FinTech, a portmanteau of finance and technology, refers to financial services made more convenient through technology. Its fundamental premise is that "anyone," "anywhere," can benefit from it.

Amid concerns about the slow adoption of IT by small and medium-sized enterprises (SMEs) in regional areas, what initiatives are using FinTech to support these businesses? Takashi Hoshikawa, CEO of Cloudcast, which develops cloud-based expense reimbursement apps, joined Dentsu Inc.'s Yu Mitsui and Kohei Morimoto for a discussion at FINOLAB Inc., Japan' s FinTech hub.

From left: Dentsu Inc.'s Yu Mitsui, Cloudcast CEO Takashi Hoshikawa, Dentsu Inc.'s Kohei Morimoto

"Money management is such a hassle..." What's the common pain point for SMEs, which make up 99.7% of domestic businesses?

Mitsui: Morimoto and I work on businesses for SMEs. One of these is operating the website " HANJO HANJO," which delivers industry information offering hints for SME growth.

This time, we had the opportunity to team up with Mr. Hoshikawa for a fintech service offered on that site. To be honest, before meeting Mr. Hoshikawa, my knowledge of fintech was just at the "heard of it" level. You provide fintech services for SMEs, but why specifically SMEs?

Hoshikawa: First, the essence of fintech is the movement to make financial services, which everyone uses, more accessible and user-friendly through the power of technology.

One reason I'm involved in fintech is my awareness of the problem of low financial literacy in Japan. When I was in charge of new business development at Microsoft, I worked with people from the US and Europe. Talking with them, I got the impression they viewed knowledge about stocks, interest rates, and such as "essential knowledge for living."

For example, in the US, business professionals handle their own tax returns. In Japan, with year-end tax adjustments, you just stamp a document and your tax filing is done, right? There are simply fewer opportunities to use financial literacy in the first place.

Morimoto: That's true. There might be a tendency to leave everything to the accounting department.

Hoshikawa: Exactly. Actually, the survival rate for small and micro businesses or sole proprietorships in their second year is said to be around 60%. One reason for this low survival rate is likely that owners often have to juggle managing the tedious financial aspects themselves.

It's the same for app developers like us, but also for people starting businesses like hair salons, apparel shops, or restaurants. They establish companies because they excel in their specialized skills. However, being skilled at their job doesn't necessarily mean they're good at cash flow management. In fact, many lack financial knowledge.

Mitsui: Japan has over 4 million small and medium-sized enterprises (SMEs), accounting for 99.7% of all companies. The reality is that most of these companies have few employees and lack the resources to hire professionals with specialized accounting knowledge or management consultants.

Hoshikawa: If we can support them with fintech tools, they can focus on developing their specialized skills or allocate funds and time to product development. Plus, they won't need to maintain a full-fledged back-office accounting department, which should improve the survival rate of SMEs.

While there are many startup support programs, there weren't many initiatives to follow up after launch. That's why I wanted to help business owners sustain their operations.

Morimoto: Since joining Media Services / Newspaper Division, I've primarily covered regional papers. I often meet with SME owners in local areas, and I frequently hear their frustration about being consumed by non-core tasks, including money management.

Fintech makes cash flow planning much easier for SMEs

Mitsui: While Dentsu Inc. has strong ties with large corporations, it hasn't sufficiently communicated with SMEs, which make up the majority of Japanese companies. I believe Dentsu Inc. can contribute by acting as a bridge between large corporations and SMEs, and also by helping solve SME challenges.

With "HANJO HANJO," we've aimed to operate a platform that disseminates business models and new case studies originating from regional areas, providing SMEs with "profitable hints" while also serving as a bridge between large corporations and SMEs. However, we realized that going forward, it's not enough to just distribute information content; we need to provide tools that SMEs can actually use and find useful, and offer concrete solutions that contribute to their management.

