The NIKKEI National Company Song Contest (nicknamed "Company Song Con") invites companies to submit company song videos, with the winner determined through online voting and judging by a special panel.

Organized jointly by the Nikkei Inc., JOYSOUND (XING), and Dentsu Inc., this contest is now in its third year and is currently accepting applications from participating companies starting July 8th ( see the official website for details ).

Starting this year, Cocopelli, which operates the management support platform "Big Advance" for small and medium-sized enterprises (SMEs), has joined as a new partner to help energize the contest.

Dentsu Inc.'s Kohei Morimoto, who launched the contest, interviewed Shigeru Kondo, CEO of Cocopelli, and Ayako Ima-Yasu, PR Manager, about Cocopelli's vision for the future, the appeal of SMEs, and how these align with the Company Song Contest.

[Cocopelli Inc.]

Founded in 2007. Develops and operates services including the SME management support platform "Big Advance" and "SHARES," which enables on-demand consultations with experts like social insurance and labor consultants and lawyers. Supports SME growth in collaboration with financial institutions. A rapidly growing startup that achieved listing on the Tokyo Stock Exchange Mothers market in 2020.

https://www.kokopelli-inc.com

Delivering technology to SMEs, finding the future within corporate value

Morimoto: Thank you for sponsoring the company anthem contest. Cocopelli's mission to support the growth of companies, including SMEs and financial institutions, aligns with the contest's philosophy. First, could you briefly reintroduce Cocopelli?

Kondo: Cocopelli operates under the mission "Discover the future within corporate value" and the vision "Deliver technology to SMEs." As times change, business grows increasingly complex, and corporate value becomes harder to discern. By leveraging technology to visualize corporate value, we aim to increase the number of companies that grow more and become more beloved. That sentiment is embedded in our mission and vision.

Morimoto: Why did you decide to leverage technology?

Kondo: Because we concluded that technology was essential to realizing our mission and vision. When we first started, we mainly provided back-office support for SMEs, but we often received consultations about labor and legal matters too. The underlying issue was that many SMEs couldn't afford to hire dedicated labor consultants or tax accountants. That's why we launched "SHARES" – a service where you can consult experts nationwide with zero monthly fees. It's a service that truly supports SMEs: requesting quotes is free, and they can choose the best expert from multiple quotes.

Morimoto: Getting multiple quotes from labor consultants and lawyers is revolutionary. Was there any backlash from the experts?

Kondo: It was tough until the service gained traction. While we now have nearly 3,000 registered experts, for the first few hundred, I visited each one personally, passionately arguing, "We need your help to save SMEs!" (laughs).

Morimoto: Even though it's a tech-based service, the process of building it felt very analog and required immense passion.

Kondo: On the other hand, since "SHARES" is a web service, we faced the challenge of reaching people who don't use the web much, like small town factories. When thinking about how to spread the word, we realized that the local financial institutions were where SMEs communicated most. So, to have financial institutions take on that last mile of delivering our service, we developed "Big Advance" in collaboration with Yokohama Shinkin Bank.

Big Advance: Japan's first platform where financial institutions nationwide collaborate to provide business support to their client companies. For a monthly fee of ¥3,300, client companies receive various services including IT-driven operational efficiency, sales channel expansion, talent acquisition, and information provision. Financial institutions can then provide business support and conduct lending activities based on the usage patterns of their client companies.

Morimoto: It's a fantastic partnership, isn't it? Beyond contributing to SMEs, it also enhances the value of regional financial institutions navigating transitional periods due to regulatory changes. By offering services like talent acquisition and business matching, they can increase their value.

Kondo: It's not uncommon for companies to be denied loans by financial institutions. While that's sometimes unavoidable, for business owners, it feels like being branded as "untrustworthy" by an entity that's like an extension of themselves. Mentally, it's quite tough. At that moment, just having a financial institution suggest, "We can't provide a loan, but how about this business matching opportunity?" can be a huge relief. It changes the relationship with the financial institution, doesn't it?

Morimoto: Ultimately, if business matching helps their core business grow, they might avoid taking on debt. That aligns perfectly with the role financial institutions should play in supporting the local economy.

We want to create a world where SMEs can hold their heads high

Morimoto: Mr. Kondo, you've consistently championed supporting SMEs since founding your company. What was the original experience that shaped this?

Kondo: I was born and raised in Aichi Prefecture, so manufacturing SMEs were close at hand. I also had many local friends actually working there. I went to university in Tokyo at 18. Being in the sciences, I imagined a future where I'd go straight to grad school and then join a systems-related company. But at the end of my third year of university, I suddenly paused and thought, "I've never even left Japan once. Is this really okay?" I immediately submitted a leave of absence, flipped through study abroad books at a nearby bookstore, and intuitively decided to go to San Diego, USA.

Morimoto: That's incredible initiative.

Kondo: I bought just a one-way ticket. Since I had no money, I took a route via Portland and Salt Lake City to get to San Diego. I knew so little I even confused Portland with Poland (laughs).

