How can we further promote cashless usage in Japan?

The Dentsu Inc. Cashless Project, a Dentsu Inc. project team supporting marketing strategies in the payment domain, conducted the 6th "Consumer Cashless Awareness Survey" online in November 2023 to clarify the current cashless landscape and identify challenges in its adoption. ( Survey overview here ).

This survey defined cashless usage more strictly than the previous survey conducted in 2022. This was done to quantify cashless usage frequency and uncover the reality of those we call "Full-fledged Cashless Users."

The "Full-fledged Cashless Users" segment is defined as those who use cashless payment methods for over 60% of their transactions at locations accepting cashless payments.

This article examines what Japan must address to become a cashless leader, continuing our exploration of this segment. We analyze their attitudes toward savings and points, their interest in investment, as well as cashless usage patterns by store type and effective promotion strategies.

Where do hardcore cashless users not use cashless payments?

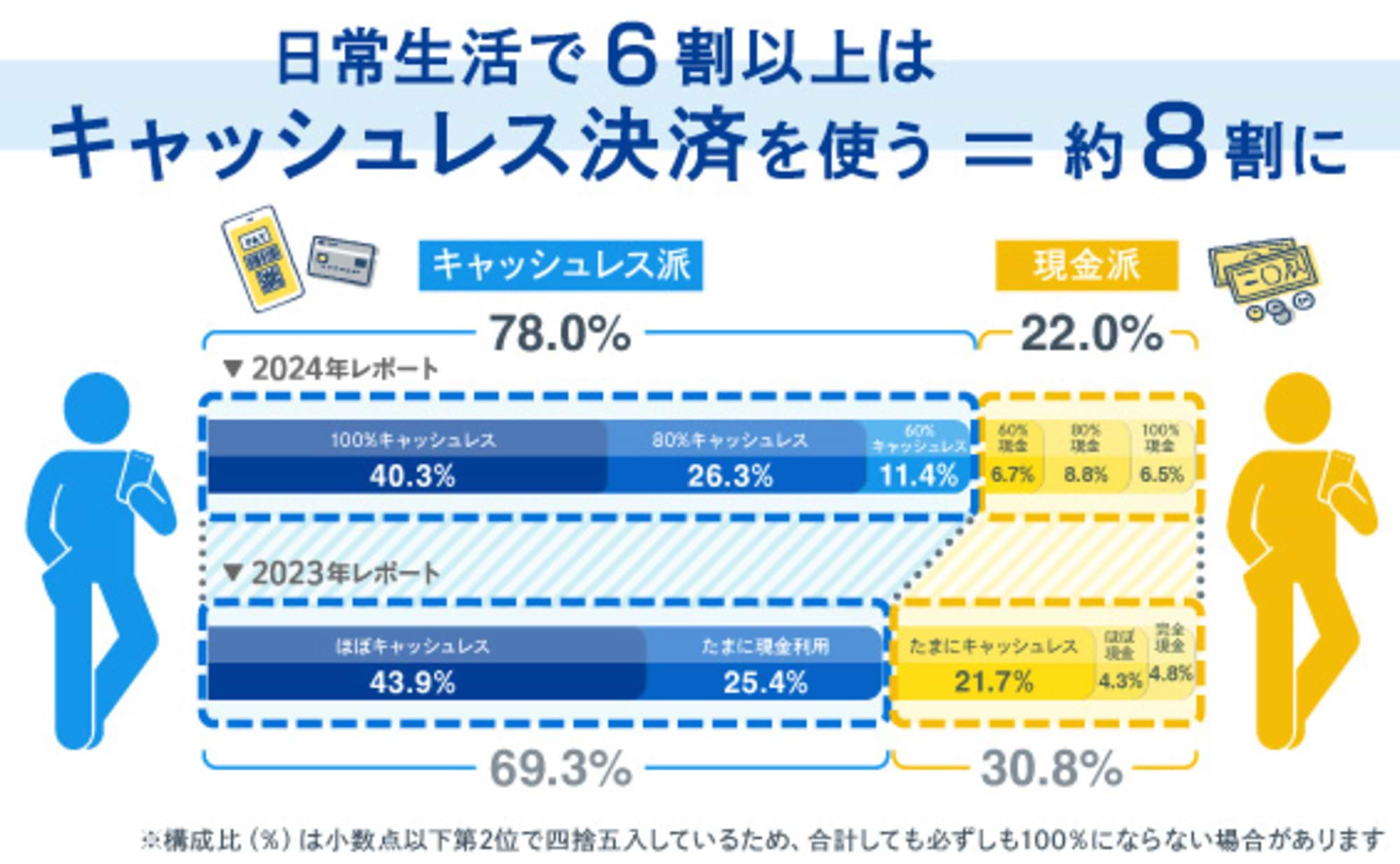

This survey found that hardcore cashless users (those who made cashless payments 60% or more of the time in their daily lives over the past year) accounted for 78% of respondents (based on frequency of use "where cashless is available"). However, according to METI data, this represents a significant gap compared to the cashless ratio of approximately 40% of Japan's personal consumption expenditure ( details here ). So, what factors are hindering the promotion of cashless usage?

Here, we examine where cash payments occur among clusters reporting cashless payment ratios of 100%, 80%, and 60%.

Those in the "100% Cashless" group generally use cashless payments 100% of the time wherever it's accepted. However, 8.6% still use cash at convenience stores. The figures are 10.7% at specialty stores, 10.9% at drugstores, and 11.4% at department stores and lodging facilities. This suggests that cashless payments are not accepted at some locations within these categories.

Within the "80% Cashless" segment, accommodation facilities had the lowest cash usage (17.3%). Department stores saw 24.1%, specialty stores 25.7%, drugstores 27.1%, and convenience stores 31.5% cash payments.

In the "60% cashless" segment, the cash ratio increases significantly. Even the lowest figure, for lodging facilities, was 40.6% cash payments. This was followed by specialty stores (53.6%), department stores (56.5%), drugstores (57.2%), and convenience stores (57.4%).

Looking at the combined "full cashless adopters" segment (60%–100%), the places with the highest cash usage were hospitals, followed by shopping districts, taxis, and restaurants. The reason for using cash in these places is clear: they simply don't have cashless payment equipment installed, making cash the only option.

