As individual content creators like YouTubers and Instagrammers have flourished, the social prominence of influencers has grown, and demand from advertisers has risen proportionally.

Why are YouTubers so accepted by consumers? To delve deeper into the reasons, Dentsu Inc. has been conducting joint research with UUUM Inc. since 2018. This series reports on the findings.

The series will explain the following three points:

・What value do YouTube creators (influencers) hold for consumers today?

・Why consumers watch YouTube creators' videos with such high engagement (Brainwave Measurement Research)

・UUUM and Dentsu Inc.'s perspective on the solution capabilities of YouTube creators

The first installment summarizes key findings from our late-2018 survey on influencer impact, laying the groundwork for discussions in later parts of this series. Note that UUUM has already released a news article on this survey, and this content aligns with that report.

https://www.uuum.co.jp/2019/04/15/33670

First, here are key findings from this survey:

1. In consumers' purchasing processes, the importance of "affinity" – feeling a personal fit – is increasing.

2. Consumers perceive "trustworthiness" in influencers, meaning a sense of personal familiarity and empathy.

3. Influencers' "trustworthiness" is supported by the authenticity and genuine nature of their activities. We found that influencers are establishing unique value as consumers' "new information position." Below, we explain findings 1 through 3.

The importance of "affinity" – feeling convinced it suits them – is increasing

After the spread of SNS, consumers began rationally comparing and evaluating products and services during the purchasing process to make the optimal choice for themselves. In addition, they have come to value "affinity" – the sense of being convinced that something truly suits them.

However, we should take with a grain of salt the frequently cited, appealing narrative that "while consumers previously made rational purchasing decisions based on price and specifications, today they prioritize affinity and empathy." This is often presented as if a new shift is occurring, but the author holds a different perspective.

There is a concept called "bounded rationality."The idea that "consumers meticulously examine every available option to find the optimal choice" is based on a rather idealistic assumption. In reality, constrained by knowledge, time, and energy, people often become satisfied with the first "suitable option" they encounter and stop searching. In other words, it's more accurate to view rational decision-making as invariably incomplete, with only the manner of that interruption changing.

In this particular study, the author sought to verify whether the widely held perception—that "modern people who frequently buy things online tend to make quick decisions based on others' recommendations and just click to buy"—the so-called "quick decision theory," is actually true.

To state the conclusion upfront, the findings suggested the opposite of this hypothesis. It became apparent that those most influenced by influencers are actually more cautious and discerning consumers.

We defined three segments: "General Users," "SNS Influenced Users," and "Influencer Influenced Users." We then examined the path to purchase for each segment.

"became interested in the product"

"researched the product"

"Compared the product with others"

We asked how many steps they took in this funnel during their decision-making process.

The average number of steps was 2.39 for the General Segment, 2.74 for the SNS Influenced Segment, and 3.14 for the Influencer Influenced Segment. The Influencer Influenced Segment actually requires more consideration than the General Segment before reaching "Let's buy!" or "Decided!", indicating they are a more cautious group.

The same holds true for the length of time taken to decide from awareness to purchase. Figure 1 shows that the further left, the higher the rate of immediate decisions, and the further right, the more deliberation occurs. While the general population tends to decide more frequently within timeframes like "less than 10 minutes" or "less than 30 minutes," the influencer-influenced segment has lower scores in these areas.

Specifically, looking at the proportion making "immediate decisions" (within one day), the order was "General Group > SNS Influenced Group > Influencer Influenced Group." This means they are more likely to carefully consider their options, gather various information, and ultimately make a purchase influenced by influencers, rather than making snap decisions.

[Figure 1]

Within this purchasing process, the key factor driving the decision to buy was "feeling the product suited me." This was cited by 33.9% of the general public, 38.0% of the SNS-influenced group, and 44.0% of the influencer-influenced group. The influencer-influenced group places significant importance on compatibility – "whether it suits me" – during the comparison and conviction phase, and influencer content plays a role in this.

These results suggest that SNS-influenced and influencer-influenced consumers are not necessarily "impulse buyers" swayed by influencer recommendations. Instead, they are "cautious buyers" who carefully compare and evaluate products while prioritizing the criterion of "whether it suits them."

The value of influencers lies in their "credibility." Mass media exposure also boosts their "trustworthiness."

