Note: This website was automatically translated, so some terms or nuances may not be completely accurate.

"Disposable listening time" is expanding! Audio media is gaining momentum through digital services.

The "Information Media White Paper 2024" (edited by Dentsu Inc. Media Innovation Lab/DENTSU SOKEN INC., published by Diamond Inc.) was released on March 1. This data book, which reveals the full scope of the information media industry, marks its 31st year of publication.

The opening feature, "The Rapidly Changing Media Environment and Consumers," explains trends in the information media market and people's behaviors across the following four articles:

- Media Usage Behavior: Swing Back and Stabilization Before and After the Pandemic, Accelerating Polarization

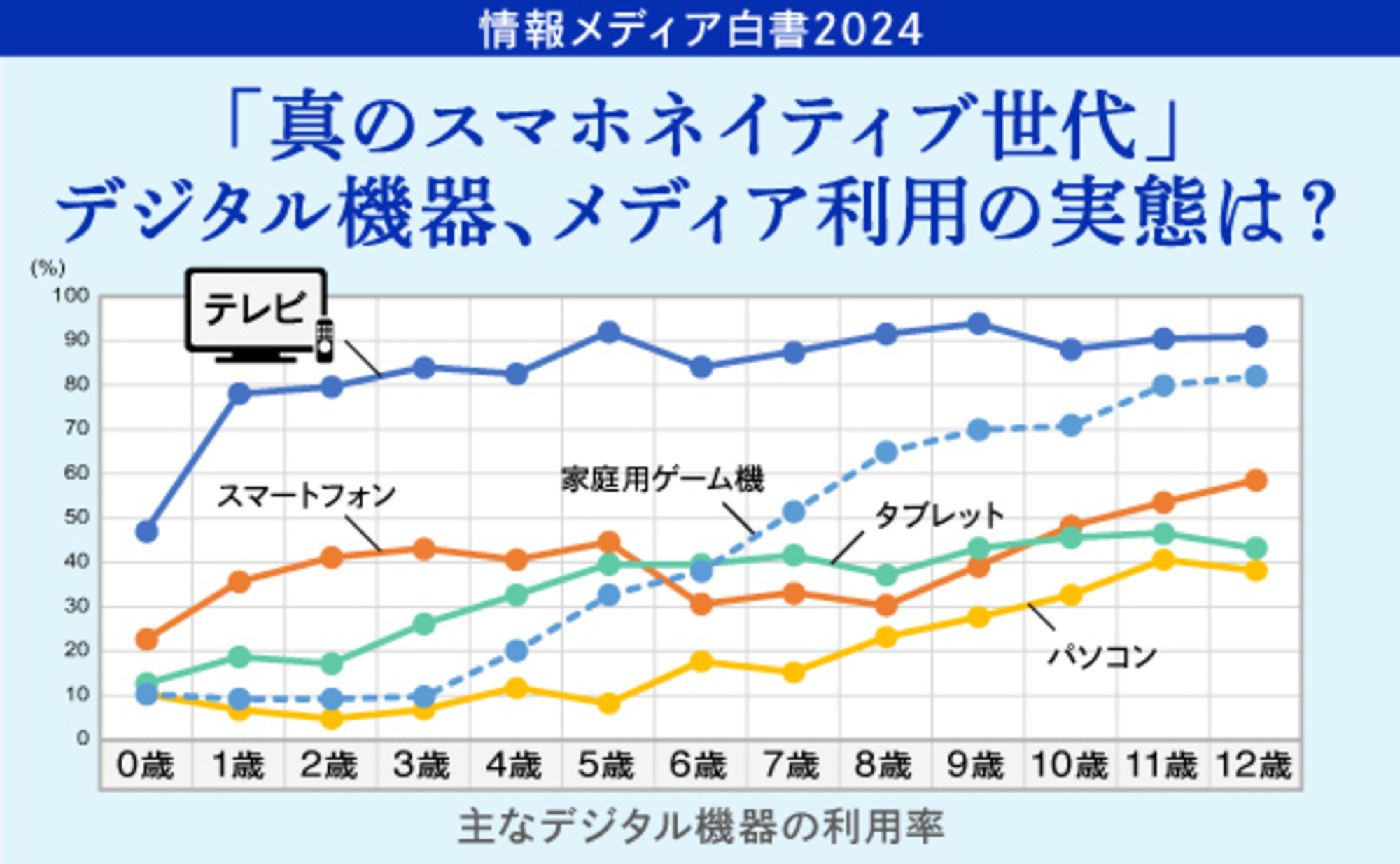

- Media Usage Among Infants, Toddlers, and Elementary School Children

- The Impact of Generative AI on the Creative Industries

- The Current State and Future Potential of Audio Media Revitalized by Digital Services

This series introduces parts of the cover story content. Part 2, based on "The Present and Future Potential of Audio Media Revitalized by Digital Services," covers trends and utilization possibilities for audio media, primarily radio.

▼Evolution of Audio Media Services and Improved Listening Environments Contribute to Increased Advertising Spending

▼ "I Don't Want My Ears to Be Idle." Actual Usage of Audio Media Across All Scenarios

▼"Entertainment You Listen To," "AI Horiemon." Expanding Content Initiatives

▼ "Sensor-Neutral" Planning to Capture "Disposable Ear Time"

Evolution of audio media services and improved listening environments contribute to increased advertising spending

According to Dentsu Inc.'s annual "Japan Advertising Expenditure" report, while total advertising expenditure across the four major media channels in 2023 was 96.6% of the previous year (¥2.3161 trillion), radio advertising expenditure increased to 100.9% of the previous year (¥113.9 billion), growing alongside magazine advertising within these channels.Radio advertising expenditure turned upward in 2021 for the first time in four years, increasing to 103.8% year-on-year (¥110.6 billion). In 2022, it grew to 102.1% year-on-year (¥112.9 billion), making it the only medium among the four major media to achieve three consecutive years of growth.

