Amid the raging third wave of the novel coronavirus, Dentsu Inc. Cashless Project conducted a "Survey on Cashless Awareness During the Pandemic" in December 2020.

With lifestyles significantly altered by COVID-19, how have consumers' payment methods changed, and what payment methods will become mainstream going forward? Here, we present three key cashless insights revealed by the survey results.

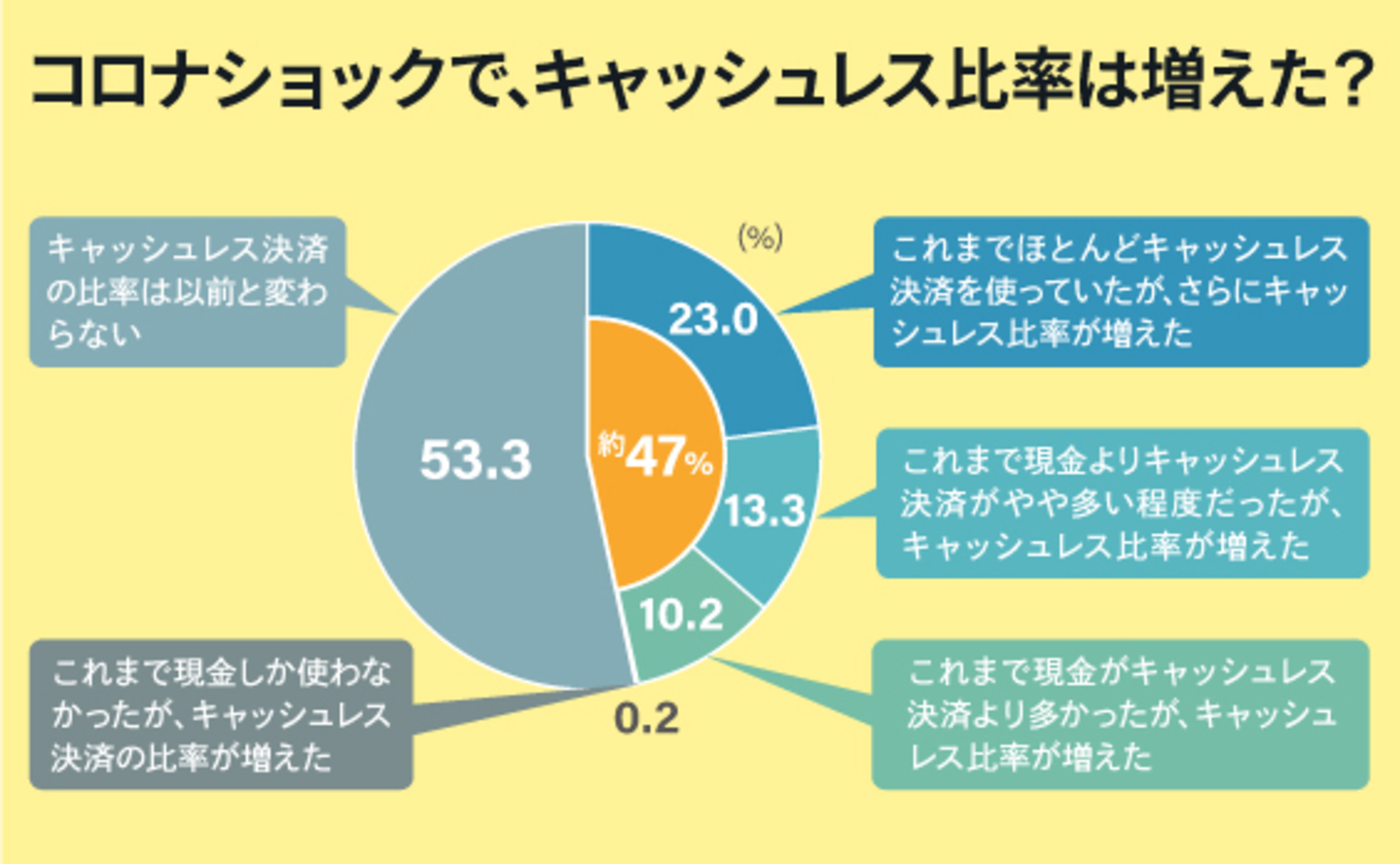

Nearly Half Report "Increased Cashless Payments"

