In the previous article of this series, we introduced the actual state of 'health tech utilization' in Japan based on the results of the large-scale annual survey 'Wellness 10,000 Survey' conducted by the Dentsu Inc. Healthcare Team ( survey overview here ). We reported on the current situation where the intention to use products and services utilizing health tech is gradually increasing.

Dentsu Inc. also conducts a large-scale survey in China (covering the same key items as Japan's "Well-E 10,000-Person Survey") The results reveal that utilization of similar products and services is significantly more advanced in China than in Japan. We examine the reasons for this, comparing the Chinese survey results ( survey overview here ) with actual case studies.

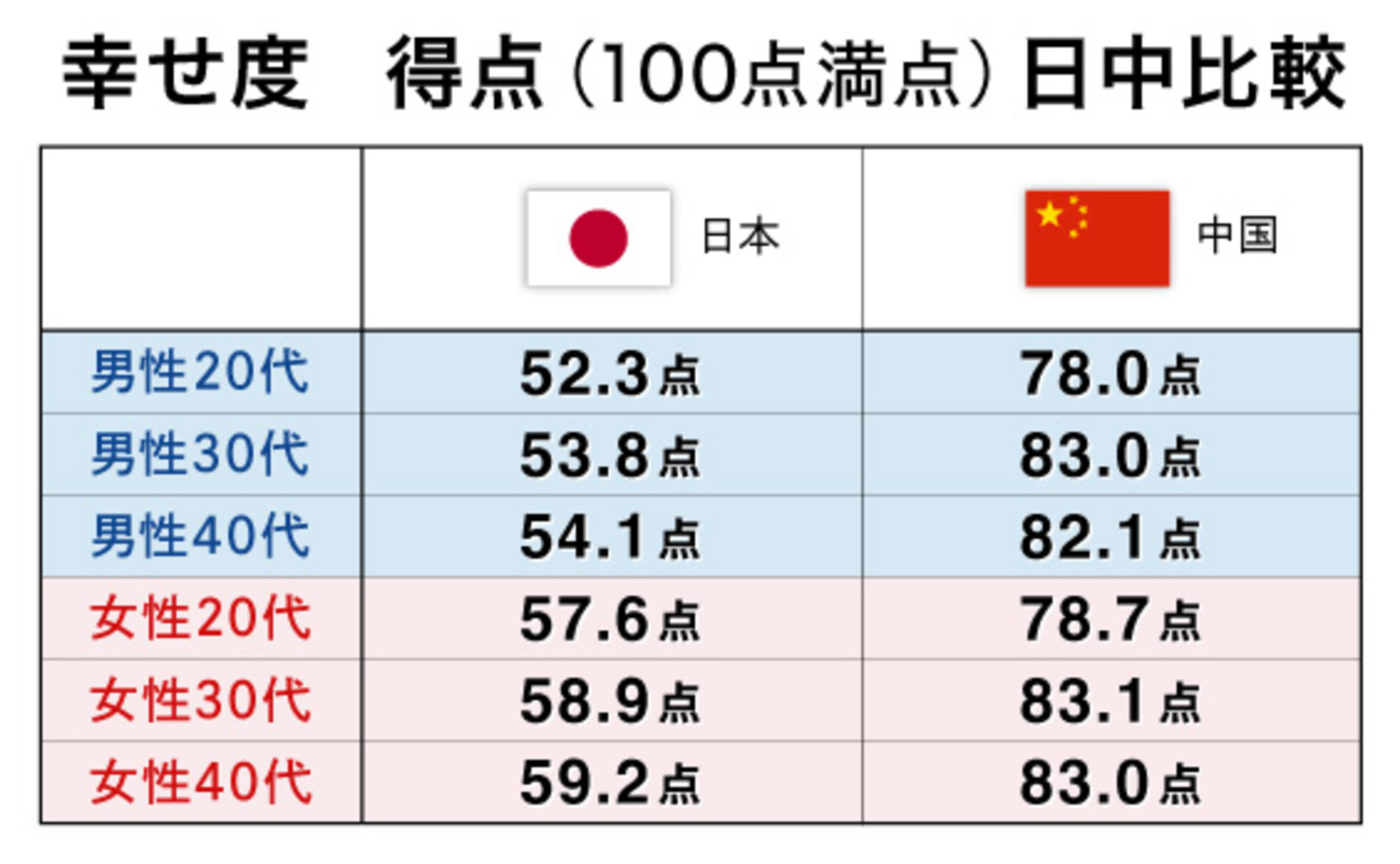

*Note: As the Chinese survey participants were limited to those in their 20s to 40s, this article presents results from Japan's "Wellness 10,000 Survey" focusing solely on the same age group.

Smartwatch usage rate: 10% in Japan, over 60% in China!

First, let's look at the actual usage rates of specific services in the health tech sector for health promotion, conditioning, and prevention.

The current usage rate for "wristwatch-type devices," which offer comprehensive basic health management and are likely valued for their fashion appeal, stands at 11.0% in Japan and 62.1% in China, revealing a significant gap. Furthermore, the current usage rate for "services providing comprehensive, personalized diet guidance via apps or web platforms" is 45.4% in China and 4.3% in Japan.