This growth in radio advertising spending is likely due to the expanding audience base for "radio broadcasts/radiko." This expansion comes as users of radiko, accessible via the internet, increase alongside traditional radio listeners. Furthermore, in 2023, radio digital advertising spending within "digital advertising spending originating from the four major media" reached ¥2.8 billion, a 127.3% increase year-on-year.While the pandemic, particularly during stay-at-home periods, saw expanded use of many content services like video streaming, it is also presumed that audio service usage grew, leading to increased related advertising spending.

Meanwhile, even before the pandemic, the environment for listening to audio media via digital services was already being established. Platforms like radiko, Spotify,Voicy, audio content from existing media like "Nikkei While You Work" and "Asahi Shimbun Arukiki," audiobooks such as Amazon's Audible, smart speakers from Amazon and Google, the proliferation of wireless earbuds and headphones, and the evolution of AI-powered voice recognition and synthesis technologies. This evolution and expansion of services related to audio media was progressing across various aspects: content, platforms, and devices.

This article examines the usage patterns of audio media—including radio/radiko, music streaming, and audio content (such as podcasts and audiobooks)—based on findings from a survey ("Audio Media Usage Survey") conducted by Dentsu Inc. in July 2023. It also introduces initiatives by various companies in the audio media sector.

For details on the survey methodology, generational classifications (including Generation Z), and service categories (like radio/radiko and music streaming), please refer to this link.

"Don't want to leave my ears idle." The reality of audio media usage across all scenarios

According to the "Audio Media Usage Survey," the MAU (Monthly Active Users*) penetration rate was 43.6% for individuals overall and for audio media as a whole. By service type, radio broadcasts/radiko had 30.6%, music streaming had 24.8%, and audio content had 7.4%.

Looking at each service, radio broadcasts/radiko show higher usage rates among older age groups, while music streaming services show higher usage rates among younger age groups. These two services can be said to have a complementary relationship (see Figure 1).

