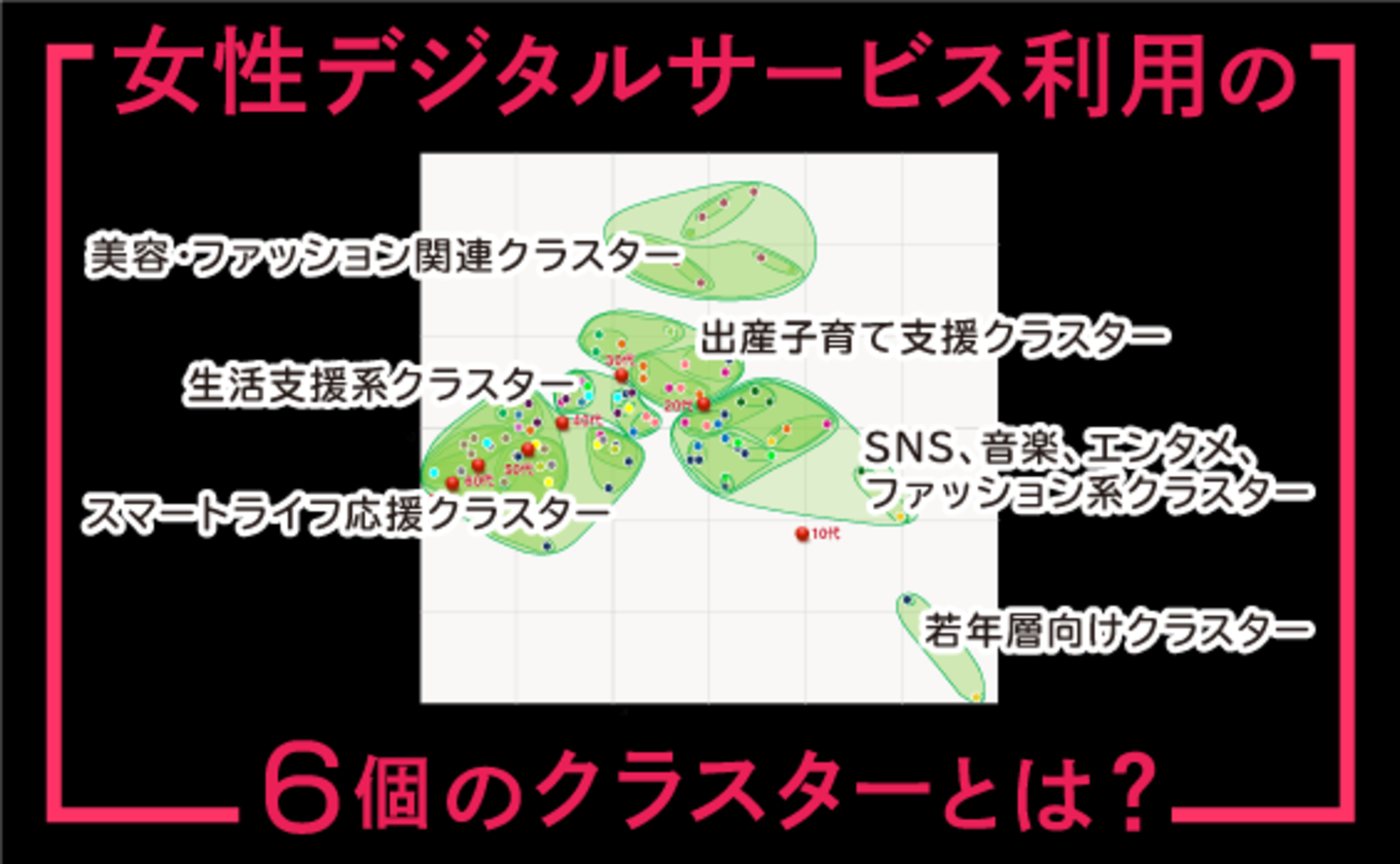

In Part 2, we overviewed women's digital services and introduced the clusters within these services. This time, we shift focus to provide a detailed analysis of values and tendencies among women from their late teens to early seventies, broken down into five-year age groups.

Generational Characteristics of Women in Five-Year Increments

Specifically, we attempted to identify generational characteristics by investigating lifestyle preferences, favorite things in daily life, beauty-related awareness, outlook on life, interpersonal relationships, social awareness, consumption awareness, and media exposure (such as magazines and manga that influenced each generation).