Thus, it's natural not to use cashless payments at places or stores that don't accept them. Next, we'll delve deeper into "reasons for choosing cash payments despite available cashless options." Let's examine user insights at convenience stores, where cashless adoption is nearly complete.

To further promote cashless usage at convenience stores

These days, it's rare to encounter a convenience store that doesn't accept cashless payments. Yet, in this environment, 8.6% of "100% cashless" users, 31.5% of "80% cashless" users, and 57.4% of "60% cashless" users still don't use cashless payments at convenience stores. Why is this?

The top reason cited by "Full Cashless Adopters" for using cash was "Coins piling up in my wallet are a nuisance." This was the response for 36.4% of "100% Cashless," 49.9% of "80% Cashless," and 54.7% of "60% Cashless" users. In other words, convenience stores seem to serve as an outlet for getting rid of such loose change.

The second most common reason for using cash at convenience stores was "I feel awkward using cashless for small purchases." 25.0% of "100% cashless" users, 28.1% of "80% cashless" users, and 31.8% of "60% cashless" users said they feel awkward using cashless payment at convenience stores.

The survey asked how people would switch to cashless payments when using convenience stores.

The overwhelmingly popular incentive among "full-fledged cashless users" was receiving points or discounts for cashless use. This gained support from about 60% across all segments. However, most convenience stores already offer point systems for cashless payments. This approach may struggle to change the mindset of those who feel "cashless payments feel awkward for small purchases."

The most effective strategy might be the "cashless-only lanes for faster payment," cited as the second-best option by both the "80% cashless" and "60% cashless" groups. Other promising approaches include "staff recommending cashless payments" and "in-store posters or announcements promoting cashless payments."

All major convenience store chains are promoting cashless payments. This is likely because it improves operational efficiency and reduces security risks. If the hesitation about cashless payments disappears in convenience stores, where small transactions are common, then perhaps people will also feel comfortable using cashless payments without hesitation in department stores, supermarkets, malls, and drugstores.

The "Hardcore Cashless Users" who excel at managing money and points

Is there a difference in financial management sensibilities between "hardcore cashless users" and "cash users"? We compared the differences between a representative "100% cashless" user and a representative "100% cash" user.

*Percentage composition is rounded to the second decimal place, so totals may not always add up to 100%.