*MAU = Refers to the number of active users who used a specific service, such as social media or apps, during a given month.

Figure 2 shows usage rates for each media type by usage scenario within the home.

For audio media, usage during scenes such as waking up, getting ready, doing housework/childcare, and doing chores is higher than for video or SNS.

Additionally, usage scenarios like "during work (remote work)"—which grew significantly due to the pandemic—show the highest usage rate for audio media. This suggests audio media is integrating into various home-based daily life scenarios via smartphones and other devices, positioning itself as a medium closely aligned with consumers' routines.

Figure 3 shows the usage rates of each media type by usage scenario outside the home.

While radio/radiko has the highest usage rate during car driving, music streaming services significantly outpace other media during walking or public transportation commutes. This likely reflects usage during spare moments outside the home via smartphones.

Furthermore, these services are also frequently used during "walking or jogging" and "gym or sports" activities. This trend is likely driven by the proliferation of wireless earbuds and headphones. Notably, usage during active physical scenes suggests motivations beyond mere music enjoyment, potentially including mental benefits like mood elevation and concentration enhancement.

As the environment for audio media consumption becomes increasingly flexible,不受限于时间、地点或场景, multitasking listening—such as while doing housework, getting ready, or studying—along with listening during commutes or other spare moments, reflects a so-called "time performance" (タイパ) mindset. This indicates a desire to use time efficiently and avoid creating boring periods.

In a group interview conducted by Dentsu Inc. in August 2022 regarding media usage ( ), a working adult in their early 20s commented, "I don't want my eyes or ears to be idle." Audio media, which keeps the ears occupied, aligns well with the desire, particularly among younger audiences, to enhance life satisfaction through media engagement.

"Listening Entertainment," "AI Horiemon": Expanding Content Initiatives

Not only are opportunities to listen to audio content increasing, but the number and variety of content are also growing, with podcasts becoming particularly popular domestically.

Podcasts offer a wide range of programs covering news, music, entertainment, business and technology, education and culture, health and fitness, art and science, and hobbies.According to Masahiro Murakami, Client Partner at Spotify Japan, the number of unique podcast listeners on Spotify in 2022 was 42 times higher than in 2019, when the service was fully launched. Furthermore, as of October 2023, the number of podcast titles available to listen to on Spotify exceeded 5 million.

Meanwhile, radiko launched "radiko podcasts" in February 2024, enabling users to enjoy various audio content, suggesting momentum is building for further content expansion.

While the publishing industry faces challenges today, audiobooks like audiobook.jp and Audible are gaining significant attention.Audiobooks are valued for reasons such as being accessible even to those who struggle with text, allowing for multitasking while listening, and enhanced appeal through professional voice actors and narrators. Consequently, various new initiatives are anticipated from different companies. Content beyond traditional book categories, such as meditation and stress-reduction materials, as well as "entertainment designed to be listened to," is also expected to increase.

These align with the so-called "time-saving" trend and are likely to grow in prominence within digital audio content services.

Radio stations are also advancing new initiatives. In July 2023, five major Tokyo metropolitan radio stations launched a proof-of-concept experiment for "TRA (Targeting Radio AD)." This aims to transform radio advertising into data-driven, programmatic mass advertising by leveraging Video Research Ltd.'s proprietary data and radiko's data for radio/radiko ad sales.

This pilot verifies sales based on estimated listener numbers, moving away from traditional sales by spot count. While similar sales initiatives oriented towards programmatic advertising have been announced for TV and outdoor/transportation ads, this effort is noteworthy for being a joint pilot by five companies, aiming to enhance the value of radio as a medium.

In September 2023, Takafumi Horie assumed the role of Chairman at CROSS FM, an FM radio station in Kitakyushu City, Fukuoka Prefecture, announcing plans to expand business integrated with the internet.As part of these initiatives, plans include providing news and traffic information via "AI Horiemon" using Horie's synthesized voice, producing programs where influencers purchase portions of broadcast slots, and enabling listener participation in program creation through a membership-based online salon.