Figure 1 lists the characteristics identified for each generation in this survey. From left to right in the header: the generation name, a single-word description of its defining feature, and a notable phenomenon associated with that generation.

What are the five generational characteristics?

Let's examine the five notable generational characteristics.

① Generation 01: "I don't want to miss TV shows I want to watch"

Generation 01 showed the highest combined percentage (78.8%) for "Strongly Agree" and "Somewhat Agree" to the statement "I feel frustrated when I miss a TV show I wanted to watch," compared to other generations. Additionally, their combined percentage ("Often use" and "Sometimes use") for TV catch-up services like TVer and NHK On Demand was 46.4%, also the highest among all generations.

The former result, in particular, contradicts the long-discussed phenomenon of "young people turning away from TV" over the past decade. This may be influenced by the survey's focus on the Kanto, Chubu, and Kansai regions. However, the reality might be that the distance between the smartphone-native Generation 01—the catch-up generation—and television is not as great as we marketers might assume.

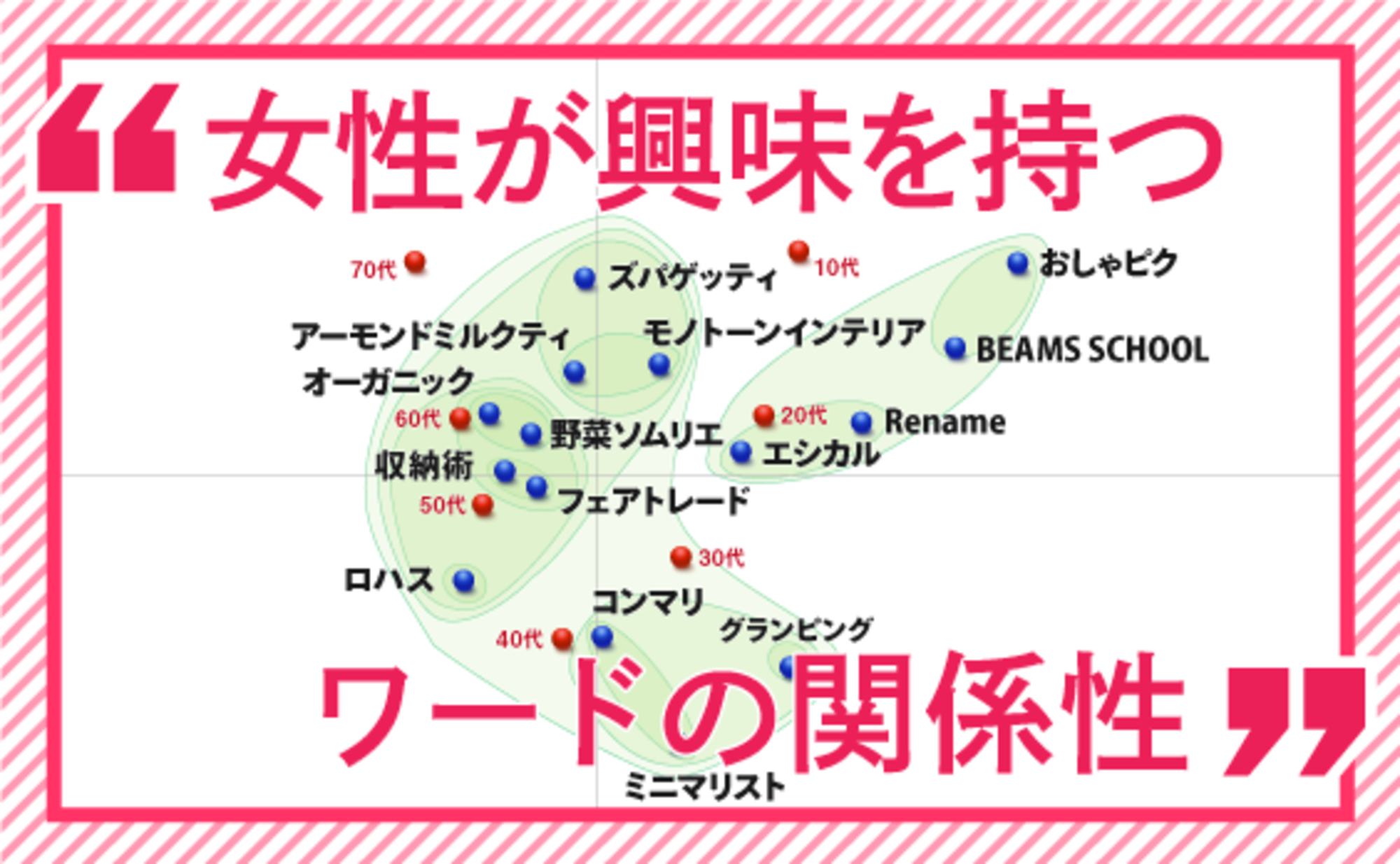

② Generation 96: Ethical and Steady Over Flashy

The '96 generation showed stronger interest in "ethical" and "fair trade" compared to other generations. The former implies acting in line with ethical principles, such as choosing products and services aligned with ethical values. The latter means purchasing Fair Trade certified products to support producers in developing countries.

The combined percentage of those who are "very interested" and "somewhat interested" in ethical products is 15.2% for the Generation 96 cohort, while for fair trade it is 28.4%—the highest among all generations. This indicates that this generation is an ethical generation practicing a solid lifestyle.

③ Generation 81: Secret Fans of Ai Yazawa's Works?!

The 81 Generation showed the highest fan base, with 43.2% combining "Strongly Agree" and "Somewhat Agree" to the statement "I was deeply engrossed in Ai Yazawa's works." Ai Yazawa's works began appearing when the 81 Generation was in elementary and junior high school, and the experiential value gained from reading them then has been passed down within this generation.

Furthermore, NANA began serialization in 1999, when the '81 generation was around high school age. Experiences during adolescence are said to significantly shape subsequent values. While the '81 generation includes the kogal subculture, our lab observes that many possess a fundamentally pure-hearted mentality. Understanding the consciousness and values of this generation may hold clues hidden within Ai Yazawa's works.

