Dentsu Inc. Desire Design (DDD) is an organization that develops various solutions and disseminates information based on the relationship between consumption and desire.

Starting now, we will analyze the "Heart-Moving Consumption Survey" conducted by DDD in May 2025. We will share insights and findings derived from the survey results.

In this first installment, Manabu Tachiki of DDD introduces the attitudes toward money among today's consumers, revealed by focusing on the phenomenon of "high prices" that has been straining household budgets lately.

Food-Related Price Hikes Strain Households

How long will this inflation, which is straining household budgets, continue?

If real wages were rising despite higher prices, the burden on households would remain unchanged. However, real wages have actually been declining (as of May 2025). Consequently, price increases for daily necessities like food are directly impacting household budgets.

Indeed, in 2025, over 6,000 food items saw price hikes: 2,121 processed foods, 1,834 alcoholic beverages and drinks, and 1,227 bread products. You've probably noticed how much more expensive vegetables have become...

Recently, both vegetable and gasoline prices have dropped from their peaks, yet they still feel expensive. Rice, the staple food for Japanese people, also saw a significant price hike, leading to a situation dubbed the "Reiwa Rice Riots." The government released old rice from its disaster reserves into the market, and the sight of long lines forming at stores is still fresh in people's memories.

Three out of four consumers feel countermeasures against rising prices are necessary

Amid this persistent inflation, what is the current mindset of consumers?

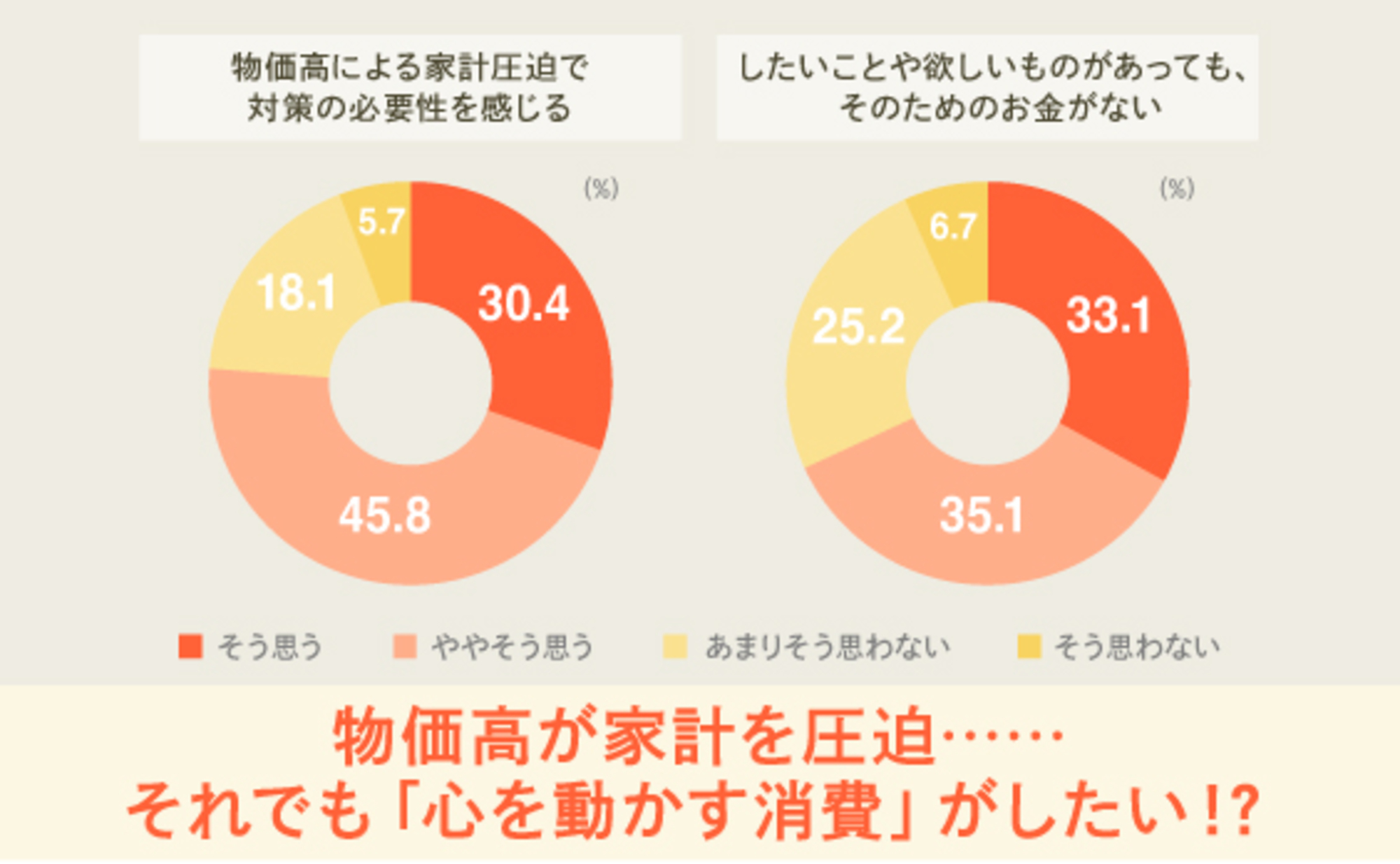

When prices remain high while wages and income growth are sluggish, households must take some form of countermeasure. As shown in Figure 1, DDD's analysis found that 76.2% of respondents overall feel countermeasures are necessary (combining "strongly agree" and "somewhat agree").