The station's initiatives, including integration with the internet and adoption of cutting-edge technology, are drawing significant attention.

"Sensor-Neutral" Planning to Capture "Disposable Ear Time"

As mentioned at the outset, the evolution of various technologies—content, platforms, devices—has driven the expansion of audio media usage. However, the pandemic undoubtedly accelerated this trend.

Remote work and learning increased opportunities to wear earphones. It became commonplace, for instance, to see people wearing earphones even during work hours, prompting others to think twice before speaking to them. This shift in consumer awareness likely contributed to more time where individuals could freely control their auditory environment.

Listening "while doing something else" and during "spare moments" has expanded "disposable ear time," and now various players are joining the battle for this disposable time.

Traditional radio broadcasting was primarily used for motivations like enjoying music or entertainment, or listening to news. Today's audio media, however, is incorporating motivations and purposes that were less common in traditional radio listening, such as wanting to improve oneself or enjoy "self-BGM" (to concentrate, boost mood, etc.).

Furthermore, even when consuming video content, it's not uncommon for users to actually enjoy only the music or audio. Considering this situation, when delivering content or advertising, especially to younger audiences, it's crucial to move beyond simple media characteristics. Instead, planning should be "sensory-neutral" – thoroughly understanding the purpose, the specific usage scenario where the touchpoint occurs, and the level of attention captured by both sight and sound at that moment.

Audio media, which can align with consumers' daily routines, holds potential for further growth by incorporating diverse purposes and usage scenarios.

■ Details on the "Information Media White Paper 2024" can be found here.

【Survey Overview】

Survey Name: "Voice Media Usage Survey"

Survey Period: Conducted in July 2023

Survey Method: Internet survey

Sample Size: 6,664 nationwide

Conducted by: Dentsu Inc. Media Services / Radio,TV Division / Video Research Ltd.

*Regarding Generation Definitions

15-25 years old (male/female) = Generation Z

Men and women aged 26-39 = Millennials

Ages 40-54 (both genders) = Prime Working Age Generation

Aged 55-69 (both genders) = Pre-Retirement Generation

※Service Definitions

Radio/radiko

Radio broadcasts, radiko, and other radio streaming services (including "Radiru★Radiru") are covered

Music Streaming

Spotify, Amazon Music, Apple Music, YouTube Music, LINE MUSIC

Other music streaming services are included

Audio content

Audio distribution platforms (Voicy, Spoon, etc.)

Audio content distribution (Radio talk, Himalaya, etc.)

Podcasts (Apple, Spotify, Google, etc.)

Audiobooks and other audio content services are included

Television

Terrestrial broadcasts, BS broadcasts, CS broadcasts

Video Content Services

YouTube, Netflix, TVer, etc.

SNS

X (formerly Twitter), Facebook, Instagram, etc.

Was this article helpful?

Newsletter registration is here

We select and publish important news every day

For inquiries about this article

Author

Hasegawa So

Dentsu Inc.

Dentsu Inc. Media Innovation Lab

Director of Media Innovation Research

After working on the development and operation of information media services at a domestic telecommunications carrier, joined Dentsu Inc. Primarily handled media planning and digital marketing before assuming current position. Interested in information behavior, media business, advertising media development, and local media. Master of Interdisciplinary Information Studies. Marketing Meister, Japan Marketing Association.

Series Information Media White Paper 2023: What You Need to Know Now—The Past, Present, and Future of Media and Society

Information Media White Paper 2023: What You Need to Know Now—The Past, Present, and Future of Media and Society Information Media White Paper 2024: The Rapidly Changing Media Environment and Consumers

Information Media White Paper 2024: The Rapidly Changing Media Environment and Consumers 100 years since its birth. Radio, today...

100 years since its birth. Radio, today... Information Media White Paper 2025: New Horizons in Communication Shaping the Future

Information Media White Paper 2025: New Horizons in Communication Shaping the Future

dentsu Media Innovation Lab

Dentsu Inc.

