From left: Murayama (Dentsu Digital Inc.), Hamada (OOH Division), Maekawa (Data & Technology Center)

"Data marketing," "data-driven," "big data," "data management platform"... While the advertising industry continues to generate new terms related to data, the OOH (Out-of-Home = outdoor advertising and transit advertising) sector is also undergoing major changes driven by data.

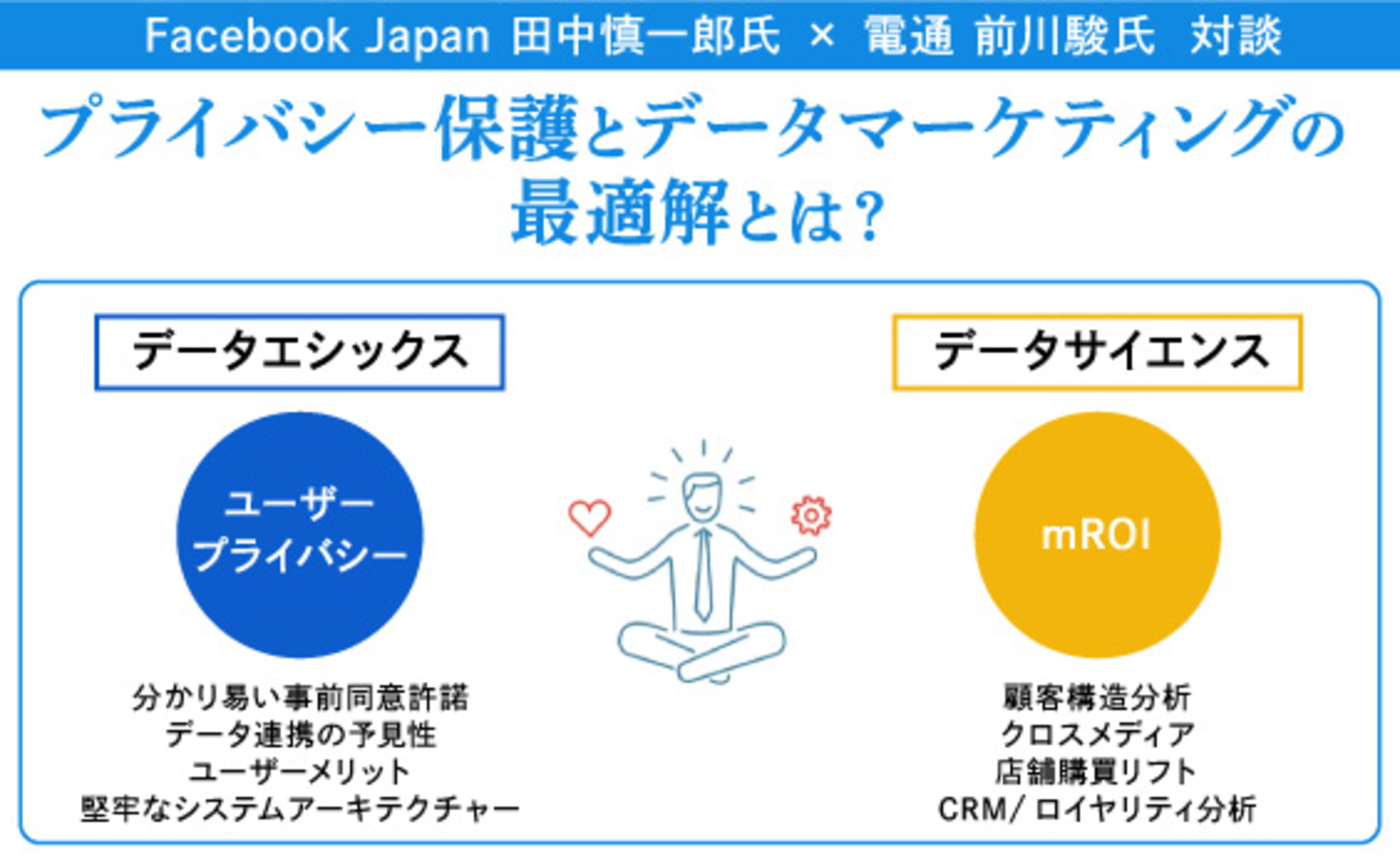

Kei Hamada from Dentsu Inc.'s OOH Bureau, Shun Maekawa from the Data & Technology Center, and Ryota Murayama from Dentsu Digital Inc. explore the cross-media utilization of data across television, digital, and OOH.

