Dentsu Inc.'s Cashless Project, a team providing marketing strategy support in the payment domain, conducted an online "Cashless Awareness Survey of Consumers" in December 2022. The survey examined how consumers used cashless payments in their daily lives over the preceding year. ( Survey overview here )

This series uses the survey results to explore hints for promoting cashless payments in Japan.

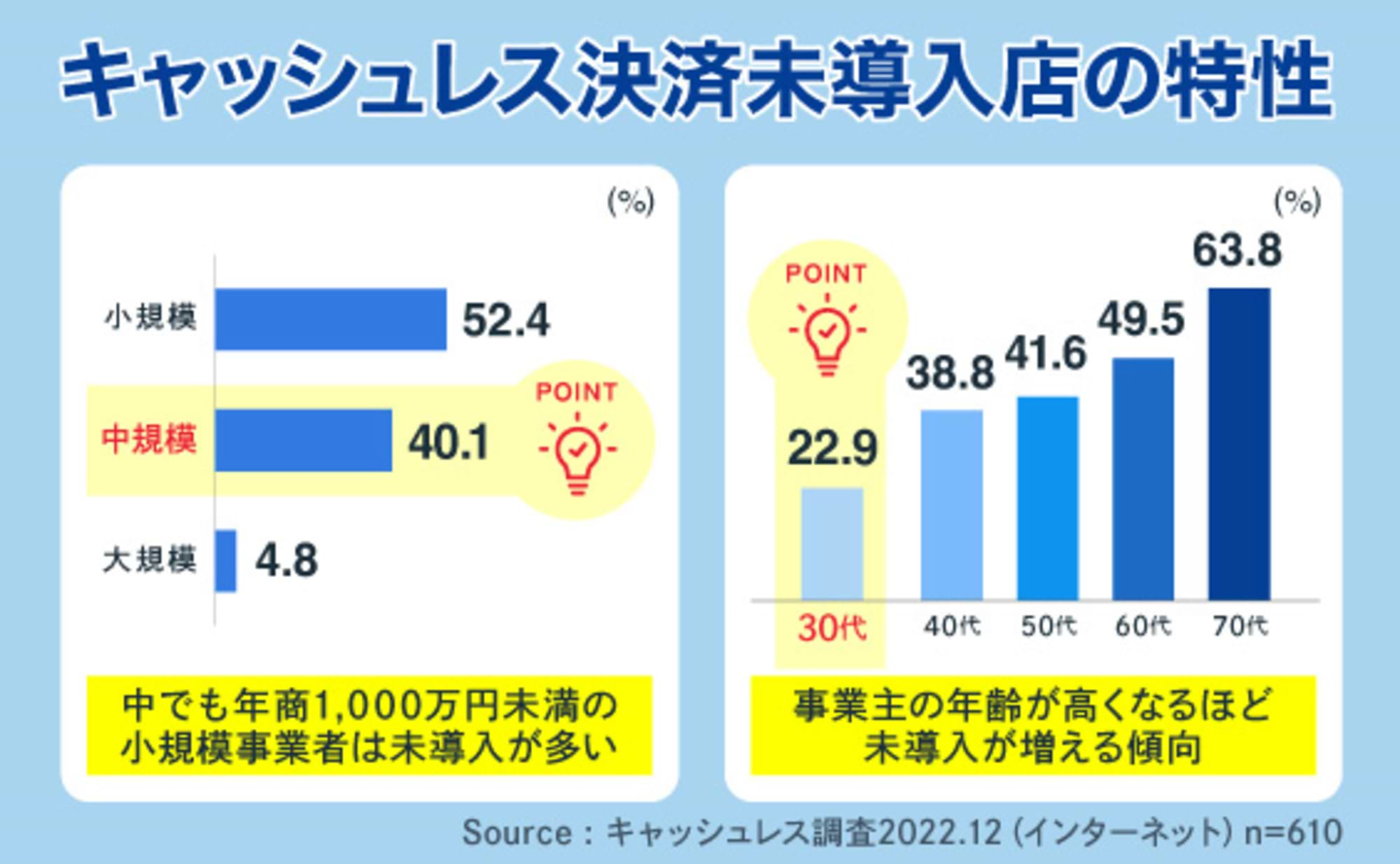

The previous installment covered the characteristics and adoption status of merchants—retailers, restaurants, and other businesses accepting cashless payments. This time, we examine the effects merchants experience after adopting cashless systems and the actual usage patterns, while also considering the challenges faced by merchants who have not yet adopted these systems.

The top benefit cited by merchants is "reduced hassle of preparing change"

We asked merchants who have adopted cashless payments about their effects.

The top benefit cited was "Reduced hassle of preparing change" (25.8%). Retail businesses (30.7%) reported this more frequently than food service businesses (21.9%). By industry, convenience stores, coffee shops, and clothing/personal goods retailers reported higher-than-average rates.

For merchants, preparing change, especially coins, is both time-consuming and labor-intensive. Additionally, while exchanging bills for coins or coins for bills used to be free, many financial institutions now charge fees. This situation likely contributed to merchants perceiving this as a benefit.

Second place was "Reduced checkout time" (20.1%). Among industries experiencing this, convenience stores showed a high response rate of 76.0%. Cashless payments potentially create a virtuous cycle: faster checkout speeds reduce wait times, boost customer satisfaction, and ultimately increase sales.

Third place was "Enabling hygienic payment acceptance" (16.4%), fourth was "Reduced staff change-giving errors" (15.9%), and fifth was "Expanded customer base" (12.9%).

Mobile payments are growing faster than cards in contactless transactions

While stores are increasingly equipped to accept contactless payments, how widely are they actually used? We asked respondents whether they had increased their use of any of three contactless payment methods in the three months immediately preceding the survey period.

Combining "significantly increased" and "somewhat increased" responses, the payment method showing the highest increase was mobile QR code payments (34.8%), followed by mobile contactless payments (23.3%) and contactless credit card payments (19.1%).

