Note: This website was automatically translated, so some terms or nuances may not be completely accurate.

Interview with CyberAgent President Shun Fujita: The State of Advertising Today. Special Discussion on "2022 Japan Advertising Expenditures"

Shin Fujita

CyberAgent, Inc.

Ritsuya Oku

Representative of Media Vision Lab

dentsu Media Innovation Lab

Dentsu Inc.

Japan's advertising expenditure in 2022 reached a record high of ¥7.1021 trillion, a 104.4% increase from the previous year ( see overview here ). Of this, ¥3.0912 trillion was spent on internet advertising.

What lies ahead for internet media and advertising?

Ritsuya Oku of Dentsu Inc. Media Innovation Lab spoke with Shin Fujita, President and CEO of CyberAgent, about the 2022 review and future outlook.

▼Internet Advertising Continues to Grow, but What is the Core Advertising Model?

▼Seeing New Possibilities for Internet Advertising in the Spread of "Connected TV"

▼The Future of the Live Streaming Era Seen in ABEMA × Soccer World Cup

▼Realizing "Passive Viewing" is Essential for Establishing Advertising Models

Related Articles

"2022 Japan Advertising Expenditure" Explained: Exceeding ¥7 Trillion, the Highest in 15 Years. Internet Advertising Surpasses ¥3 Trillion

Analysis of "2022 Internet Advertising Media Spending": What's the Breakdown of the Record-Breaking ¥3.0912 Trillion?

Internet advertising continues to grow, but what is its core advertising model?

Oku: Japan's advertising expenditure in 2022 exceeded 7 trillion yen, setting a new record high. It can be said that the industry has overcome the downturns of 2020 and 2021 caused by the COVID-19 pandemic and is back on a growth trajectory. How do you view this result, Mr. Fujita?

Fujita: It feels a bit unexpected. In 2022, the pandemic wasn't yet under control, global conditions were unstable, the US raised interest rates, and Japan faced inflation due to yen depreciation and soaring energy prices. I felt the economy wasn't doing particularly well.

Oku: The major factor driving up Japan's advertising spending is undoubtedly the growth in internet advertising. Looking at recent years, internet advertising spending first surpassed television media advertising in 2019. In 2021, internet advertising spending exceeded the total advertising spending across the four major media outlets. Then in 2022, internet advertising spending surpassed 3 trillion yen, accounting for 43.5% of total advertising spending.

While Japan's total advertising spending exceeded 7 trillion yen for the first time since 2007, its composition has changed significantly, clearly highlighting the prominence of internet advertising spending.

Fujita: I get the impression that DX (digital transformation) has rapidly advanced across society in recent years. However, even though internet advertising spending is growing, it hasn't established clearly high-impact advertising slots like TV commercials or front-page newspaper ads.

The internet market portfolio changes at a dizzying pace, and it feels like growth continues without a core advertising model. Of course, looking at consumers' media exposure time, I believe internet usage now dominates, so I'm confident overall growth will continue.

Oku: Even online, formats closer to mass media, like reserved advertising, have clearly defined slots. But what's actually growing is programmatic advertising and search-linked ads. In that sense, it's true that significant growth continues, even though understanding the actual situation is more challenging than before.

One key indicator for predicting future trends is media consumption among teenagers. The media landscape shifted dramatically even during the pandemic. How do you interpret the viewing behavior of younger demographics?

Fujita: Younger audiences definitely seem to watch video services like YouTube and TikTok the most. This might be a leading indicator. For example, middle-aged and older people watched a lot of TV growing up and still do today. Thinking about that, you can kind of see where things might be in 30 years. The internet has shifted dramatically from text to video-based content. Back in the day, bloggers held the most influence, but now YouTubers wield significant power.

Seeing New Possibilities for Internet Advertising in the Spread of "Connected TV"

Oku: One major change in the media landscape is the significant increase in users of internet-connected TVs, or so-called Connected TVs. Do you use one at home, Mr. Fujita?

Fujita: Yes. My wife and kids each watch their favorite content on their smartphones, but during meals, we decided to stop looking at our phones and watch TV together. My child asked, "Is TV okay?" But I figured since TV is something we watch together and share that time, it's fine.

Okuda: Traditionally, the TV was in the living room, and there was a habit of everyone watching the same content together during dinner. Now, it's connected to the internet, and we're in an era where we can watch online video content on a big 55-inch screen. What are your thoughts on the advertising effectiveness of connected TVs?

Fujita: Once, while watching TV in the dining room, I saw an ad for a game from one of our group companies. I thought, "Oh, they're advertising on terrestrial TV," but when I looked closer, it was actually on ABEMA.

Oku: That's true. With connected TV, it's sometimes hard to tell immediately which platform you're actually watching.