Is TV × Digital Really Enough?

OOH Station · Kei Hamada

Hamada: Today, I'd like to discuss how OOH is changing through data with Mr. Maekawa, who knows TV and data, and Mr. Murayama, who knows digital and data. Right off the bat, do you two watch TV?

Maekawa: Of course I do! Back in my student days, I was glued to the TV watching the Hanshin Tigers' pro baseball games. I'd cry sometimes, and other times I'd be drunk with joy. That announcer's excited voice when Tsuyoshi Shinjo hit a walk-off hit on a ball pitch? My eardrums still remember it.

Murayama: Maekawa-san, you're a die-hard Kansai guy, aren't you? (laughs) I love TV too. It's hard to imagine how families spend time together in the living room without watching TV. So, when someone says, "I don't watch TV~," I even wonder if they're just stubbornly insisting it's not trendy to admit they watch. But looking at the actual data, people who don't watch TV definitely exist, and their numbers are gradually increasing.

Hamada: Trendy... (laughs). In that sense, I am trendy. It's not that I don't watch TV; I just don't have time to watch it. In the morning, I'm only getting myself and my son ready. After I get home, I make dinner, give my son a bath, and put him to bed—and it's already 10 PM. After that, I do housework and maybe a little online shopping, and then I'm already sleepy.

Murayama: But you do like dramas, right?

Hamada: I love dramas, but I don't watch them on TV. For domestic dramas, I catch up on "TVer" over the weekend, and for foreign dramas, I watch them on "Amazon Prime Video" during my commute. Specifically, my weekdays look something like this.

Maekawa: I see. I like TV too, but these days, after getting home, I spend about an hour watching news programs and making snarky comments about the commentators. After that, I'm in bed watching YouTube, so my actual TV viewing time has decreased a bit... Thinking about it this way, it seems like just relying on the "TV × Digital" trend of the past few years might have limitations in terms of reach and frequency for delivering information to people like Hamada-san and me.

Murayama: Plus, people like Hamada-san are a demographic that's only going to grow, not shrink, right?

Hamada: Exactly. There's an interesting graph about this!

The top two groups who watch TV frequently are M3 (women aged 50+) and F3 (men aged 50+).

The proportion exposed to digital advertising and OOH digital signage is significantly higher among Teens (10s, both genders) compared to other demographics.

Hamada: While M3 and F3 have the highest percentage of people exposed to TV at least once a week, Teens have the highest exposure rate to digital and OOH! This clearly shows a trend that will only grow.

Murayama: Seeing this data, OOH resembles digital contact patterns more than I expected. I'd like to discuss something here—if that's okay?

Hamada: Go ahead!

How have we approached the non-TV viewing demographic through digital?

Ryota Murayama, Dentsu Digital Inc.

Murayama: To capture audiences like Mr. Hamada and Mr. Maekawa who "don't watch much TV," I think we typically select digital menus in the following ways: ① to ③. The idea is to run a product commercial on a TV program and then use digital to supplement reach for audiences who likely won't watch that program. Let's look at three examples of digital menu designs and their respective advantages and disadvantages.

① Targeting delivery to "users likely not to watch the program" without relying on TV viewing logs or behavioral logs

Murayama: First, ① involves simply selecting users who are unlikely to watch the program based on demographic attributes like age and gender, or interests, and then delivering ads to them. The advantage is gaining a large reach, but the accuracy drops significantly.

② Targeting delivery to users predicted to have low TV exposure based on TV viewing logs and behavioral logs

Murayama: This case involves delivering ads to users who are estimated to have little TV exposure in the first place, based on viewing logs and digital media exposure. While ensuring a certain level of reach, the targeting accuracy for users who don't watch much TV is higher than in ①.

③ Targeting delivery to "users who do not watch the specific program" based on TV viewing logs and behavioral logs

Murayama: This approach specifically uses viewing logs to estimate which programs users watch and, consequently, which ads they encounter. While the precision is higher due to its pinpoint nature, the reach drops significantly.