Launched in October 2017, leveraging Dentsu Inc.'s longstanding media and audience research expertise. Conducts research and disseminates insights to capture shifts in people's diverse information behaviors and understand the broader media landscape. Provides proposals and consulting on the communication approaches companies need within this context.

Series Insight Memo

Insight Memo Special Discussion: "Japan's Advertising Expenditures"

Special Discussion: "Japan's Advertising Expenditures" Explore the Amazing World of YouTube Creators with UUUM

Explore the Amazing World of YouTube Creators with UUUM Information Media White Paper 2024: The Rapidly Changing Media Environment and Consumers

Information Media White Paper 2024: The Rapidly Changing Media Environment and Consumers Life Stage Matters More Than Age!? Analyzing Women's Media Behavior in the Age of Diversity

Life Stage Matters More Than Age!? Analyzing Women's Media Behavior in the Age of Diversity 100 years since its birth. Radio, today...

100 years since its birth. Radio, today... College Students and the Future of Media, Communication, and Advertising in Ten Years

College Students and the Future of Media, Communication, and Advertising in Ten Years Information Media White Paper 2025: New Horizons in Communication Shaping the Future

Information Media White Paper 2025: New Horizons in Communication Shaping the FutureAlso read

▼Evolution of Audio Media Services and Improved Listening Environments Contribute to Increased Advertising Spending

▼ "I Don't Want My Ears to Be Idle." Actual Usage of Audio Media Across All Scenarios

▼"Entertainment You Listen To," "AI Horiemon." Expanding Content Initiatives

▼ "Sensor-Neutral" Planning to Capture "Disposable Ear Time"

Evolution of audio media services and improved listening environments contribute to increased advertising spending

According to Dentsu Inc.'s annual "Japan Advertising Expenditure" report, while total advertising expenditure across the four major media channels in 2023 was 96.6% of the previous year (¥2.3161 trillion), radio advertising expenditure increased to 100.9% of the previous year (¥113.9 billion), growing alongside magazine advertising within these channels.Radio advertising expenditure turned upward in 2021 for the first time in four years, increasing to 103.8% year-on-year (¥110.6 billion). In 2022, it grew to 102.1% year-on-year (¥112.9 billion), making it the only medium among the four major media to achieve three consecutive years of growth.

This growth in radio advertising spending is likely due to the expanding audience base for "radio broadcasts/radiko." This expansion comes as users of radiko, accessible via the internet, increase alongside traditional radio listeners. Furthermore, in 2023, radio digital advertising spending within "digital advertising spending originating from the four major media" reached ¥2.8 billion, a 127.3% increase year-on-year.While the pandemic, particularly during stay-at-home periods, saw expanded use of many content services like video streaming, it is also presumed that audio service usage grew, leading to increased related advertising spending.

Meanwhile, even before the pandemic, the environment for listening to audio media via digital services was already being established. Platforms like radiko, Spotify,Voicy, audio content from existing media like "Nikkei While You Work" and "Asahi Shimbun Arukiki," audiobooks such as Amazon's Audible, smart speakers from Amazon and Google, the proliferation of wireless earbuds and headphones, and the evolution of AI-powered voice recognition and synthesis technologies. This evolution and expansion of services related to audio media was progressing across various aspects: content, platforms, and devices.

This article examines the usage patterns of audio media—including radio/radiko, music streaming, and audio content (such as podcasts and audiobooks)—based on findings from a survey ("Audio Media Usage Survey") conducted by Dentsu Inc. in July 2023. It also introduces initiatives by various companies in the audio media sector.

For details on the survey methodology, generational classifications (including Generation Z), and service categories (like radio/radiko and music streaming), please refer to this link.

"Don't want to leave my ears idle." The reality of audio media usage across all scenarios

According to the "Audio Media Usage Survey," the MAU (Monthly Active Users*) penetration rate was 43.6% for individuals overall and for audio media as a whole. By service type, radio broadcasts/radiko had 30.6%, music streaming had 24.8%, and audio content had 7.4%.