Fujita: That was the first time I thought, "Maybe we can create value close to that of terrestrial TV advertising."

Oku: When you create a shared viewing experience where everyone watches together on a big TV screen, the brand lift effect is significant, right?In 2022, "THE MATCH 2022" (Tenshin Nasukawa vs. Takashi) streamed on ABEMA. While pay-per-view ticket sales exceeded 500,000, Video Research Ltd. found that approximately 1 million people nationwide watched via connected TVs (※). That means roughly two people were gathered around each TV.Since TVs aren't one per person like smartphones, multiple people watching one TV screen translates to very high impressions for internet advertising.

※PPV (pay-per-view) = A service allowing access to live sports broadcasts and similar content by paying per program.

Fujita: Since PPV is paid, it might make sense for multiple people to watch together.

Oku: And I think there's a renewed appreciation for large screens, in the sense that video content is better experienced on a big screen.

Fujita: But I also found something a bit surprising. When streaming the FIFA World Cup Qatar 2022 (hereafter, the World Cup) on ABEMA, we focused intensely on video quality, assuming viewers would want to see the play on a large screen with beautiful visuals. After all, it's more enjoyable on a big screen and less tiring than watching on a smartphone.

But when we actually looked at the data, more viewers than expected were watching on their smartphones. It was surprising that so many people were watching on a smartphone screen, which is much smaller than a TV, even though players on such a vast field can sometimes look small even on a TV.

Oku: Could it be that the idea of watching online video streams on your own TV hasn't really caught on yet?

Fujita: That might be part of it, but it reminded me of something from the past. When i-mode launched during the flip phone era, I thought shopping sites wouldn't catch on because the image quality was poor and the screens were small. But in reality, products sold incredibly well and the business grew. This experience made me realize again that people who prefer small screens are actually the majority.

Another barrier to connected TV adoption might be "hassle." While set-top boxes like Fire TV, Chromecast, or Apple TV let you instantly enjoy various streaming services on an internet-connected TV, people who don't use them simply aren't interested. But if an "ABEMA button" came built into the TV remote from the start, people would watch. I think this is less about digital literacy and more about the sheer "hassle" involved.

The Future of Live Streaming Revealed by ABEMA × Soccer World Cup

Oku: 2022 also saw major news with ABEMA streaming all 64 matches of the Soccer World Cup for free. It left a significant mark on internet media history. I was deeply impressed by Mr. Fujita and the ABEMA staff's dedication.

Fujita: Broadcasting the World Cup was an enormous challenge for us. I truly feel this initiative became a major turning point for ABEMA to establish itself as a media platform.

Oku: Beyond live coverage of every match, users could watch full replays or highlights. Plus, on connected TVs, you could easily select content using the remote's directional pad. I believe ABEMA's World Cup broadcast also helped establish the habit of enjoying internet content on connected TVs.

Fujita: Thank you. ABEMA's multi-device viewing capability, allowing access anytime, anywhere, was particularly well-received. That said, features like "live streaming," "catch-up streaming," "highlights," and "multi-angle" weren't prepared specifically for this event; we'd spent considerable time developing them beforehand. The major achievement was using the World Cup as an opportunity to communicate these features to a large audience.

Oku: Many matches during this World Cup took place late at night to early morning Japan time. Looking at various data, we felt it was particularly popular among younger, male-centric demographics: teenagers, M1 (men aged 20-34), and M2 (men aged 35-49).

Fujita: Yes, M1 saw the biggest growth. Key factors in ABEMA's increased viewership were TV Asahi's cooperation and Keisuke Honda's commentary. Even terrestrial TV talk shows featured discussions about his commentary, so viewership grew with each match. Honda himself didn't expect his commentary to be so well-received (laughs).

Oku: It seems many viewers chose ABEMA specifically to hear Honda's commentary. Beyond the commentary, viewers could also watch the players' actions through multi-angle footage, selecting their preferred camera view from multiple camera feeds.

Fujita: However, we also saw current limitations. One issue was the delay compared to terrestrial broadcasts. This depends on each viewer's internet environment, so it can't be completely eliminated. Another was ABEMA's "entry restrictions." We implemented them during the Japan vs. Croatia match because heavy traffic made stable streaming impossible for all viewers. Had Japan advanced to face Brazil, further restrictions would have been necessary.

Oku: If you left the stream, you could potentially be subject to entry restrictions even if you had been watching previously.

Fujita: If that happened too often, it would be a poor user experience. And this isn't just a matter of ABEMA scaling up its servers; there are also limitations on the ISP (Internet Service Provider) side, so it's something we can't control. This remains a challenge.

Oku: I see. Still, having watched the evolution of the internet for so long, it was deeply moving to see internet media reach this point.