What struck me when I arrived was how vibrant everyone seemed—the street cleaners, the cashiers, the factory workers. Even at the supermarket, customers never acted superior to the cashiers; everyone said "thank you" before leaving. Maybe because it's a nation of immigrants, I felt a sense of mutual fairness and respect.

Morimoto: That's true, it's probably not a common sight in Japan.

Kondo: I returned to Japan with that culture shock, but at the time, tech startups were booming. That sparked my desire to start my own business someday. So I took a sales job at a bank, where I could meet many business owners.

Morimoto: I see, so you joined the company with entrepreneurship in mind from the start.

Kondo: After joining the company, while actually handling loans for small and medium-sized enterprises (SMEs), I noticed that the SME owners were all vibrant and full of life, giving off the same vibe as the people I met in America. On the other hand, I felt uneasy about how excessively deferential they were towards financial institutions. Banks are also in the business of lending, so it should be an equal relationship. I thought they shouldn't have to bow and scrape to young bank employees like me.

Carrying this personal frustration, I moved to a small business I knew. There, I realized that while owners should be focusing their energy on their core business, they were having their time stolen by back-office tasks like accounting and payroll.

I wanted to reduce the back-office burden so business owners could focus on enhancing corporate value, creating a society where SMEs could thrive with confidence. Just as this mission was solidifying within me, the company I worked for unexpectedly went bankrupt. That's when I took the plunge and founded Cocopelli.

Kokopelli is a spirit from Native American mythology. While each tribe has its own distinct spirits, Kokopelli is the only one said to appear across all tribes. Legend tells that he sows seeds from his back, bringing prosperity to the earth.

Morimoto: I see. My parents also ran a small business, so I witnessed firsthand how much resolve entrepreneurs must have, even on a small scale. I deeply resonate with your belief that "SMEs should hold their heads high." The more I met remarkable SME leaders through my work, the more I felt I couldn't use the term "support" for them. It seemed presumptuous to offer "support" to people continuously challenging and succeeding in fields far beyond my own expertise.

Kondo: I understand. Terms like "small and medium-sized 'micro' enterprises" are truly awful, aren't they? Every day, we think about how SMEs, financial institutions, and us should all grow together as equal partners.

It's not about the numbers increasing, but the feeling of gaining more allies.

Morimoto: For this company anthem contest, our PR manager, Ms. Ima-Yasu, has been incredibly dedicated. How did you come to join Cocopelli?

Ima-yasu: I started my career at an insurance agency with thousands of employees, working in sales and HR before moving to the president's office handling internal communications. While I found that work very rewarding, I also wanted to experience working at a company where I could know people personally. I also wanted to challenge myself to build up our own services as a PR professional, rather than just promoting an agency's offerings. That's why I started looking for a new job.

That's when I happened to come across Cocopelli. To be honest, I wasn't entirely sure what kind of company it was at first, but it just seemed interesting somehow, so I applied.

Morimoto: What ultimately made you decide to join?

Ima-Yasu: The first interview was conducted by the current director. He spoke about the company and the service with such candor—to the point where I thought, "Is it really okay to share that much with an outsider?" His passion was overwhelming; I probably didn't even speak for five minutes (laughs). But it was clear he had absolute confidence in their product and genuinely believed it could benefit small and medium-sized enterprises and Japan as a whole. By the way, I'd heard there was a second interview, but at the end of the first one, they said, "We're absolutely sure you'll be a great fit—you're in!" So I decided on a gut feeling to join this company (laughs).

Morimoto: That's amazing. How has it been since you actually joined?

Ima-Yasu: I knew nothing about the financial industry, and it was my first time working at a small company. I'd never even talked to engineers before, so I was full of anxiety. But since joining, every day has been stimulating. More than anything, meeting the people at small and medium-sized businesses—seeing how vibrantly they live their lives—makes me think every day that joining was the right decision.

Morimoto: That's an answer worthy of a recruitment interview (laughs). Seeing Cocopelli's releases daily, I notice you're constantly traveling all over the country. "Big Advance" is clearly spreading rapidly too, with 72 financial institutions and over 50,000 member companies. Looking at the financial results, the needs of financial institutions and companies nationwide are reflected in both sales and profits, showing rapid growth.

Ima-Yasu: When I joined, we had just one partner financial institution and around 1,000 users. Thinking back to that makes me feel quite emotional. But more than just numbers increasing, it feels like our community is growing. At our regular events, we all brainstorm together about how to improve our regions, transcending business types. The value in that always moves me deeply.

Morimoto: I believe one of the strengths of SMEs lies in their horizontal connections and sense of solidarity among peers. When one business owner decides to take action, their fellow owners quickly gather to co-create together. This dynamic movement, which is difficult to achieve in large corporations, holds significant value.

Scene from a Big Advance financial institution representative networking event

The shining faces of those singing the company anthem led to our decision to sponsor

Morimoto: Finally, could you tell us why you chose the company song contest as the first sponsorship project since founding?