Hamada: It seems each approach has its pros and cons.

Murayama: And in current TV×digital planning, I feel approach ② is very common for audiences who don't watch much TV. For users in this "low TV exposure" segment, approach ② can achieve sufficient reach.

Furthermore, by linking this viewing and behavioral log data with "location data," it becomes theoretically possible to infer things like "how much OOH exposure do non-TV viewers actually get?" and "to what extent do they take actions close to purchase afterward?"

Maekawa: So, in addition to the traditional TV × digital reach, we're now incorporating OOH integration. Mr. Hamada wrote about just how significant it is to obtain high-precision location data last time, right?

Murayama: As a result, approaches previously impossible with TV and digital alone become feasible, and I believe this will gradually influence how we evaluate the advertising value of OOH. Right, Maekawa?

Maekawa: Exactly! Then I'll take it from here!

Integrated planning for TV × Digital × OOH is now possible!

Shun Maekawa, Data & Technology Center

Maekawa: Dentsu Inc. has long offered "STADIA," an integrated marketing platform enabling digital advertising based on TV viewing logs. Now, we've released "STADIA OOH Plus," expanding this capability to the OOH domain. This allows for the verification of the effectiveness of the relationship between TV, digital, and OOH using actual data. Currently in beta with limitations on sample size, we aim to develop it into a tool that supports integrated marketing tailored to today's challenges, while conducting proof-of-concept experiments and expanding the scale of data.

Hamada: STADIA was groundbreaking because it linked "TV viewing logs" with digital advertising. Now, by also utilizing location data, we can estimate exposure to OOH!

Maekawa: By cross-referencing STADIA viewing logs with OOH exposure data, we can uncover insights like this. Below is a graph from a survey conducted by Dentsu Inc. last year. Based on STADIA TV viewing logs, we examined how much higher the proportion of "Light TV Viewers" (those who watch little TV) was at each station compared to the overall average of all surveyed station users.

The survey covered 21 major stations in the Tokyo metropolitan area. Using viewing log data and exposure survey data, we estimated the proportion of Light TV Viewers at each station. We quantified the difference compared to the average across all surveyed stations.

Maekawa: According to these results, Omotesando Station has a higher proportion of Light TV Viewers than the average across all surveyed stations. Shinjuku Station and Shibuya Station also have high proportions of Light TV Viewers. On the other hand, Ginza Station has a lower proportion of Light TV Viewers than the overall average, confirming that it is used by people who watch a lot of TV.

Hamada: That's interesting. Honestly, I rarely go to Ginza. I mostly use Omotesando (laughs).

Maekawa: On the other hand, from an integrated planning perspective, there's also the approach of using OOH advertising to re-engage customers reached by TV commercials and drive them to stores. For example, this survey shows areas like Ginza and Tameike-Sanno have high concentrations of "frequent TV viewers." Therefore, we hypothesize that planning could be effective: after announcing a new luxury boutique opening via TV commercials, re-engaging customers near Ginza Station or Tameike-Sanno Station with OOH ads. This would reinforce the TV commercial message in a location closer to the actual store.

Utilizing STADIA OOH Plus enables the verification of this hypothesis. Furthermore, it facilitates a "three-media integrated marketing" approach encompassing TV + OOH + digital, with a view toward driving store traffic from awareness. This includes delivering geo-targeted ads to segments estimated to have been exposed to OOH advertising.

Murayama: As I've written in another article before, in the digital world, ad viewability—the minimum time a user must see an ad to count as seen—is considered 1 second for static images and 2 seconds for video. By that standard, people spend over 2 seconds passing by station signage, so they can recognize video ads too. I really feel OOH's advertising value is being reevaluated.

Hamada: Plus, OOH has no ad fraud, and brand safety is assured! And even if people don't watch TV or use the internet, they all go out.

Maekawa: Going forward, by linking viewing logs with location data, we'll be able to estimate behavioral characteristics including Light TV Viewer's OOH exposure. Being able to measure OOH's effectiveness like this will become a new strategic move in integrated planning, going beyond just reach and frequency supplementation.

Murayama: I'm looking forward to it!

Hamada: I'm looking forward to it! Thank you both for today!