Fujita: That's certainly true. The internet evolved from text-based platforms like chat rooms and bulletin boards, then broadband arrived, smartphones became widespread, devices got stylish, and now we're here. But the ability to watch live soccer streams on your smartphone is actually a very recent development.

Oku: It truly feels like we're pioneering a new era for internet media.

Fujita: Broadcasting the World Cup has led to major content being brought to ABEMA, and more people wanting to appear on our shows. Viewer trust and favorability have also increased, and we're seeing various positive effects.

Establishing an advertising model requires enabling "passive viewing"

Oku: I heard the ratio of real-time viewing to on-demand viewing (※) for the World Cup broadcast was 56 to 44. Was the higher-than-expected on-demand share due to people wanting to catch up on missed matches or watch the secondary games?

※On-demand viewing = A viewing style where viewers can watch the content they want, from the beginning, at the time they choose. This includes catch-up streaming as well as movies and dramas on paid video streaming services.

Fujita: Typically, sports and competitive content sees much higher live viewership, so nearly half being on-demand was surprising. Probably, for the World Cup, many matches were scheduled late at night to early morning Japan time.

Oku: Due to the broadcast times, TV ratings weren't particularly high, but ABEMA saw a significant gap, with 17 million viewers on December 2, 2022, when the Spain match aired. Considering the high mobile viewing figures, it makes you think a lot of people were watching from their beds (laughs).

Fujita: Meaning they planned to watch but intended to go to sleep right away depending on how the match unfolded (laughs).

Oku: That 17 million figure is truly astonishing. Also, I hear the livestream of the Shogi A-Class Playoff between Ryuo title holder Sota Fujii and 8-dan player Akihito Hirose on March 8, 2023, drew over 4 million viewers.

Fujita: It's becoming the go-to place to watch shogi on ABEMA. When there's a big match, a lot of people tune in. Unlike soccer, shogi has less screen action—it's common for no moves to be made for 30 minutes. But even then, the commentators keep analyzing every possible scenario, so there's never a good time to stop watching (laughs).

Oku: I hear that users gained from the World Cup are showing interest in other content too, with viewership increasing across various genres on ABEMA.

Fujita: It seems many of the M1 demographic stuck around, leading to growth in genres like shogi, combat sports, and anime. Take shogi—if ABEMA becomes synonymous with a genre, it significantly boosts its value as a media platform.

Oku: Another representative ABEMA content is the news channel. We always ensure unlimited time coverage, streaming every press conference in full.

Fujita: I believe news is the core of any media platform. It's precisely because we have this core that we can take on new challenges daily. To cultivate the habit where people think, "Is ABEMA covering this?" when a major event or incident occurs, I believe the news channel must always be operational for those who come to watch.

Oku: On the other hand, ABEMA also offers rich content like movies and dramas for its paid service, ABEMA Premium. Could you share your approach to the free and paid models on ABEMA?

Fujita: ABEMA's foundation remains free streaming, a model generating revenue through advertising. However, looking back at television history, the advent of video and scheduled recording brought the challenge of skipped ads. Keeping that in mind, we created ABEMA Premium, a subscription-based paid service. Additionally, we offer pay-per-view (PPV) for sports and other content, providing real-time streaming for a fee.

Oku: With ABEMA's value as a media platform rising since the World Cup, what is the outlook for the free ad-supported model?

Fujita: Since creating ABEMA, I've been deeply committed to "passive viewing." In a style where users actively choose and watch content on-demand, commercials aren't seen. However, because the internet is fundamentally active, creating points for "passivity" is harder than expected. Not just ABEMA, but internet media in general is still searching for the ideal form to integrate ads without annoying users.

Oku: That's the core advertising model you mentioned earlier. Still, what strikes me about ABEMA is how well it navigates between live streaming and its archived on-demand content.

Fujita: We put a lot of thought into that. That said, there's a dilemma: the more we improve convenience, making catch-up playback and on-demand viewing easier, the less time users spend passively watching content. We need to keep exploring ways to encourage more passive viewing.

Oku: I also see potential in what you mentioned earlier about users not realizing they were watching ABEMA video ads on Connected TV. I look forward to seeing what ABEMA, constantly challenging itself with new initiatives in the internet world, will achieve next. Thank you for today.

Was this article helpful?

Newsletter registration is here

We select and publish important news every day

For inquiries about this article

Back Numbers

Advertisement

Advertisement2022/04/05

Special Discussion: "Japan's Advertising Expenditures in 2021." The Era of DX and Advertising's Social Responsibility

Advertisement

Advertisement2021/03/25

Special Discussion: "2020 Japan Advertising Expenditures"

The Convergence of Online and Offline Accelerates. How Will the Role of Media Change?