While the survey did not ask about specific countermeasures, media reports suggest a wide range of approaches. These include buying used items instead of new ones, opting for sharing services over ownership, attempting to grow assets through aggressive investments, and canceling subscription services or insurance policies.

Furthermore, examining the detailed breakdown by gender and age group in Figure 2 reveals that women generally feel a stronger need to take countermeasures. Notably, women in their 50s show a high score of 87.5% for "Agree (Total)". In contrast, the lowest scores are among men in their 10s and 20s, at 65.6% and 65.0% respectively.

Reasons for these results include the fact that women in their 50s often purchase groceries for family meals and are in a position to manage household finances. Furthermore, interpreting this score through the DDD desire-based framework suggests that younger men tend to prioritize hedonistic feelings, leading to a stronger sense of optimism compared to other segments.

While the high scores among women in their 50s were noted earlier, the fluctuating scores among those in their 60s and 70s are also noteworthy. For instance, scores may decline among those in their 60s as pension income provides greater financial breathing room. Conversely, scores may rise again among those in their 70s as they realistically anticipate the "100-year life era" and recognize the need to manage household finances sustainably even on a pension.

Only about 30% feel it's acceptable to spend money on things they want or desire

Next, let's examine this from another perspective. Figure 3 shows responses to the question: "Do you feel you lack the money to do or buy things you want or desire?"

This trend closely mirrors Figure 1, with 68.2% of all respondents agreeing ("Agree (Total)"). This is a high figure, representing roughly 70%. It clearly indicates that many individuals and households struggle to find financial leeway in this era of high prices. Even if they have desires or wants, enjoying them becomes difficult if the cost is high.

With real wages stagnant, people may suppress their desires. For example, someone might want to pursue a hobby like playing an instrument, but due to the cost of the instrument and lessons, they might think, "Maybe I'll wait a little longer..." and hold back.

When examining responses by gender and age, the score for teenage girls was particularly noteworthy. The combined score for "Agree" and "Somewhat agree" reached 83.5%. The surveyed age group of 15-19 years old corresponds to junior high school third year to university second year. It's easy to imagine many in this group wanting to buy merchandise for their favorite idol or group ("oshi") but being unable to afford it.

Consumers seeking "heart-moving experiences" despite rising prices

As seen so far, while household finances are squeezed by rising prices, even when people have things they want to do or buy, the uncertain future due to socioeconomic impacts makes it difficult to act.

However, this survey also yielded an intriguing analysis. Examining the "consumption experiences that provided a good mood or feeling" tracked by DDD over the most recent month, we find that scores have shown little fluctuation since the November 2023 survey (Figure 5).

Even when examining scores ranging from "had many" to "had many to maybe had some," the fluctuations over the past year and a half are so minimal they could be considered within the margin of error.

This indicates that regardless of inflation, many consumers desire or are actively seeking meaningful consumption experiences that resonate emotionally. To understand how to engage these consumers, we draw insights from DDD's proposed "11 Fundamental Desires" (Figure 6) and the "Desire-Action Model" (Figure 7) built upon them.

The concept assumes consumers possess all 11 desires, though the "intensity" of these desires varies from person to person. To design experiences that truly move consumers, it's crucial to understand which of these 11 desires, when stimulated, most readily leads to action.

Figure 7 illustrates the mechanism by which "desires" take shape. This occurs through the interaction between a variable called the "Value Foundation"—representing an individual's unique traits—and their fundamental desires. "Fundamental desires" interact with each person's unique traits—shaped by their personality, the era they lived in, and the values cultivated throughout their life—causing some inclinations to strengthen while others weaken. It is believed that the 11 desires are generated through such interactions, including combinations with other inclinations. ( For details, see here )

In other words, as shown in the 11 basic desires in Figure 6 and the desire-action model in Figure 7, it becomes crucial to examine which desire a phenomenon or specific consumption behavior—such as a hit product in the market—might relate to.

Of course, the desires that serve as hooks vary case by case depending on the industry, product, and consumer type. By also considering desires specific to each type, it becomes possible to develop desire-based marketing and communication strategies that incorporate the elements of this era of rising prices.

With household finances facing headwinds, businesses and society are being challenged to deliver product experiences that truly resonate with consumers.

[Survey Overview]

<10th "Heart-Moving Consumption Survey" Overview>

・Target Area: Nationwide, Japan

・Subject Criteria: Men and women aged 15–74

・Sample Size: Total 3,000 samples (allocated according to population ratio across 7 age groups: 15-19, 20s-60s, 70-74, and 2 gender categories)

・Survey Method: Internet survey

・Survey Period: Tuesday, May 13, 2025 – Friday, May 16, 2025

・Survey Sponsor: Dentsu Inc. DENTSU DESIRE DESIGN

・Survey Agency: Dentsu Macromill Insight, Inc.