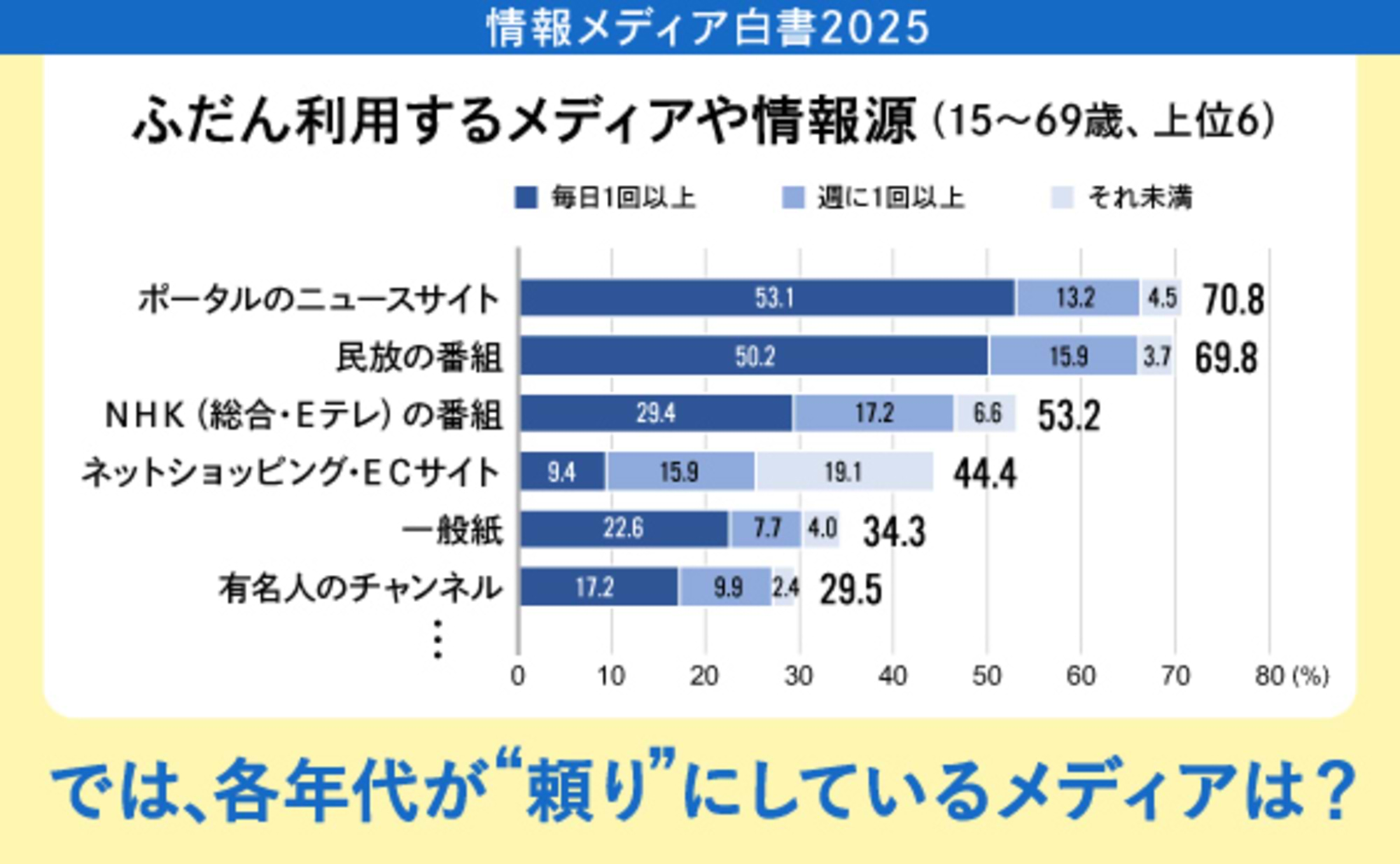

Modern consumers obtain information daily from various media. So, what value does influencer communication hold in this side-by-side comparison?

Figure 2 graphs various media and information sources from the perspective of the influencer-influenced segment, using the axes of "reliability" and "credibility." The former is underpinned by resources like social credibility and tradition, while the latter signifies personal familiarity, likability, and empathy. The purpose is not to determine which is more important, but to test the hypothesis that the diversification of information media has led consumers to develop distinct and clear criteria for judgment.

*For "reliability," the scale used is the combined score of survey items indicating whether the service or media is "widely recognized," "guaranteed to be valuable," and "likely to continue long-term." For "credibility," it is the combined score of items indicating "likability or familiarity," "authenticity," and "believed to be a good fit."

[Figure 2]

The vertical axis represents reliability scores, with television and portal sites ranking highest. They are followed by official TV/newspaper websites, newspapers, and magazines. Specific scores: Television has 77.0% reliability and 24.7% trustworthiness.Major portal site A has a reliability score of 69.3% and a credibility score of 17.7%. Both have an advantage in reliability, placing them in the second quadrant. This likely reflects not only the quality of the information itself—such as the daily delivery of newspapers—but also the solidity of the social infrastructure supporting it (aspects of media's social and industrial nature).

On the other hand, sources with high credibility but low trustworthiness include "family, friends, and acquaintances," conversations with store clerks, and word-of-mouth. While information obtained in these everyday settings lacks general applicability, it inevitably permeates through filters of familiarity and empathy specific to the individual.

So, are reliability and credibility a trade-off?

Focusing on the first quadrant reveals this is not the case. YouTube creators positioned here have 54.7% reliability and 66.1% credibility. Instagram creators have 55.1% reliability and 68.5% credibility. Beyond reliability, they score higher in credibility compared to other media and sources, securing a unique position for both.

Furthermore, the fact that YouTube creators score higher on credibility than YouTube itself, and Instagram creators score higher than Instagram, aligns with the argument presented here.