Author

Shin Fujita

CyberAgent, Inc.

President and Representative Director

In April 2016, TV Asahi and CyberAgent launched "ABEMA" (initially named "AbemaTV"), a new future television service as a joint venture. As the executive producer, he oversaw content expansion and product development.

Ritsuya Oku

Representative of Media Vision Lab

Honorary Fellow, DENTSU SOKEN INC. / Director, Video Research Ltd. Media Design Institute

Joined Dentsu Inc. in 1982. Served in Media Services / Radio,TV Division, Media Marketing Division, and later held positions as Fellow at DENTSU SOKEN INC. and Head of Dentsu Media Innovation Lab. Left Dentsu Inc. at the end of June 2024. Established Media Vision Lab, a personal consulting practice. Primarily provides consulting services to media-related companies in the information and communications sector, focusing on three perspectives: business, audience, and technology.

Publications include: "The Birth of Neo-Digital Natives: The Internet Generation Evolving Uniquely in Japan" (co-authored, Diamond Inc.), "An Explanatory Guide to 'The TV Theory That Has Come Full Circle' and the Outlook for Broadcasting Services" (co-authored, New Media), "Confirming the Acceptability of Simultaneous Online Streaming of Broadcasts" ("Nextcom" Vol. 2017 No. 32, KDDI Research Institute), "New Media Textbook 2020" (co-authored, Sendenkaigi), "70-Year History of Commercial Broadcasting" (co-authored, National Association of Commercial Broadcasters in Japan), "Broad and Universal Online Distribution / NHK and Commercial Broadcasters: From Competition to Cooperation" ("Journalism" December 2022 issue, Asahi Shimbun), and "Information Media White Paper 2024" (co-authored, Diamond Inc.). Member of the Ministry of Internal Affairs and Communications' "Study Group on the Future of Broadcasting Systems in the Digital Age." Member of the Publishing and Editorial Committee, NPO/Broadcasting Critics Conference.

Series The Future of Media

The Future of Media "2014 Japan Advertising Expenditures" Special Interview

"2014 Japan Advertising Expenditures" Special Interview Smartphones and the Japanese

Smartphones and the Japanese Shiodome Media Researcher Commentary

Shiodome Media Researcher Commentary Special Discussion: "Japan's Advertising Expenditures"

Special Discussion: "Japan's Advertising Expenditures" The Near Future of Advertising from the Device's Perspective

The Near Future of Advertising from the Device's Perspective Smartphones: A Decade of Creative Destruction

Smartphones: A Decade of Creative Destruction The "Time Performance Era": How Should We Design Viewing Environments for Consumers?

The "Time Performance Era": How Should We Design Viewing Environments for Consumers? Information Media White Paper 2024: The Rapidly Changing Media Environment and Consumers

Information Media White Paper 2024: The Rapidly Changing Media Environment and Consumers

dentsu Media Innovation Lab

Dentsu Inc.

Launched in October 2017, leveraging Dentsu Inc.'s longstanding media and audience research expertise. Conducts research and disseminates insights to capture shifts in people's diverse information behaviors and understand the broader media landscape. Provides proposals and consulting on the communication approaches companies need within this context.

Series Insight Memo

Insight Memo Special Discussion: "Japan's Advertising Expenditures"

Special Discussion: "Japan's Advertising Expenditures" Explore the Amazing World of YouTube Creators with UUUM

Explore the Amazing World of YouTube Creators with UUUM Information Media White Paper 2024: The Rapidly Changing Media Environment and Consumers

Information Media White Paper 2024: The Rapidly Changing Media Environment and Consumers Life Stage Matters More Than Age!? Analyzing Women's Media Behavior in the Age of Diversity

Life Stage Matters More Than Age!? Analyzing Women's Media Behavior in the Age of Diversity 100 years since its birth. Radio, today...

100 years since its birth. Radio, today... College Students and the Future of Media, Communication, and Advertising in Ten Years