Looking at each service, radio broadcasts/radiko show higher usage rates among older age groups, while music streaming services show higher usage rates among younger age groups. These two services can be said to have a complementary relationship (see Figure 1).

*MAU = Refers to the number of active users who used a specific service, such as social media or apps, during a given month.

Figure 2 shows usage rates for each media type by usage scenario within the home.

For audio media, usage during scenes such as waking up, getting ready, doing housework/childcare, and doing chores is higher than for video or SNS.

Additionally, usage scenarios like "during work (remote work)"—which grew significantly due to the pandemic—show the highest usage rate for audio media. This suggests audio media is integrating into various home-based daily life scenarios via smartphones and other devices, positioning itself as a medium closely aligned with consumers' routines.

Figure 3 shows the usage rates of each media type by usage scenario outside the home.

While radio/radiko has the highest usage rate during car driving, music streaming services significantly outpace other media during walking or public transportation commutes. This likely reflects usage during spare moments outside the home via smartphones.

Furthermore, these services are also frequently used during "walking or jogging" and "gym or sports" activities. This trend is likely driven by the proliferation of wireless earbuds and headphones. Notably, usage during active physical scenes suggests motivations beyond mere music enjoyment, potentially including mental benefits like mood elevation and concentration enhancement.

As the environment for audio media consumption becomes increasingly flexible,不受限于时间、地点或场景, multitasking listening—such as while doing housework, getting ready, or studying—along with listening during commutes or other spare moments, reflects a so-called "time performance" (タイパ) mindset. This indicates a desire to use time efficiently and avoid creating boring periods.

In a group interview conducted by Dentsu Inc. in August 2022 regarding media usage ( ), a working adult in their early 20s commented, "I don't want my eyes or ears to be idle." Audio media, which keeps the ears occupied, aligns well with the desire, particularly among younger audiences, to enhance life satisfaction through media engagement.

"Listening Entertainment," "AI Horiemon": Expanding Content Initiatives

Not only are opportunities to listen to audio content increasing, but the number and variety of content are also growing, with podcasts becoming particularly popular domestically.

Podcasts offer a wide range of programs covering news, music, entertainment, business and technology, education and culture, health and fitness, art and science, and hobbies.According to Masahiro Murakami, Client Partner at Spotify Japan, the number of unique podcast listeners on Spotify in 2022 was 42 times higher than in 2019, when the service was fully launched. Furthermore, as of October 2023, the number of podcast titles available to listen to on Spotify exceeded 5 million.

Meanwhile, radiko launched "radiko podcasts" in February 2024, enabling users to enjoy various audio content, suggesting momentum is building for further content expansion.

While the publishing industry faces challenges today, audiobooks like audiobook.jp and Audible are gaining significant attention.Audiobooks are valued for reasons such as being accessible even to those who struggle with text, allowing for multitasking while listening, and enhanced appeal through professional voice actors and narrators. Consequently, various new initiatives are anticipated from different companies. Content beyond traditional book categories, such as meditation and stress-reduction materials, as well as "entertainment designed to be listened to," is also expected to increase.

These align with the so-called "time-saving" trend and are likely to grow in prominence within digital audio content services.

Radio stations are also advancing new initiatives. In July 2023, five major Tokyo metropolitan radio stations launched a proof-of-concept experiment for "TRA (Targeting Radio AD)." This aims to transform radio advertising into data-driven, programmatic mass advertising by leveraging Video Research Ltd.'s proprietary data and radiko's data for radio/radiko ad sales.

This pilot verifies sales based on estimated listener numbers, moving away from traditional sales by spot count. While similar sales initiatives oriented towards programmatic advertising have been announced for TV and outdoor/transportation ads, this effort is noteworthy for being a joint pilot by five companies, aiming to enhance the value of radio as a medium.