These results suggest a shift in payment behavior from card-based customer interfaces toward mobile.

Consumers likely find mobile devices, which they carry constantly, more convenient.

The cleanliness and safety of contactless payments also rank high among benefits

How do merchants view the benefits of adopting contactless payments? Since the COVID-19 pandemic, contactless payment usage has surged globally. The primary reason cited was the absence of virus transmission risk.

How do small and medium-sized businesses in Japan perceive the benefits of contactless payments? We asked merchants who have adopted contactless payments.

The top benefit cited was "reducing the need to prepare change" (50.2%). This advantage applies to cashless payments in general and is not unique to contactless payments.

However, the fact that half of respondents selected this as the "effect of introducing contactless payments" suggests they genuinely feel the benefit: transactions that previously required cash change now use contactless payments, reducing the need to prepare change.

Second place was "Improved customer cleanliness and safety" (28.2%). It appears that small and medium-sized businesses in Japan, like their counterparts globally, are interested in the enhanced customer safety offered by contactless payments. Furthermore, fourth place was "Increased cleanliness and safety for employees" (23.4%). This likely reflects the growing recognition, especially after the pandemic, that contactless payments are a cleaner and safer payment method for both customers and employees.

Ranked third was "Faster payment processing leads to shorter checkout times" (26.4%). "Reducing checkout wait times and avoiding crowding" (19.2%) also made it to fifth place. For both stores and consumers, reducing checkout time—equivalent to shorter wait times—is a significant benefit.

Cashless payment usage has increased over the past year

We asked small and medium-sized businesses that have adopted cashless payments whether the proportion of cashless payments in their sales had actually increased over the past year.

Merchants reporting "significantly increased" accounted for 9.5%. By industry, convenience stores, restaurants, and izakaya/restaurants showed results higher than the average. Merchants answering "increased" totaled 43.7%. Adding those who said "significantly increased," 53.2% felt there was an "increase."

