How much do you think people in your own generation enjoy video streaming services?

※ Usage rate of at least once within the past year

According to a June 2020 survey by Cyber Communications targeting individuals aged 15 to 69 nationwide, approximately 81% of respondents had used video streaming services, including YouTube, at least once within the past year ( survey details are provided at the end of the article ).

It also revealed that these services are no longer used only by younger generations but have grown into media utilized across a wide range of age groups.

So, what differences can be observed between the digital native generation—teens and those in their 20s—and generations more accustomed to traditional media?

This article examines age-specific viewing trends for video streaming services.

Older age groups show low usage rates for platforms other than YouTube. Expect future growth!

First, let's look at usage rates by age group.

※Usage rate within the past 3 months (April–June 2020)

For video streaming services overall, including YouTube, usage rates are high among teens and those in their 20s, exceeding 80%.

Subscription Video on Demand (SVOD) services, represented by Amazon Prime Video and Netflix, have usage rates around 40%.

Usage rates for ad-supported free streaming services (AVOD), such as "TVer" and "Abema TV," range from 30% to 40%.

Among older age groups in their 50s and 60s, while overall video streaming service usage remains high at over 60%, the majority is concentrated on user-generated sites like YouTube. Usage of SVOD and AVOD services remains in the 20% range, indicating room for growth.

Furthermore, television broadcasting maintains usage rates above 80% across all age groups, demonstrating its continued strength as a mass medium.

Music videos are the most-watched content on YouTube across all generations. However, the rankings for second place and beyond differ significantly.

How much do preferred genres change by generation? Here are two rankings.

Official Content Viewing Genre Rankings

For official content operated by corporations like broadcasters and video streaming companies, "dramas" and "movies" are popular genres across all generations.

From third place onward, the 50s and 60s show distinct characteristics compared to other generations, with "Music" and "News" ranking higher.

YouTube Viewing Genre Rankings

For YouTube viewing genres, "Music" is the most watched across all age groups.

For teens to those in their 30s, "Games"—including game playthroughs and strategy guides—are popular. Among teens and those in their 20s, "Try It Out" challenge-style content, a staple YouTube format, also ranks highly.

A notable feature for those in their 40s and older is that "Pets and Animals" ranks second, a category not seen among those under 30. This indicates a strong tendency to watch videos that provide comfort and relaxation in daily life.

YouTube has a higher proportion of solo viewing via smartphones compared to other services, reflecting individual preferences and interests.

Video viewing has become firmly established in consumers' lives during the stay-at-home period. So, how resistant are they to ads?

Video viewing has become ingrained in users' habits following the stay-at-home period during the pandemic. Since June, when this survey was conducted, each service has steadily increased its user base. Naturally, content offerings continue to expand to meet this demand.