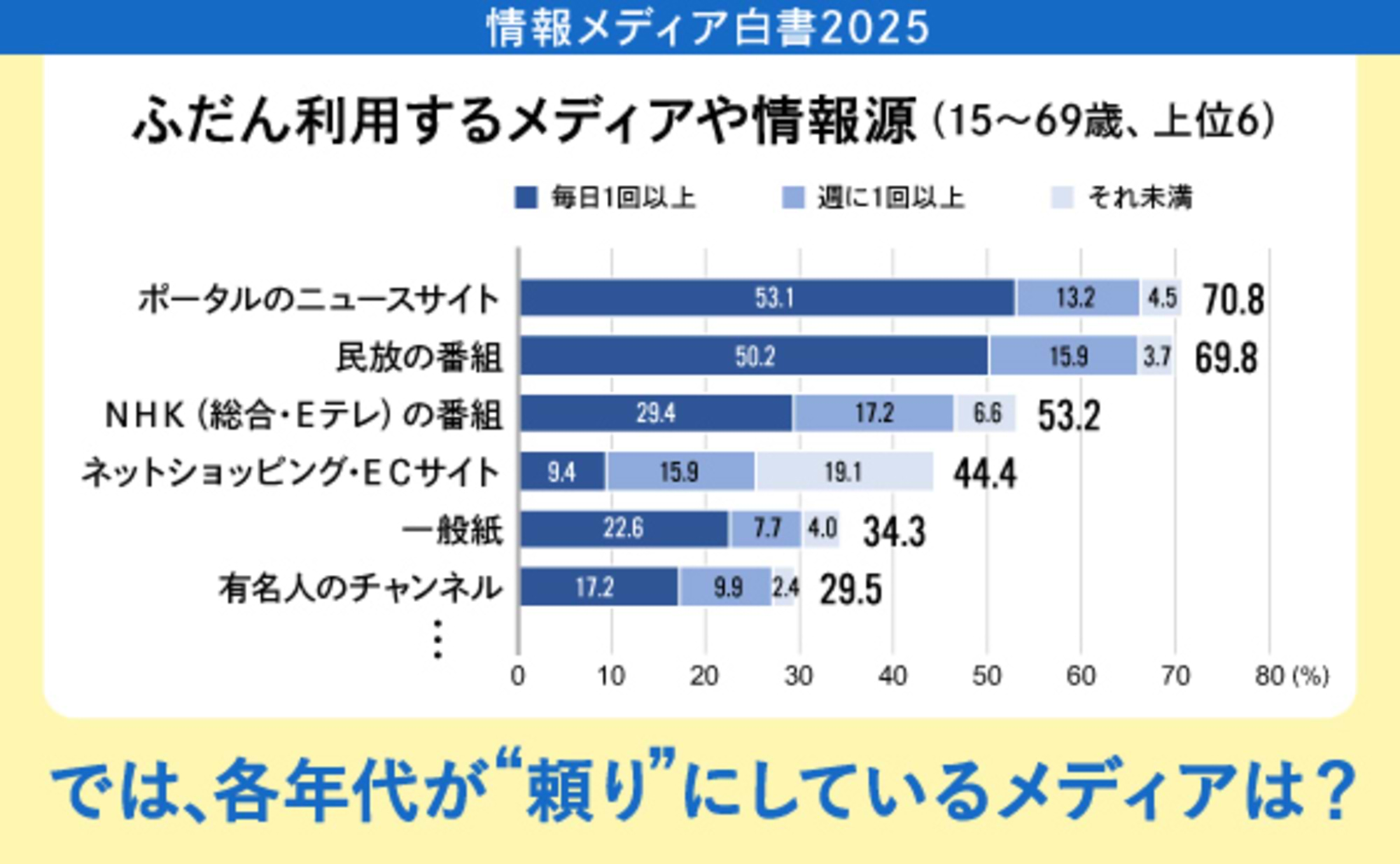

College Students and the Future of Media, Communication, and Advertising in Ten Years Information Media White Paper 2025: New Horizons in Communication Shaping the Future

Information Media White Paper 2025: New Horizons in Communication Shaping the FutureAlso read

▼Internet Advertising Continues to Grow, but What is the Core Advertising Model?

▼Seeing New Possibilities for Internet Advertising in the Spread of "Connected TV"

▼The Future of the Live Streaming Era Seen in ABEMA × Soccer World Cup

▼Realizing "Passive Viewing" is Essential for Establishing Advertising Models

Related Articles

"2022 Japan Advertising Expenditure" Explained: Exceeding ¥7 Trillion, the Highest in 15 Years. Internet Advertising Surpasses ¥3 Trillion

Analysis of "2022 Internet Advertising Media Spending": What's the Breakdown of the Record-Breaking ¥3.0912 Trillion?

Internet advertising continues to grow, but what is its core advertising model?

Oku: Japan's advertising expenditure in 2022 exceeded 7 trillion yen, setting a new record high. It can be said that the industry has overcome the downturns of 2020 and 2021 caused by the COVID-19 pandemic and is back on a growth trajectory. How do you view this result, Mr. Fujita?

Fujita: It feels a bit unexpected. In 2022, the pandemic wasn't yet under control, global conditions were unstable, the US raised interest rates, and Japan faced inflation due to yen depreciation and soaring energy prices. I felt the economy wasn't doing particularly well.