Even though awareness and interest in utilizing health tech have increased in Japan, the number of current users is still considerably lower compared to China. We examine the reasons for this, using examples of popular apps in China.

Over 4,000 Lesson Menus! App-Born Influencers Emerge! Why "Keep" is Popular

According to the 2023 China Wellness Survey, the most widely used app was "Keep." Launched in 2014, Keep is China's largest online fitness app. According to Keep's IR information, its average MAU (Monthly Active Users) for 2023 was approximately 29.76 million.

When the company was founded, Keep's main users were college students. University life in China differs from Japan; it's common for students to live in dormitories on campus. Many universities are located in remote areas, so even if students wanted to start weight training or exercise, there were few gyms within walking distance, and the costs were high. This made Keep, which allows for easy "home workouts," increasingly popular.

Later, it also gained popularity among working adults who lacked time to visit gyms amid busy schedules. One of the authors, Jiang, started using it as a university student and continues to use it today.

Since 2020, the pandemic's strict movement restrictions further boosted demand for home workouts. The app has become established across generations, from young people to the elderly. The company has recently expanded its business into diverse areas, including offline gym operations and its own sportswear brand. Keep has evolved into an integrated platform present in every aspect of healthy living, becoming synonymous with "healthy lifestyle."

As an app that has seen continuous user growth over a decade, I believe its popularity stems from two key factors.

First is its extensive curriculum and personalized customer experience. After downloading the app, users input basic information and goals. Based on this, the app not only suggests recommended plans but also uniquely assesses their current fitness level through specific questions.

For example: "How many push-ups can you do?" or "Have you ever gotten winded climbing the stairs to the 5th floor of your apartment building?" This allows the app to create a sustainable curriculum tailored to the user's current lifestyle.

The app's extensive curriculum is another key feature. It offers over 60 categories, ranging from strength training, running, and cycling to ball sports, dance, and even skiing. Furthermore, it provides 4,225 situation-specific lesson menus, including series tailored for women during menstruation or postpartum, and location-based series like those for student dorms or offices. Its appeal lies in enabling anyone to enjoy exercise anytime, anywhere, within limited time or space, while aligning with each individual's physical condition and needs.

Keep's Extensive Curriculum

The second feature is the "Community" social networking function. Users can freely post in the "Community," sharing not only training and sports know-how but also their exercise history. Other users can respond with "likes" or comments. Within the "Community," numerous smaller communities exist. Users can share exercise records with friends and fellow fitness enthusiasts, mutually encouraging each other and providing motivation to keep training.

Users who post photos showcasing their toned physiques alongside positive messages after intense workouts gain attention, leading to the rise of many famous influencers. For example, "Yu Jie Jie," who has over 2.6 million followers on Keep, initially gained followers by posting photos of her abdominal muscle transformation. After quitting her job of seven years, she became an exclusive Keep influencer. Furthermore, she acquired knowledge in yoga and nutrition, and her original lessons created on Keep have also gained popularity.

Keep also hosts numerous events within its "Community." These include collaborative lessons with celebrities both domestic and international, online sports competitions utilizing popular IP content, and collaborations with other industries, all contributing to an increase in active users. Moreover, users participating in events like online sports competitions can earn physical medals with original designs. Posting photos of collected medals increases "likes," boosting motivation and helping shape new lifestyles.

Health Tech Contributing to Market Expansion

The healthcare market has expanded significantly through advancements in prevention, health management, and medical/nursing care technologies. The evolution of digital technologies like smartphones and wearables, along with AI utilization, is influencing people's health awareness and behaviors, further driving the healthcare market's growth.

This article focuses on health tech, clarifying differences in usage between Japan and China, and analyzes why China's top healthcare app gained popularity. As living environments and health awareness change, and health tech usage rates rise in Japan too, we hope this provides some insight.

Of course, health tech represents just one perspective on health awareness and behavior in Japan and China. Our healthcare team conducts comprehensive, multi-faceted, and longitudinal analyses of consumer healthcare awareness and behavioral insights, based on the results of our annual large-scale surveys. We hope that insights gained from this survey will help Japanese companies developing healthcare businesses, Japanese companies expanding services into the Chinese market, or vice versa, to understand the healthcare market from the consumer perspective and support their business development.

[Survey Overview]

〈Japan〉

Survey Name: 17th Annual "Wellness 10,000-Person Survey"

Survey Period: June 2023

Survey Method: Internet survey

Survey Population: Men and women aged 20 to 60 nationwide (10,000 samples)

Survey Company: Dentsu Macromill Insight, Inc.

*Since the China survey only included respondents aged 20 to 40, this article also presents results from Japan's "Wellness 10,000 Survey" exclusively for the 20-40 age group.

〈China〉

Survey Name: 2023 China "Wellness Survey"

Survey Period: November 2023

Survey Method: Online survey

Survey Population: Men and women aged 20-49 in China's Tier 1 and Tier 2 cities (5,150 samples)