First, regarding money management. When asking cash users why they use cash, we sometimes hear responses like, "With cash, I don't worry about overspending." So, do many people truly believe that using cash alone ensures proper money management without overspending?

In the survey, those who answered they were "good at managing money" showed almost no difference in awareness: 16.8% were "100% cashless" and 15.5% were "100% cash."

However, when including those who answered "somewhat good," "100% cashless" users accounted for 63.0% and "100% cash" users for 47.3%, showing that the fully cashless group is larger. The percentage of "100% cash" users who answered "not good" was 19.1%, over three times that of "100% cashless" users.

Regarding saving money, the hardcore cashless group also showed a stronger sense of being "good at it" compared to the cash group. Comparing those who felt "good at saving money" or "somewhat good at saving money," 58.0% of the "100% cashless" group felt this way, compared to 35.5% of the "100% cash" group.

Furthermore, the tendency for full-fledged cashless users to be "good" at accumulating points was even more pronounced. 34.6% of respondents were "good" at accumulating points, and including those who were "somewhat good," the figure reached 87.5%. It appears that relatively more full-fledged cashless users are skilled at money management, saving money, and accumulating points.

Hardcore Cashless Users Are Also Active in Investment and Management

The "hardcore cashless users" are good at accumulating points. Among them, the "100% cashless" cluster responded to the question "Do you actively (consciously) accumulate points in your daily life?" with 66.2% stating they "decide on payment methods based on the points they can earn." Including those who "choose payment methods that offer points whenever possible," this figure rises to 95.2%.

While the proportion of those conscious about earning points gradually decreases as cashless usage frequency drops, the survey results reveal a consistently high level of point-earning awareness among consumers overall.

We also asked how many people use their points for investment or asset management services, or intend to use them for such purposes in the future.

Among all respondents, 52.6% had experience investing or managing their points. While the possibility of investing using points has become well-known, the fact that over half have experience is higher than expected.

Incidentally, segments with higher cashless usage frequency tend to have more investment/management experience and stronger usage intentions.

Among those already using points for investment/management and intending to continue: * "100% Cashless" users: 55.6% * "80% Cashless" users: 50.8% * "60% Cashless" users: 41.8% Including non-users, 64.0% expressed interest in using points for investment/management in the future.

The launch of the new NISA system will also act as a tailwind, likely increasing the number of people who currently do not use these points but would like to try using them in the future.

One in three people want to try "credit card-based regular investment"

We also asked about the new NISA program launched in January 2024. Overall, 13.8% of respondents said they knew all the details of the new NISA, while 29.9% said they knew most of it. Awareness and understanding of the new NISA in this survey stood at just over 40%.

*Percentage figures are rounded to the nearest hundredth, so totals may not always add up to 100%.

What about usage intentions? 56.3% of respondents expressed an interest in using the new NISA. This indicates a majority are interested in and want to use the new NISA.

The breakdown is as follows: 21.2% of those with NISA experience want to use it more actively than before. 13.8% of those with NISA experience want to use it at the same level as before. 5.1% hold a NISA account but have never traded and want to use the new NISA. 16.2% have no NISA experience but want to open a new NISA account and start trading.

We further explored credit card usage for regular investment plans and future intentions. Results showed 21.9% already engage in regular investment plans. This means one in five people use credit cards for regular investments, exceeding initial expectations.

Furthermore, 35.8% of respondents expressed an interest in using credit cards for regular investment in the future, representing one in three people.

Under the new NISA system, the purchase limit for investment trusts using credit cards has effectively increased from ¥50,000 to ¥100,000. We therefore asked the 188 respondents who already have a securities account and are using credit cards for regular investment whether they would increase their investment amount.

62.7% responded that they would like to increase their investment, while 37.3% said they would keep it the same. Credit card transaction volume will certainly increase due to the New NISA's regular investment feature, promoting cashless payments. Investment and cashless payments seem to be a good match.

Next time, we will examine retailers' attitudes toward cashless payments and explore hints for promoting cashless payments going forward.

[Survey Overview]

Title: 6th Survey on Cashless Awareness Among Consumers

Survey Method: Online survey

Survey Period: November 17-20, 2023

Survey Area: Nationwide

Survey Participants: 1,000 men and women aged 20–69 (weighted based on population composition)

Survey Sponsor: Dentsu Inc., Dentsu Cashless Project

Survey Company: Rakuten Insight