Morimoto: It was at this juncture that Mr. Hasegawa was introduced to us by Mr. Toshiaki Hasemura of Dentsu Inc., who is involved in operating FINOLAB Inc. What benefits will the fintech service provided within "HANJO HANJO" offer SMEs?

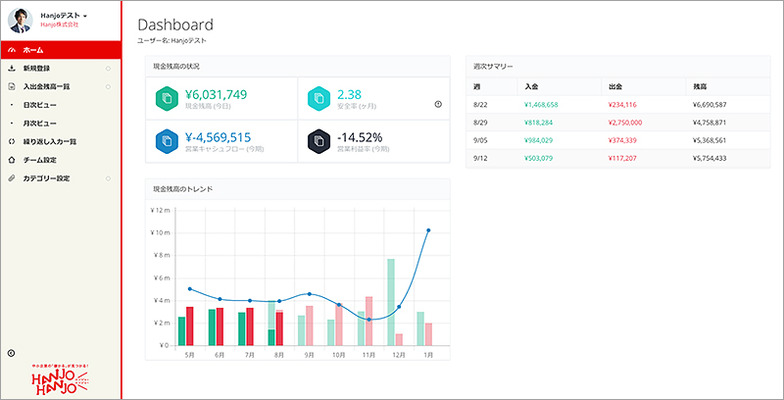

Hoshikawa: It's a free online support service called " Staple Pulse for HANJO HANJO, " which simplifies and makes clearer the company's "cash flow statement" that was previously created using paper or spreadsheet software.

For SMEs, the key is understanding fixed costs and how much cash they have on hand. Then it's just a matter of fine-tuning variable costs. This enables cash flow management. Unlike accounting software for tax filings, it supports forecasting future cash flow.

With this service, you simply enter your current cash balance and record incoming and outgoing payments. This visualizes your cash flow. You can instantly see the company's "safety margin" for continued operations. This allows proactive measures like, "If we continue like this, we'll likely face cash flow problems in six months, so let's consult now." It helps avoid situations where you realize you're running out of cash just before it's too late.

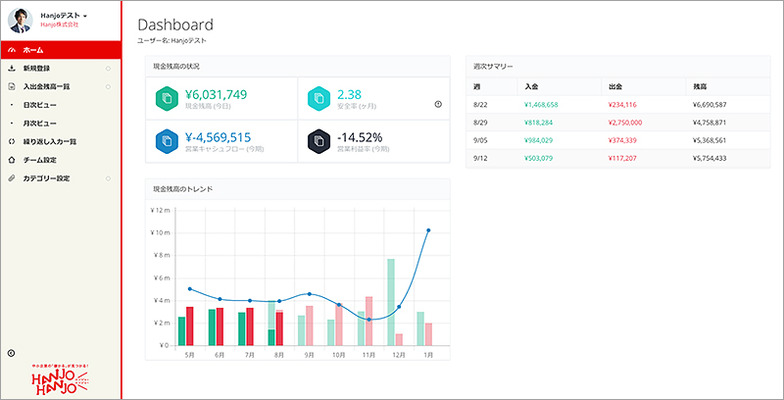

Test screen of the free online support service "

Staple Pulse for HANJO HANJO ". Incoming payments are shown in green bar graphs, outgoing payments in red, allowing users to grasp cash flow several months ahead at a glance. On October 27, 2016,

an event featuring presentations by Cloudcast CEO Mr. Hoshikawa and Mr. Mitsui

introduced effective fintech

solutions for SMEs and freelancers.

Morimoto: It's very simple. There are few input fields, yet you can check important information well into the future. Moreover, this service isn't just for SMEs; large corporations can also use it to manage finances by department or project.

Hoshikawa: That's right. We focused development on how end users—like managers and employees without accounting knowledge—could use it easily. Previous business apps often had many features, but without the knowledge, they were hard to master.

Mitsui: Incidentally, this service went from our initial meeting—where we were both starting from scratch—to launch in just about two months. While our shared Nagasaki roots helped us click instantly, this pace is probably unusual for Dentsu Inc. (laughs).