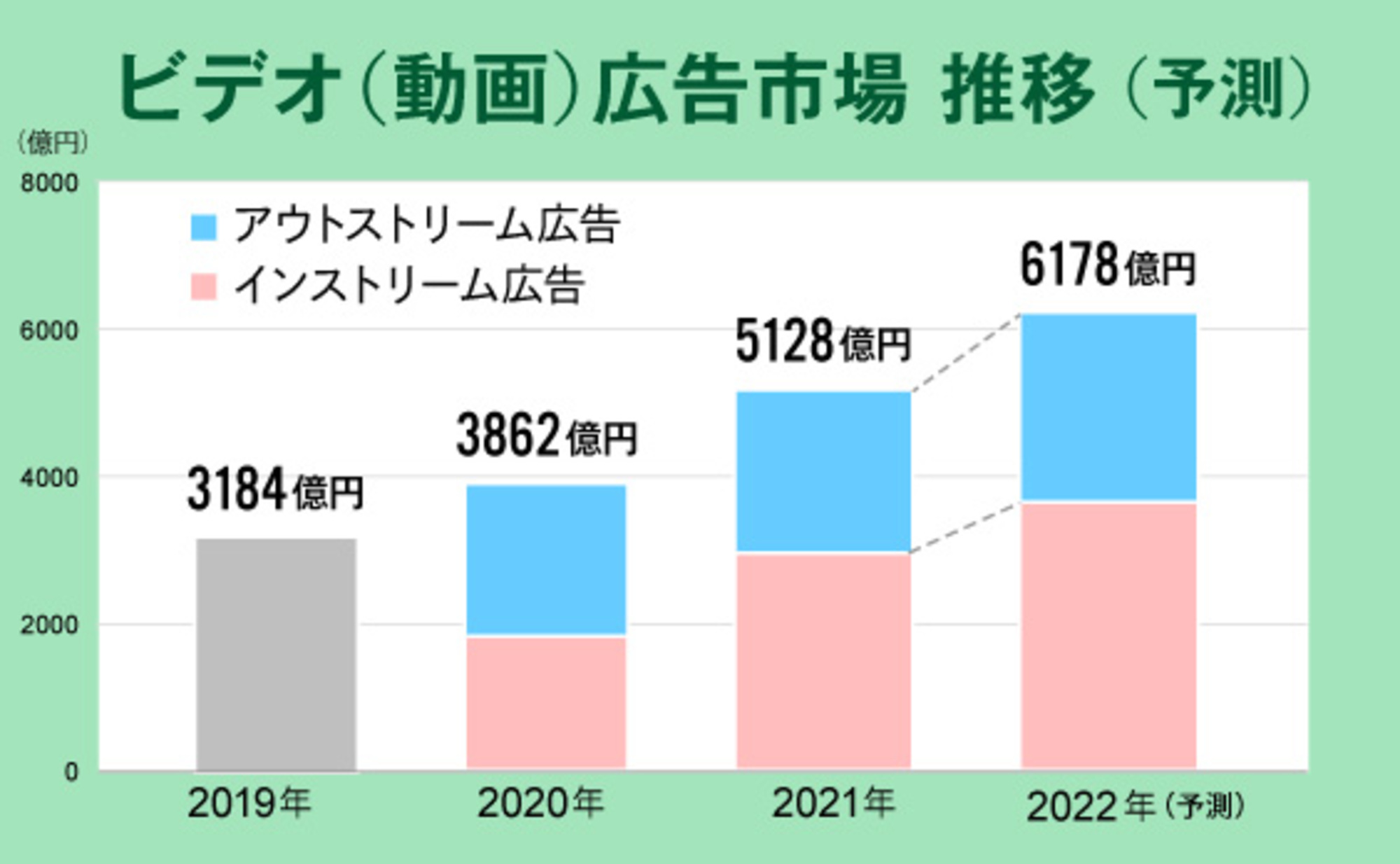

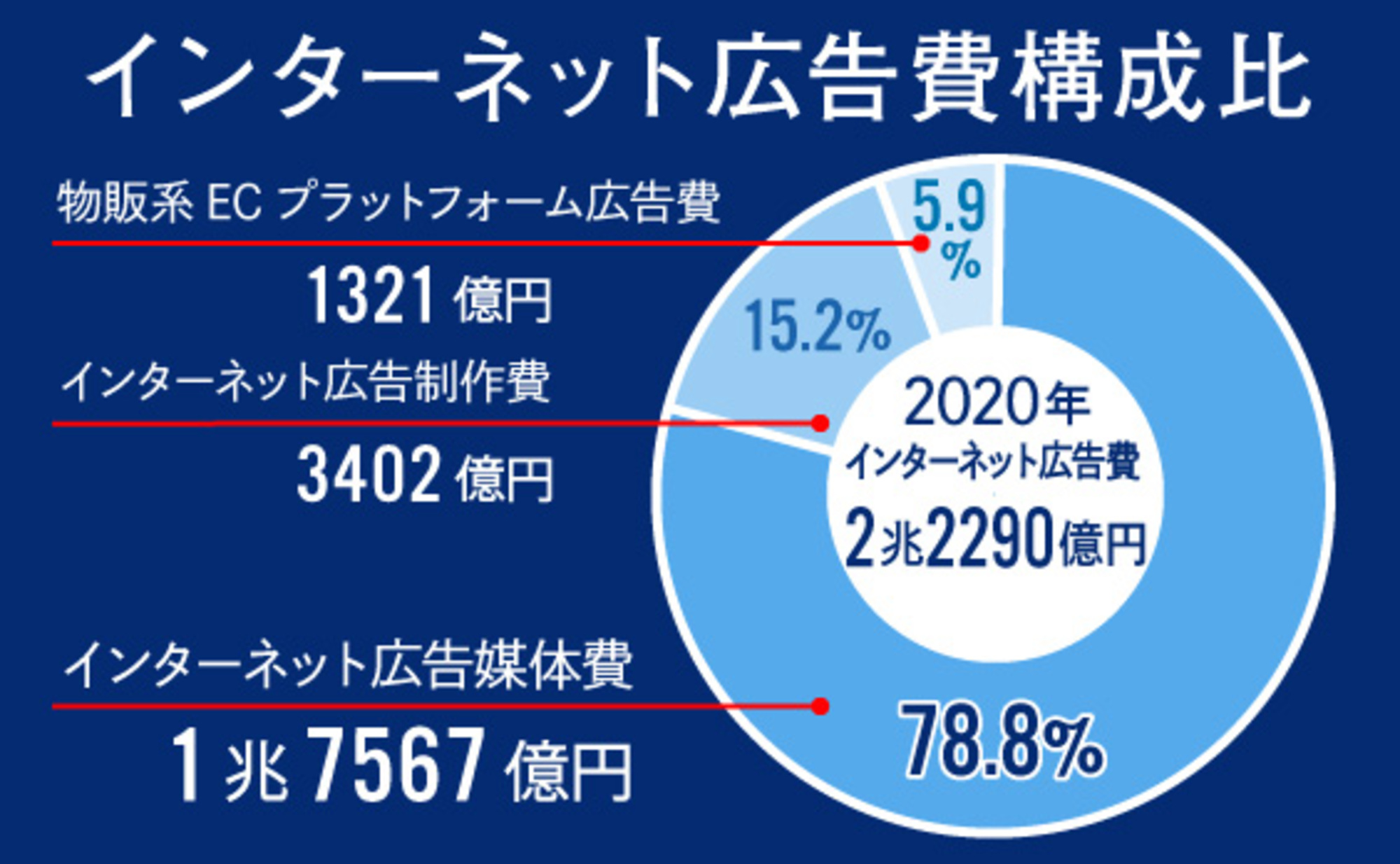

Naturally, video streaming services are also gaining attention as "advertising platforms." So, what image do users have of ads within these services?

The chart above compares the perceived image of video ads versus TV commercials (with points indicating where each type outperforms the other).

TV commercials scored higher than video ads on points like "providing the latest information," "feeling approachable," and "being trustworthy."

Conversely, video ads score higher than TV commercials on "offering unique content," "feeling tailored to me," and "featuring ads in genres I'm interested in."

Don't you think this reflects their respective characteristics?

Couldn't we differentiate their use—TV commercials for delivering the latest information, while video ads use targeting to communicate more deeply with viewers?

Next, let's examine how ads are received by generation. The table below shows the percentage of each generation who answered "I don't find ads painful."

While it's often said that "younger generations are more resistant to ads compared to other age groups," this survey doesn't necessarily show that. Surprisingly, the highest percentage of respondents who answered "I don't find ads painful" for both TV and video ads was among teenagers.

Another point worth noting is that for video ads, the percentage who "don't find them painful" decreases with age (meaning older age groups feel more pain). However, this trend is less pronounced for TV commercials. One possible reason is that viewing habits for video streaming services are still relatively new, leading to less familiarity with video ads.

Although video streaming services are visual media like television broadcasts, they add a more personal element: "watching desired content whenever you want." By leveraging the unique characteristics of the internet for targeting and using original stories that generate "empathy" in advertisements, effectiveness could be further enhanced.

Will video streaming viewing habits become established? Signs seen from "number of services used" by age group

The table below shows the number of video streaming services used by age group, including YouTube.

Among teens and those in their 20s, around 15% use six or more services simultaneously, indicating widespread adoption.

However, overall, the trend is stronger toward "using one or two other services in addition to YouTube."

*Service usage calculated based on usage rate within the three months from April to June 2020

Subscribing to multiple paid SVOD services appears to be a high hurdle, making it difficult for such arrangements to become established. Amidst this "subscription fatigue" among consumers, retaining viewers requires unique strengths, such as compelling original content unavailable elsewhere.

Amidst this, the continuous growth in users for "ad-supported video streaming services that offer free viewing," such as "TVer," is a noteworthy point. The strength of being "free" lowers the barrier to viewing, and further expansion in usage is anticipated.

Additionally, services adopting "hybrid" models—combining paid plans with ad-supported options—will likely emerge to attract more users.