④ The PC Net Generation that Overcame Japan's Economic Downturn

The PC Net Generation, whose university years coincided with the release of Windows 95, developed a high affinity for PC internet use. This affinity led them to become a generation that produced many IT venture entrepreneurs. This PC Net Generation was the first to use Rikunabi during the Job Ice Age. Later, during their prime working years, they faced the Lehman Shock (occurring in 2008, when this generation was in their late 20s to early 30s). This cohort, born around 1976 and often called the Nanaroku generation, can be described as a generation that has navigated the turbulent waves of a changing era.

⑤ The 46 Generation with Strong Engagement with Print Media

The Generation 46 cohort, which includes the so-called baby boomers, showed significantly stronger engagement with print media compared to other generations. The combined percentage of those who "often" or "occasionally" engage with print magazines was 45.6%, while for print newspapers it was 66.8%—the highest scores across all generations. These results highlight the high potential of print media for reaching Generation 46.

As a real-world example, the magazine 'Harumeku', with its slogan "Women who shine even in their 50s," surpassed 248,000 copies sold in the first half of 2019, ranking first in sales among women's magazines (according to the Japan Audit Bureau of Circulations). The magazine's success can be attributed to its various initiatives: disseminating information via its website, operating a mail-order business, hosting real-world events, and establishing an official LINE account, all of which have garnered reader support.

Values Revealed Through Insight Building That Incorporates Historical Context

Value formation is influenced not only by changes in the media environment and the information content we are exposed to, but also by the myriad things that existed or did not exist when we were growing up. Deconstructing and visualizing this complex structure is no simple task. However, by dividing age groups into five-year increments and factoring in the historical context each generation was born and raised in, we can relatively easily discern the values of each generation. This approach enables us to build deeper insights.

Next time, we'll explain the affinity between digital services and magazines.

[Survey Overview]

● Survey Name: 12-Tier Female Age Group Survey

● Target Areas: Kanto (Tokyo/Kanagawa/Saitama/Chiba), Chubu (Aichi/Gifu/Mie), Kansai (Osaka/Kyoto/Hyogo/Nara)

● Target Criteria: Women aged 15–74

●Sample Size: 3,000 respondents

●Survey Method: Internet survey

●Survey Period: November 1–5, 2019

●Research Organization: Video Research Ltd.