The Dentsu Inc. Cashless Project, a Dentsu Inc. project team supporting marketing strategies in the payment domain, conducted the 6th "Cashless Awareness Survey for Consumers" online in November 2023 to clarify the current state of cashless payments and identify challenges in promoting their adoption. ( Survey overview here )

This series examines the realities of cashless users and the stores that provide these services, based on the survey results, to identify challenges Japan must overcome to become a cashless leader.

This third installment focuses on the still-limited adoption of cashless payments among small and medium-sized businesses (SMBs). We explore hints for promoting adoption by examining shop owners' own cashless usage patterns and insights.

Slow Progress in Cashless Adoption Among Small and Medium-Sized Businesses

One major challenge in promoting cashless payments in Japan is encouraging SMEs to adopt them. According to our latest survey, 58.1% of SMEs have implemented cashless payments. This compares to 54.8% in 2022 and 52.3% in 2021.

58.Among the 1% of stores that have adopted cashless payments, 4.0% did so after January 2023. While adoption is gradually increasing, it was found that 41.9% of stores still do not offer cashless payments.

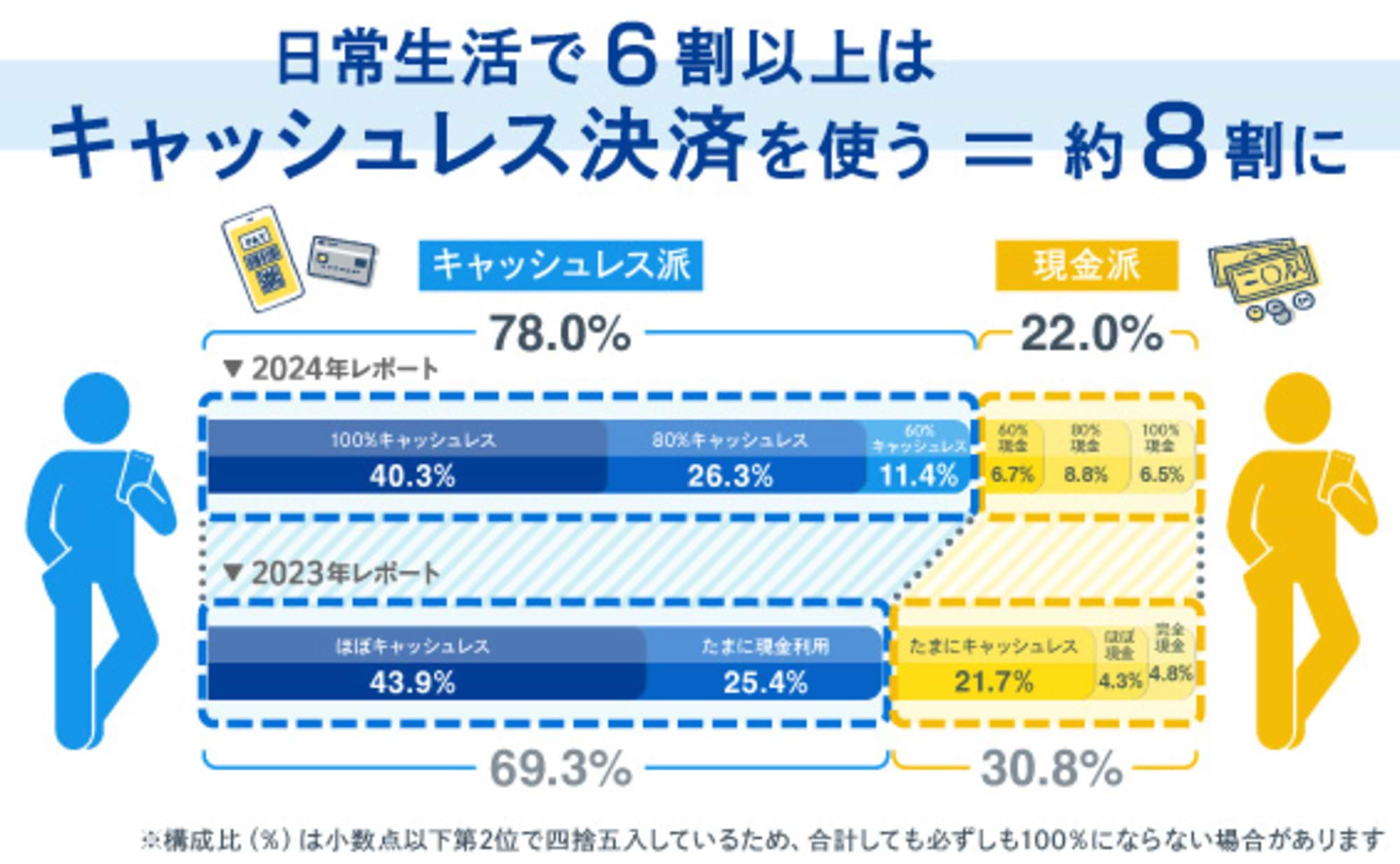

78.4% of the SMEs surveyed are sole proprietors. Therefore, similar to individual users, it stands to reason that the higher their own cashless usage frequency, the higher their rate of adopting cashless payments. Based on this hypothesis, we asked about their cashless usage in daily life.