Oku: The major factor driving up Japan's advertising spending is undoubtedly the growth in internet advertising. Looking at recent years, internet advertising spending first surpassed television media advertising in 2019. In 2021, internet advertising spending exceeded the total advertising spending across the four major media outlets. Then in 2022, internet advertising spending surpassed 3 trillion yen, accounting for 43.5% of total advertising spending.

While Japan's total advertising spending exceeded 7 trillion yen for the first time since 2007, its composition has changed significantly, clearly highlighting the prominence of internet advertising spending.

Fujita: I get the impression that DX (digital transformation) has rapidly advanced across society in recent years. However, even though internet advertising spending is growing, it hasn't established clearly high-impact advertising slots like TV commercials or front-page newspaper ads.

The internet market portfolio changes at a dizzying pace, and it feels like growth continues without a core advertising model. Of course, looking at consumers' media exposure time, I believe internet usage now dominates, so I'm confident overall growth will continue.

Oku: Even online, formats closer to mass media, like reserved advertising, have clearly defined slots. But what's actually growing is programmatic advertising and search-linked ads. In that sense, it's true that significant growth continues, even though understanding the actual situation is more challenging than before.

One key indicator for predicting future trends is media consumption among teenagers. The media landscape shifted dramatically even during the pandemic. How do you interpret the viewing behavior of younger demographics?

Fujita: Younger audiences definitely seem to watch video services like YouTube and TikTok the most. This might be a leading indicator. For example, middle-aged and older people watched a lot of TV growing up and still do today. Thinking about that, you can kind of see where things might be in 30 years. The internet has shifted dramatically from text to video-based content. Back in the day, bloggers held the most influence, but now YouTubers wield significant power.

Seeing New Possibilities for Internet Advertising in the Spread of "Connected TV"

Oku: One major change in the media landscape is the significant increase in users of internet-connected TVs, or so-called Connected TVs. Do you use one at home, Mr. Fujita?

Fujita: Yes. My wife and kids each watch their favorite content on their smartphones, but during meals, we decided to stop looking at our phones and watch TV together. My child asked, "Is TV okay?" But I figured since TV is something we watch together and share that time, it's fine.

Okuda: Traditionally, the TV was in the living room, and there was a habit of everyone watching the same content together during dinner. Now, it's connected to the internet, and we're in an era where we can watch online video content on a big 55-inch screen. What are your thoughts on the advertising effectiveness of connected TVs?

Fujita: Once, while watching TV in the dining room, I saw an ad for a game from one of our group companies. I thought, "Oh, they're advertising on terrestrial TV," but when I looked closer, it was actually on ABEMA.

Oku: That's true. With connected TV, it's sometimes hard to tell immediately which platform you're actually watching.

Fujita: That was the first time I thought, "Maybe we can create value close to that of terrestrial TV advertising."

Oku: When you create a shared viewing experience where everyone watches together on a big TV screen, the brand lift effect is significant, right?In 2022, "THE MATCH 2022" (Tenshin Nasukawa vs. Takashi) streamed on ABEMA. While pay-per-view ticket sales exceeded 500,000, Video Research Ltd. found that approximately 1 million people nationwide watched via connected TVs (※). That means roughly two people were gathered around each TV.Since TVs aren't one per person like smartphones, multiple people watching one TV screen translates to very high impressions for internet advertising.

※PPV (pay-per-view) = A service allowing access to live sports broadcasts and similar content by paying per program.

Fujita: Since PPV is paid, it might make sense for multiple people to watch together.

Oku: And I think there's a renewed appreciation for large screens, in the sense that video content is better experienced on a big screen.

Fujita: But I also found something a bit surprising. When streaming the FIFA World Cup Qatar 2022 (hereafter, the World Cup) on ABEMA, we focused intensely on video quality, assuming viewers would want to see the play on a large screen with beautiful visuals. After all, it's more enjoyable on a big screen and less tiring than watching on a smartphone.

But when we actually looked at the data, more viewers than expected were watching on their smartphones. It was surprising that so many people were watching on a smartphone screen, which is much smaller than a TV, even though players on such a vast field can sometimes look small even on a TV.

Oku: Could it be that the idea of watching online video streams on your own TV hasn't really caught on yet?

Fujita: That might be part of it, but it reminded me of something from the past. When i-mode launched during the flip phone era, I thought shopping sites wouldn't catch on because the image quality was poor and the screens were small. But in reality, products sold incredibly well and the business grew. This experience made me realize again that people who prefer small screens are actually the majority.

Another barrier to connected TV adoption might be "hassle." While set-top boxes like Fire TV, Chromecast, or Apple TV let you instantly enjoy various streaming services on an internet-connected TV, people who don't use them simply aren't interested. But if an "ABEMA button" came built into the TV remote from the start, people would watch. I think this is less about digital literacy and more about the sheer "hassle" involved.