Note that trustworthiness and credibility are not opposing metrics. Influencers with high credibility can also enhance their own trustworthiness by appearing in trustworthy mass media, creating a cycle.

Looking at specific survey questions, regarding YouTube creators, the percentage of respondents who think "seeing them appear on other media (TV, online, etc.)" indicates "broad recognition" was 55.5% among the general public, 50.2% among SNS influencers, and 42.3% among influencer influencers.It is suggestive that the general public scored higher. Similarly, regarding Instagram creators, 40.5% of the general public, 16.4% of the SNS influence group, and 26.1% of the influencer influence group believe that appearing in magazines "guarantees their value."

This indicates that influencers also operate within relationships with other media, meaning overlapping effects occur.

Influencers' credibility is underpinned by the authenticity and genuineness of their activities

What underpins influencer credibility? The survey revealed that it hinges on whether influencers can authentically express themselves as individuals.

Regarding YouTube creators, the percentage of respondents who believe that "speaking honestly" enhances credibility was 51.9% among the general public, 56.8% among SNS influencers, and 71.1% among influencer influencers. Similarly, the percentage who believe that "genuinely enjoying themselves" enhances credibility was 39.1% among the general public, 36.0% among SNS influencers, and 50.0% among influencer influencers.

Similarly, regarding Instagram creators, the percentage of respondents who answered that "speaking their true feelings" enhances credibility was 42.9% among the general public, 44.6% among the SNS influence group, and 50.0% among the influencer influence group.

While YouTube creators and Instagram creators are also evaluated by consumers based on quantitative metrics like video views, channel subscriptions, and follower counts, this survey highlights the importance of their posting attitude.

The key lies in whether viewers sense genuine enjoyment and spontaneity—not a sense of being forced to create—but rather the creator's own enjoyment and intrinsic motivation. This makes viewers think, "I can trust the information this person shares" or "I might try this out."

In relation to this, I'd like to introduce an interesting framework from the paper "Brand Building in the Digital Age: Co-Creating Brand Value" (2020) by Akihiro Nishihara, Tetsuma Enmaru, and Kazuhiro Suzuki.They state that we've moved from "brand value persuasion," where companies unilaterally build brands, through "brand value co-creation," where companies and consumers jointly build brands, to the modern paradigm of "brand value co-creation." This new paradigm involves not just the two parties but also a third party contributing to brand building—the BIT (Brand Incubation Third-party)—working in tandem. Our discussion can be reframed as precisely about this third element.

Influencers are essentially that "third party" standing between consumers and companies. It is precisely the balance between their personal identity and their ability to communicate as a public voice through social media that underpins the value of influencer messaging.

[Survey Overview]

Research Firm: Dentsu Macromill Insight, Inc.

Survey Period: Mid-December 2018 (quantitative questionnaire survey via the internet)

Sample Composition: 4,200 men and women aged 13-49. The following conditions were considered.

● To assess the effectiveness of influencer recommendations by category, respondents were screened based on purchasing products (excluding ongoing subscriptions) within the past 2-3 months across the following 27 categories:

Apparel, Clothing, Bags & Shoes, Footwear, Travel, Leisure, Skincare Products (cleansers, lotions, emulsions, serums, etc.), Makeup Products (foundation, lipstick, mascara, eyeshadow, etc.), Body Care Products (hand cream, body soap, body scrub, body cream, body oil, etc.),Perfume, Hair Care Products (shampoo, conditioner, treatment, etc.), Watches, Accessories, Jewelry, Eyewear (glasses, sunglasses), Automobiles, Hotels, Inns, Restaurants, Gourmet Food, Alcoholic Beverages (wine, beer, sake, cocktails, etc.), Cup Noodles &frozen foods, snacks, and other processed foods, fresh produce like vegetables and fish, games, smartphone apps, soft drinks, healthcare, fitness (supplements, health foods, etc.), information devices (smartphones, tablets, PCs, smartwatches, etc.), home appliances (refrigerators, microwaves, etc.), digital appliances (TVs, recorders, digital cameras, audio equipment, etc.), interior goods, furniture, tableware, cooking utensils, sports, and outdoor gear

● Non-SNS users were excluded during screening. Among the remaining users, those who selected "Web/Internet" (including portals and SNS) as the media/information source used at either the "Want to try" or "Purchase" stage, and who selected Instagram, Facebook,"willing to try," or "purchase." Those who selected web/internet (including portals and SNS) as the source and specified one of the following platforms: Instagram, Facebook, Twitter, LINE, SNOW, TikTok, MixChannel, YouTube, C CHANNEL, or blogs (like Ameba Blog or LINE Blog) were defined as the "SNS Influenced Segment" (37.0% male, 63.0% female).Furthermore, among those who selected the above social media, individuals who also selected either "statements or posts by people famous online but not appearing in mass media (TV, newspapers, magazines, etc.)" or "statements or posts by people not widely known in society but famous within specific genres" were classified as the "Influencer-Influenced Group" (18.0% male, 82.0% female). All others were classified as the "General Group" (42.2% male,women 57.8%). The breakdown is: General Group: 2,600 people, SNS Influencer Group: 1,300 people, Influencer-Influenced Group: 300 people.