So, what is the actual percentage of cashless payments in sales for the most recent month? Has the cashless payment ratio surged, surpassing cash?

The results differed from expectations. The actual cashless payment ratio of total sales was 30.4%. Since the previous survey (conducted in December 2021) showed a ratio of 26.7%, this represents an increase of only 3.7% over the past year.

Despite 53.2% of merchants reporting they feel cashless payments have "increased," there exists a gap where the actual cashless share of sales has only risen by 3.7%.

Reviewing the survey results so far, merchants are beginning to recognize the benefits of cashless payments, such as "reducing the need for change," "ensuring customer and employee cleanliness and safety," and "improving register productivity." However, the reality may be that progress has not yet reached the point of "increasing sales through cashless payments."

What cashless promotion measures do merchants support?

To explore solutions, we asked how to increase the ratio of cashless payments in total sales.

The most common response was "Promoting cashless payments through posters and announcements" (34.0%). Industries supporting this measure included convenience stores, various food/beverage retailers, coffee shops, drugstores, liquor stores, book/stationery stores, and fresh fish/meat/vegetable/fruit retailers.

Next was "Staff actively encouraging cashless payments" (32.1%). This strategy involves prompting customers to use cashless payments at checkout. This approach was favored by department stores/supermarkets, convenience stores, coffee shops, and fresh fish/meat/vegetable/fruit retailers.