The Future of Live Streaming Revealed by ABEMA × Soccer World Cup

Oku: 2022 also saw major news with ABEMA streaming all 64 matches of the Soccer World Cup for free. It left a significant mark on internet media history. I was deeply impressed by Mr. Fujita and the ABEMA staff's dedication.

Fujita: Broadcasting the World Cup was an enormous challenge for us. I truly feel this initiative became a major turning point for ABEMA to establish itself as a media platform.

Oku: Beyond live coverage of every match, users could watch full replays or highlights. Plus, on connected TVs, you could easily select content using the remote's directional pad. I believe ABEMA's World Cup broadcast also helped establish the habit of enjoying internet content on connected TVs.

Fujita: Thank you. ABEMA's multi-device viewing capability, allowing access anytime, anywhere, was particularly well-received. That said, features like "live streaming," "catch-up streaming," "highlights," and "multi-angle" weren't prepared specifically for this event; we'd spent considerable time developing them beforehand. The major achievement was using the World Cup as an opportunity to communicate these features to a large audience.

Oku: Many matches during this World Cup took place late at night to early morning Japan time. Looking at various data, we felt it was particularly popular among younger, male-centric demographics: teenagers, M1 (men aged 20-34), and M2 (men aged 35-49).

Fujita: Yes, M1 saw the biggest growth. Key factors in ABEMA's increased viewership were TV Asahi's cooperation and Keisuke Honda's commentary. Even terrestrial TV talk shows featured discussions about his commentary, so viewership grew with each match. Honda himself didn't expect his commentary to be so well-received (laughs).

Oku: It seems many viewers chose ABEMA specifically to hear Honda's commentary. Beyond the commentary, viewers could also watch the players' actions through multi-angle footage, selecting their preferred camera view from multiple camera feeds.

Fujita: However, we also saw current limitations. One issue was the delay compared to terrestrial broadcasts. This depends on each viewer's internet environment, so it can't be completely eliminated. Another was ABEMA's "entry restrictions." We implemented them during the Japan vs. Croatia match because heavy traffic made stable streaming impossible for all viewers. Had Japan advanced to face Brazil, further restrictions would have been necessary.

Oku: If you left the stream, you could potentially be subject to entry restrictions even if you had been watching previously.

Fujita: If that happened too often, it would be a poor user experience. And this isn't just a matter of ABEMA scaling up its servers; there are also limitations on the ISP (Internet Service Provider) side, so it's something we can't control. This remains a challenge.

Oku: I see. Still, having watched the evolution of the internet for so long, it was deeply moving to see internet media reach this point.

Fujita: That's certainly true. The internet evolved from text-based platforms like chat rooms and bulletin boards, then broadband arrived, smartphones became widespread, devices got stylish, and now we're here. But the ability to watch live soccer streams on your smartphone is actually a very recent development.

Oku: It truly feels like we're pioneering a new era for internet media.

Fujita: Broadcasting the World Cup has led to major content being brought to ABEMA, and more people wanting to appear on our shows. Viewer trust and favorability have also increased, and we're seeing various positive effects.

Establishing an advertising model requires enabling "passive viewing"

Oku: I heard the ratio of real-time viewing to on-demand viewing (※) for the World Cup broadcast was 56 to 44. Was the higher-than-expected on-demand share due to people wanting to catch up on missed matches or watch the secondary games?

※On-demand viewing = A viewing style where viewers can watch the content they want, from the beginning, at the time they choose. This includes catch-up streaming as well as movies and dramas on paid video streaming services.

Fujita: Typically, sports and competitive content sees much higher live viewership, so nearly half being on-demand was surprising. Probably, for the World Cup, many matches were scheduled late at night to early morning Japan time.

Oku: Due to the broadcast times, TV ratings weren't particularly high, but ABEMA saw a significant gap, with 17 million viewers on December 2, 2022, when the Spain match aired. Considering the high mobile viewing figures, it makes you think a lot of people were watching from their beds (laughs).

Fujita: Meaning they planned to watch but intended to go to sleep right away depending on how the match unfolded (laughs).

Oku: That 17 million figure is truly astonishing. Also, I hear the livestream of the Shogi A-Class Playoff between Ryuo title holder Sota Fujii and 8-dan player Akihito Hirose on March 8, 2023, drew over 4 million viewers.

Fujita: It's becoming the go-to place to watch shogi on ABEMA. When there's a big match, a lot of people tune in. Unlike soccer, shogi has less screen action—it's common for no moves to be made for 30 minutes. But even then, the commentators keep analyzing every possible scenario, so there's never a good time to stop watching (laughs).

Oku: I hear that users gained from the World Cup are showing interest in other content too, with viewership increasing across various genres on ABEMA.