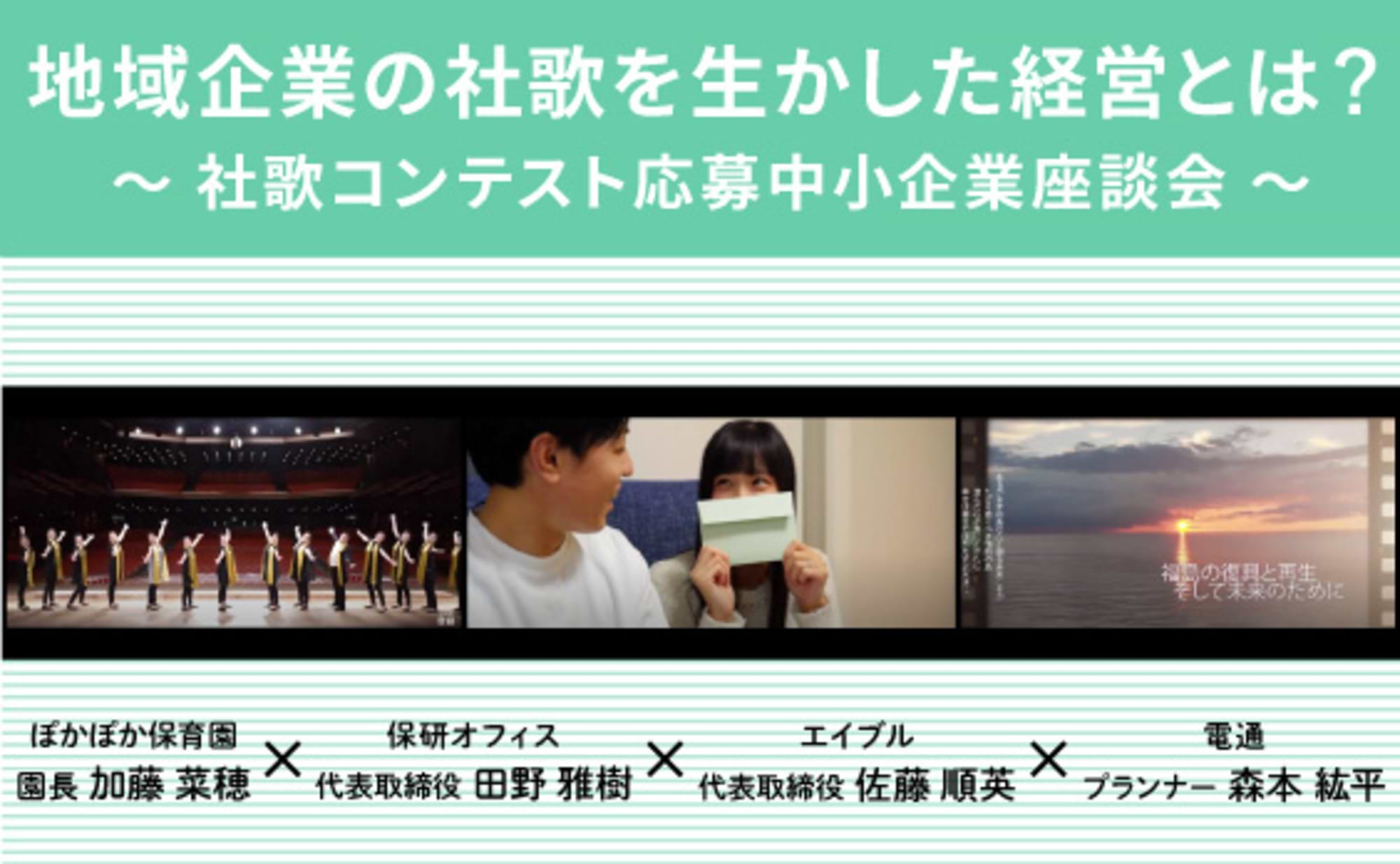

Kondo: When I first heard about the company song contest, I honestly didn't get it and was going to decline. But Iya-san kept pushing me, so I tried watching a video. The expressions on everyone's faces were shining, and I was incredibly moved.

Imanishi: Company songs don't usually have a sparkling image, but the contest was different. It truly featured the very people we wanted to support.

Kondo: Watching that video changed my mind instantly. In a society where small and medium-sized enterprises are overwhelmingly dominant, if those people could take pride in their own companies, the world would definitely become a better place. I felt the company song could play that role.

Ima-Yasu: It has the potential to engage not just the company but the entire community. The contest could also spark new connections between businesses.

Morimoto: Thank you for your kind words. We believe the core value of the company anthem contest is building community. We aim for it to spark ongoing connections, not just a one-time event. The organizing team—including host Nikkei Inc., special collaborator JOYSOUND (XING), judges, and supporting companies—is made up of passionate members. We'd love for Cocopelli to join us too.

Kondo: That's great! I'm looking forward to it. "Big Advance" also aims to be a community where companies can utilize each other, so I feel it fundamentally resonates with the company song contest.

Morimoto: Thank you. It's deeply meaningful to be collaborating in this way, three years after we assisted with the 2018 Yokohama Big Advance launch event and PR at the request of Yokohama Shinkin Bank. We'd be thrilled if Big Advance member companies also participated, helping us all make the company anthem contest a success. Thank you for today!