Since the state of emergency was declared in March 2020, 47.7% of consumers reported an "increase in the proportion of cashless payments for purchases and transactions." This represents a slight increase from the previous survey (May 2020) at 46.7%. As the impact of COVID-19 persists, consumers' shift towards cashless payments continues.

SA=Single Answer

Cashless Insight ①

Use increased at "supermarkets," "convenience stores," and "drugstores"

So, where did cashless payments increase during the pandemic? When asked where payment frequency increased,

Supermarkets & Shopping Malls 40.0%

Convenience stores 38.4%

Drugstores 30.0%

These three locations ranked highest.

This shows that cashless payments are increasing at familiar locations along daily life routes.

MA=Multiple answers

Cashless Insight ②

There is a gap in the use of "electronic money" and "mobile payments" between places where usage has increased and places where it has not.

When asked about payment methods used in "locations where cashless payments increased," differences emerge depending on the location.

At "supermarkets/shopping malls," the top location showing growth, "cards" (58.3%) are most commonly used, surpassing "cash" (55.7%). At "convenience stores," while "cash" (47.1%) remains the most common, "electronic money" (37.3%) and "mobile payments" (37.1%) are now more prevalent than "cards" (27.3%).

Furthermore, when comparing payment methods between locations where cashless payments increased and those where they did not, significant gaps were observed, particularly in the use of "e-money" and "mobile payments."

For example, at "drugstores" where cashless payments increased, "electronic money" and "mobile payments" accounted for 21.6% and 27.6% respectively, whereas at "taxis/hire cars" where they did not increase much, they were only 5.3% and 5.1%.

This suggests that one factor driving the increase in cashless payments is the availability of "electronic money" and "mobile payments," which are currently spreading rapidly.

Cashless Insight ③

Progress in Cashless Small-Amount Payments

When asked about the amount range where cashless payments increased, the highest increase was in the "over ¥1,000 to ¥5,000 or less" range (48.0%), "over ¥500 to ¥1,000 or less" (41.0%), and "over ¥300 to ¥500 or less" (25.8%). This indicates progress in cashless adoption for small transactions under ¥1,000.

This growth in small-amount payments, combined with increased cashless usage at everyday destinations like "supermarkets," "convenience stores," and "drugstores," is expected to become a tailwind for promoting cashless payments going forward.

Japan's cashless payments will expand through progress in "everyday use"

This "Survey on Cashless Awareness During the COVID-19 Pandemic" revealed the following three key cashless insights:

① Increased usage along daily life routes such as "supermarkets," "convenience stores," and "drugstores"

② The key lies in whether usage of "electronic money" and "mobile payments" increases

③ Cashless adoption is progressing for "small payments" under 1,000 yen

The Dentsu Inc. Cashless Project views this "everyday use" as the backdrop for cashless payments in Japan to continue expanding even further.

<DENTSU Inc. Cashless Project>

For details regarding cashless initiatives, please contact Yoshitomi at the New Industry Development Department, Business Co-creation Bureau ( cash-less@dentsu.co.jp ).

【Survey Overview】

Survey Method: Internet survey

Survey Period: December 24-25, 2020

Survey Area: Nationwide

Survey Subjects: ① General consumers, ② Small and medium-sized enterprise (SME) owners*

① 500 men and women aged 20–69 (weighted based on population composition)

② 200 men and women aged 20–69

※ SMEs in the food service or retail industry with 100 or fewer employees and capital of 50 million yen or less