Fujita: It seems many of the M1 demographic stuck around, leading to growth in genres like shogi, combat sports, and anime. Take shogi—if ABEMA becomes synonymous with a genre, it significantly boosts its value as a media platform.

Oku: Another representative ABEMA content is the news channel. We always ensure unlimited time coverage, streaming every press conference in full.

Fujita: I believe news is the core of any media platform. It's precisely because we have this core that we can take on new challenges daily. To cultivate the habit where people think, "Is ABEMA covering this?" when a major event or incident occurs, I believe the news channel must always be operational for those who come to watch.

Oku: On the other hand, ABEMA also offers rich content like movies and dramas for its paid service, ABEMA Premium. Could you share your approach to the free and paid models on ABEMA?

Fujita: ABEMA's foundation remains free streaming, a model generating revenue through advertising. However, looking back at television history, the advent of video and scheduled recording brought the challenge of skipped ads. Keeping that in mind, we created ABEMA Premium, a subscription-based paid service. Additionally, we offer pay-per-view (PPV) for sports and other content, providing real-time streaming for a fee.

Oku: With ABEMA's value as a media platform rising since the World Cup, what is the outlook for the free ad-supported model?

Fujita: Since creating ABEMA, I've been deeply committed to "passive viewing." In a style where users actively choose and watch content on-demand, commercials aren't seen. However, because the internet is fundamentally active, creating points for "passivity" is harder than expected. Not just ABEMA, but internet media in general is still searching for the ideal form to integrate ads without annoying users.

Oku: That's the core advertising model you mentioned earlier. Still, what strikes me about ABEMA is how well it navigates between live streaming and its archived on-demand content.

Fujita: We put a lot of thought into that. That said, there's a dilemma: the more we improve convenience, making catch-up playback and on-demand viewing easier, the less time users spend passively watching content. We need to keep exploring ways to encourage more passive viewing.

Oku: I also see potential in what you mentioned earlier about users not realizing they were watching ABEMA video ads on Connected TV. I look forward to seeing what ABEMA, constantly challenging itself with new initiatives in the internet world, will achieve next. Thank you for today.

Was this article helpful?

Newsletter registration is here

We select and publish important news every day

For inquiries about this article

Back Numbers

2022/04/05

Special Discussion: "Japan's Advertising Expenditures in 2021." The Era of DX and Advertising's Social Responsibility

2021/03/25

Special Discussion: "2020 Japan Advertising Expenditures" The Convergence of Online and Offline Accelerates. How Will the Role of Media Change?

Author

Shin Fujita

CyberAgent, Inc.

President and Representative Director

In April 2016, TV Asahi and CyberAgent launched "ABEMA" (initially named "AbemaTV"), a new future television service as a joint venture. As the executive producer, he oversaw content expansion and product development.

Ritsuya Oku

Representative of Media Vision Lab

Honorary Fellow, DENTSU SOKEN INC. / Director, Video Research Ltd. Media Design Institute

Joined Dentsu Inc. in 1982. Served in Media Services / Radio,TV Division, Media Marketing Division, and later held positions as Fellow at DENTSU SOKEN INC. and Head of Dentsu Media Innovation Lab. Left Dentsu Inc. at the end of June 2024. Established Media Vision Lab, a personal consulting practice. Primarily provides consulting services to media-related companies in the information and communications sector, focusing on three perspectives: business, audience, and technology. Publications include: "The Birth of Neo-Digital Natives: The Internet Generation Evolving Uniquely in Japan" (co-authored, Diamond Inc.), "An Explanatory Guide to 'The TV Theory That Has Come Full Circle' and the Outlook for Broadcasting Services" (co-authored, New Media), "Confirming the Acceptability of Simultaneous Online Streaming of Broadcasts" ("Nextcom" Vol. 2017 No. 32, KDDI Research Institute), "New Media Textbook 2020" (co-authored, Sendenkaigi), "70-Year History of Commercial Broadcasting" (co-authored, National Association of Commercial Broadcasters in Japan), "Broad and Universal Online Distribution / NHK and Commercial Broadcasters: From Competition to Cooperation" ("Journalism" December 2022 issue, Asahi Shimbun), and "Information Media White Paper 2024" (co-authored, Diamond Inc.). Member of the Ministry of Internal Affairs and Communications' "Study Group on the Future of Broadcasting Systems in the Digital Age." Member of the Publishing and Editorial Committee, NPO/Broadcasting Critics Conference.

dentsu Media Innovation Lab

Dentsu Inc.

Launched in October 2017, leveraging Dentsu Inc.'s longstanding media and audience research expertise. Conducts research and disseminates insights to capture shifts in people's diverse information behaviors and understand the broader media landscape. Provides proposals and consulting on the communication approaches companies need within this context.