The results showed that among those accepting cashless payments, 32.8% were "100% cashless" (using cashless payments 100% of the time), 22.0% were "80% cashless," and 11.3% were "60% cashless." On the other hand, 6.3% were "60% cash," 13.2% were "80% cash," and 14.4% were "100% cash."

While shop owners with high cashless usage rates (100% or 80%) also tend to have higher adoption rates at their own stores, the adoption rate among cash-preferring owners shows that it doesn't necessarily correlate with their own usage patterns.

Even among "full-fledged cashless users," over 30% of small and medium-sized businesses are negative about introducing cards

To further explore whether there is a correlation between shop owners' personal cashless usage and their adoption of cashless payment systems, we also asked about card payment adoption.

Card payment adoption rates were 54.0% among "100% cashless" shop owners, 50.0% among "80% cashless" shop owners, and 53.1% among "60% cashless" shop owners. Considering shop owners in the "Full Cashless Segment" (where cashless payments account for over 60% of transactions at establishments accepting cashless), approximately half had introduced card payments, with no significant differences observed across the segments.

Conversely, among "cash-only" shop owners, adoption rates dropped to the 30% range for "80% cash" shops and fell to 18.8% for "100% cash" shops.

Regarding the response "Currently not accepting card payments but plan to introduce them in the future," the "100% cashless" segment showed a slightly higher rate at 9.1%, while the "100% cash" segment was lower at 2.8%. The other segments were largely on par. Regarding the response "Currently not using card payments and have no plans to introduce them," "100% cash" shop owners showed the highest result at 75.7%.

Interestingly, 33.8% of respondents who identified as "100% cashless" users themselves stated they had "no plans to introduce card payments." Among "80% cashless" shop owners, 38.6% responded similarly, and among "60% cashless" shop owners, 35.4% stated they had "no plans to introduce card payments."

This means that over 30% of shop owners who consider themselves "full-fledged cashless advocates" do not want to introduce card payments. You might think that instead of card payments, they would introduce mobile QR code payments, which have lower transaction fees and implementation costs. However, the results were similar for mobile QR code payments as well.

When considering store management as an owner, there may be other reasons for insisting on cash payments, regardless of fees or implementation costs. The root of this challenge seems quite deep.

Cashless adoption boosts sales and cuts costs

Next, let's look at the benefits cashless payment providers perceive.

According to the survey, small and medium-sized businesses that have actually adopted cashless payments are seeing some results.

When asked about the effects of cashless adoption among cashless stores (58.1%), the most significant benefit cited was "Reduced hassle of preparing change" (22.4%). Preparing change involves both effort and cost, and conversely, exchanging coins for bills also incurs fees. Considering this, going cashless eliminates the worry about change and reduces costs.

There is another cashless benefit related to change: "Reduced staff errors in giving change" (13.3%). Cashless adoption contributes to operational efficiency. 17.7% of respondents reported that it "shortened checkout time."

When handling cash, staff must receive payment, verify the amount, prepare change, hand it over, and have the customer confirm it – all of which inevitably takes time and effort. Switching to contactless payments speeds up checkout and reduces processing time. This operational efficiency also translates to cost savings, making cashless adoption effective.

Cashless payments also appear to have marketing benefits. 16.0% of respondents reported that their customer base expanded. As revealed in surveys targeting consumers introduced in thefirstand second articles, the number of "hardcore cashless users"—those who use cashless payment methods whenever possible—is increasing at establishments that accept cashless payments. Simultaneously, this segment tends to have relatively higher household incomes.

If businesses can attract these "hardcore cashless users" to their stores, they can expect not only a broader customer base but also the cultivation of repeat customers and increased revenue. In this way, introducing cashless payments appears to be effective for boosting sales.

The shop owners among the "hardcore cashless users" will be the driving force behind future cashless adoption!

After 2023, only 4% of small and medium-sized businesses newly introduced cashless payments. Why did these shops adopt cashless?

When asked their reasons for adoption, the most common response was "to improve customer convenience" (55.0%). The second most common reason was "due to customer requests" (42.5%). Among these customer-focused shop owners, over 35% were themselves "100% cashless" users. Their personal experience likely makes them proactive about cashless adoption.

The third reason was "to improve operational efficiency" (27.5%), the fourth was "to attract more customers" (25.0%), and the fifth was "because cashless is hygienic" (17.5%).

For Japan to become a cashless leader, promoting cashless adoption among small and medium-sized businesses is essential. To accelerate this movement, it may be necessary to more actively, clearly, and concretely communicate the benefits of cashless adoption to these businesses.

Dentsu Inc. Cashless Project will continue its efforts to promote cashless payments in Japan through regular surveys and by examining insights from both users and participating stores.

[Survey Overview]

Title: "Cashless Awareness Survey"

Survey Method: Internet survey

Survey Period: November 17-20, 2023

Survey Area: Nationwide

Survey Participants: 1,000 small business owners/sole proprietors in the food service/retail industry (ages 20–69)

Survey Sponsor: Dentsu Inc., Dentsu Cashless Project

Survey Company: Rakuten Insight