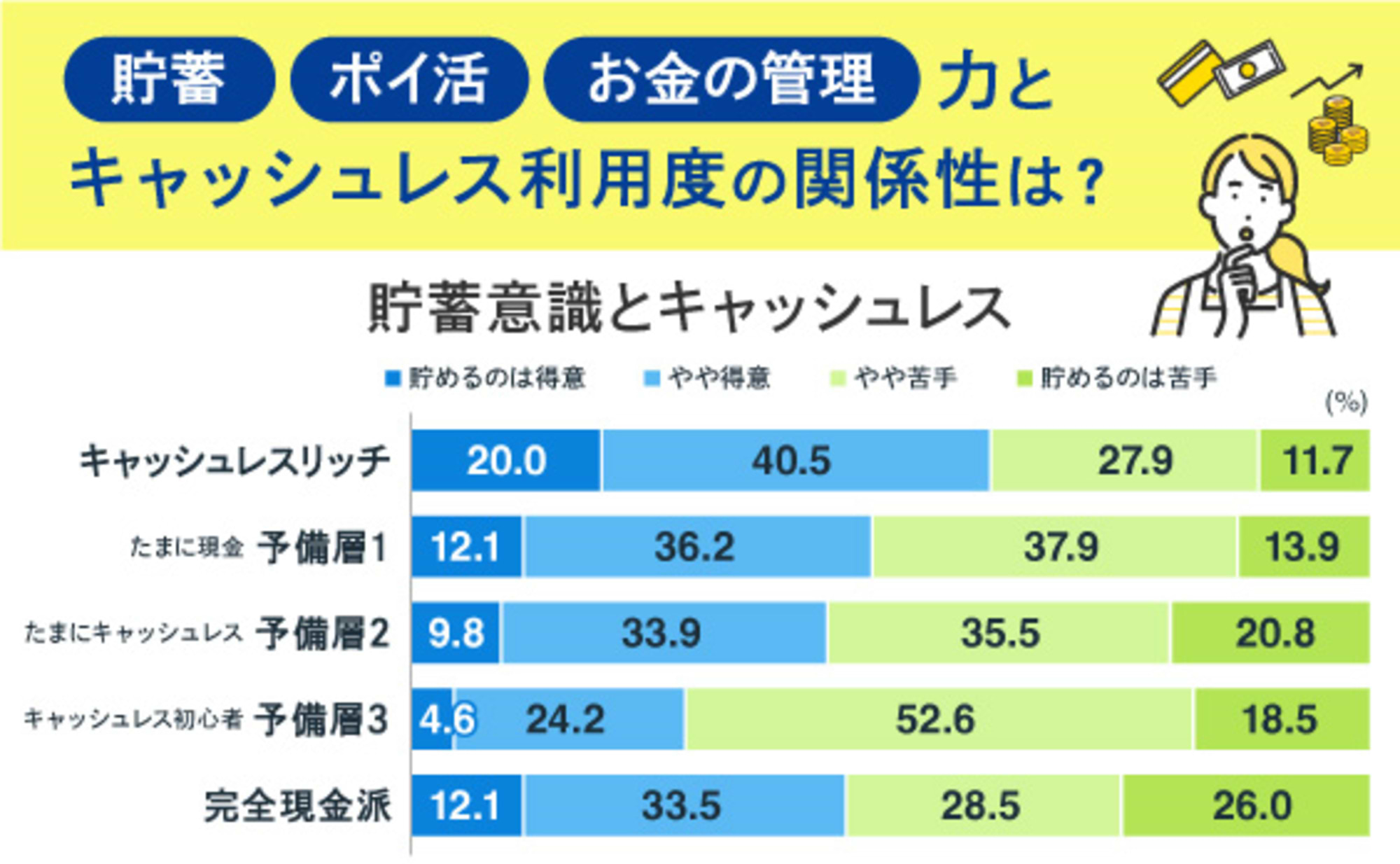

Third place was "Promoting the image that cashless customers have status" (13.8%). In the second survey, we learned that "cashless rich" (people who frequently use cashless payments) also tend to be financially affluent. They also use financial services smartly. If special treatment could be offered when they use cashless payments, they might be more likely to use cashless payment methods.

Fourth place was "Establishing dedicated cashless payment lanes" (10.2%). As mentioned in the benefits of introducing cashless payments, such as "Faster transaction processing reduces checkout time" and "Shortens wait times at registers and helps avoid crowding," there appear to be successful cases where such measures have shortened checkout times, increased customer turnover and store utilization rates, and boosted sales.

Addressing the cost challenges faced by small and medium-sized stores that haven't adopted cashless is essential for promoting cashless payments.

Finally, let's look at the results of asking unadopted stores what issues cashless payment could solve to encourage adoption.

By far the most common response was "lower (or free) payment processing fees," cited by 51.0%. This indicates that reducing fees could potentially lead half of these stores to adopt cashless systems.

The second most common reason was "lower initial investment costs (for terminals, systems, etc.) or no initial investment" (27.4%). Merchant-presented mobile QR code payment systems only require placing a QR code near the register. This means zero initial investment. For mobile QR code payment providers, this is a demand they can readily meet, suggesting a high feasibility rate.

The third most common response was unique: "Taxes become lower when cashless is introduced" (25.8%). The advancement of cashless payments in South Korea was significantly influenced by government tax policies, and its effectiveness has been proven. Even if the state offers preferential tax rates, tax revenue increases as transaction volume grows. Thus, the top three reasons were dominated by cost-related challenges. Fourth place was "Increased customer demand" (21.6%), and fifth was "Expected sales growth" (20.0%).

This survey reaffirms that cost-related challenges are the most pressing issue for small and medium-sized businesses accepting cashless payments. Addressing the challenges faced by Japanese small and medium-sized stores—cost reduction, customer orientation, and top-line (sales) growth—is essential for further promoting cashless payments in Japan.

[Survey Overview]

Title: "Cashless Awareness Survey of Consumers"

Survey Method: Online survey

Survey Period: December 12-15, 2022

Survey Area: Nationwide

Survey Participants: 610 male and female store owners aged 20–79

Survey Sponsor: Dentsu Inc., Dentsu Cashless Project

Survey Company: Dentsu Macromill Insight, Inc.