In September 2023, Takafumi Horie assumed the role of Chairman at CROSS FM, an FM radio station in Kitakyushu City, Fukuoka Prefecture, announcing plans to expand business integrated with the internet.As part of these initiatives, plans include providing news and traffic information via "AI Horiemon" using Horie's synthesized voice, producing programs where influencers purchase portions of broadcast slots, and enabling listener participation in program creation through a membership-based online salon.

The station's initiatives, including integration with the internet and adoption of cutting-edge technology, are drawing significant attention.

"Sensor-Neutral" Planning to Capture "Disposable Ear Time"

As mentioned at the outset, the evolution of various technologies—content, platforms, devices—has driven the expansion of audio media usage. However, the pandemic undoubtedly accelerated this trend.

Remote work and learning increased opportunities to wear earphones. It became commonplace, for instance, to see people wearing earphones even during work hours, prompting others to think twice before speaking to them. This shift in consumer awareness likely contributed to more time where individuals could freely control their auditory environment.

Listening "while doing something else" and during "spare moments" has expanded "disposable ear time," and now various players are joining the battle for this disposable time.

Traditional radio broadcasting was primarily used for motivations like enjoying music or entertainment, or listening to news. Today's audio media, however, is incorporating motivations and purposes that were less common in traditional radio listening, such as wanting to improve oneself or enjoy "self-BGM" (to concentrate, boost mood, etc.).

Furthermore, even when consuming video content, it's not uncommon for users to actually enjoy only the music or audio. Considering this situation, when delivering content or advertising, especially to younger audiences, it's crucial to move beyond simple media characteristics. Instead, planning should be "sensory-neutral" – thoroughly understanding the purpose, the specific usage scenario where the touchpoint occurs, and the level of attention captured by both sight and sound at that moment.

Audio media, which can align with consumers' daily routines, holds potential for further growth by incorporating diverse purposes and usage scenarios.

■ Details on the "Information Media White Paper 2024" can be found here.

【Survey Overview】

Survey Name: "Voice Media Usage Survey"

Survey Period: Conducted in July 2023

Survey Method: Internet survey

Sample Size: 6,664 nationwide

Conducted by: Dentsu Inc. Media Services / Radio,TV Division / Video Research Ltd.

*Regarding Generation Definitions

15-25 years old (male/female) = Generation Z

Men and women aged 26-39 = Millennials

Ages 40-54 (both genders) = Prime Working Age Generation

Aged 55-69 (both genders) = Pre-Retirement Generation

※Service Definitions

Radio/radiko

Radio broadcasts, radiko, and other radio streaming services (including "Radiru★Radiru") are covered

Music Streaming

Spotify, Amazon Music, Apple Music, YouTube Music, LINE MUSIC

Other music streaming services are included

Audio content

Audio distribution platforms (Voicy, Spoon, etc.)

Audio content distribution (Radio talk, Himalaya, etc.)

Podcasts (Apple, Spotify, Google, etc.)

Audiobooks and other audio content services are included

Television

Terrestrial broadcasts, BS broadcasts, CS broadcasts

Video Content Services

YouTube, Netflix, TVer, etc.

SNS

X (formerly Twitter), Facebook, Instagram, etc.

Was this article helpful?

Newsletter registration is here

We select and publish important news every day

For inquiries about this article

Author

Hasegawa So

Dentsu Inc.

Dentsu Inc. Media Innovation Lab

Director of Media Innovation Research

After working on the development and operation of information media services at a domestic telecommunications carrier, joined Dentsu Inc. Primarily handled media planning and digital marketing before assuming current position. Interested in information behavior, media business, advertising media development, and local media. Master of Interdisciplinary Information Studies. Marketing Meister, Japan Marketing Association.

dentsu Media Innovation Lab

Dentsu Inc.

Launched in October 2017, leveraging Dentsu Inc.'s longstanding media and audience research expertise. Conducts research and disseminates insights to capture shifts in people's diverse information behaviors and understand the broader media landscape. Provides proposals and consulting on the communication approaches companies need within this context.