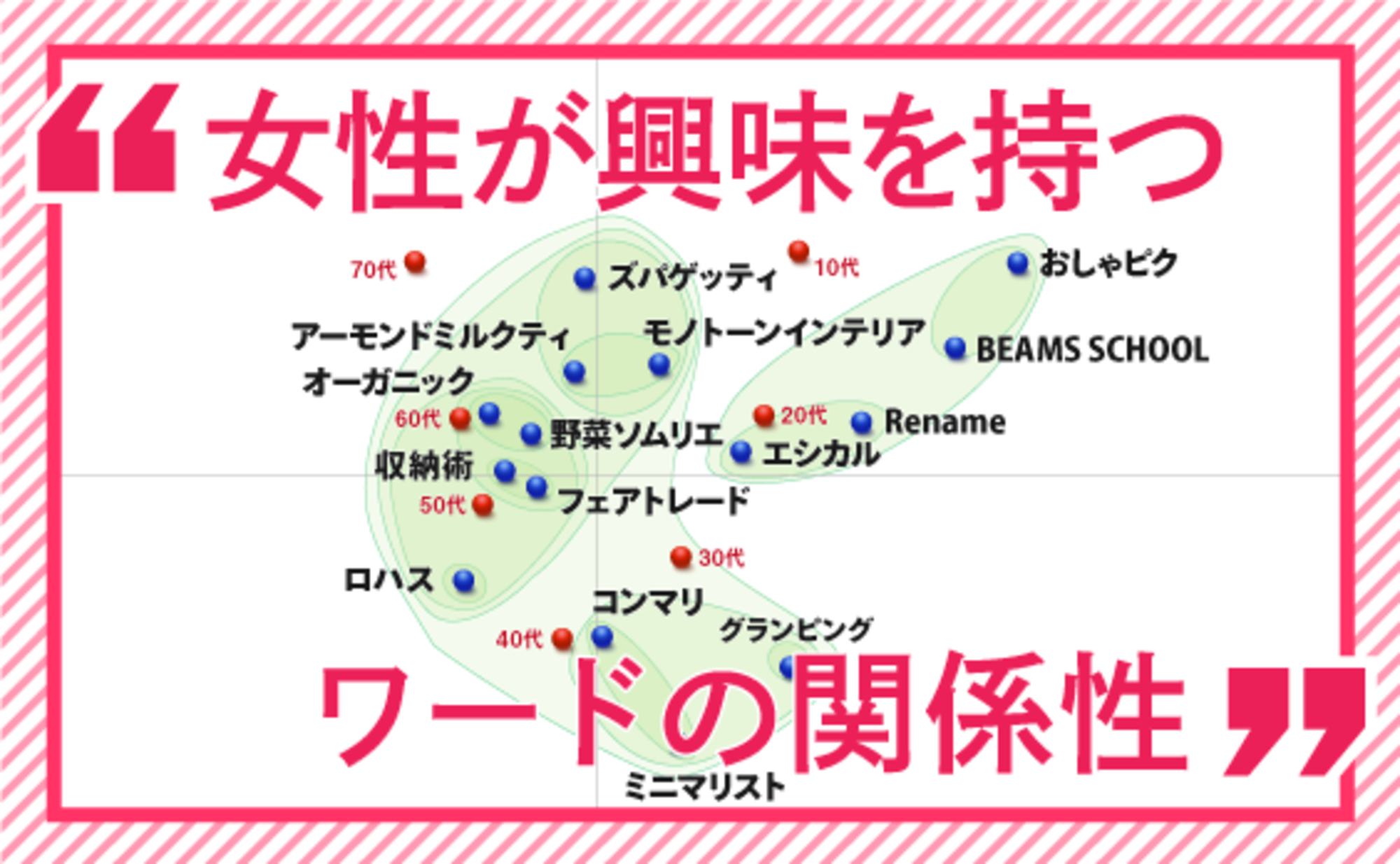

Last time, we introduced recent terminology and its connection to women. In this second installment, we will provide an overview of women's digital service usage while explaining the relationships between each service.

The Overall Picture of Women's Digital Service Usage

This analysis covers a total of 93 digital services (including 19 "Other Services" across all categories). Correspondence analysis and hierarchical cluster analysis were applied, with the results shown in Figure 1.

This distribution map shows a group in the lower right corner featuring services popular among teens, such as <TikTok> and <PicsArt>. Higher up, there is a group of childbirth and childcare services, like <Tamahiyo> and <Mamari>, whose main users are in their 20s and 30s (detailed later). As shown, services with a high affinity for specific age groups tend to form distinct clusters.

Six Clusters of Women's Digital Services

While each digital service broadly falls into one of six clusters, the following sections will focus on explaining each group.

① Younger Generation Cluster

This group includes two digital services popular among younger users. TikTok is a service where users share videos and enjoy connecting with each other, while PicsArt, originating in the US, allows users to edit and enhance photos and videos. This cluster stands apart from the others, establishing a unique position.

② SNS, Music, Entertainment, and Fashion Cluster

Here, services like <Mecha Comic> and <Comic Seemore>, belonging to the same genre, form one group. Meanwhile, services from different genres—<Twitter>, <Spotify>, and <Hulu>—form another distinct group.

Many other digital services in SNS, music, entertainment, and fashion are also present, making this a group that leans more toward younger demographics. Noting the proximity of <hulu>, <Spotify>, and <twitter>, cross-promoting users between twitter and Spotify (or hulu) could create synergies and enhance media value.

③ Childbirth and Child-Rearing Support Cluster

While this cluster includes some dating services, it primarily represents childbirth and childcare support. Like Cluster ①, it is characterized by its distance from other clusters. In this sense, services plotted here are those that support childbirth and childcare—specifically, those addressing women's needs—more than the digital services above.

④ Beauty & Fashion Cluster

This group features beauty-related digital services like <hotpepper beauty>, <@cosme>, and <Bikiki.com>, alongside fashion-related digital services such as <Brandear>, <GAP>, and <ZOZOTOWN>.

⑤ Lifestyle Support Cluster

Here, services from various genres are grouped together in the same cluster: SNS platforms like <Facebook> and <LINE>, word-of-mouth gourmet sites like <Tabelog>, entertainment services like <Amazon Prime Video> and <Amazon Music>, and money management services like <Money no Tatsujin>.

Furthermore, cashless services like <LINE Pay> and <Merpay>, practical digital services like <DELISH KITCHEN>, and lifestyle support services like <JIMOTY> are grouped together in this cluster. Examining the services within this cluster suggests that its primary users are likely homemakers adept at utilizing diverse services.

⑥ Smart Life Support Cluster

Like Cluster ⑤, this cluster has a very large number of items and diverse genres. What's distinctive here is that it includes e-commerce services like Rakuten Ichiba, Amazon, LOHACO, Locondo, and Kakaku.com, alongside coupon services like Ponpare and GROUPON, and asset-building services like Minna no Kabushiki and Yahoo! Finance. This cluster seems to depict women who, anticipating the era of 100-year lifespans, manage their assets while also obtaining coupons to access valuable information and shop smartly online.

Next time, we'll explain the factors influencing women's digital service usage.

[Survey Overview]

● Survey Name: Survey of 12 Female Age Groups

● Target Areas: Kanto (Tokyo/Kanagawa/Saitama/Chiba), Chubu (Aichi/Gifu/Mie), Kansai (Osaka/Kyoto/Hyogo/Nara)

● Target Criteria: Women aged 15–74

●Sample Size: 3,000 respondents

●Survey Method: Internet survey

●Survey Period: November 1–5, 2019

●Research Organization: Video Research Ltd.