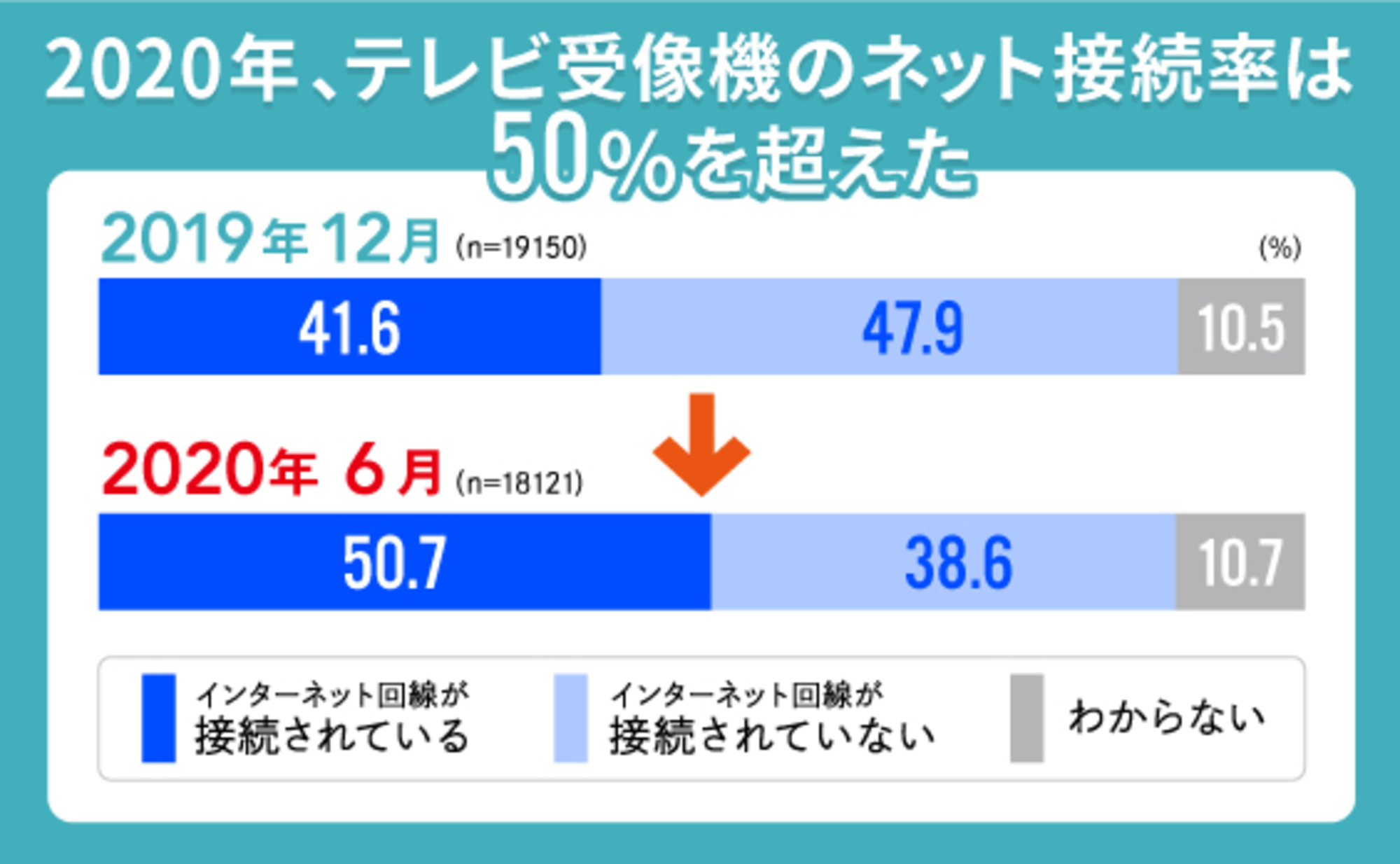

In this series, we examined the latest viewing trends for video streaming services: Part 1 focused on the rise in internet-connected TVs, and Part 2, this installment, looked at viewing tendencies by age group. The pandemic has accelerated society's digital transformation. Video viewing for entertainment is currently at a pivotal phase, permeating all generations.

We will continue to closely monitor which services will establish themselves and how they will do so.

<Survey Overview>

"Domestic Video Streaming Service Detailed Report"

・Survey Purpose: To clarify the actual usage of video streaming services and identify characteristics within service genres

• Survey Purpose: To clarify the usage patterns of video streaming services and understand the

・Survey Area: Nationwide

・Survey Method: Internet survey

・Survey Participants: Men and women aged 15–69

・Sample Size: 6,000 per group

・Survey Conducting Agency: Video Research Ltd.

・Survey Period: December 23, 2019 - December 25, 2019 / June 12, 2020 - June 14, 2020