Hoshikawa: I'm well aware of how difficult it is to get proposals approved in large corporations, so I was genuinely impressed by that. The reason this collaboration worked so well is simple: we shared the same direction and desire to support small and medium-sized enterprises.

What is the key to Fintech × SME Support × Regional Revitalization...?

Morimoto: There's no doubt fintech can be useful for local SMEs. However, I also get the impression that many SME owners in regional areas still have reservations about "IT" or "digital" and don't fully see the benefits.

Mitsui: This might be an extreme example, but when I spoke with someone at a local port market, they mentioned how children would take a little pocket money from the overflowing coins in the store's basket. That kind of rough accounting is part of the market's history, and quantifying exactly how much cash is physically present through data doesn't hold much meaning.

Hearing that made me realize accounting itself has a culture, and forcing change where that culture is deeply rooted is difficult... As HANJO HANJO, we must understand these backgrounds and consider how to approach them.

Hoshikawa: The beauty of technology is that it allows access to information regardless of location—urban or rural—and can bridge the information gap. It's crucial to make it so widespread that everyone can use it as a matter of course.

That said, there's no such thing as a tool that appeals to absolutely everyone. That's why I believe the existence of early adopters – people who are sensitive to trends and quickly embrace innovative services and information – is key. They actively use new services and spread the word about what they find convenient.

Morimoto: That's essentially a grassroots movement. Especially in rural areas, there's a strong tendency to try something because "a friend recommended it."

Mitsui: It's entirely possible that people connected to local business owners, like those at chambers of commerce or regional banks, could become influencers for these fintech services. And the power of media is indispensable too. Radio personalities enjoy tremendous local support.

Morimoto: When we hosted a symposium earlier, we asked a radio personality to facilitate. Their ability to capture the audience's attention and skillfully steer the conversation was truly impressive. Afterwards, they covered the event on their own show, creating further reach. We're considering future collaborations with radio stations.

Furthermore, both Mr. Mitsui and I come from the Media Services / Newspaper Division. Working with local newspapers, I've realized they possess numerous assets beyond just their media platforms. They've built extensive networks with local businesses and industry groups, expertise in reporting and sales promotion, and strong event execution capabilities.

I firmly believe local newspapers remain unmatched in their ability to deliver the information people in regional areas need. Having worked alongside local papers for about seven years, I can attest that when launching events, projects, or businesses, it was always the local paper that ultimately came through. Local newspapers possess a truly admirable resolve: no matter what happens, they stand their ground in the community and walk alongside its residents.

Precisely because we live in an era where newspaper media is said to be struggling, I believe that creating more work that leverages the "grounding power" of local newspapers will also lead to solving the challenges faced by small and medium-sized enterprises.

Hoshikawa: As fintech players, we're confident in developing services and creating products. However, we lack the know-how to broaden awareness or penetrate services into regional areas. That's where we want to leverage Dentsu Inc.'s creative and promotional power to jointly boost our business.

Mitsui: Regarding internal movements at Dentsu Inc., collaboration with regional Dentsu Inc. offices is also crucial. The opinions of people actually living in those areas are invaluable; they understand the local atmosphere and sensibilities that we simply can't grasp.

Currently, for another project, we regularly exchange information via video conference with employees from Tokyo and Kansai Dentsu Inc., as well as regional Dentsu Inc. offices. This reveals the realities and challenges faced in those areas, and conversely, it provides opportunities to share solutions developed in Tokyo with our regional colleagues. We want to take the lead in driving even more of these internal collaborative efforts.

Morimoto: Exactly. When clients request initiatives involving regional SMBs, we want to build a team where they think, "Let's consult HANJO HANJO first." We also aim to become a place where external SMB owners and managers can consult when planning or launching projects locally. Through our collaboration with Cloudcast, we feel we've taken the first step in energizing the SMB* market. We hope to create a space where diverse people from inside and outside the company gather.

※SMB…Small Medium Business, mid-sized and small businesses