internet advertising, unlike broadcast advertising constrained by a 24-hour limit on ad placement space, saw its advertising inventory expand significantly. By 2006, internet advertising expenditure reached ¥482.6 billion, surpassing magazine advertising (¥477.7 billion).

In 2007, the Japanese version of the video-sharing service YouTube launched. This coincided with the acceleration of high-speed internet connections, becoming a catalyst for the expansion of video consumption among consumers. In 2008, Apple's iPhone was released in Japan, accelerating the proliferation of smartphones. Also that year, Japanese versions of Facebook and Twitter began service, further accelerating the use of social media thereafter.

The so-called digital platform providers offering these services leveraged vast amounts of data to evolve ad technology (technologies and systems enhancing ad delivery efficiency), improving the precision of ad targeting. These efforts gained support from advertisers prioritizing return on investment, leading to steady growth in internet advertising spending. By 2009, it reached ¥706.9 billion, surpassing newspaper advertising (¥673.9 billion). Furthermore, in 2014, it crossed the major threshold, reaching ¥1.0519 trillion.

Advertising expenditure estimation methods adapting to diversifying advertising media

In 2007, responding to the diversification of advertising media, the estimation method was revised for the first time since 1985. First, the scope of what was previously called SP advertising expenditure was expanded to include advertising costs for free papers and free magazines, and the category was renamed promotional media advertising expenditure.

Regarding internet advertising expenditure, the estimation scope was expanded to include advertising production costs, previously limited to media fees. This change responded to increased demand for various ad formats beyond traditional banner ads, such as video ads and ads displayed on social media. Retroactively applied to the base year 2005, internet advertising production costs were estimated at ¥96.9 billion, rising to ¥119.6 billion (123.4% year-on-year) the following year.

One reason for the rapid expansion of internet advertising expenditure was the improvement in targeting technology utilizing ad technology. So-called digital platform operators widely adopted mechanisms that instantly displayed ads likely to interest visitors to a page, leveraging data such as search histories and page viewing histories they possessed.

In response to this situation, starting in 2012, we began estimating internet advertising media costs by dividing them into the following two categories based on the advertising transaction method:

- "Reservation-based advertising"

Advertisements with predetermined amounts, durations, and placement locations

- "Performance-Based Advertising"

Includes search-linked ads, ads displayed on platforms like video-sharing sites and SNS, and ads shown on ad networks. Content can be flexibly modified during the campaign period (ad unit price determined by bidding).

As ad technology evolved, programmatic advertising grew significantly from ¥339.1 billion (51.2% of total internet advertising media costs) in 2012, the first year of estimation, to ¥2.1189 trillion (85.4%) in 2022.

How have Internet advertising expenditures and advertising expenditures for the four major media outlets changed?

Amid media diversification and the growth of internet advertising spending, the increase in advertising spending across the four major mass media outlets has stalled and begun to decline. However, the peak in advertising spending for these four media outlets varies by medium.

Newspapers reached their peak first, at ¥1.3593 trillion in 1990, accounting for 24.4% of total advertising expenditure. Radio peaked next, at ¥240.6 billion in 1991, representing 4.2% of total advertising expenditure. For both newspapers and radio, their advertising expenditure peaks occurred during the so-called bubble period, before estimates for internet advertising expenditure began.

Next was television (estimated as "terrestrial TV" at the time), reaching ¥2.0793 trillion in 2000, accounting for 34.0% of total advertising expenditure. Finally, magazines reached ¥484.2 billion in 2005, accounting for 7.1% of total advertising expenditure. It is evident that television and magazine advertising expenditure showed an increasing trend even after the bubble burst, despite experiencing several declines.

It is particularly interesting that these media reached their peak before the emergence of video-sharing services, smartphones, and social media, which accelerated the growth of internet advertising. Continuing its upward trajectory, internet advertising reached ¥2.1048 trillion in 2019, surpassing television media advertising (¥1.8612 trillion, combining terrestrial TV and satellite media-related advertising) to become the top medium. Its share of total advertising expenditure reached 30.3%.

Amidst stagnating advertising spending, mass media operators are actively advancing the digitization of their content. This extends beyond the websites and apps operated by individual media companies to include platforms like TVer (launched in 2015) and radiko (which began practical trial broadcasts in 2010), where users can enjoy content from multiple broadcasters.

Responding to these trends, "Japan's Advertising Expenditures" began estimating advertising spending on internet media services primarily operated by the four major media companies in 2018. "Digital advertising spending originating from the four major media" reached ¥58.2 billion in its first year but expanded to ¥121.1 billion by 2022. Within "Digital Advertising Spending Originating from the Four Mass Media," the largest medium by value in 2022 was magazines at ¥61 billion, followed by television media at ¥35.8 billion.

Hypotheses for Advertising's Near Future: Blurring Boundaries in Digital and the Emergence of New Players

According to the " Global Advertising Expenditure Growth Forecast (2022-2025) " released by the Dentsu Group in December 2022, digital advertising expenditure accounted for 52.5% of total global advertising expenditure in 2021 (actual figures) and is projected to reach 59.5% by 2025. (See Figure 1) Domestically, factors such as the Ukraine situation, yen depreciation, and the 2024 logistics industry crisis are expected to continue driving cost increases, particularly for print-related media. These negative factors will likely impact advertising expenditure levels, with a shift toward digital media anticipated.

The television media category within the aforementioned "digital advertising spending originating from the four mass media" includes advertising on video streaming services operated by broadcasters and others. Regarding these video streaming services, viewership via connected TVs (television sets connected to the internet) continues to increase. Regarding video ads displayed on TV sets, viewers' awareness of whether they are TV media ads or internet ads is likely to become blurred. Furthermore, it is becoming increasingly difficult to discuss television as an industry based solely on the trend of TV media advertising expenditure.

Retail media is a recently prominent advertising medium. Retail media refers to advertising platforms provided by retail companies as publishers, such as various online ads on their e-commerce sites and digital signage ads installed in physical stores.

These media, positioned closer to consumers' actual purchasing locations, are expected to enhance advertising targeting precision by leveraging the data held by retail companies. Such advertising represents a broader category of marketing expenses, difficult to capture within traditional advertising or sales promotion budgets. Its scale is anticipated to grow, increasing the presence of retail companies as media providers.

As discussed, a major trend is the shift toward digital media. Digitalization is bringing changes to the framework of existing advertising media in various aspects. Furthermore, the emergence of new players, such as those in retail media, leveraging technology to transform their own assets into advertising platforms, is anticipated. This article has also touched on revisions to the estimation methods for "Japan's Advertising Expenditures." It is certain that further revisions to advertising expenditure estimation will be necessary in the future.

In today's environment, where change accelerates and methods diversify and become more complex, estimating Japan's advertising expenditure also necessitates a discussion on how to define the very advertisements being measured. As stated in the previous article, "advertising is a mirror reflecting the times." Moving forward, it is essential to continue asking "what is advertising?" while meticulously capturing the movements of the economy and society from various perspectives.